分析员:股市进入盘整 高息防御股跑赢大市

(吉隆坡12日讯)眼见美联储即将收紧货币政策,包括马股在内的全球股市极大可能进入盘整,大华继显研究认为,届时高周息率和防御股将跑赢大市。

分析员眼中能跑赢大市的板块,包括产托、博彩、银行、公用、消费股等。

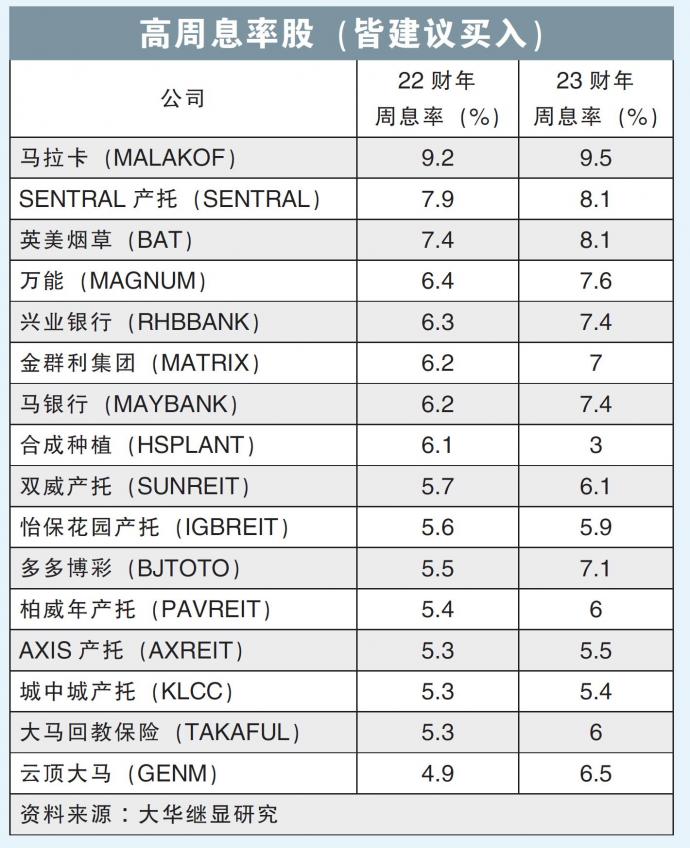

同时,在防御投资策略下,分析员首选的高周息率股为英美烟草(BAT,4162,主板消费股)、云顶大马(GENM,4715,主板消费股)、万能(MAGNUM,3859,主板消费股)、金群利集团(MATRIX,5236,主板产业股)。

同时,马银行(MAYBANK,1155,主板金融股)、兴业银行(RHBBANK,1066,主板金融股)、SENTRAL产托(SENTRAL,5123,主板产业信托)和双威产托(SUNREIT,5176,主板产托股)也在名单内。

至于首选防御股,则是喜力大马(HEIM,3255,主板消费股)、IHH医疗集团(IHH,5225,主板保健股)、时光网络(TIMECOM,5031,主板电信与媒体股)和西港控股(WPRTS,5246,主板交通与物流股)。

提及全球股市,分析员指出,尽管美股在日渐严重的通胀环境下保持弹性,但已箭在弦上的货币政策紧缩,和标普500指数估值过高,已预示着未来数个月会遭受卖压。

高周息率股

投资正回报

回看大马,分析员评论,虽然经济展望趋向乐观,但碍于美股进入盘整、外资撤出、全球资金流动性趋紧,马股难免会跟随美股脚步。

分析员续指,这场景下,优质的高周息率股料会跑赢综指走势,并带来投资正回报。

细看上述首选股名单,分析员青睐的公司涵盖经济重启、边境解锁受惠股,其2023年平均预期周息率为6.1%。

其中,分析员点出,云顶大马2023财年周息率可达到6.5%;金群利集团2022至2024财年周息率,介于6%至7%。

另一边厢,万能可从2023财年起,将周息率拉升至7%至8%;SENTRAL产托可从2022财年起,让周息率突破8%。

高周息率股和催化剂

5 Habits of Top-Producing Real Estate Agents

1 hour ago