Why should AYS (5021) AYS VENTURES BHD rebound - Koon Yew Yin

An official blog in i3investor to publish sharing by Mr. Koon Yew Yin.

All materials published here are prepared by Mr. Koon Yew Yin

Author: | Publish date: Wed, 17 Nov 2021, 10:32 AM

The Budget 2022 announcement on 1st Nov, has been pulling down all the listed stocks, especially big companies. The biggest culprit is the additional prosperity tax increase from 24% to 33% for big companies whose annual profit exceeds Rm 100 million. Although smaller companies like AYS is not affected by the additional prosperity tax, it is being drag down. Its price chart is showing a down trend which encourages weak holders to sell.

No stock can drop continuously for whatever reason. After some time, it must rebound.

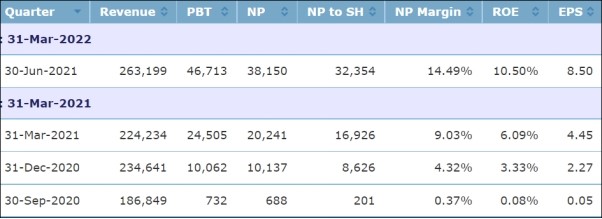

The last column of the above table shows EPS for AYS. Its latest EPS was 8.5 sen and its previous EPS was 4.45 sen, an increase of nearly 100%. Its EPS for next quarter ending September which will be announced before the end of this month, should be more than 10 sen EPS. AYS deserves a much higher rating.

Why Steel price does not affect AYS?

AYS does not produce steel. It buys steel from the cheapest steel producer to sell the construction contractors.

Back ground:

AYS Ventures Bhd is an investment holding principally involved in the trading and manufacturing of steel related products. The company is organized into three segments namely trading, manufacturing and others. The trading division trades and markets a diverse range of steel products and construction materials whilst the manufacturing division manufactures and trades pressed steel and fiberglass reinforced polyester sectional water tanks, steel purlin, and wire products. Other segment includes investment holding, warehousing and storage services and dormant. The products serve customers in the construction, engineering for heavy steel industries, fabrication, oil and gas, power plant and shipbuilding sectors. The group principally operates within Malaysia.

Market Buzz

https://klse.i3investor.com/blogs/koonyewyinblog/2021-11-17-story-h1593874845-Why_should_AYS_rebound_Koon_Yew_Yin.jsp

Singapore Investment

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Basic Healthcare Sum 20261 day ago

-

-

-

-

-

-

-

-

Finance Investment Movement 642 days ago

-

-

-

-

-

AI takes the backseat, for a change4 days ago

-

-

2025 Review and Predictions4 days ago

-

-

-

-

-

-

-

Let It Go5 days ago

-

-

-

-

-

-

-

冷眼孙子股市兵法:真正的投资心法"1 week ago

-

Dec 20251 week ago

-

letter to myself1 week ago

-

-

-

-

Dear Universe2 weeks ago

-

-

-

-

Portfolio Summary for November 20252 weeks ago

-

-

-

Portfolio (Nov 30, 2025)2 weeks ago

-

Portfolio (Nov 30, 2025)2 weeks ago

-

-

-

-

-

-

Portfolio -- Nov 20252 weeks ago

-

-

-

-

-

-

-

I’m Elated.3 weeks ago

-

-

What Shall We Do About VERS?3 weeks ago

-

-

-

人生意义是什么?5 weeks ago

-

-

-

-

-

-

-

Singapore FinTech Festival 20251 month ago

-

-

iFAST 3Q25: Achieving record AUA1 month ago

-

-

-

Can we survive the next market crash?2 months ago

-

-

-

-

-

-

-

-

-

Key Collection2 months ago

-

-

-

-

-

Decoupling3 months ago

-

Been a while!4 months ago

-

-

-

-

-

-

-

-

FAQ on Quantitative Investing Part 28 months ago

-

-

-

-

-

-

-

-

Arigato Everyone! A Decade of Blogging!11 months ago

-

Top 10 Highlights of 202411 months ago

-

-

-

STI ETF1 year ago

-

-

-

Unibet Casino Bonus Codes 20241 year ago

-

-

-

-

Monthly IBKR Update – June 20241 year ago

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Monthly Summary of November 20232 years ago

-

Migration of website2 years ago

-

-

-

-

-

-

Hello SP Group, I'm Back!2 years ago

-

-

-

A New Light2 years ago

-

-

-

-

-

2022 Thoughts, Hello 2023!2 years ago

-

Series of Defaults for Maple Finance2 years ago

-

Takeaways from “Sea Change”3 years ago

-

Greed is Coming Back3 years ago

-

-

-

-

-

-

-

-

What is Overemployment3 years ago

-

Terra Hill Condo (former Flynn Park)3 years ago

-

Alibaba VS Tencent: The Battle Royale3 years ago

-

-

-

-

-

-

-

-

-

-

-

-

-