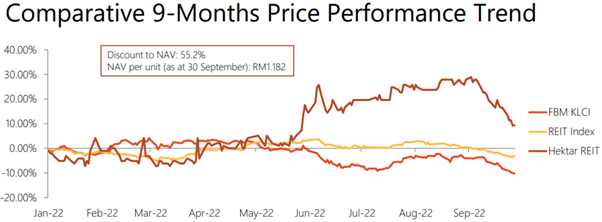

The better-than-expected sets of results by HEKTAR (KLSE: 5121) had resulted in a circa 40.0% increase in share price from its 6-months low of 50.0 cents to the highest point of 70.0 cents.

Faring a 4.12% in dividend yield and normalized PE ratio of 5.71, together with a NTA of RM1.1822, can we say that HEKTAR is now undervalued?

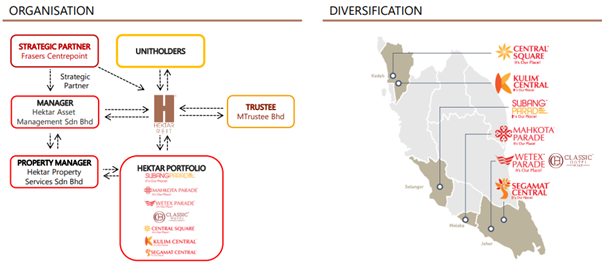

As the first retail-focused REIT in Malaysia, HEKTAR is backed by a strong sponsor/strategic partner – Frasers Centrepoint for future potential acquisitions of assets.

The REIT had Subang Parade, Mahkota Parade, Wetex Parade, Central Square, Kulim Central and Segamat Central for its retail business. It is interesting to note that the company also owns a hospitality asset close to Wetex Parade, which is the Classic Hotel located strategically in Muar, where there was low competition in town.

It is good to note that HEKTAR is now experiencing 82.3% in occupancy rate, where the management is expecting more recovery in tandem with the growth in economy, as well as ongoing strategies, such as tenant remixing.

Since the emergence of the new key management of the company, we are also seeing a huge jump in tenant sales, where the sales improved by 142.0% on year-on-year basis, and it was at the benchmark of 89.0% at pre-pandemic level.

Across the assets of the REIT, they also observed an increase in footfall of 269.0% on year-on-year basis, where it hits approximately 69.0% of pre-pandemic level, it is important to note where the vehicle count of the assets had also recovered to 61.0% of pre-pandemic level.

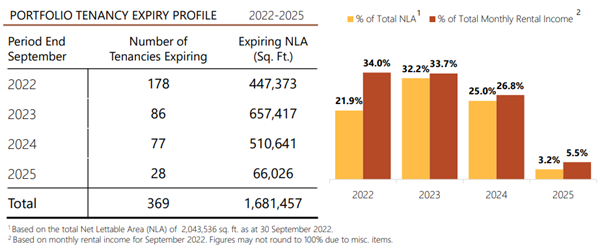

In

terms of risks, the management had also mentioned that 447,373 sq. ft.

or approximately 22.0% of the NLA will be expiring in 2022, where 120

total tenants of 13.8% of the NLA was renewed, with 8.1% of the NLA

outstanding and pending for renewal for 2022.

As for the sole hospitality asset – Class Hotel, we are seeing much better overall occupancy and Average Room Rate (ARR) in the current quarter, where the occupancy rate had increased from 17.0% to the current 46.0% on year-on-year basis, where the ARR had grown from RM125.61 to RM136.47, indicating a better demand for the rooms of the said hotel.

To conclude, HEKTAR is well on their track of recovery, and for a good asset holding REIT to see 55.2% discount from the NTA, this is simply unjust for the company. Based on a fairer valuation of 8.0 times PER and 20.0% discount to NTA, HEKTAR should be conservatively trading at 91.5 cents/94.5 cents instead.

This REIT is definitely undervalued at the moment.

https://klse.i3investor.com/web/blog/detail/HOSEHStockTalk/2022-11-27-story-h-304728758-Re_visiting_the_valuation_of_HEKTAR_REITs