Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

KAMDAR GROUP (M) BERHAD or KAMDAR (Code 8672, MAIN Market, Consumer Products & Services-Retailers)

Some basic info on this company:

i. Number of shares float : 197.99 million

ii. Market Cap : RM 61.39 million

iii. Last closing price : 31 cents

iv. Website : https://kamdar.com.my/

KAMDAR - RAYA SOON ! OVERLOOKED STOCK TO BENEFIT FROM RAYA SHOPPING !

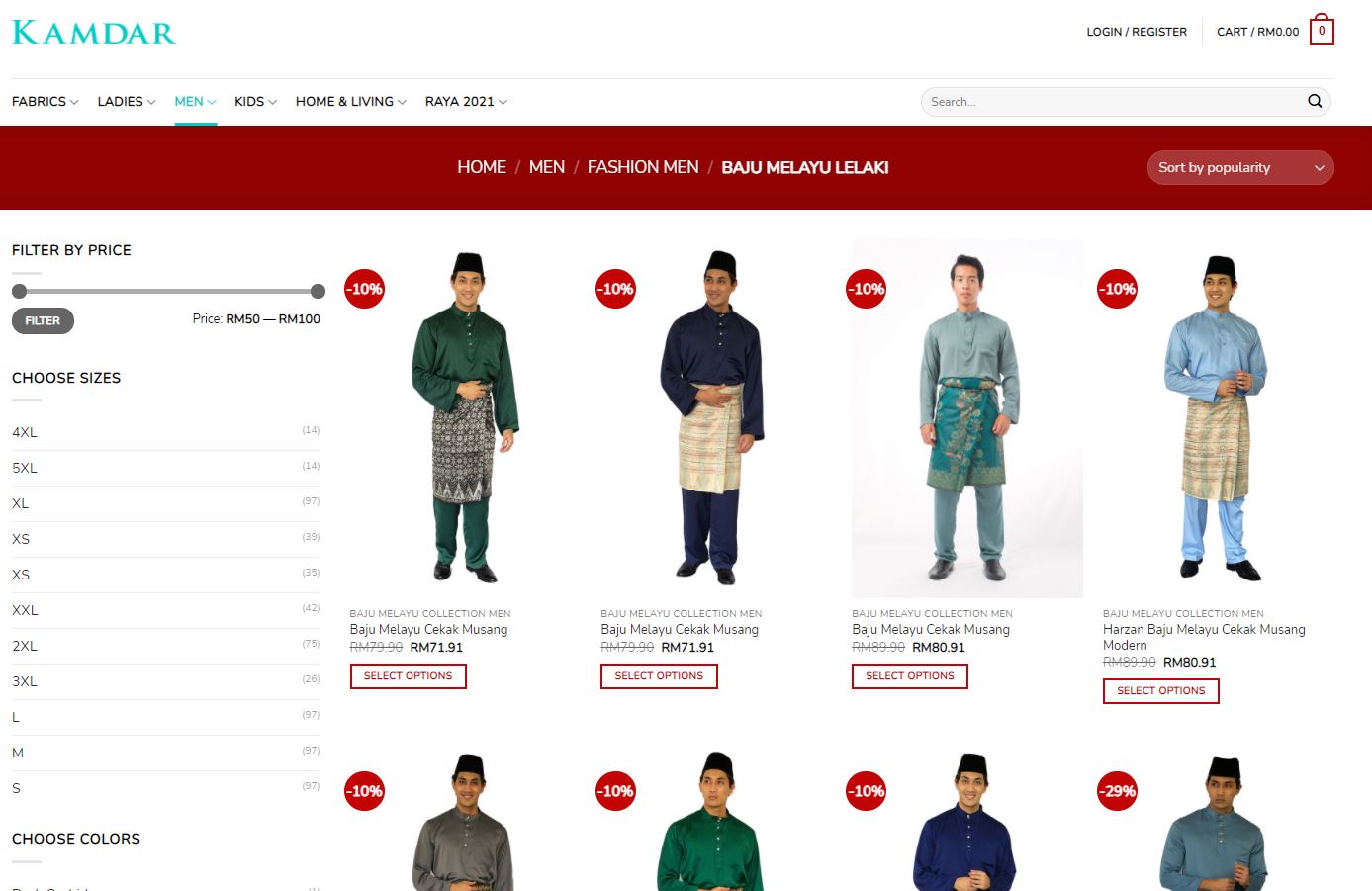

1. Raya Shopping - Online Shopping As Alternative to Brick-And-Mortar Shopping

KAMDAR has completed its online shopping platform so that all products would be also available online instead of at the brick-and-mortar stores.

Therefore, this would help to boost its online sales eventhough less people are physically going to the stores due to third wave of COVID19 infections.

You may buy their products at their website as stated above.

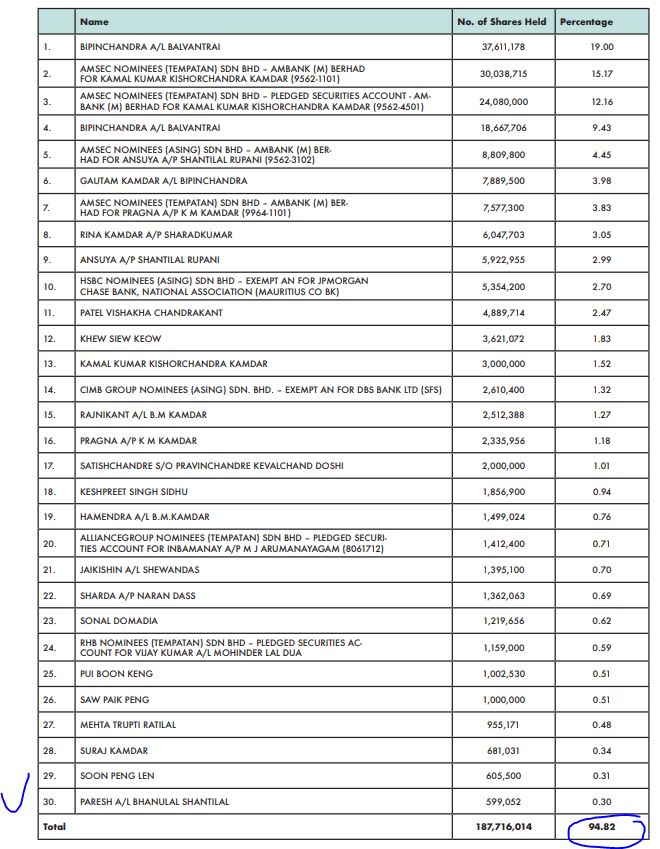

2. Small Float Shares As Top 30 Shareholders Hold 94.82% of Total Float

Refer screenshot taken from latest Annual Report available. From a total float of 197.99 mil, the top 30 shareholders are holding 94.82% of the total float.

This means that about only 5.18% of the total shares are floating in the market if we consider the top 30 shareholders as long term investors.

Therefore, less resistance will mean a smooth movement towards uptrend.

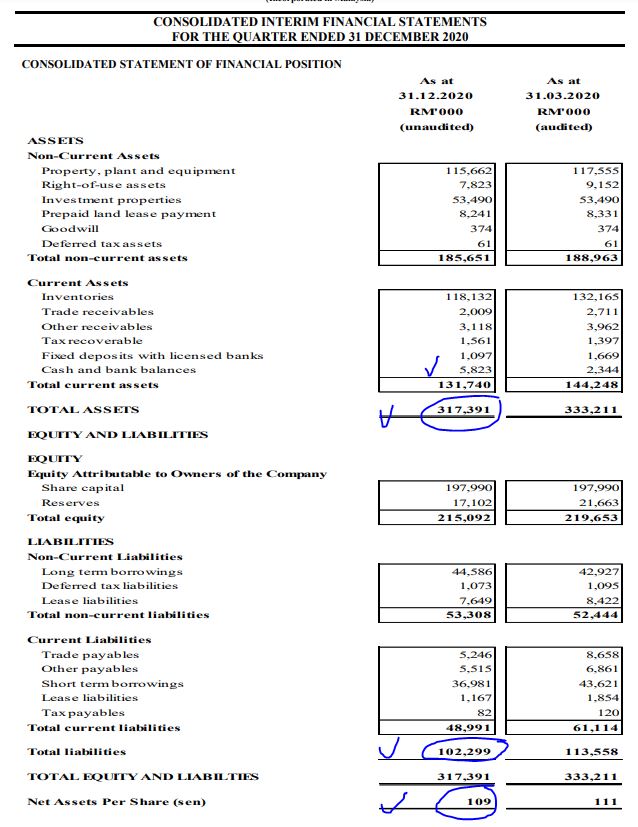

3. Trading At 71.6% Discount to Its NTA of RM 1.09

Refer screenshot taken from latest QR. As we can note the following:

i. Total Assets amouting to RM 317.39 mil

ii. Total Liabilities amounting to RM 102.3 mil

iii. Net Asset exceeds Net Liabilities by RM 215 mil

iv. Total NTA stood at RM 1.09. With the latest closing price of 31c this means that the price is trading at 71.6% discount to its NTA

v. We also see that total cash position has improve from to RM 5.8 mil from RM 2.3 in previous corresponding year

4. Technical Analysis - Red Chips Position Increasing Showing Longer Term Investors Holding On For Higher Prices

Let's take a look at the daily chart of KAMDAR using Homily Chart:

A few observations:

i. Recently, in the past few weeks, red chips have been accumulating position in Kamdar, thus causing the price to trend above the pink support line (indicating bullish trend)

ii. Red chips position have been increasing to around 80-90% of total chips

iii. Such a trend, indicates that more investors are holding on this stock in anticipation of higher prices in near future

CONCLUSION

Based on my opinion, KAMDAR should be given attention in coming weeks, based on below:

i. Raya is coming soon and KAMDAR sales thru both brick-and-mortar and also online sales to benefit from raya shopping activity

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/2021-04-24-story-h1564112776-RAYA_SOON_OVERLOOKED_STOCK_TO_BENEFIT_FROM_RAYA_SHOPPING.jsp