Dear friends,

Reading the news on (08/04/21) make me realised 2 things;

1. Asia-pacific air cargo demand still strong & outperformed February 2019 (pre-covid 19) level by 10.9%.

2. Passenger traffic remain down at 74.7% compared to February 2019 & worst than January 2021.

https://www.theedgemarkets.com/article/asiapacific-air-cargo-demand-105-february-%E2%80%94-iata

This news coupled with few others facts has enhanced my believe that MMAG recent sell down was overdone.

This is even true when the sell down happened when the company's fundamental has not changed to the worst.

In fact, I believe that MMAG's turnaround prospect is bright. An opportunity to bottom fish? perhaps, since the price is still low.

Here are why:

- The downside is limited.

The stock has fallen more than 50% from its peak, broke supports & is now trading at 0.25-0.305 cents.

P

- Logistic & courier business is booming.

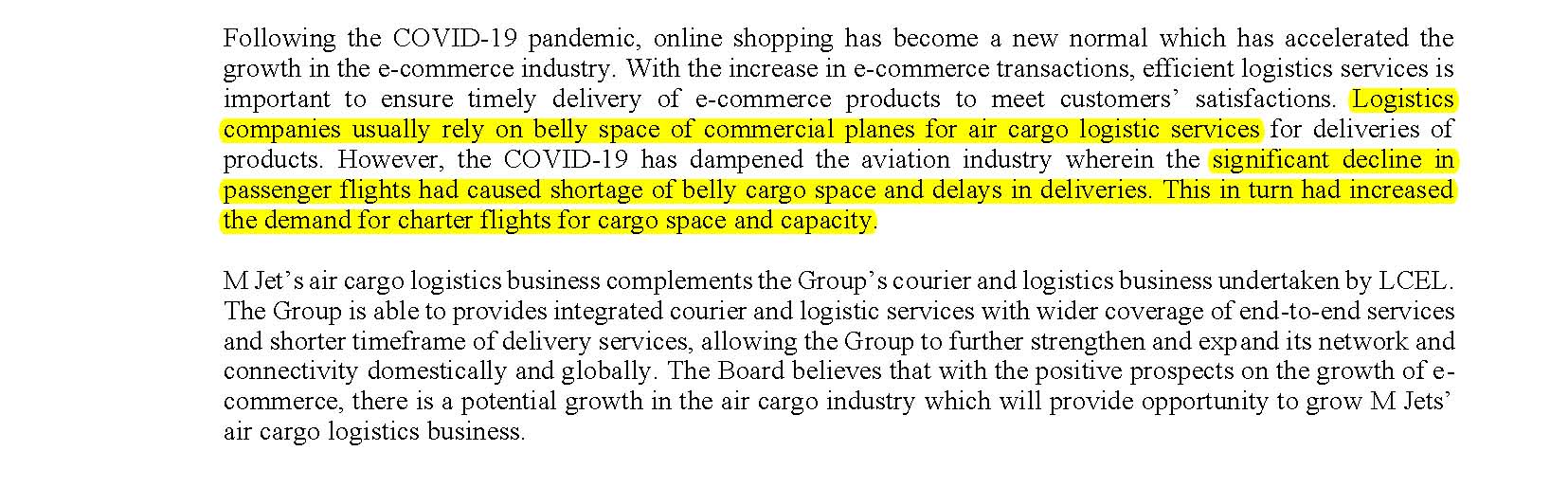

MMAG acquired 80% of M Jets & became the 1st full fledged intergrated supply chain management company from private sector.

https://www.nst.com.my/business/2020/11/641581/mmag-acquires-m-jets-rm2136mil-shares-sale

My Jet Xpress Airlines from 2 aircrafts doubled to 4. With the latest aircraft received earlier than scheduled due to the spike in demand.

https://mymntnews.com/2020/12/12/my-jet-lancar-pesawat-kargo-keempat-tingkat-frekuensi-penerbangan/

My Jets’ CEO forecasted 3 times profit increase for 2021

My Jets to expand cargo services to few provinces in China. Already start flying to Macau last month.

Review of the aircrafts flight histories. All aircrafts' schedules are busy.

https://www.flightradar24.com/data/aircraft/9m-net

https://www.flightradar24.com/data/aircraft/9m-new

https://www.flightradar24.com/data/aircraft/9m-ney

https://www.flightradar24.com/data/aircraft/9m-net

Currently, MyJet Xpress operates to PEN, BKI, KCH, TWU & KUL in Malaysia. SGN, SIN,CGK, MFM, BKK & PNH Internationally.

New traffic rights to Xiamen, Shenzhen, Hanoi & Macau. Routes that MyJet Xpress will operate soon. Notice the frequencies of the new routes. It is inevitable that MyJet Xpress will increase their fleet size soon.

3. Major airlines in Malaysia & around the globe are returning planes to lessors & shrinking fleets. Vacuum created in air cargo capacity.

As passenger flights has dwindled significantly amid the coronavirus outbreak, cargo flights are seeing a booming in business. The reason is simple: passenger planes that used to carry cargo in the hold (around 50% of cargo in total) on any given flight are now mostly evaporated. That has meant cargo operators are busier than ever, and the price of air freight has increased.

Today's (13 Apr 2021) news bleak outlook remains.

4. What the rivals say & doing lately.

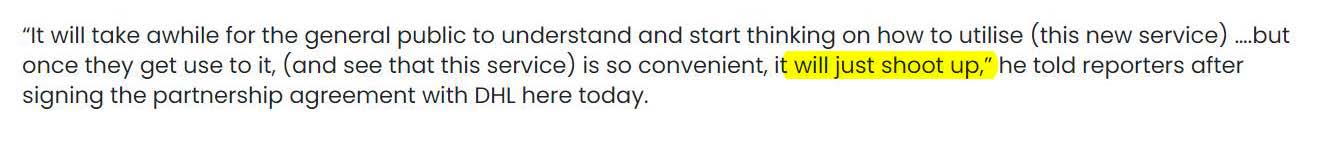

Maskargo ceo said ''It will just shoot up.'' Here he refers to 'end to end service' or layman terms 'door-to-door' service. The kind of service that MMAG is running on after aquired My Jet Xpress.

Raya Airways is increasing its capacity with the new addition of B767-200F with another one coming?

https://www.nst.com.my/business/2021/04/680407/raya-airways-adds-b767-aircraft-fleet

https://cargofacts.com/allposts/business/strategy/malaysian-fleet-grows-with-raya-addition/

World Cargo Airlines (formally known as Asia Cargo Express) now operated by Asia Cargo Network Sdn Bhd. Take the first Southeast asia B737-800F.

https://cargofacts.com/allposts/business/strategy/world-cargo-airlines-takes-southeast-asias-first-737-800f/

https://www.dailyexpress.com.my/news/168897/tawau-cargo-flown-direct-to-kl/

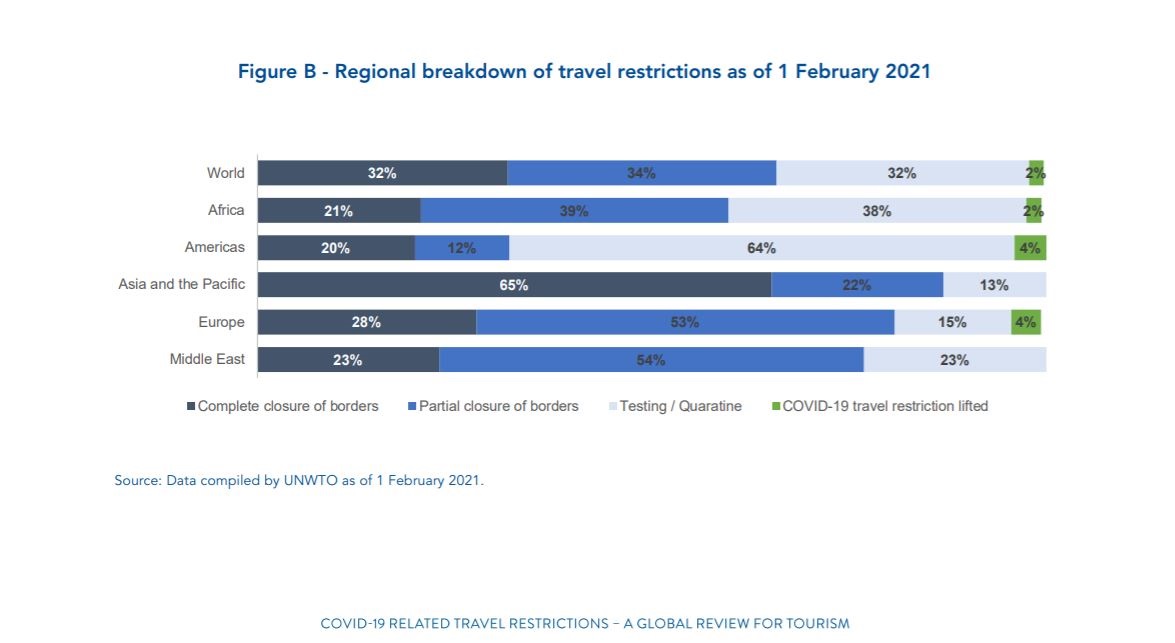

5. The passenger traffic will not return to pre-covid 19 level in near term.

The recovery outlook is based on:

- the successful containment of covid-19 virus

- business travel budgets continue to be under pressure even as economy improved, as video conferencing appears to have made significant inroads as a substitute for in-person meetings

- Weak consumer confidence. while pent-up demand exists for visiting friends & relatives & leisure travel, consumer confidence is weak over job security & rising unemployment, as well as risks of catching Covid-19.

Asia-Pacific has the biggest proportion of total border closures compared to other regions, reflecting local governments’ relative caution that has curbed confirmed Covid-19 case numbers but heavily impacted air traffic recovery.

Southeast Asian nations Malaysia, Indonesia and the Philippines, whose borders remain closed to tourists, all saw flights fall by similar levels, by 95% to 4,600 flights, 93% to 3,700 flights and 88% to 5,100 flights respectively.

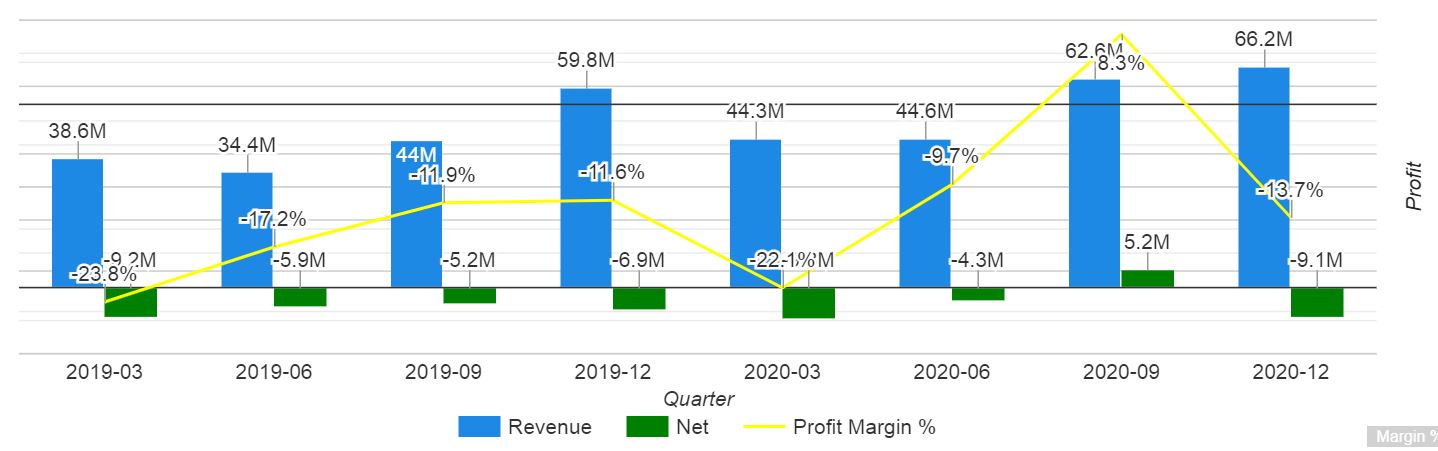

Health check on MMAG financial

MMAG's debt

As of 31 Dec 2020, MMAG's had debt of RM3.67m, down from last quarter's of RM3.76m. However, it does have cash of RM23.26m to offseting this, leading to a net cash of RM19.6m.

MMAG's Balance sheet

As of 31 Dec 2020, MMAG's Balance sheet had a total liabilities of RM58.41m. On the other hand, it had cash of RM23.26m & RM69.89m worth of receivables. Leaving a +ve liquid assets of RM34.83m.

Over the last 12 months, MMAG reported revenue increase QoQ although it did not report any profit before interest & tax (besides the one off gain). However, it did pared down its debt signicantly from RM18.2m as of 30 Jun 2020 to RM3.6m at 31 Dec 2020.

This suggests that MMAG can eliminate its debt easily in the near future & grow the company into profits.

Conclusion:

It is obvious that MMAG is a loss making companies for the longest time & it is riskier than profitable ones. However, its revenue growth is encouraging & debts is minimal, it may well be in a position to turn profitable in due course. By investing before those profits roll in, i am taking on more risk in hoping of a bigger rewards.

My Jets Xpress is a clear beneficiary of the shortage of belly cargo space in the market. MMAG might had done the best ever decision to aquired My Jets Xpress while its in infancy.

Key risks on MMAG include: 1) higher jet fuel price; 2) Margin compression in courier & logistics service division as industry players compete in the price game 3) successful containment of covid-19

DISCLAIMER: This post serves as an educational analysis and is

never meant to be a buy/sell call or recommendation. Investors must

always do their own due diligence before making any investment

decisions. The contents provided were obtained and referred from

publicly available data.

https://klse.i3investor.com/blogs/everest_blog/2021-04-13-story-h1543107106-MMAG_0034_MMAG_HOLDINGS_BHD_IT_WILL_JUST_SHOOT_UP.jsp