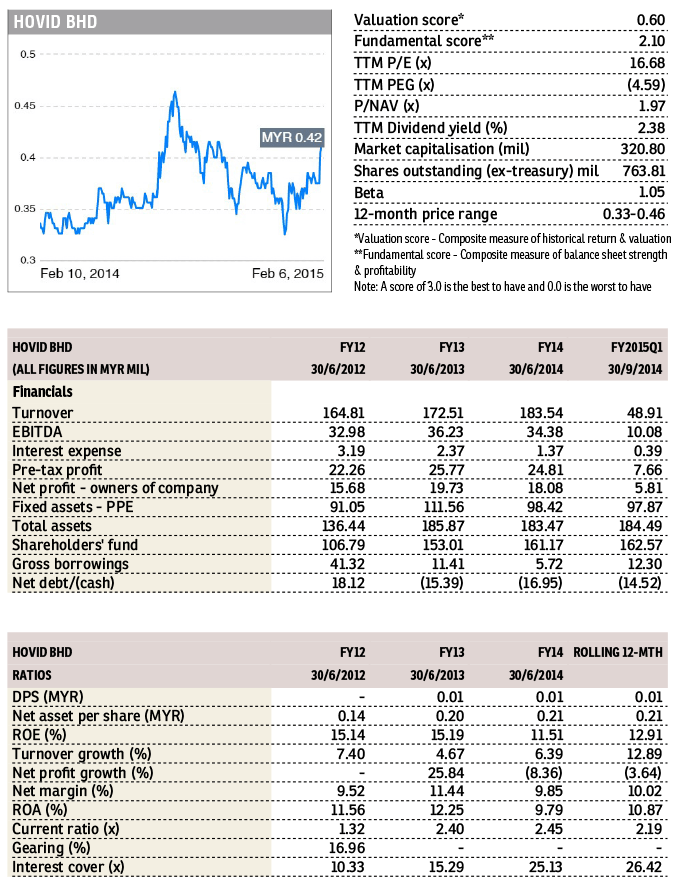

HOVID (Fundamental: 2.1/3; Valuation: 0.6/3) saw its share price rise 1.5 sen or 3.57% to 43.5 sen on substantially higher volume.

Ipoh-based Hovid is a major manufacturer of generic drugs. It derives half of its USD-denominated sales from export, particularly to Asia and Africa and as such, will benefit from the ringgit’s depreciation.

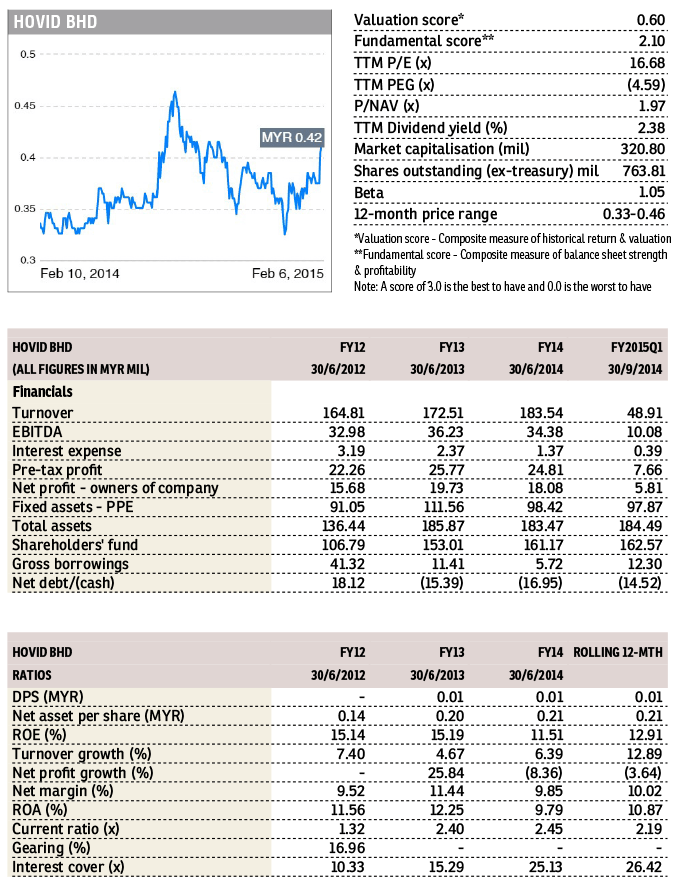

Since disposing its loss-making biodiesel subsidiary Carotech in 2011, Hovid saw its net profit grow at a 2-year CAGR of 7.4% to RM18.1 million in FYJune2014, on the back of revenue of RM183.5 million. A new plant to be completed this year will alleviate capacity constraints and drive future growth.

Hovid has net cash of RM14.5 million or 1.9 sen per share, with ROE of 12.9%. The stock trades at a trailing 12-month P/E of 16.7 times and 1.97 times book. Dividends totalled 1 sen in FY2014, with a yield of 2.4%.

This article first appeared in The Edge Financial Daily, on February 10, 2015.

http://www.theedgemarkets.com

Ipoh-based Hovid is a major manufacturer of generic drugs. It derives half of its USD-denominated sales from export, particularly to Asia and Africa and as such, will benefit from the ringgit’s depreciation.

Since disposing its loss-making biodiesel subsidiary Carotech in 2011, Hovid saw its net profit grow at a 2-year CAGR of 7.4% to RM18.1 million in FYJune2014, on the back of revenue of RM183.5 million. A new plant to be completed this year will alleviate capacity constraints and drive future growth.

Hovid has net cash of RM14.5 million or 1.9 sen per share, with ROE of 12.9%. The stock trades at a trailing 12-month P/E of 16.7 times and 1.97 times book. Dividends totalled 1 sen in FY2014, with a yield of 2.4%.

This article first appeared in The Edge Financial Daily, on February 10, 2015.

http://www.theedgemarkets.com