蔡兆源 | 来自税收局的情书?

上一期文章,“不呈报租金也算逃税吗?”见报后,还是有读者问到:“那税收局又如何知道我已购置产业呢?”

这期,我们继续谈为甚么当纳税人一购置产业时,税收局就来查呢?税收局的消息有这么灵通吗?

●税局总监有权要求资料

在1967年所得税法令之下,税收局总监有权力要求任何人提供一切税收局所需要的资料,当然这资料可以是关于他自己个人或其他人。

任何人拒绝服从税收局的要求,如果被判罪,可以被罚款不少于200令吉和不超过2万令吉,或监禁6个月,或两者兼施。

●置产须需报产业盈利税

很多人不晓得他们在购置产业时,一般上律师都会帮他们呈报产业盈利税。因为根据1976年产业盈利税法令(Real Property Gains Tax Act,1976或Cukai Keuntungan Harta Tanah,1976),任何人购置产业都须向税收局呈报。

呈报时需填写CKHT2表格,表格中的资料包括购置产业者姓名、地址、产业地址等。当然,产业盈利税也是由税收局管辖。所以你说税收局可能没有任何人购置产业的消息吗?

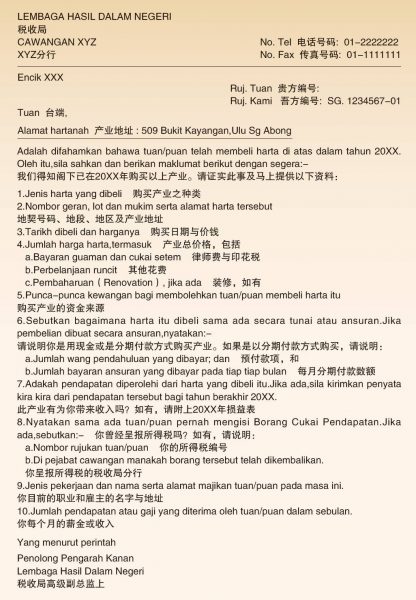

再说,一般上,买卖产业的割名手续都须要通过各州的土地局处理,就算是购置产业者没呈上CKHT2表格,要取得产业交易的资料并不难,税收局也可以要求建屋发展商提供购置产业者的资料。有了购置产业者的资料,税收局就能将类似以下的这封“情书”寄给他们。

●税务识别号码

再者,从2022年起,政府推行税务识别号码(Tax IdentificationNumber,TIN)是我国走向更严谨税务制度的一步,有望把影子经济和非正规领域纳入征税网络中,这包括非法的活动和交易;还有非正规领域如电商、高收入的小贩等等。

在TIN实施后,没有TIN,任何人都无法进行转让产业、股份和生意,因为在呈报印花税与产业盈利税时都需要TIN。

上期我们谈过不呈报租金就是逃税。从逃税的角度,税法并无区分商业收入与非商业收入差距如租金收入。有租金收入,就要依法报税,极大化可扣税开销的申索,减轻税务负担,才是上策,别冒险哦!

https://www.sinchew.com.my/20220912/%E8%94%A1%E5%85%86%E6%BA%90-%E6%9D%A5%E8%87%AA%E7%A8%8E%E6%94%B6%E5%B1%80%E7%9A%84%E6%83%85%E4%B9%A6%EF%BC%9F/

Wealth Transfers Fail Without Proper Planning

3 hours ago