Since this topic is a hot cake right now, we have decided to express our point of view on this company, SERBA DINAMIK HOLDINGS BERHAD (SERBADK).

It has not been easy this past 2 weeks especially for shareholders of this company. SERBADK used to be the gem for value investors due to the following:

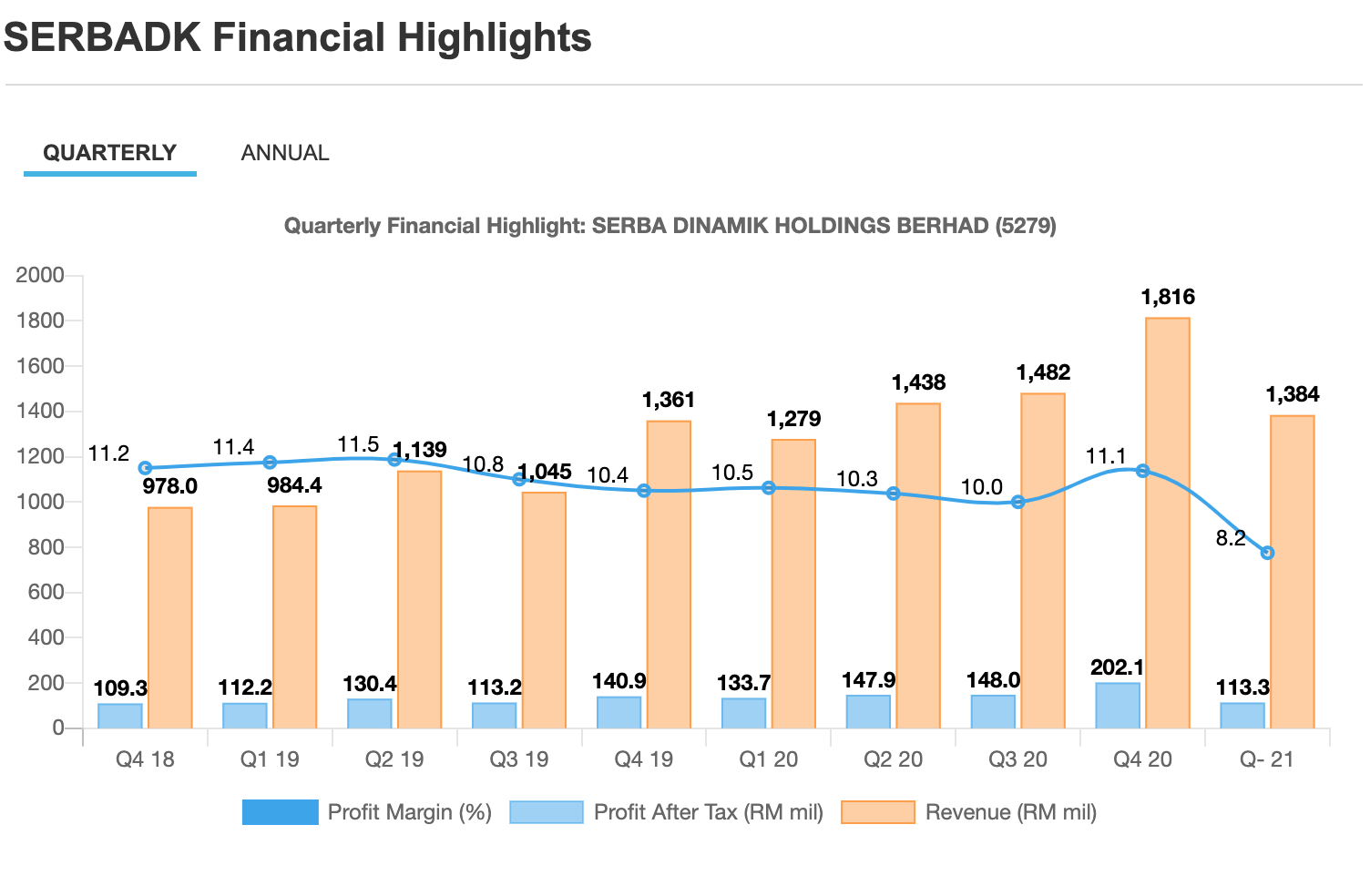

1) producing consistent results (profits)

2) securing projects successfully; and

3) diversifying its business into more areas that could propel this company to its next level.

However, we have recently been bashed by

KPMG's red flag to SC regarding the accounts of SERBADK which has caused

its share price to drop beyond what an investor could hardly imagine

for this company.

We believe most of you have been keeping up with the latest updates of

SERBADK as this issue is a hot cake. Hence, we would not want to repeat

what you already know. (enough of watching the same drama)

We are writing this article to discuss how we can move forward from

this issue. Can we save ourself from this chaos if we are a shareholder?

Or can we capitalise from the drop in share price and expect a reversal

to happen?

For that we need to rely on Technical Analysis

(the only way to know if a turnaround is going to happen or if the

bottom has reached for a company) unless you have some form of insider ![]()

CAN I COLLECT SERBADK ALREADY?

Technically, we can only forecast the

zone at which traders will be selling and collecting. No one really

knows what is the exact price to which this stock will go to. Based on Fibonacci Retracement, we forecast this stock to have the final selling/collection zone from RM0.235-RM0.325).

It may not reach the bottom of the zone before reversal, but we need to

be prepared for the worst case scenario. That's where the strategy

comes in.

IF YOU BELIEVE SERBADK WILL BE ABLE TO SOLVE THIS PROBLEM, THEN WE CAN CONSIDER THIS STRATEGY

1) Collect in stages on the maximum amount you can hold/allocate for this stock.

2) Divide your allocation into 3 stages. First 30% collect at current zone at any price. Second 30% collect if it drops further below 30 cents. Last 30% collect only when there is confirmation that SERBADK is on track of resolving the issue (news confirmation and high buy volume).

3) Be prepared to see your holdings red in this strategy as stock movement is extremely volatile now with big institutions and directors force selling/disposing their shares.

4) Be wary of the next short term resistance levels. In this case we are first looking at RM0.485 and RM0.61. That's almost 100% gains.

5) Have patience as this issue needs time to be solved and depends on the pace of the company.

REMEMBER THAT DESPITE THE FUNDAMENTALS OF THIS COMPANY BEING STRONG, FUNDS ARE MORE PARTICULAR ON ESG.

ESG stands for Environment, Social and Governance.

SERBADK is believed to be a company that complies with ESG and therefore attracted the interest of many institutional investors. The recent issue is related to the lack of governance and therefore funds are deciding to pull out.

Only if this issue is solved, we will see light at the end of the tunnel for SERBADK shareholders. Since SERBADK is a world-class organisation, we believe the management will take quick actions to resolve this issue. As a retail investor, we are also prepared for the worst for this company. As such we have to take calculated risks.

We wish you all the best in applying what we have wrote here. If you have managed to secure profits from this stock, kindly remember to apply a well thought strategy in any of your investments.

Kindly refer to your licensed investment advisors to know if this sector could benefit your portfolio of stocks.

This article is intended to educate you on how to take advantage on sectors that have been sold on uncertainty but has the potential to reverse its direction based on prospects.

We have more for you! Follow us in our Telegram Channel @StockAdvisor FBMKLCI for more updates in Bursa Malaysia on a daily basis!

Disclaimer : All notes expressed

here are solely individual point of views and we are not responsible for

any buy or sell decisions made by others. Kindly use this as a

reference reading material to add value to your current research and

please verify any information stated here with a licensed individual in

the capital markets industry before making any decisions.

https://klse.i3investor.com/blogs/StockAdvisor/2021-06-30-story-h1567119866-SHOULD_YOU_BUY_SERBA_DINAMIK_IF_YES_HOW.jsp