Why MAYBULK (5077) MALAYSIAN BULK CARRIERS BHD? ASP have been increased by almost 100%

Yes. The title is not misleading. It is happening now.

The ASP have been increased by almost 100%. Continue

the reading and you will know about it.

Malaysian Bulk Carries Berhad

I am here to answer one question. Why Maybulk?

1) Charter rate have been increased by almost to 100%

2) Share price remain low although charter rate

increase significantly

3) Company start to make pure business earning since

Q1FY21

4) Increase in demand and decrease in supply for dry

bulk vessel

Background

MALAYSIAN BULK CARRIES BERHAD is the largest drybulk shipowner in Malaysia engaged in international shipping. The MBC Group presently owns and operates dry bulk carriers.

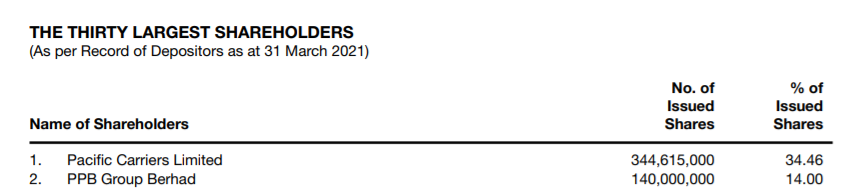

Maybulk mainly owned by richest man in Malaysia, Robert

Kuok (48.46%)

Currently, Maybulk operates 7 dry bulk vessels (3 units Kamsarmax/Panamax, 3 units Supramax and 1 unit Handysize).

These are some of the information regarding on the dry bulk carriers

1) Charter rate have been increased by almost to 100%

Based on the Hudsonshipping.com, Panamax / Kamsarmax Average Time Charter Rate have been significant increased to above USD 25,000 as at Jun 2021

For Supramax, Average Time Charter Rate also increased significantly since early March 2021 to above RM27,500 as per Jun 2021.

Same for smaller size ship, Handysize (or Handymax), the average time charter rate have significantly increased to above USD23,500 as per Jun 2021

From the observation above, you can see there is significant increased on the average time charter rate compare to Q1 FY21. The average time charter rate per days is at USD12,860 (for 7 ships) but currently all of their vessels' charter rate are above USD23,500 (Handysize), USD27,500 (Supramax) and USD25,000 (Kamsarmax). It have increased near to

100% for ASP!!! Refer to the table below, the

cost and expenses of the dry bulk carries are

coming down from USD9.8k (Q1FY20) to

USD8.7k during Q1FY21 due to restructuring

Hence we expect a significant increased in

their profit for the next few quarters.

| Quarter | Q1 FY18 | Q2 FY18 | Q3 FY18 | Q4 FY18 | Q1 FY19 | Q2 FY19 | Q3 FY19 | Q4 FY19 | Q1 FY20 | Q2 FY20 | Q3 FY20 | Q4 FY20 | Q1 FY21 |

| Revenue (RM'000) | 54,263 | 57,488 | 58,179 | 69,044 | 64,086 | 68,747 | 67,149 | 58,011 | 52,272 | 39,063 | 42,658 | 41,993 | 46,617 |

| PAT (RM'000) | (14,343) | (151,272) | 23,017 | 406,436 | (10,762) | (6,941) | (1,294) | 11,678 | 47,653 | (12,704) | (5,950) | (49,780) | 15,008 |

| Minus (Exclude) | |||||||||||||

| Other income (RM'000) | 4 | 1 | 23,738 | 414,748 | 69 | 2,973 | 28,804 | 51,535 | 298 | 3,370 | 408 | ||

| Other loss (RM'000) | 836 | 147,663 | 91 | 6,372 | 557 | 785 | 6,063 | 15,965 | 55,782 | 74 | |||

| PAT (pure) (RM'000) | (13,511) | (3,610) | (630) | (1,940) | (10,205) | (6,225) | 1,796 | (1,161) | (3,882) | (13,002) | (9,320) | 5,594 | 15,082 |

| EPS (pure) (sen) | (1.35) | (0.36) | (0.06) | (0.19) | (1.02) | (0.62) | 0.18 | (0.12) | (0.39) | (1.30) | (0.93) | 0.56 | 1.51 |

| Margin | -25% | -6% | -1% | -3% | -16% | -9% | 3% | -2% | -7% | -33% | -22% | 13% | 32% |

| Cost (USD) | 11,935 | 10,985 | 10,245 | 10,993 | 11,553 | 9,856 | 10,106 | 10,865 | 9,784 | 9,363 | 9,736 | 8,933 | 8,699 |

| Average Time Charter Rate (USD) | 9,556 | 10,336 | 10,135 | 10,693 | 9,966 | 9,038 | 10,384 | 10,652 | 9,108 | 7,025 | 7,990 | 10,306 | 12,860 |

Prediction

| Average Time Charter rate | ||||

| Dry bulk (USD) | 12,860 | 17,000 | 20,000 | 25,000 |

| Revenue (RM) | 46,617 | 61,624 | 72,499 | 90,624 |

| PAT | 15,082 | 30,015 | 40,890 | 59,015 |

| EPS (sen) | 1.51 | 3.00 | 4.09 | 5.90 |

| Margin | 32% | 49% | 56% | 65% |

| Cost (USD) | 8,699 | 8,699 | 8,699 | 8,699 |

As per prediction table above, assume the cost remain constant at USD8,699 and currency exchange between USD and Malaysia ringgit is remain the same, if the average time charter rate is at USD17k for coming quarter, the EPS will be 3sen per quarter, which is increase of 100% in term of EPS!

If average time charter rate is at USD20k, EPS per quarter predicted will be at 4sen

If average time charter rate is at USD25k, EPS per quarter predicted will be at 5.9sen

2) Share price remain low although charter rate

increase significantly

Let's talk about the share price. The share price have rebound from the lowest point of RM0.34 since March 2020. The share price have spiked for a moment on April and reached 52weeks high at RM0.86 before it declined to RM0.665 (11 June 2021). The share price have been trading around RM0.5 to RM0.9 before the financial crisis on March 2020. In my opinion, it is still consider relatively cheap to enter with current price as the ASP have increased near to 100% since last quarter.

3) Company started to make pure business earning

since Q1FY21

For quarter ended 31 March 2021, Maybulk have started to make pure business profit (without other extraordinary income) of RM15mil or profit margin 32.19% at average time charter rate at USD12,860 as the charter rate's are going up, we expected the profit and profit

margin will be skyrocket in the next few quarters.

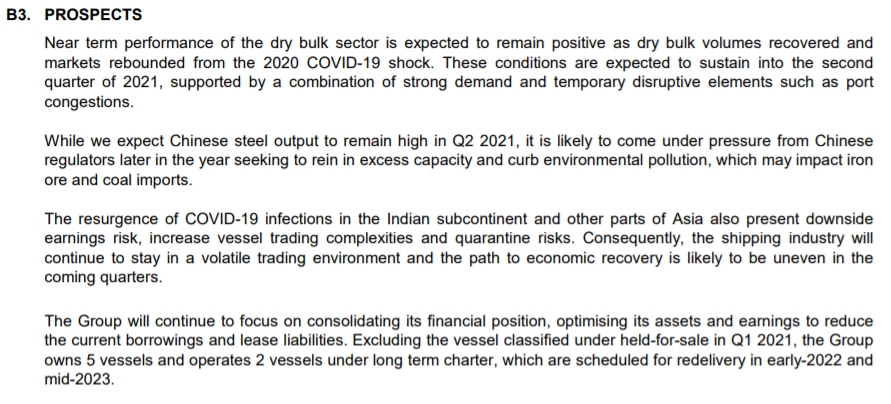

Management remain positive on these condition expected to sustain into second quarter of second (as per quarter report on 31 March 2021)

4) Increase in demand and decrease in supply for dry

bulk vessel

I guess we will one question in mind. Does the high charter rate will be maintained or higher during 2021 and 2022? Let me answer your question with the demand and supply for dry bulk vessel.

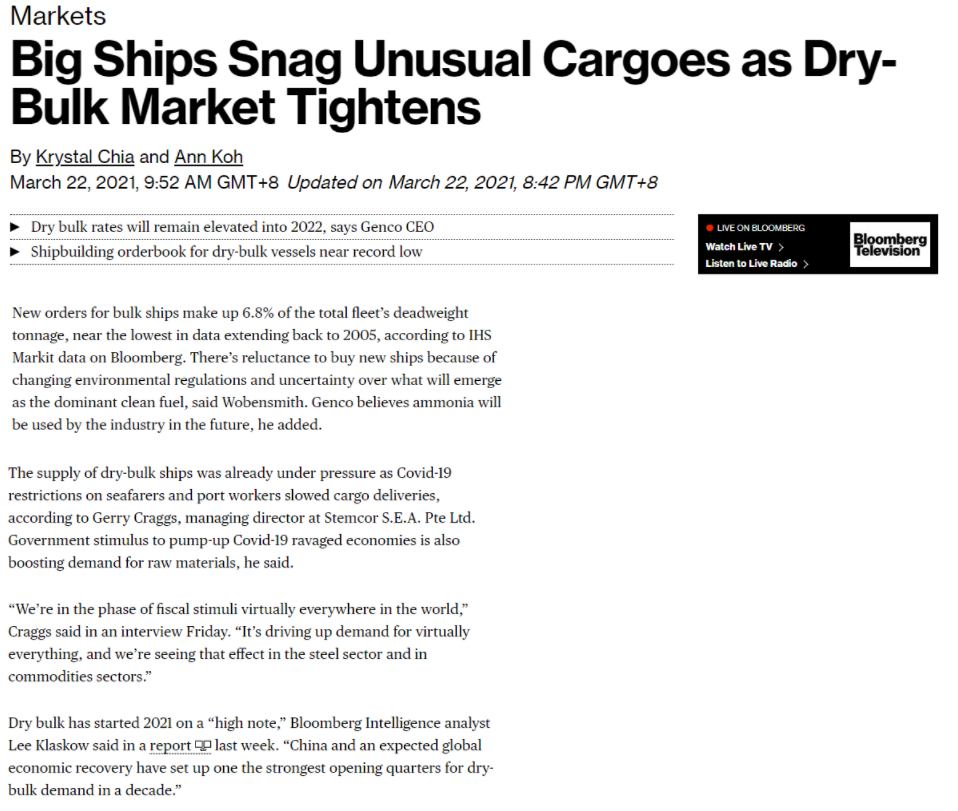

Demand for dry bulk vessel

a) Covid-19 restriction on seafarers and port workers slowed cargo deliveries lead to longer deliveries time, hence demand increase

b) Infrastructure stimulus across the globe lead to more demand for commodity, hence demand for dry bulk ship increase

Supply for dry bulk vessel

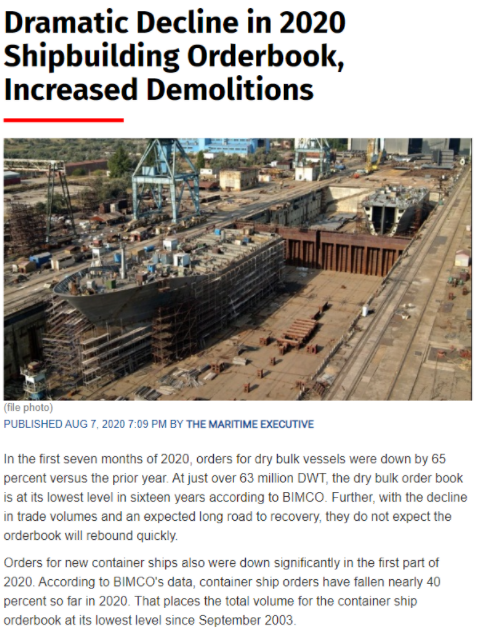

a) Lowest new order for of dry bulk vessel since 2005. Supply for dry bulk vessel will hit hard during 2022.

For your information, the useful life for dry bulk vessel normally will be 10years. Also, shipbuilder will need 2 years to build a new vessel. As the news report above, the dry bulk orderbook for 2020 have been decreased by 65% compare to 2019 due to pandemic. Hence as 2022 approaching, we expect the number of vessels will be significant reduce which lead to increase in charter rate for dry bulk.

For more reading, refer to link below

Dramatic Decline in 2020 Shipbuilding Orderbook, Increased Demolitions (maritime-executive.com)

Dramatic Decline in 2020 Shipbuilding Orderbook, Increased Demolitions (maritime-executive.com)

Big Ships Snag Unusual Cargoes as Dry-Bulk Market Tightens - Bloomberg

Biden's infrastructure plan: Here are the details - CNNPolitics

【马股分析】这个领域的春天来了?!看看他的龙头老大是谁!!| MAYBULK | 5077 [English CC] - YouTube

【马股分析】这个领域的春天来了?!看看他的龙头老大是谁!!PART 2 | MAYBULK | 5077 [English CC] - YouTube

Additional content

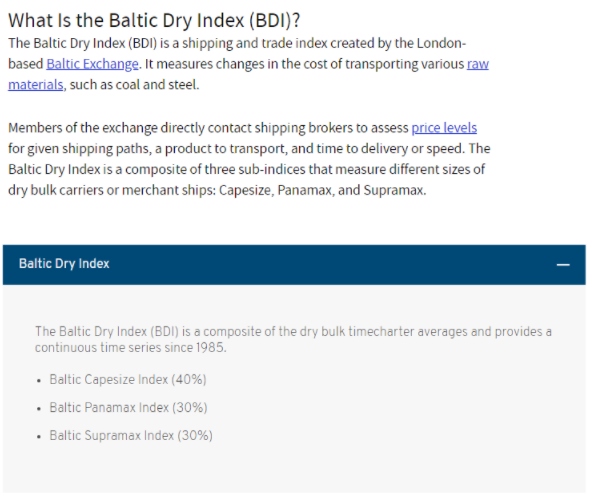

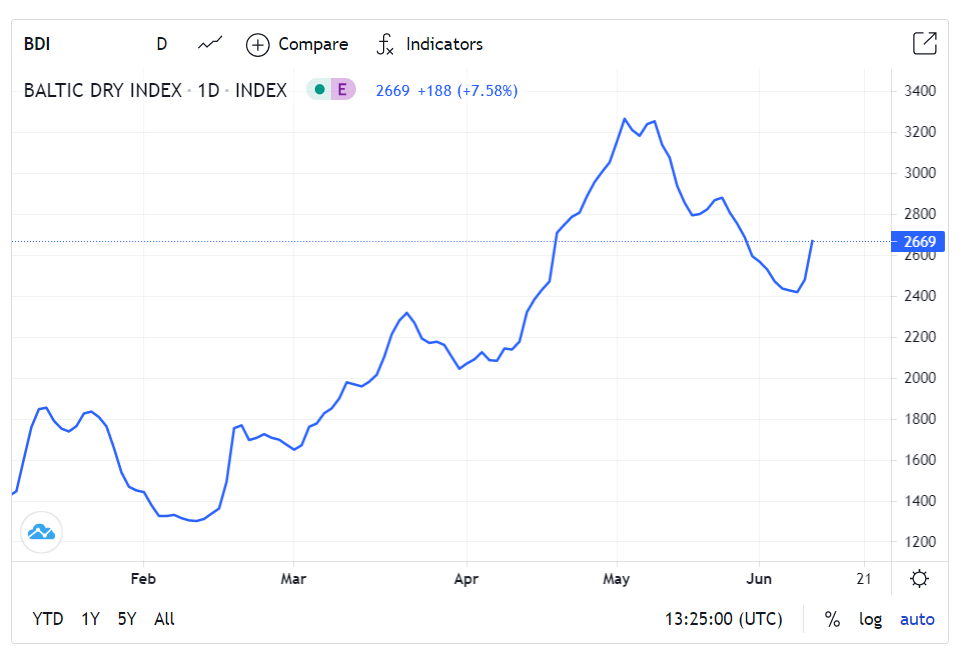

Baltic Dry Index

Many article have linked Maybulk to Baltic Dry Index. Hence let's talk about Baltic Dry Index.

As graph below, it shown that Baltic Dry Index

have decreased significantly since early May 2021.

It is mainly due to decrease in Baltic Capesize

Index. As it weighted 40% of the Baltic Dry Index,

the decrease of Baltic Capesize Index will lead to

decrease in Baltic Dry Index.

As the graph shown on point 1, the price of

Panamax, Supramax and Handysize have

increased. As Maybulk did not owned any Capesize

vessel, the decrease in Capesize price will not

impact Maybulk.

Thank you for your times.

Please feel free to leave a comment below.

Disclaimer: The aritcle written for sharing purpose. It do not represent any buy or sell call. Please do your research before any investment!!!

https://klse.i3investor.com/blogs/undervalue/2021-06-12-story-h1566109640-Why_Maybulk_ASP_have_been_increased_by_almost_100.jsp