PMBTECH (7172) PMB TECHNOLOGY BHD - Will it become the next Genetec?

If you have noticed, the share price of PMBTECH roses from RM 6 to the highest RM 13.77 recently.

Do you know why?

Stated from UMA replied:

- There has been a recent surge in metallic silicon prices (as well as for raw materials in general), due to worldwide market forces, which augurs well for the Group; and b.

- The Board continues to engage with Syarikat Sesco Berhad (SESCO) from time to time and at any time to explore opportunities for additional power supply from SESCO which will enable the Group to expand the production of its metallic silicon plant situated in Bintulu, Sarawak.

Ref:

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=118669&name=EA_GA_ATTACHMENTS

So the problem now is where is the next stops for PMBTECH? Will it become the next GENETEC?

My answer is based on the following facts:

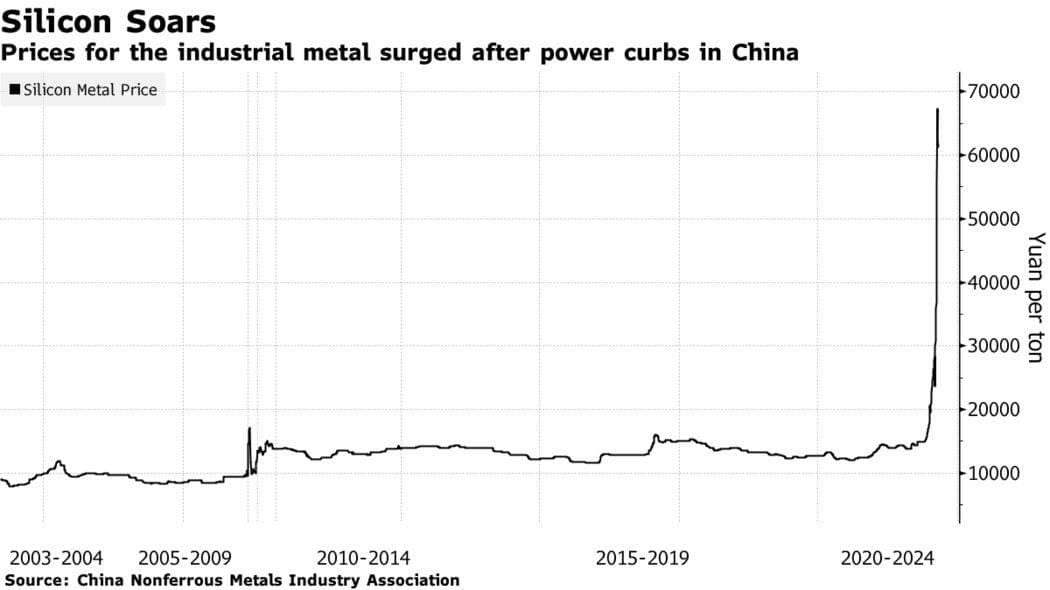

(a). The Silicon Price has been surged to the highest 60,000 Yuan per ton based on the following charts.

Based on Bloomberg, it has rised for about 300%.

Silicon’s 300% Surge Throws Another Price Shock at the World

https://www.bloomberg.com/news/articles/2021-10-01/silicon-s-300-surge-throws-another-price-shock-at-the-world

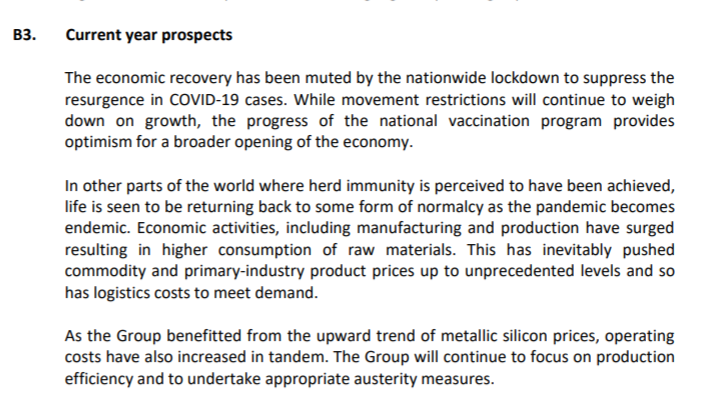

Here what is the important reply from PMBTECH's AGM 29 June 2021:

Ref: http://www.pmbtechnology.com/?cat=231

-

How does China’s decarbonisation policy affects our business?

What strategic moves we took in response to the said development?

When and how much is our next expansion?Answer:

In our opinion, China’s decarbonisation policy will increase the cost of the silicon metal manufacturers in China. We see this as an opportunity for us to have a bigger share of market and we are taking every effort to ensure our prices remain as competitive. We are also planning to improve our marketing strategy to take advantage of the opportunity.

Our next expansion will depend very much on the market demand and subsequently the additional capacity to be installed.

Subject to market conditions, the expansion can be considered when the opportunity arises.

-

Can you share with us more about your silicon metal:

-

i. What is the range of its usage?

ii. Who are your main clients?

iii. Is it a raw material used for solar cells and electric vehicle?

Answer:

i. Silicon metal has been widely used in the aluminium industry, chemical as well as electronic industries.

ii. Our clients include both local and overseas including Japan, India, America and Europe.

iii. Yes, our silicon metal can be used as raw material in solar cells and semiconductor.

-

-

How big is your market share as a producer of sillicon metal globally? Who are the top 3 producers?

Answer:

Silicon metal production is approximately 7 million tonnes per year globally with the Group contributing 70,000 tonnes. The top producers in the market are Ferroglobe PLC, Elkem ASA and Hoshine Silicon Industry Co. Ltd.

-

Are you part of the semiconductor's supply chain?

Answer:

Yes, we are processing silicone of more than 99% purity which can be further purified for use in the semiconductor industries.

(b) From the above reply, you can know that it's bussiness supporting the current HOT SECTOR: ALUMINIUM AND SEMICONCOCTOR Business. Furthermore, SILICON actually a raw material and needed for EV's Batteries. (EV Battery made GENETEC rally so crazily, why PMBTECH can't?)

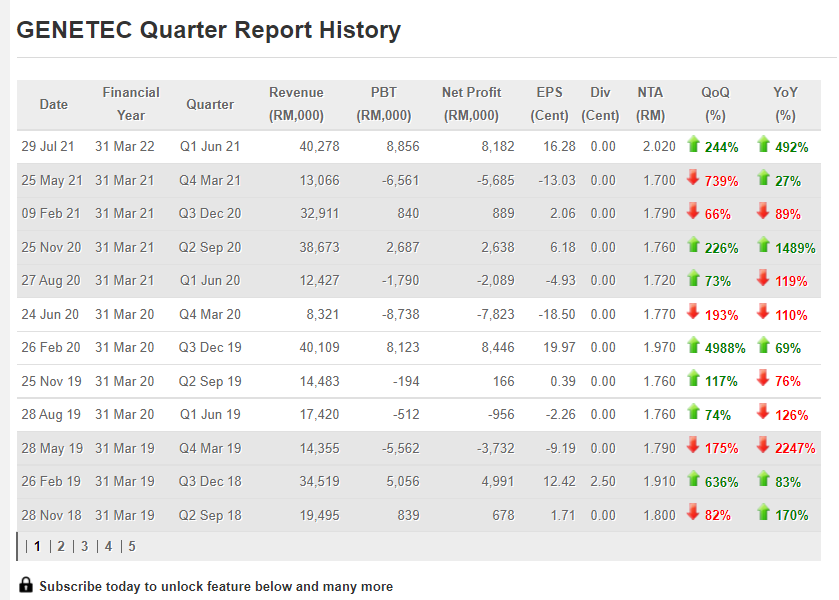

(c) Let's talk about the assumption earning.

PMBTECH can produce 70,000 ton per year. We take an average price of 50,000 YUAN per ton for example.

70,000 * 50,000 = 3,500,000,000 YUAN (3.5 billions YUAN = RM 2,272,907,032)

Per year estimated can earn about RM 2.5 billion.

Now you can compare the EARNING between GENETEC and PMBTECH.

The Technical Chart showing a retracement shall done soon.

We believed many glove investors are losing lot of money and stuck in glove counters.

Simple and Easy Quote for glove investors:

"Never go against the Market and Never Buy Downtrend Stocks."

Disclaimer: You should only refer your Dealer/Remisier for any Buy/Sell suggestions. It is neither a trading advice nor an invitation to trade. Any action that you take as a result of information, analysis or commentary on the contents is ultimately your responsibility.

https://klse.i3investor.com/blogs/EagleEyed/2021-10-02-story-h1591871253-PMBTECH_Will_it_become_the_next_Genetec.jsp