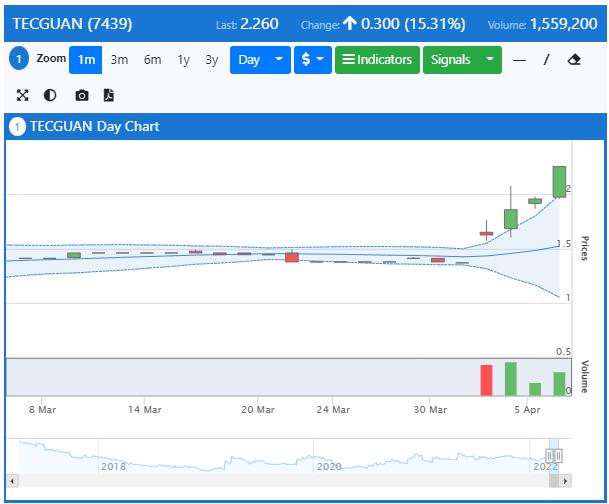

31st March Teck Guan reported EPS 42.98 sen for its quarter ending January and its previous quarter EPS was 4.7 sen, a fantastic jump in profit. On 2 April I wrote and posted my article namely “Teck Guan is leading the way”. Its share price chart below shows that it has shot up from Rm 1.37 to close at Rm 2.25 today. It has gone up 88 sen in the last 4 trading days. Only today it has gone up 29 sen.

Warning:

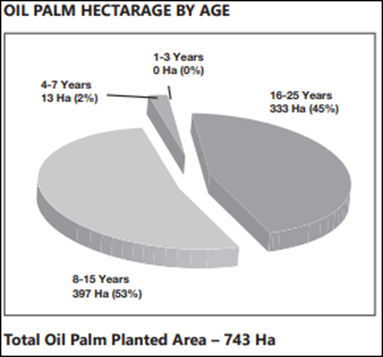

I am obliged to warn all my readers that Teck Guan has shot up too fast and it is risky to buy it at the current price level. Its upside is limited. Moreover, it has only 743 Ha of oil palm plantation in Sabah as you can see from its 2021 annual report.

Just for comparison, SOP has 88,000 Ha, Surbur Tiasa has 13,000 Ha, Cepatwawasan has 10,000 Ha and Jaya Tiasa has 70,000 Ha.

The best Plantation Stocks to buy are Subur Tiasa, Cepatwawasan, SOP and Jaya Tiasa. You can the comparison based on the last traded prices.

|

Name |

Price |

Latest EPS |

Price ÷EPS |

|

Subur |

Rm 1.86 |

16.15 sen |

11.6 |

|

Cepat |

Rm 1.09 |

7.74 sen |

14.0 |

|

SOP |

Rm 5.70 |

36.44 sen |

15.7 |

|

Jaya Tiasa |

Rm 1.02 |

5.28 sen |

19.3 |