SYMLIFE (1538) SYMPHONY LIFE BHD - Race for Control, Who will Win?

The departure of founder TS Azman from SYMLIFE was supposed to be a new beginning for the property company.

With new directors, new Group CEO, new JV with Open Road for a first-of-its-kind Langkawi integrated tourism complex with a race-circuit as its heart...

So much excitement...BUT!!!

Symlife was nothing more than disappointment for its shareholders since then.

This is especially painful for MBL who bought at a multi-year-high price of 93sen when market was trading below 90sens for most of last year 2020 and this year.

What was on MBL's mind!? Surely they must be in possession of valuable information that gave them the conviction to take Symlife shares at 93sen?

MBL is holding Symlife shares at a whopping 40% loss in less than 6 months!! Ouch!!

A big part of the downfall of Symlife may be attributed to its ongoing feud between Group CEO with Symlife's independent directors and audit committee over the mismanagement of Symlife by JP Chin ("JPC"), Group CEO of Symlife.

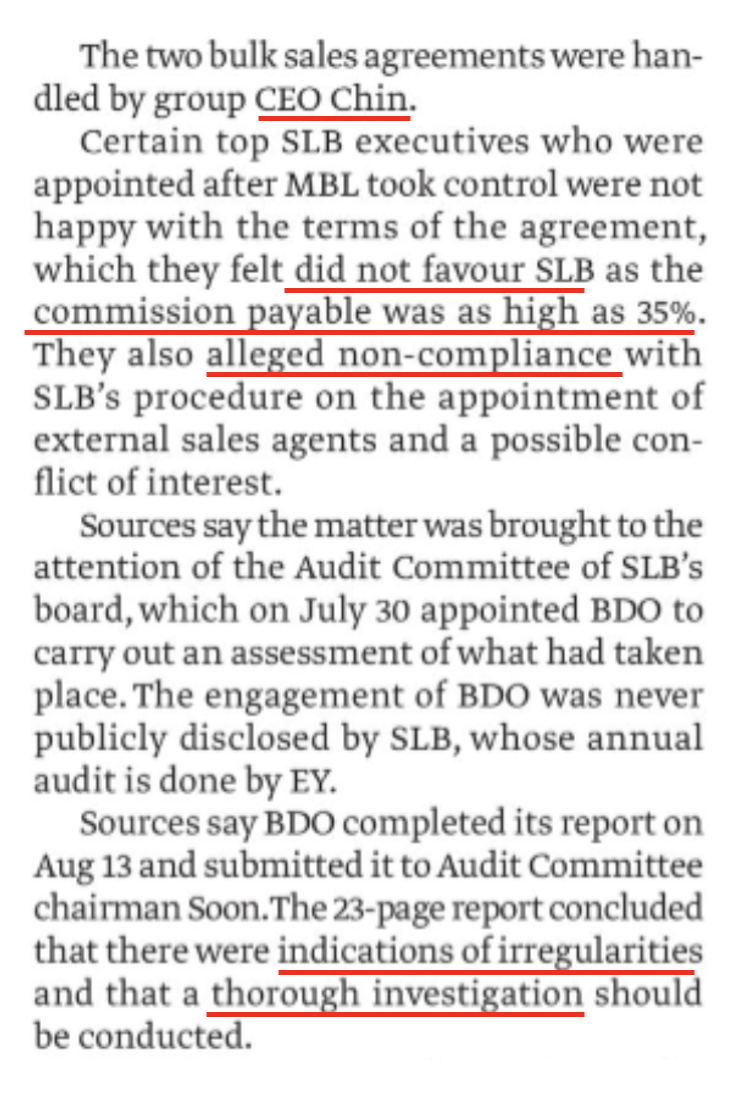

Group CEO Under Investigation

Long story short, JPC agreed to appoint Heritage Shield Sdn Bhd ("HSSB") as an agent for Symlife at terms that are unjustifiably favorable to HSSB including a bonkers 35% sales commission!!! This is way above the commission structure for other property agencies appointed by Symlife throughout the years.

Also, HSSB's directors are linked to JPC via other private companies where JPC is director and HSSB's directors are shareholders.

Running a listed-company as his own friends-and-family business?

TheEdge has just reported on this issue in the latest weekly.

BDO as Symlife's independent advisor has even concluded that JPC's appointment of HSSB and his handling of certain financial transactions involving HSSB had "indications of irregularities and that a thorough investigation should be conducted".

Surely BDO must know that something is amiss to be recommending such actions?

SYMLIFE - A Potential Hostile Target?

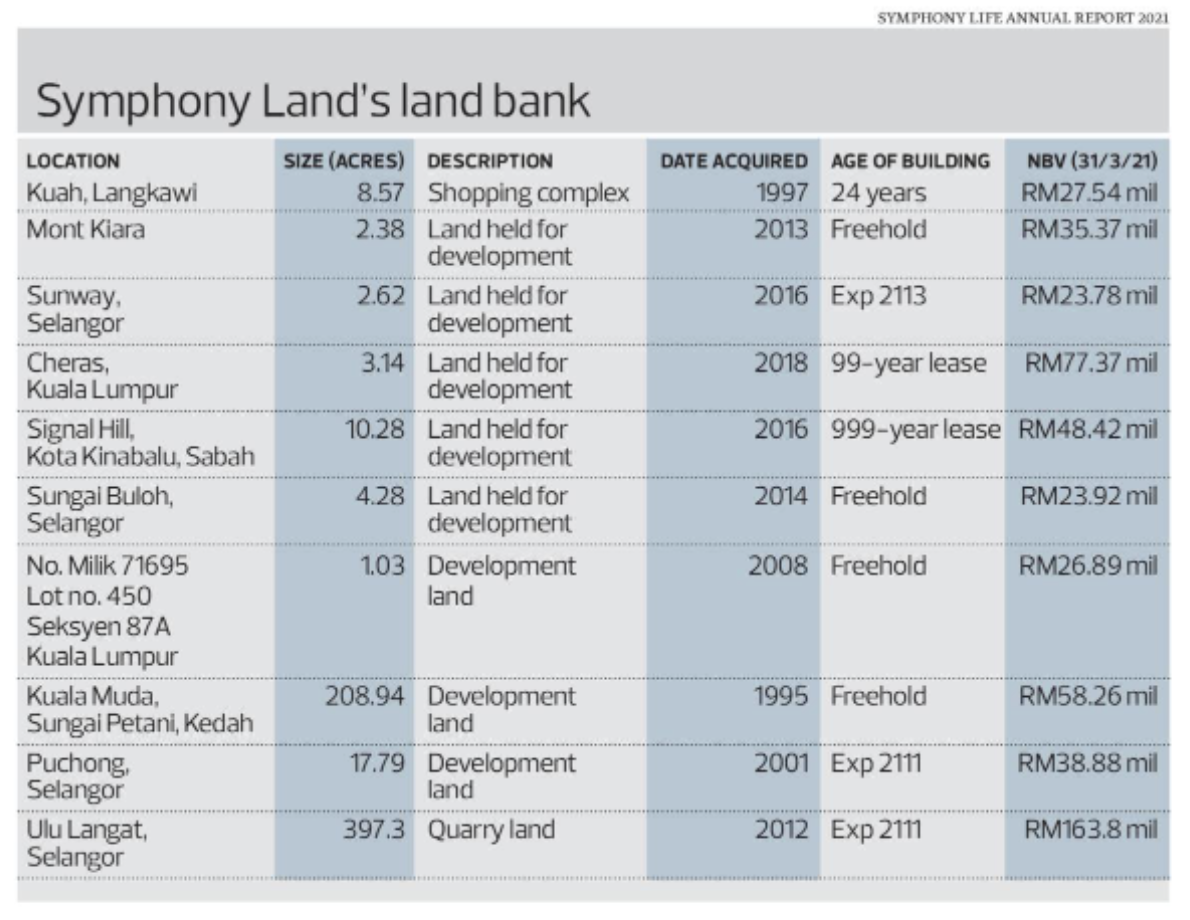

Amidst the infighting between JPC and the board, let's not forget Symlife is actually a company with NTA of RM1.64 per share. At the current price of 56sen, it is trading at 65% discount to its NTA.

Could this be one of the values that investors see in Symlife?

Just recently, VSOLAR announced that they bought 15.73 million shares (2.33%) stake in Symlife at an average price of 58sen. This would've cost them approximately RM9.25m.

The market cannot help but wonder what is it that VSOLAR sees in Symlife? Another new investor after MBL?

RACE FOR CONTROL, WHO WILL WIN?

The fragmented shareholding structure of Symlife does not give anyone a clear majority or control.

Word on the street is that there is a race between the existing shareholders of Symlife to gain control of Symlife as there are multiple profitable projects in the pipeline that would boost the company once the property cycle turns favorable.

Also, given the attractive valuations of Symlife now at a huge discount to its NTA, the race may see a new mystery racer joining the fray...

As the race heats up, will excitement come back to Symlife and revive its share price performance?

Let's wait and see...

https://klse.i3investor.com/blogs/symlife2021/2021-09-19-story-h1571617287-Symlife_Race_for_Control_Who_will_Win.jsp