Feb 18, 2013

Company background

Established in 1960, Jaya Tiasa Holdings Bhd is one of Malaysia’s largest fully integrated timber companies, with activities from extraction and trading of logs, to the manufacturing and export of plywood, veneer and sawn timber. The group’s timber concessions span a vast 713,211ha in Sarawak. In addition, the group also has 141,308ha of replantable reforestation land, of which just over 20% has been planted.

The group ventured into the palm oil industry in 2002. As at April 30, 2011, the total landbank of the group for oil palm stood at 83,483ha with 70,900ha estimated to be suitable for planting.

http://www.theedgemalaysia.com/in-the-financial-daily/196583-jaya-tiasa-holdings-bhd.html (Nov.2011)

Jaya Tiasa has grown into Sarawak's second largest listed planter after diligently investing the cash flows from its timber business into palm oil over the past 11 years(2002).

http://biz.thestar.com.my/news/story.asp?file=/2013/1/7/business/20130107084629&sec=business (Jan.2013)

At the time of listing in 1995, the group was merely involved in processing timber. In 1998, it acquired 11 timber concession licences from the RH Group and several private vendors, transforming itself into an integrated timber producer. The acquisition gave Jaya Tiasa access to 713,211ha of timber concessions or 5.7% of the total area in Sarawak.

[CIMB Research Jan.2013]

Management

- Tan Sri Tiong’s son Dato’ Sri Tiong Chiong Hoo was the managing director of Jaya Tiasa from 1995 to 31 Dec 2012. He led Jaya Tiasa's diversification into oil palm plantations 11 years ago when the palm oil industry was unexciting, with CPO price averaging RM1,365 per tonne. Under his stewardship, Jaya Tiasa's oil palm plantations steadily expanded at an average rate of 5,322ha per year and became the group’s largest profit centre, at 67% of FY6/12 pretax profit.

- After his promotion to executive deputy chairman on 1 Jan 2013, Dato' Sri Tiong willno longer be involved in Jaya Tiasa’s day-to-day operations, which will be handled by Dato' Wong Sie Young, a senior manager who has been with the group for 25 years. Dato' Sri Tiong will continue to be in charge in the group's strategy.

[CIMB Research Jan.2013]

[Am Securities December.2012]

Log harvesting

- Jaya Tiasa sold approximately half of its logs to local and overseas customers in FY6/12 while the rest was processed by its downstream division.

- Asian countries are its largest customers, with India, Taiwan and Japan accounting for a combined 83% of its total log exports in FY6/12.

Wood processing

- In terms of market share, we estimate that the group accounted for 7% of Sarawak’s plywood exports in FY6/12.

[CIMB Research Jan.2013]

Shareholdings

- 種植業務是該公司最大的貢獻者,佔近一半的稅前盈利,成熟地段增加江激勵鮮果串產量高企。

http://biz.sinchew.com.my/node/48809 (June.2011)

- For FY11, timber remained the company’s core segment and was responsible for 74.9% of revenue. This was a decline from 89.3% in FY10, while contribution from its oil palm segment grew to 24.9% from 10.4%.

http://www.theedgemalaysia.com/in-the-financial-daily/193087-plantations-to-drive-jaya-tiasas-earnings.html (September.2011)

- The availability of resources is one of our key strengths. We have a sustainable supply of logs through natural and planted forests, as well as a diversified export market for our timber and timber-related products. Our landbank for the development of oil palm plantations is huge, and we have a favourable age profile of palms.

- Another major advantage is the strategic location of our facilities. Our timber processing factories are within the vicinity of the concession areas as well as the seaport, providing ease of export. Our existing and future palm oil mills are located within the estates, saving us on transport costs.

- With our logs and wood-based products exported to over 10 countries, we are one of the most diversified, in terms of export sales markets, among Malaysian timber companies.

http://www.theedgemalaysia.com/in-the-financial-daily/196583-jaya-tiasa-holdings-bhd.html (Nov.2011)

- Revenue & Profit breakdown

[Am Securities December.2012]

- Timber remained its largest revenue contributor in FY6/12 though its earnings contribution to the group has dwindled to 33% of group pretax profit in FY6/12.

[CIMB Research Jan.2013]

- Timber operation

Today, Jaya Tiasa's timber business consists of three units:

1) log harvesting and trading,

The group's timber operations are currently partially integrated. It owns 713,211ha of timber logging concessions in Sarawak which is approximately 10 times the size of Singapore and, we believe, is the second largest in Sarawak among the listed players. The largest is Lingui Development (LING MK) with 721,000ha of concessions.

One of its licences (7% of concessions area) is subject to annual renewal while the remainder (93% of total concession area) expire in 2015 and are subject to annual renewal thereafter. We understand that the renewal fee is nominal as the state government collects royalties for logs harvested.

- We are more optimistic on prospects for timber demand from India due to its strong domestic demand. ITTO reported that imports from India in the recent years were driven by its domestic economic growth and increasing construction activities.It also reported India's exports of SPWPs were only 0.5% of the world’s total exports in 2010. This suggests that most of the timber products imported into India were ultimately consumed domestically. However, the weakening rupee may affect India's demand for timber by reducing its purchasing power.

- However, strong demand from India may not offset the slowdown in demand growth from China as the former's imports of tropical log were only about half of China's tropical log imports in 2010.

2) wood processing (downstream), and

- The group carries out its downstream processing activities through five mills located in Sarawak.

- Plywood is the downstream division’s key product, accounting for 80% of total wood processing revenue in FY6/12.

- The group has a capacity to produce 420,000m3 of plywood, 324,000m3 of veneer and 112,800m3 of sawn timber annually.

- Although it harvested more logs than its downstream capacities, the utilisation rate of the group's wood processing facilities remains low, which we suspect is due to stiff competition from the overseas producers which have lower production costs. Because of lower profitability for the wood processing business, Jaya Tiasa prefers to sell logs than process them.

- Japan is the biggest importer of tropical plywood, accounting for almost a third of global imports in 2010.

- We also expect weaker demand for plywood from other export markets in the medium term compared to FY6/12 due to ongoing uncertainties in the global economic conditions. Approximately three quarters of Jaya Tiasa's plywood products are sold to three export-oriented economies - Japan, S. Korea and Taiwan. Demand from these countries is likely to be weaker than a year ago as buyers have turned cautious.

[CIMB Research Jan.2013]

- We see lower Sarawak timber export prices in FY6/13 compared to FY6/12 as demand from the key purchasing countries is likely to weaken. We expect the average export prices to hover around US$180/m3 for Sarawak logs and US$480/m3 for plywood in FY6/13. These prices are lower than FY6/12’s US$189/m3 and US$523/m3, respectively.

[CIMB Research Jan.2013]

3) planted forest.

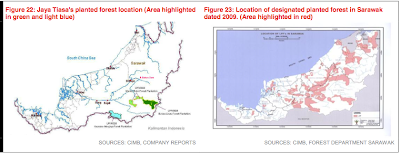

- Jaya Tiasa ventured into reforestation in FY4/04 through a JV with RH Forest Corporation Sdn Bhd, a related party.

- It currently manages 235,859ha of reforestation area, out of which 30,818ha are planted.

- We understand from the group that the JV agreement for reforestation is similar to the JV agreement for oil palm plantations under which the group will capture all the profits derived from the land held by the JV upon paying the JV partner a nominal fee.

- We believe that the rationale behind the venture is to ensure sufficient log supply for the group in the long run in view of the declining log supply from the natural forests in Sarawak. According to Sarawak Timber Association, Sarawak's timber production reached its peak in the 1990s.

- Planted forests typically take 12-15 years to mature. The group expects this division to start contributing revenue only in FY6/22.

[CIMB Research Jan.2013]

1) log harvesting and trading,

The group's timber operations are currently partially integrated. It owns 713,211ha of timber logging concessions in Sarawak which is approximately 10 times the size of Singapore and, we believe, is the second largest in Sarawak among the listed players. The largest is Lingui Development (LING MK) with 721,000ha of concessions.

One of its licences (7% of concessions area) is subject to annual renewal while the remainder (93% of total concession area) expire in 2015 and are subject to annual renewal thereafter. We understand that the renewal fee is nominal as the state government collects royalties for logs harvested.

- China and India accounted for 85% of global tropical wood log imports in 2010. India took up 61% of Sarawak's log exports in 2011.

- We expect slower global economic growth to dampen demand for secondary processed wood products (SPWPs). China will be one of the most affected as it is the world's largest SPWP exporter, accounting for 26.3% of world exports in 2010, according to the International Tropical Timber Organisation (ITTO). Weaker demand for SPWP is likely to result in lower timber imports by China.

- However, strong demand from India may not offset the slowdown in demand growth from China as the former's imports of tropical log were only about half of China's tropical log imports in 2010.

[CIMB Research Jan.2013]

- The group's timber business accounted for 79% of cost of sales in FY6/12. The bulk of the division's cost relates to

1) contract fees for log extraction,

2) royalties and premium for logs harvested,

3) transportation expenses and

4) raw materials and chemicals.

The oil palm division made up 20% of the total cost of sales in FY6/12. It rose from RM15m in FY4/08 to RM162m in FY6/12, in line with the rise in FFB production from 61k tonnes in FY4/08 to 611k tonnes in FY6/12.

[CIMB Research Jan.2013]

1) contract fees for log extraction,

2) royalties and premium for logs harvested,

3) transportation expenses and

4) raw materials and chemicals.

The oil palm division made up 20% of the total cost of sales in FY6/12. It rose from RM15m in FY4/08 to RM162m in FY6/12, in line with the rise in FFB production from 61k tonnes in FY4/08 to 611k tonnes in FY6/12.

[CIMB Research Jan.2013]

2) wood processing (downstream), and

- The group carries out its downstream processing activities through five mills located in Sarawak.

- Plywood is the downstream division’s key product, accounting for 80% of total wood processing revenue in FY6/12.

- The group has a capacity to produce 420,000m3 of plywood, 324,000m3 of veneer and 112,800m3 of sawn timber annually.

- Although it harvested more logs than its downstream capacities, the utilisation rate of the group's wood processing facilities remains low, which we suspect is due to stiff competition from the overseas producers which have lower production costs. Because of lower profitability for the wood processing business, Jaya Tiasa prefers to sell logs than process them.

- Japan is the biggest importer of tropical plywood, accounting for almost a third of global imports in 2010.

- We also expect weaker demand for plywood from other export markets in the medium term compared to FY6/12 due to ongoing uncertainties in the global economic conditions. Approximately three quarters of Jaya Tiasa's plywood products are sold to three export-oriented economies - Japan, S. Korea and Taiwan. Demand from these countries is likely to be weaker than a year ago as buyers have turned cautious.

[CIMB Research Jan.2013]

- We see lower Sarawak timber export prices in FY6/13 compared to FY6/12 as demand from the key purchasing countries is likely to weaken. We expect the average export prices to hover around US$180/m3 for Sarawak logs and US$480/m3 for plywood in FY6/13. These prices are lower than FY6/12’s US$189/m3 and US$523/m3, respectively.

[CIMB Research Jan.2013]

3) planted forest.

- Jaya Tiasa ventured into reforestation in FY4/04 through a JV with RH Forest Corporation Sdn Bhd, a related party.

- It currently manages 235,859ha of reforestation area, out of which 30,818ha are planted.

- We understand from the group that the JV agreement for reforestation is similar to the JV agreement for oil palm plantations under which the group will capture all the profits derived from the land held by the JV upon paying the JV partner a nominal fee.

- We believe that the rationale behind the venture is to ensure sufficient log supply for the group in the long run in view of the declining log supply from the natural forests in Sarawak. According to Sarawak Timber Association, Sarawak's timber production reached its peak in the 1990s.

- Planted forests typically take 12-15 years to mature. The group expects this division to start contributing revenue only in FY6/22.

[CIMB Research Jan.2013]

- Oil Palm

Jaya Tiasa is also the second largest listed oil palm operator in Sarawak by planted area, with 58,545ha of planted estates as at 30 June 2012, after Sarawak Oil Palms (SOP MK) which had 62,755ha at end-2011. This places the group as a mid-cap plantation player.

Jaya Tiasa marked its entry into oil palm plantations when it acquired a 90% stake in Simalau Plantation Sdn Bhd (SPSB) in 2001. It continued to accumulate landbank. By 2005, its landbank had grown to 83,483ha, with 70,900 ha estimated to be plantable.

Approximately 63% or 52,880ha of its total landbank are held through joint venture agreements (JV) with companies related to the RH Group. Of this, 46,880ha are designated for forest plantations for 60 years (2003-2063) but the group has been granted approval to develop palm oil in this area for 25 years. Although the group may not own the land outright as it is held by its JV partners, we understand that it can capture all of the profit generated from the land held through the JVs after paying its JV partners a "leasing fee" equivalent to RM10 per tonne of FFB produced.

Jaya Tiasa marked its entry into oil palm plantations when it acquired a 90% stake in Simalau Plantation Sdn Bhd (SPSB) in 2001. It continued to accumulate landbank. By 2005, its landbank had grown to 83,483ha, with 70,900 ha estimated to be plantable.

Approximately 63% or 52,880ha of its total landbank are held through joint venture agreements (JV) with companies related to the RH Group. Of this, 46,880ha are designated for forest plantations for 60 years (2003-2063) but the group has been granted approval to develop palm oil in this area for 25 years. Although the group may not own the land outright as it is held by its JV partners, we understand that it can capture all of the profit generated from the land held through the JVs after paying its JV partners a "leasing fee" equivalent to RM10 per tonne of FFB produced.

[CIMB Research Jan.2013]

Landbank/Production line/Output

- 目前,常成控三夹板业务的产能使用率,只有大约60%,但随着原木产量增加,产能已在提升。日本地震之后,该公司出口至日本的原木销量已经从15%,增加到25%;此外,也继续保持对美国、台湾、中国及韩国的出口活动。该公司管理层也宣称,韩国政府的反倾销税仅针对特定的厚大三夹板,因此常成控股并不受影响。

- 常成控股也计划建立另一个原棕油工厂,每小时产能达40公吨,并计划在2012年投入生产。

http://www.nanyang.com.my/node/319857 (June.2011)

- 大馬研究預計常成控股2012財政年鮮果串產量將增長45%至52萬公噸,2013財政年則料另成長50%至75萬公噸,而2012至2014財政年的原棕油價預估則是每公噸3千300令吉。“這將促使該公司成為規模龐大的中型種植公司,2013財政年成熟種植地料倍增至近5萬公頃,而截至2011財政年杪的成熟種植地則達2萬5千零58公頃。”

http://biz.sinchew.com.my/node/48809 (June.2011)

- “We expect FFB production to grow significantly by 45% to 520,000 tonnes in FY12F and by another 50% to 750,000 tonnes in FY13F,” Am Research said.

- AmResearch said Jaya Tiasa’s mature hectarage was expected to rise 50% to over 37,000ha in FY12F and by another 30% to about 50,000ha by FY13F, after adding 70% to 25,058ha as at end-FY11.

http://www.theedgemalaysia.com/business/190358-amresearch-maintains-buy-on-jaya-tiasa.html (July.2011)

- Jaya Tiasa have a plantable area of 70,900ha. As at April 30, 2011, we have planted a total area of 55,017ha, of which 25,058ha have matured. Fresh fruit bunch (FFB) production increased significantly by 96% to 358,798 tonnes from the preceding financial year.

- The group’s first palm oil mill commenced operation in 2009 with an initial processing capacity of 45 tonnes per hour of FFB. The mill is currently under expansion to increase the FFB processing capacity to 90 tonnes per hour to support the higher crop levels.

http://www.theedgemalaysia.com/in-the-financial-daily/196583-jaya-tiasa-holdings-bhd.html (Nov.2011)

- JAYA TIASA拥有总地库为 83480公顷,适合种植的地段是68267公顷。JTIASA WHOLLY-OWNED的地库为36150公顷,通过JOINT VENTURE的地库为47330公顷。截至2011年,55017公顷已种上棕油树。目前还能种植的空地为13250公顷。棕油提炼厂1间,未来2年将增加2间。

以下是JTIASA的棕油树龄:

0岁:4593公顷

1岁:6866

2岁:9027

3岁:9276

4岁:10483

5岁:7177

6岁:3400

7岁:1407

8岁:1903

9岁:885

http://www.investalks.com/forum/viewthread.php?tid=8056&extra=&highlight=jaya%2Btiasa&page=4

#曾经沧海难为水 (March.2012)

- According to Jaya Tiasa’s announcements on Bursa Malaysia, its average monthly FFB production stood at 65,000 tonnes for the July-October 2012 period vs. an average of over 40,000 tonnes in the previous 14-month period. If this trend continues, FFB production could touch 780,000 tonnes for FY13F – at least 7% higher vs. our current assumption.

- YoY, log ASP fell 9% to RM549/cu m from RM606/cu m a year earlier, while plywood ASP fell 11% to RM1,691/cu m (See Table 3). Log exports to India could also improve next year due to pent- up demand vis-à-vis the current weakening Rupee that has affected buying from that country. This is after a year of declining buying activity from India and the downstream industry there would have to start buying logs to continue operations.

- Jaya Tiasa currently processes only 50% of its FFB output which may be a source of risk during times of bumper crop as the group may not be able to sell its FFBs at market price.

[CIMB Research Jan.2013]

- Since 2002, Jaya Tiasa has planted a total of 58,545ha of oil palm estates in Sarawak. Its new plantings reached a peak in 2008 but have slowed down since. Jaya Tiasa's first CPO mill was commissioned in 2009.

[CIMB Research Jan.2013]

- We estimate the group's FFB yield to be 16.3 tonnes/ha in FY6/12, which is lower than the national average of 18.9 tonnes/ha but in line with Sarawak’s 16.3 tonne/ha (see Figure 10). We attribute the low yield to the group's young estates which will only reach their peak yielding age when they are nine years old (see Figure 11).

- Its CPO mill also recorded a lower-than-average oil extraction rate of 17.0% in FY6/12 compared with Sarawak's 20.5% and the national average of 20.5%. This is not surprising as it mainly processes FFBs from its estates’ young trees which have lower oil content. The group expects its OER to improve to the industry average in 2014-15.

[CIMB Research Jan.2013]

- To fully capture the value of its upstream operations, the group is building three additional palm oil mills (total capacity of 240MT/hr), targeted to be completed within the next two years. We estimate the group currently sell half of its FFBs as a result of limited capacity in its own mill. Fruits that are not processed internally represent loss of milling margin that would otherwise be captured. The new mills are also located close to its estates, which helps to save transportation cost. The group expects transportation cost savings of RM20-30 for every tonne of FFB processed by the new mills compared to selling the fruits to third-party mills.

Growth/Strategy

- 分析员也说:“常成控股的盈利大好,再加上7万公顷地库种植活动即将完成,种植部门未来3年所需的资本开销将逐渐减少,这些都加强了该公司的现金流表现。”

http://www.nanyang.com.my/node/319857 (June.2011)

- With sizable palm oil areas reaching maturity in the coming years, Jaya Tiasa said it plans to build five new CPO mills to cope with the rapid growth in crop production. It currently has one mill operating with an installed annual processing capacity of 270,00 tonnes.

http://www.theedgemalaysia.com/in-the-financial-daily/193087-plantations-to-drive-jaya-tiasas-earnings.html (September.2011)

- Jaya Tiasa’s plantation division has taken over as the main earnings contributor, accounting for +65.1% of 1QFY12 profit before tax (versus +47% in 4QFY11).We continue to expect oil palm plantation to be the main growth driver going forward as a result of:

i) increase in matured acreage which leads to higher FFB production volume; and

ii) fluctuating log production volume as a result of unfavourable wet weather conditions disrupting supply.

http://www.theedgemalaysia.com/in-the-financial-daily/193885-jaya-tiasas-oil-palm-driving-fy12-earnings.html (October.2011)

- Planted forests require a maturity period of 12 to 15 years to provide commercially exploitable timber. In this respect, we anticipate that the forest plantations division will start to positively contribute to the group’s earnings by 2022.

- The palm oil division is expected to be the engine for future growth and a major contributor to the group in the future. Currently palm oil contributes about 30% of the total group revenue.

http://www.theedgemalaysia.com/in-the-financial-daily/196583-jaya-tiasa-holdings-bhd.html (Nov.2011)

***********************************************************************************************************

- Jaya Tiasa Holdings Bhd is on target to commission three more palm oil mills, all of which are strategically located near its oil palm plantations, over the next two years.

- Its Chairman Tan Sri Abdul Rahman Abdul Hamid said the mills are estimated to cost a cumulative RM235 million. He said two mills are under construction while the other was in the final stage of planning.

- "Our present mill has been upgraded, with enlarged palm oil processing capacity of 330,000 metric tonnes a year.

- "We certainly need more mills to cope with the expected rapid growth in crop production in the years ahead as a sizeable oil palm-planted estates are reaching maturity," he said in a statement in the run-up to the group's 52nd annual general meeting for financial year ended June 30, 2012 here on Wednesday.He said the oil palm division had continued to be the "solid pillar of growth" for the group.

- In the financial year under review, he said, the group's palm oil mills produced about 55,000 metric tonnes of CPO and 9,000 metric tonnes of palm kernel. As of June 30, 2012, the company's total plantable areas stood at 70,900hectares over 10 plantations in the state. "Of the total, 83 per cent or 58,545 hectares are fully planted, an increase of about six per cent compared to last year. "Sixty-four per cent of the planted area or 37,419 hectares have matured. "Our fresh fruit bunches' production has increased by 68 per cent to 604,836metric tonnes compared to last financial year's production of only 359,100metric tonnes," he added.

- Revenue from the division was at RM352 million, a 62 per cent increase from the 2011 financial year, while pre-tax profit surged by 43 per cent to RM151million, he said.

- Abdul Rahman attributed the impressive performance largely to higher output despite the lower CPO price towards the end of the financial year.

http://www.btimes.com.my/articles/20121126123115/Article/send_html (November.2012)

***********************************************************************************************************

- Management has also guided that it may focus on manufacturing more veneer (which is used for the production of plywood) for exports to markets such as Taiwan. Veneer currently garners better margins than the finished plywood.

[Am Securities December.2012]

- The group has plans for around 9,000ha of new plantings over the next two years, raising its planted area by 15%. We believe that this is achievable as Jaya Tiasa has 12,355ha of plantable land reserves and has recorded new plantings of 5,322ha p.a. in the past.

- It also plans to more than triple the capacity of its mills to 330 tonnes/hr to cater for the rising output from its estates.

[CIMB Research Jan.2013]

- The company’s net profit surged five-fold to RM54.49 million in the fourth quarter ended April 30, 2011 from RM8.98 million a year agor, due mainly to higher profit margin and increase in average selling prices.

- For the financial year ended April 30, Jaya Tiasa’s net profit jumped to RM146.91 million from RM24.37 million on the back of revenue RM870.91 million.

http://www.theedgemalaysia.com/business/188642-jaya-tiasa-up-in-early-trade.html (June.2011)

- Higher selling prices and sales volume of logs and palm oil products boosted Jaya Tiasa Bhd’s quarterly results. For 4QFY11 ended April 30, the company’s pre-tax profit tripled to RM72.8 million from RM16.6 million previously. Net profit was six times higher at RM54.5 million against RM9 million previously.

- The strong 4QFY11 results are partly due to wider profit margins from the sale of logs, which saw a 40% increase in average selling prices (ASP).

- Its palm oil division saw an increase of over 100% in sales volume of fresh fruit bunches (FFB) accompanied by a 44% increase in ASP, while crude palm oil (CPO) sales volume more than doubled, coupled with a 38% rise in ASP.

- For FY11, Jaya Tiasa’s revenue grew 17% to RM870.9 million from RM746 million for FY10. Pre-tax profit soared to RM202.3 million from RM40 million while net profit ballooned to RM148.2 million from RM25.1 million. Earnings per share increased to 55 sen from 9.13 sen.

http://www.theedgemalaysia.com/in-the-financial-daily/188671-higher-commodity-prices-lift-jaya-tiasas-net-profit.html (June.2011)

-The company announced a better than expected net profit of RM147 million for FY11 (+503% against FY10), which was 16% and 12% above our and consensus estimates. Excluding a large “other income” of over RM35 million, the results would likely have been within expectations.

- While FY11 revenue surged 17% to RM871 million on higher crude palm oil and timber prices, net operating costs fell 5%. The effective tax rate fell to 27% from 37% in FY10. The bottom line was also boosted by the higher “other income” of RM35.5 million against RM21 million in the previous year. We believe this was mainly due to forex gains at its timber division.

- For its timber division, pre-tax profit nearly quadrupled to RM105 million despite turnover falling by 3% on the back of lower production and sales volume, but for higher prices.Log sales plunged 31% year-on-year to 113,982 cu m in 4QFY11, leading to a 29% decline in full-year sales at 462,574 cu m. Log production fell 13% y-o-y to 901,471 in FY11 (4QFY11: -2% y-o-y). Management has guided that log production has resumed to normal levels. May 2011 saw the harvesting of 93,603 cu m of logs versus the lows of 40,331 cu m and 51,263 cu m in January and February.

- At its manufacturing division, plywood sales fell slightly by 2.5% to 183,861 cu m in FY11 from 188,489 the previous year, while production rose 2% to 187,449 cu m.

- Its oil palm division continued to be the star performer, bringing a 430% surge in pre-tax profit to RM105 million, representing about half of the group’s total pre-tax profit of RM202 million.

http://www.theedgemalaysia.com/in-the-financial-daily/188728-jaya-tiasas-fy11-beats-expectations.html (June.2011)

- Pre-tax profit from the company’s oil palm segment rose more than five-fold to RM106.5 million in FY11 ended April 30 from RM17.1 million the year before, asits mature oil palm hectarage grew 71% to 25,255ha over the period.

- As at end-June, its mature area, comprising oil palm trees aged three years and above, had grown 50% to 37,399ha from 25,058ha a year before on a marginal 5% increase in its planted area. Conversely, about half of its planted area has yet to reach maturity.

http://www.theedgemalaysia.com/in-the-financial-daily/193087-plantations-to-drive-jaya-tiasas-earnings.html (September.2011)

- Jaya Tiasa recorded a surge in 1QFY2012 net profit to RM55.9 million (+149% year-on-year) on higher revenue of RM260 million (+40.1% y-o-y). Growth was driven by a combination of stronger revenue and firmer Ebit margin of 31.7% (versus 17.6% in 1QFY11). This is largely underpinned by:

i) an increase in fresh fruit bunches (FFB) production to 145,158 tonnes (+78.9% y-o-y) which led to a more than double increase in crude palm oil (CPO) sales volume,

ii) higher ASPs for FFB (+30% y-o-y) and CPO (+38% y-o-y),

iii) higher log ASPs (+37% y-o-y) and

iv) an increase in log production to 252,999 m3 (+16.75% y-o-y). The latter is a result of improvements in weather conditions compared with mid-2010.

http://www.theedgemalaysia.com/in-the-financial-daily/193885-jaya-tiasas-oil-palm-driving-fy12-earnings.html (Oct.2011)

- 常成控股(JTIASA,4383,主板工業產品組)受原木、原棕油及鮮果串平均售價和銷量上揚提振,截至2011年10月31日止第二季淨利按年猛漲36.84%至4千115萬8千令吉,推動上半年淨利走揚至9千707萬7千令吉,較前期5千253萬4千令吉增長85.99%。

- 第二季營業額亦因產品售價走高而自前期1億9千221萬5千令吉,按年成長24.61%至2億3千952萬5千令吉,上半年營業額則自前期3億7千774萬4千令吉成長至4億9千951萬8千令吉,寫下32.23%漲幅。

- 該公司發文告表示,第二季原木及膠合板平均售價分別按年成長了33%和31%,鮮果串銷量則取得32%成長,原棕油銷量和平均售價,也分別寫下39%和16%增長數據。

http://biz.sinchew.com.my/node/55177 (December.2011)

- 截至2012年1月31日,常成控股净利按年增长14.1%(quarter),即从上财年同期的3988万9000令吉,上扬至4551万6000令吉。

- 常成控股合计9个月净利报1亿4259万3000令吉,上财年同期则报9242万3000令吉,涨幅为54.28%。

- 单季营业额方面,则从上财年同期的2亿3764万7000令吉,微跌0.04%至2亿3756万1000令吉。9个月累计7亿3707万9000令吉,较上财年同期的6亿1539万1000令吉扬19.77%。

http://www.nanyang.com/node/431321?tid=462targetta (March.2012)

- Jaya Tiasa Holdings Bhd recorded a lower pre-tax profit of RM38.901 million for the three-month financial period ended April 30, 2012 compared with RM72.841 million seen in the same period of 2011.

- The company, which has changed its financial year end from April 30 to June 30, said in filing to Bursa Malaysia today that its revenue for the period was higher at RM274.536 million compared with RM255.522 million previously.

- It attributed the increase in revenue to significant increase in logs sales volume."However, our pre-tax profit was lower, affected by fell in logs, fresh fruit bunches (FFB) and crude palm oil (CPO) average selling price and reduction in plywood sales volume," it said.

http://www.btimes.com.my/Current ... _html#ixzz1yL8Zmfxk (June.2012)

- Jaya Tiasa’s 1QFY13 results disappointed on the back of higher net operating costs (+33% YoY vis-à-vis an only 11% rise in revenue) stemming from higher production and sales volume for lower selling prices.

- Significantly, FFB production rose over 45% YoY and by an estimated 48% compared to the preceding three months to 195,589 tonnes. CPO production volume rose 56% YoY and by 44% compared to the preceding three months to 17,161 tonnes. The average CPO price realized fell 8% each YoY and QoQ to RM2,918/tonne.

[Am Securities December.2012]

- Capex over the past three years amounted to RM155m-305m annually and went largely to the development of its oil palm plantations and expansion/upgrade of its processing facilities. We gathered that it plans capex of RM240m in FY6/13 and RM190m in FY6/14, mainly for new milling capacity and the development of new estates.

[CIMB Research Jan.2013]

News

- 分析员向大安管理层了解到,砂拉越的原木价格飙涨,大约从1月份的每立方米230美元,涨至4月份的每立方米300美元。“有鉴于此,印度买家开始谨慎购买原木,并放缓了近期的购买步伐,再加上供应逐渐增多,热带原木的供求因此达到了平衡,价格也开始合理化,但原木价格预料会站稳目前的水平。”

http://www.nanyang.com.my/node/319857 (June.2011)

- Commenting on its outlook, Jaya Tiasa said on Thursday, June 23 that the prospect of the timber division was expected to remain positive in view of the tight log supply condition and increase in demand for wood products from Japan’s reCONSTRUCTION [] efforts coupled with strong demand from emerging economies, such as India and China.

- "For the oil palm division, higher fresh fruit bunches and CPO production volume is expected to contribute significantly to the group’s profitability.

http://www.theedgemalaysia.com/business/188642-jaya-tiasa-up-in-early-trade.html (June.2011)

- 基于印度卢比贬值,印度买家仅按照需求来购买木材,并偏好购买高品质的木材,因而促使木材价格走低。

- 此外,常成控股也以较低的价格出售部分低品质木材,其赚幅也跟着走弱。

http://www.nanyang.com/node/472220?tid=722 (August.2012)

- 常成控股曾表示,有意自4月开始,将净利至少20%作为派息用途,因此有可能派发10仙总股息,或1.5%的股息派发率。分析员也说:“常成控股目前有1550万库存股,相等于股本的5.5%,因此该公司也有能力以20配1的方式派发股息,从中促进公司的股票流通率。”

http://www.nanyang.com.my/node/319857 (June.2011)

Corporate exercise

- Distribution of one (1) treasury share for every twenty (20) existing ordinary shares of RM1.00 each

http://www.bursamalaysia.com/market/listed-companies/company-announcements/726741 (Mar.2012)

- (I) PROPOSED PLACEMENT OF NEW ORDINARY SHARES OF RM1.00 EACH IN JTH (“JTH SHARES”), REPRESENTING UP TO 15% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF THE COMPANY (Private placement -- see following)

- (II) PROPOSED BONUS ISSUE OF NEW JTH SHARES (“BONUS SHARES”) ON THE BASIS OF 2 BONUS SHARES FOR EVERY 1 JTH SHARE HELD AFTER THE PROPOSED PLACEMENT

http://www.bursamalaysia.com/market/listed-companies/company-announcements/726797 (Mar.2012)- Commenting on its outlook, Jaya Tiasa said on Thursday, June 23 that the prospect of the timber division was expected to remain positive in view of the tight log supply condition and increase in demand for wood products from Japan’s reCONSTRUCTION [] efforts coupled with strong demand from emerging economies, such as India and China.

- "For the oil palm division, higher fresh fruit bunches and CPO production volume is expected to contribute significantly to the group’s profitability.

http://www.theedgemalaysia.com/business/188642-jaya-tiasa-up-in-early-trade.html (June.2011)

- 基于印度卢比贬值,印度买家仅按照需求来购买木材,并偏好购买高品质的木材,因而促使木材价格走低。

- 此外,常成控股也以较低的价格出售部分低品质木材,其赚幅也跟着走弱。

http://www.nanyang.com/node/472220?tid=722 (August.2012)

Dividend

- 常成控股曾表示,有意自4月开始,将净利至少20%作为派息用途,因此有可能派发10仙总股息,或1.5%的股息派发率。分析员也说:“常成控股目前有1550万库存股,相等于股本的5.5%,因此该公司也有能力以20配1的方式派发股息,从中促进公司的股票流通率。”

http://www.nanyang.com.my/node/319857 (June.2011)

Corporate exercise

- Distribution of one (1) treasury share for every twenty (20) existing ordinary shares of RM1.00 each

http://www.bursamalaysia.com/market/listed-companies/company-announcements/726741 (Mar.2012)

- (I) PROPOSED PLACEMENT OF NEW ORDINARY SHARES OF RM1.00 EACH IN JTH (“JTH SHARES”), REPRESENTING UP TO 15% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF THE COMPANY (Private placement -- see following)

- (II) PROPOSED BONUS ISSUE OF NEW JTH SHARES (“BONUS SHARES”) ON THE BASIS OF 2 BONUS SHARES FOR EVERY 1 JTH SHARE HELD AFTER THE PROPOSED PLACEMENT

http://www.bursamalaysia.com/market/listed-companies/company-announcements/941205 (May.2012)

- The number of new JTH Shares (“Placement Shares”) to be issued under the Placement is 42,044,100 Placement Shares, representing approximately 15% of the issued and fully-paid up share capital of JTH (excluding treasury shares) as at 10 July 2012.

- The issue price for the Placement Shares has been fixed at RM7.90 per Placement Share, representing a discount of approximately 11% to the 5-day volume weighted average market price of JTH Shares traded on Bursa Malaysia Securities Berhad up to 10 July 2012 being the market day immediately prior to the price-fixing date, of RM8.87.

- The total gross proceeds to be raised from the issuance of the Placement Shares is approximately RM332 million to be utilised in the following manner:

http://www.bursamalaysia.com/market/listed-companies/company-announcements/1008153 (July.2012)

- Bonus issue of 649,145,198 new ordinary shares of RM1.00 each in Jaya Tiasa Holdings Berhad (“JTH”) (“Bonus Shares”) on the basis of 2 Bonus Shares for every 1 existing ordinary share of RM1.00 each held in JTH (“JTH Share”) at 5.00 p.m. on 7 August 2012 (“Entitlement Date”) (“Bonus Issue”)

http://www.bursamalaysia.com/market/listed-companies/company-announcements/1017685 (July.2012)- Bonus issue of 649,145,198 new ordinary shares of RM1.00 each in Jaya Tiasa Holdings Berhad (“JTH”) (“Bonus Shares”) on the basis of 2 Bonus Shares for every 1 existing ordinary share of RM1.00 each held in JTH (“JTH Share”) at 5.00 p.m. on 7 August 2012 (“Entitlement Date”) (“Bonus Issue”)

- 鉴于集团更换财政年,即从4月30日至6月30日,集团仅计算从2011年5月1日至2012年1月31日9个月业绩。

http://www.nanyang.com/node/431321?tid=462targetta (March.2012)

- Jaya Tiasa recently placed out 45m shares or 15% of its enlarged share capital before bonus issue at RM7.90 per share (RM2.63 ex-bonus issue). The exercise, which was completed in July 2012, raised RM326m net proceeds, which will be used to construct new palm oil mills and repay bank borrowings. The group also completed a 2-for-1 bonus issue in August 2012, raising its share base to 973.7m.

[CIMB Research Jan.2013]

[CIMB Research Jan.2013]

Bear case

- The economic crisis in 2008/09 negatively affected demand and prices of timber and timber-based products. In addition, the volatility of foreign exchange rates,rising costs due to the hike in crude oil prices, inconsistent supply of logs due to unpredictable weather conditions and labour shortages were among the many challenges we have faced over the years.

http://www.theedgemalaysia.com/in-the-financial-daily/196583-jaya-tiasa-holdings-bhd.html (Nov.2011)- The key weakness is that most of its landbank is on peat soil, which we gather costs more to plant because it has a softer texture than mineral soil. This causes the palm trees to tilt as they grow older. Some tilted trees may fall and higher planting density is needed to maximise the yield on peat soil estates. Besides, peat areas are more prone to flooding and thus require a better water management system. Jaya Tiasa’s total cost for new planting is in the range of RM15,000-20,000/ha, higher than the cost of new planting on mineral soil which we gathered from other planters could be as low as RM13,000-14,000/ha.

- Only 47% of the group's plywood manufacturing capacity was utilised in FY6/12. We suspect that this may be due to stiff competition as ITTO reported that tropical plywood production continues to shift to cost-competitive China and away from Malaysia and Indonesia.

- High palm oil stocks in key producing nations may put pressure on CPO prices and lead to lower profitability for Jaya Tiasa’s estates.

- 63% of the group's landbank is held through joint venture agreements. Should any dispute arise between the group and its partners, it may not be able to continue to operate on the land. However, we think that this is unlikely as its JV partners are related parties.

- The group needs to apply for logging quotas annually and all of its timber concession licences are subject to annual renewal after expiry in 2015. As both applications are contingent upon the government's approval, changes in government policy may affect the group's licence renewal and its access to natural forests.

- Changes in government regulations.

[CIMB Research Jan.2013]

Bull case

- We harnessed our existing production technology to improve operational efficiency and were vigilant in maintaining cost discipline.

- As demand for environmentally-friendly wood products is on the rise, our green certification also gave us a good base for capturing a considerable share of this market.

- To reduce dependence on labour, we improved infrastructure to enable successful mechanisation in some areas of operations in the oil palm estates.

- For the plywood division, we invest considerably in machinery upgrading, which resulted in the ability to peel logs of smaller diameter and increase the wood recovery rate. We are flexible in the deployment of our resources and closely monitor the cost of production.

- We are continuously upgrading our plywood products by focusing on producing and exporting value-added products, such as floor base and thin panels for niche markets which offer premium pricing. Jaya Tiasa concentrates on supplying certified plywood products to effectively exploit a rising number of markets that demand certified wood products.

- For our logging division, we continue to emphasise and enforce good forest management. The company improves operational efficiency through stringent monitoring of logging equipment and machines to ensure optimal utilisation.Prominence logistic planning is deployed to ensure timely production and delivery to safeguard the quality of logs and to improve grading for better pricing. We also implement a phased approach to obtain forest management certification.

- Reforestation is an investment for the future viability of the group in keeping with the world’s move towards conservation of natural forests and ensuring sustainability of forest resources. We are endeavouring to add reforestation areas while focusing on improving workforce management, enhancing work standards and engaging more contractors and manpower for the project, as well as strengthening research and development.

http://www.theedgemalaysia.com/in-the-financial-daily/196583-jaya-tiasa-holdings-bhd.html (Nov.2011)

- Jaya Tiasa has been able to sell its timber products at prices higher than Sarawak’s timber export prices. From FY4/08 to FY6/12, its logs commanded premiums averaging 9% while its plywood fetched premiums averaging 13%.

- Its ability to sell at premiums probably stems from 1) the superior quality of its timber products and 2) its customers' confidence in its product quality given various certifications by international bodies.

- The group now aims to harvest only logs with superior quality and transport them over land instead of river. This should mitigate its logistic problem.

[CIMB Research Jan.2013]

- Jaya Tiasa's plans to build new mills as it will allow the group to enhance its milling margins and achieve better pricing for its palm products.

- There are also opportunities for Jaya Tiasa to expand its landbank as the Sarawak government has earmarked up to 2m ha of state land for oil palm plantations.

- The group could enhance its earnings from the timber business by venturing into secondary wood processing that caters for the mass consumer, such as furniture business.

- We are positive on its venture into forest plantations as it will help secure a sustainable log supply. Timber products produced from sustainable forest source may gain wider acceptance from customers compared to those produced from natural forests.

[CIMB Research Jan.2013]

Risk

- CPO prices

- Timber product prices

Selling prices for the group's timber products are linked to the global economy, weatherand government policies in the key log-producing countries.

- Execution risk

- High dependence on foreign workers

- Weather uncertainties

- Potential changes in palm oil taxes

The government imposes cess, foreign worker's levy, sales tax and land tax on the plantation business in Sarawak. A hike in any of these taxes would dampen the group's plantation earnings.

- Royalty charges

The state government imposes royalty on log harvested. An increase in royalty charges would reduce the group's earnings.

- Pest and diseases.

- Timber concessions

Seven out of eight of the group's timber concession licences (representing 93% of total concession areas) will expire in 2015. Management may not be successful in renewing these licences, leading to lower profitability.

- Log quota

The group applies for logging quotas annually. It may not be successful in retaining its existing quota in the future. Besides, timber companies in Sarawak are allowed to export 40% of the logs harvested and must sell the remainder to domestic processors. As the export market for industrial logs is more lucrative than the processed timber products at this juncture, a reduction of export quota may reduce the profitability of the group's timber business.

- Export restriction in major producing countries

Tropical wood log prices are supported by export restrictions in several major producer countries, which include Indonesia and Brazil. A lifting of the restriction may cause the price of tropical logs to fall.

[CIMB Research Jan.2013]

http://myinvestmentparadise.blogspot.my/2013/02/jaya-tiasa-4383.html