Had the dust settled for Fast Energy Holdings Berhad?

FAST – a semiconductor cum energy transformed company had faced hardship in their expansion plan, especially on the knee-jerk reaction by the market on the date fixing for the rights issue.

For some reason, Malaysian investors are extremely “allergic” to rights issue, where most company would experience a dip in share price after the announcement.

As for FAST, they had faced the same issue, too.

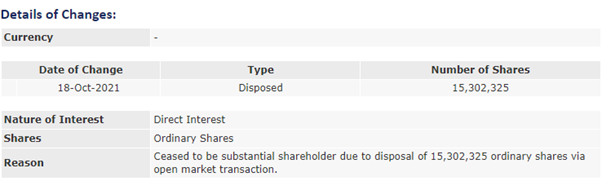

But what’s interesting about FAST is, the dip in share price actually happens after Kuah Choon Ching, the substantial shareholder of FAST as when the company acquired 35% stakes in CCK Petroleum by the means of share swap.

My question here is – why did the share price not drop during Kuah Choon Ching sold his shares, but few weeks after the share price plunge?

I have a theory.

Based on the recent price movement of oil, the offshore or maritime activities should be busier than usual, which would in turn benefit players like FAST.

Also, we noted that the bunker for FAST had arrived in one of the major ports in Malaysia. It is expected that the profits of FAST will turnaround – really soon.

If we look at the share price graph from the perspective of the operators, is this the best time to shake retail investors out of the game, so they could collect cheap mother shares and subscribe for cheap rights share to have a lower costs on FAST, who is going to see gradual turnaround in profit?

A smart operator would definitely do this.

So, as the name swim with sharks suggest, this might be the best chance to go into FAST as the price settled around 12 cents.

It might even be your last chance, better act FAST!

https://klse.i3investor.com/blogs/hsb23/2021-11-11-story-h1593779741-Had_the_dust_settled_for_Fast_Energy_Holdings_Berhad.jsp