INVESTMENT THESIS:

1. Over the past few years, China has face tremendous political and economic pressures from the US, due to the ongoing trade war as a result of the increasingly influential China in the global arena and its rising dominance in key technologies such as 5G. At the same time, a substantial portion of China's chips and components, amounting to ~USD 300 billion a year, has been imported from the US or rest of the world, which poses a key risk to its semiconductor supply chain as US continue to exert mounting pressure which prevents them from securing key component supplies and stifling the development of its industry.

This has led to the need for China to achieve self-sufficiency in semiconductors, or Made in China 2025, specifically at least 70% of the ~USD 300 billion has to be produced in China, which would imply a massive investments from the entire semiconductor supply chain from fabless (design), front-end (foundry) to back-end (assembly and testing) within these 4 years, which will also entail countless rounds of mistakes, failures and improvements, having to start mostly from scratch, before succeeding in developing its own local ecosystem, potentially driving up R&D expenses beyond budgeted. On the other hand, US companies have been slowly shifting its supply chain away from China into other parts of the world, such as Vietnam, Indonesia, Malaysia, India, Europe and America itself, hence creating double the opportunity for the entire semiconductor value chain as they both race to develop new supply chains, benefitting vendors who supply to both the megapowers.

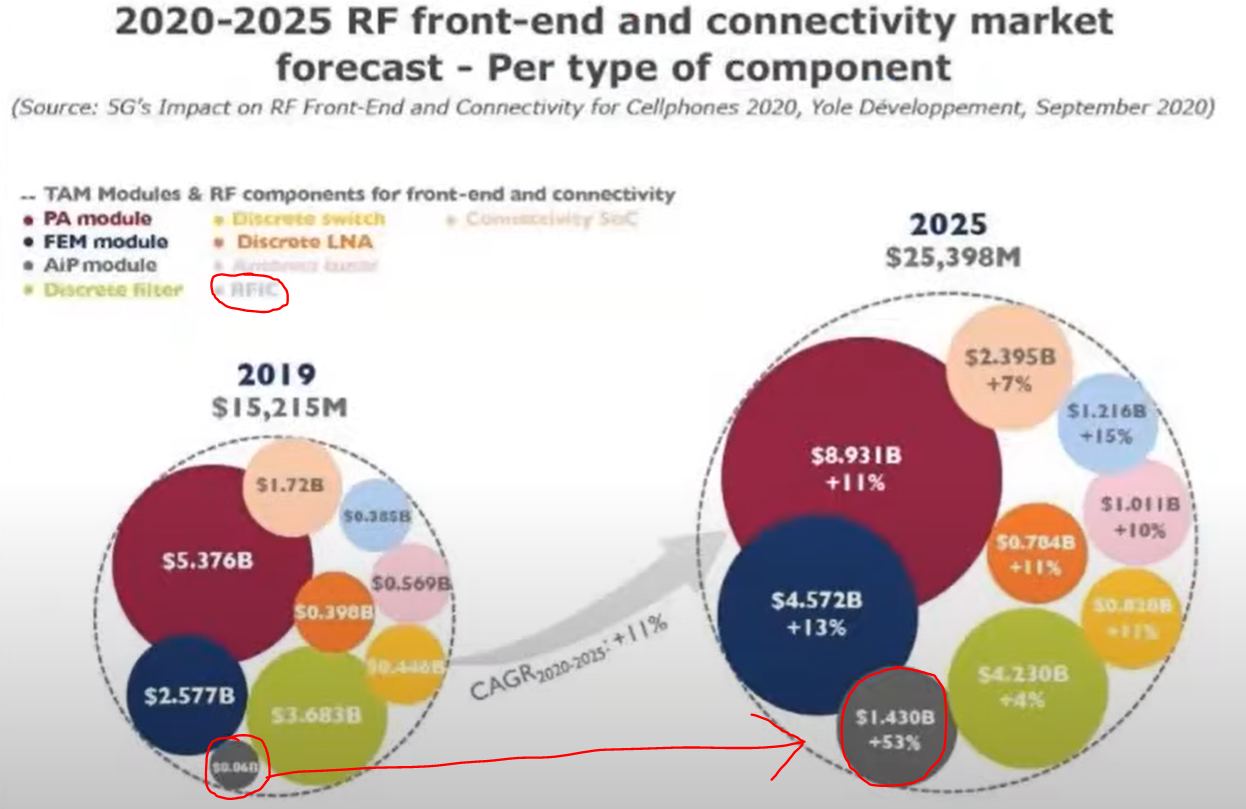

In the case of RF components and testers, ~95% of it is sourced overseas, such as US and Japan. With the Made in China 2025 directive, this would create a mammoth opportunity for local players to step up and address that need. Also, the demand for 5G mobile devices in China has already eclipsed the rest of the world with ~75 million existing 5G users, as compared to the rest of the world combined having less than 10 million, and will continue to grow as we are just in the beginning of 5G adoption globally.

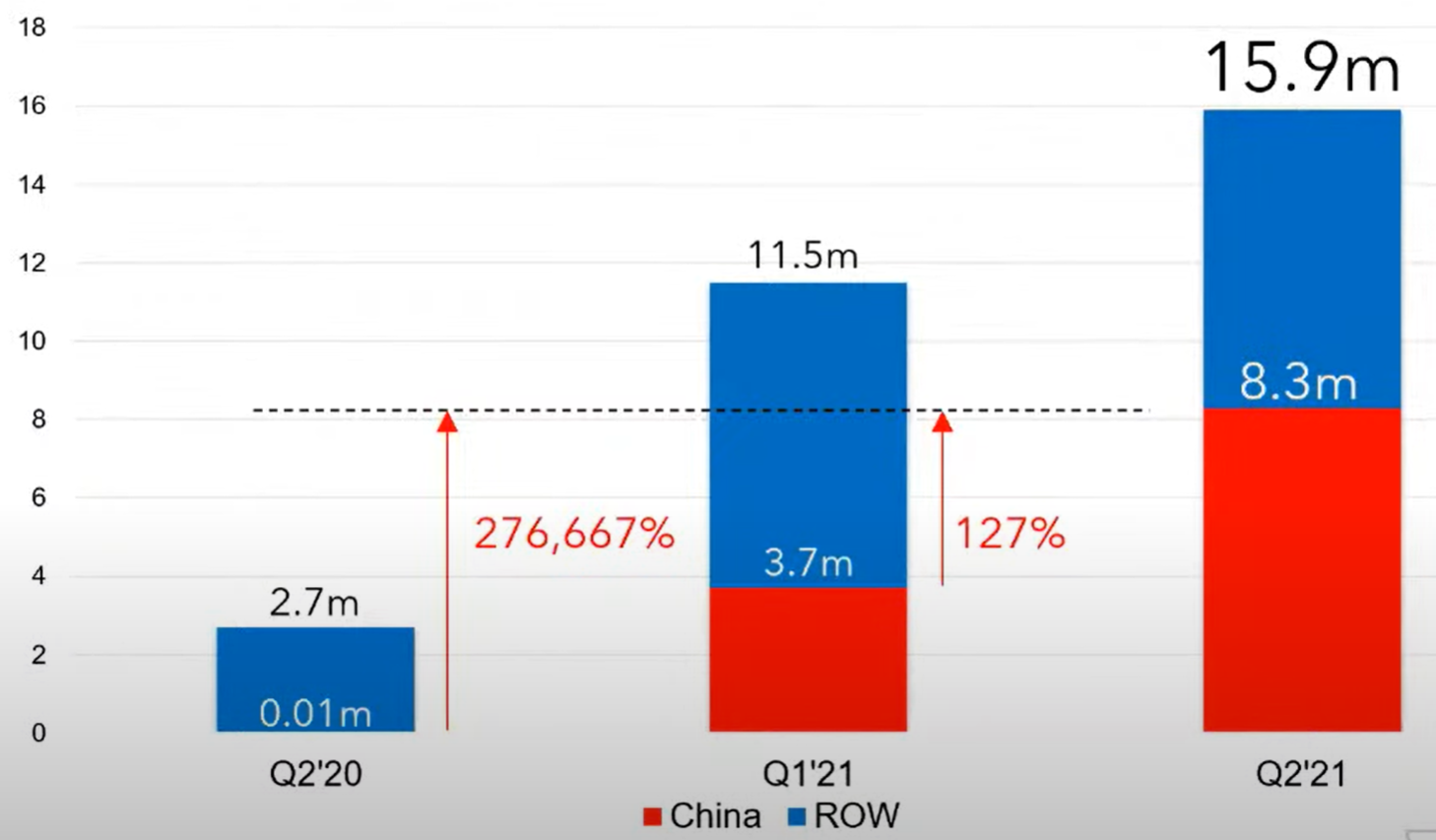

In Aemulus case, they have timely penetrated into the Chinese market with TMSS, their 40% JV with their Chinese counterparts, to supply testers for RF components (with Amoeba7600) and RF fillers (with Amoeba7300), with the latter being around 50% of the value of an RF chip. This market itself is still a blue ocean with non-existent local Chinese suppliers, except for TMSS which has already qualified and started delivering orders for their testers, as reflected in the past 2 quarters of supercharged growth from the Chinese market which they only just ventured in recently. And this is only the beginning of Aemulus' exponential growth, given the TAM of China's semiconductor demands in the next few years, in addition to the steady growth from their existing business from the Rest of World segment.

Given the nature of the ATE industry, it is extremely difficult for competitors to copy its products as it is almost impossible for them to decrypt its designs, having used embedded FPGAs in their testers, and it would take roughly 2-3 product generations before new entrants match their testers' spec comparable to Aemulus' prior designs. With their existing foothold into China's fast growing ecosystem coupled with their continuous innovation in R&D having multiple patents filed in China, Aemulus will stand to gain substantial market share for the years to come.

[Highlighted in 2020 Annual Report]

2. Automotive is another major segment that they could see massive growth going forward as they are also a tester supplier for D&O's LED business, which are experiencing huge growth due to smart LED adoption used in ambient lighting for both luxury and non-luxury passenger vehicles, including EVs and in the near future autonomous vehicles.

3. The CMOS Imaging Sensor (CIS) is another major growth area for Aemulus, with Amoeba5600 that can provide up to 3.5x faster throughout, expected to contribute significantly to their bottom line, having already delivered orders to Chinese and Taiwanese customers.

4. Their migration to Main Board from ACE market is also imminent, just a matter of time till they deliver the results, though not their main priority at the moment as they are focusing on fulfilling the market demands.

5. Given their current growth with healthily improving margins, we can expect Aemulus to deliver a minimum of ~RM 30 million profit in the next 2-3 years, with a conservative forward PE of 40x given their bright prospects in the right industry at an opportune time, which translates to an intrinsic value of ~RM 2/share, and a longer term target above RM 4/share as we see progress in the other segments of the business such as EVs and autonomous vehicle.

https://klse.i3investor.com/blogs/thealphaseeker/2021-07-04-story-h1567805953-AEMULUS_HOLDINGS_Successful_Turnaround_Story_Riding_on_Explosive_Growth.jsp