ASIA FILE CORP BHD (7129) – well positioned to ride on the takeaway and food delivery tidal wave [$$bill]

ASIA FILE CORP BHD (7129) – well positioned to ride on the takeaway and food delivery tidal wave

Share price: RM2.22

Market cap: RM432mil

Shares outstanding: 194.76mil

1. F&B takeaway packaging – the growth driver and share price catalyst

Even before Covid-19 came about, food delivery services was already a growing sector.

However, due to Covid-19, the growth of takeaway and delivered meals have accelerated even more.

Malaysians have become accustomed to this new normal and this trend should continue to grow.

This phenomenon has led to a surge in the use of takeaway food packaging.

One publicly listed company that is benefitting from this new normal is Asia File, which ventured into takeaway food packaging not too long ago.

Most people I’ve spoken to are still unaware that Asia File started a business in takeaway food packaging. As such, I believe Asia File’s share price has not fully priced in the potential of this business.

The takeaway food packaging of Asia File is marketed under the ABBAware brand (www.abbaware.com)

Source: www.abbaware.com

A simple Google search for ABBAware shows these products are also being sold by distributors on online platforms including Shopee and Lazada. The products appear to be gaining popularity.

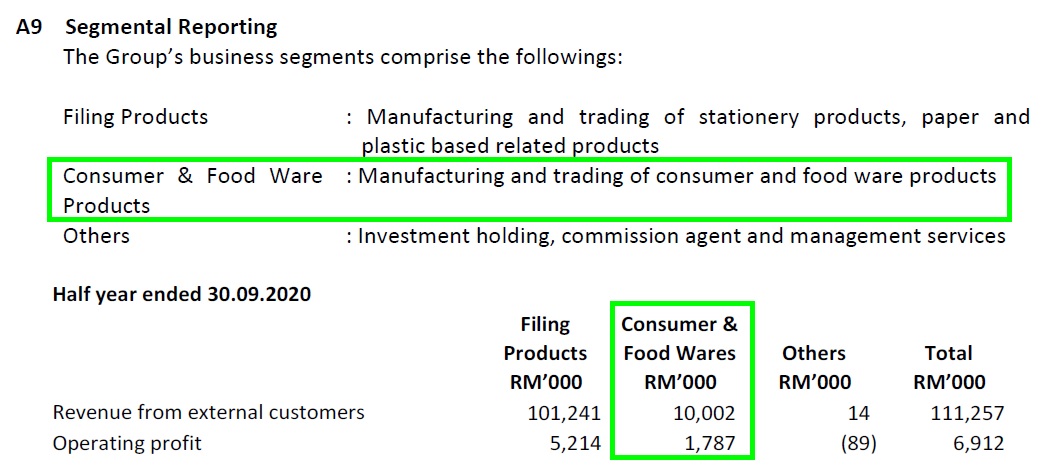

Interestingly, Asia File had for the first time disclosed this segment in its 2Q FYE Mar 2021 (called Consumer & Food Wares) as part as of its quarterly reporting.

The growth figures appear promising, albeit from a small base.

For the six months ended 30 Sep 2020, operating profit grew 144% y-o-y to RM1.8mil while revenue grew 98% y-o-y to RM10.0mil.

In its financial notes, Asia File had this to say about its food packaging business:

“The recyclable food ware segment has, however, shown a spike in demand with the rising popularity in food take away and delivery.”

“Our recyclable food ware products have also received positive responses as demand for takeaway food packaging went up considerably.”

Asia File also sounds like it's getting ready to go big into food packaging; this is what the company said in its FY20 annual report:

“In recognising the needs for the Group to go beyond its traditional filing business and to provide a healthy capital base for future expansion and diversification, the Group plans to conserve cash to take advantage of potential investment opportunities.”

Asia File seems more than well positioned to capitalise on the burgeoning food packaging sector as it will be able to leverage on its high net cash position of RM247mil – which is equivalent to 57% of its market cap!

2. Extremely undervalued = high margin of safety

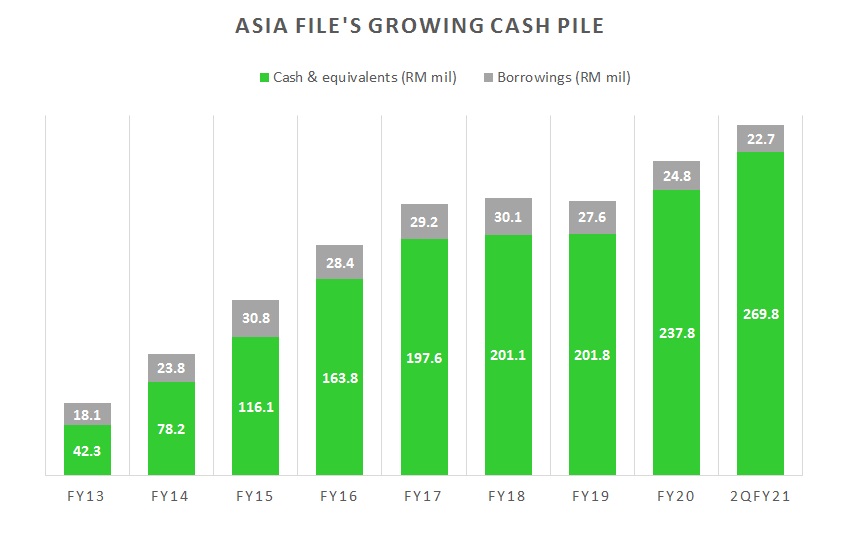

(A) As of 30 Sep 2020, Asia File had cash of RM269.8mil against borrowings of RM22.7mil, translating into net cash position of about RM247mil.

(B) Asia File has an effective 20.03% stake (61,087,500 shares) worth about RM200mil in Muda Holdings Bhd (share price RM3.27).

Net cash + 20% stake in Muda = (A) + (B) = RM447mil (or RM2.33 per share)

Given Asia File’s market cap of RM432mil, buying the stock is akin to buying the company for FREE! (you pay RM432mil and get RM447mil).

Asia File’s strong net cash position is a result of its strong and consistent cash flow generation from its filing business.

3. Foreign investor gobbling up a hidden jewel

The attractiveness and potential of Asia File had caught the eye of Fidelity Investments, one of the world's largest asset management companies.

Fidelity has been actively accumulating the stock since it emerged as a substantial shareholder in Mar 2018.

Fidelity currently owns about 12.7mil shares or a 6.5% stake.

Asia File’s latest annual report shows three Fidelity funds among Top 30 shareholders, namely: Fidelity Series Intrinsic Opportunities, Fidelity Global Intrinsic Value and Fidelity Low-Priced Stock.

Seasoned investors may also notice some notable names among the Top 30 shareholders list.

Join my Telegram channel for random updates @worthystocks

https://t.me/worthystocks

Disclaimer: All information here reflects the author’s personal views/thoughts and should not be considered as investment advice. It is very important to do your own analysis before making any investment based on your own personal circumstances. No content here constitutes - or should be understood as constituting - a recommendation to enter in any securities transactions.

#ASIAFLE