Tong’s Momentum Portfolio - Feb 10, 2015

ASIAN equities mostly ended lower, following weaker than expected China trade data that showed falling exports and imports. However, the Shanghai Composite Index bucked the trend, closing 0.62% higher.

On Wall Street, the Dow and S&P 500 indices both dropped by 0.34% in overnight trading.

Tracking the poor China data and continuing concerns over Greece, major indices in Europe also opened lower, with losses of between 0.5% and 1.1%. Greece reiterated its intention to reject the country’s international bailout program.

Brent crude and WTI crude traded steady, hovering around $58 and US$52 per barrel, respectively, at the time of writing.

On the home front, the local bourse ended little changed, after losing as much as 0.44% in the morning session. The FBM KLCI Index declined 0.09% to 1,811.58. Market breadth was slightly negative with decliners outpacing gainers by a ratio of 1.1 to 1.

Meanwhile, the ringgit fell 0.4% to RM3.56 per USD after US employment data beat median estimate, increasing the likelihood for the Federal Reserve to raise rates by the middle of this year.

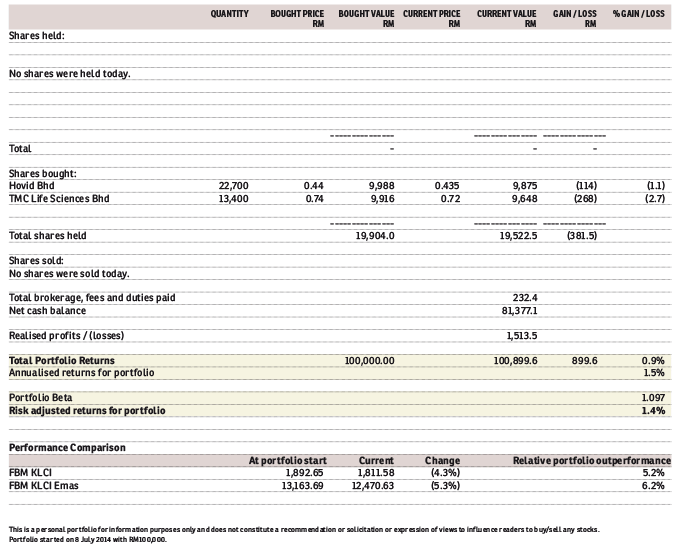

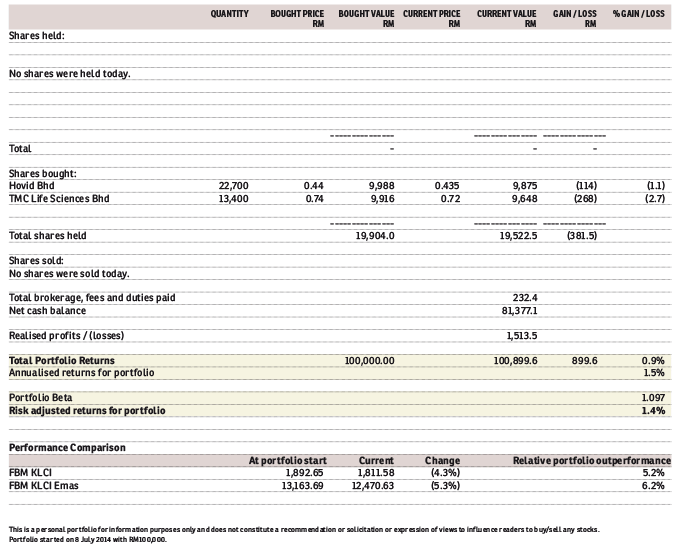

As picked by our momentum algorithm (www.theedgemarkets.com), I bought 22,700 shares of HOVID ( Financial Dashboard) at 44 sen per share and 13,400 shares of TMCLIFE at 74 sen per share.

The portfolio, which restarted on January 29 with a capital of RM100,000, is now up 1.5%. It has outperformed the benchmark FBM KLCI by 5.2%.

This article first appeared in The Edge Financial Daily, on February 10, 2015.

http://www.theedgemarkets.com

ASIAN equities mostly ended lower, following weaker than expected China trade data that showed falling exports and imports. However, the Shanghai Composite Index bucked the trend, closing 0.62% higher.

On Wall Street, the Dow and S&P 500 indices both dropped by 0.34% in overnight trading.

Tracking the poor China data and continuing concerns over Greece, major indices in Europe also opened lower, with losses of between 0.5% and 1.1%. Greece reiterated its intention to reject the country’s international bailout program.

Brent crude and WTI crude traded steady, hovering around $58 and US$52 per barrel, respectively, at the time of writing.

On the home front, the local bourse ended little changed, after losing as much as 0.44% in the morning session. The FBM KLCI Index declined 0.09% to 1,811.58. Market breadth was slightly negative with decliners outpacing gainers by a ratio of 1.1 to 1.

Meanwhile, the ringgit fell 0.4% to RM3.56 per USD after US employment data beat median estimate, increasing the likelihood for the Federal Reserve to raise rates by the middle of this year.

As picked by our momentum algorithm (www.theedgemarkets.com), I bought 22,700 shares of HOVID ( Financial Dashboard) at 44 sen per share and 13,400 shares of TMCLIFE at 74 sen per share.

The portfolio, which restarted on January 29 with a capital of RM100,000, is now up 1.5%. It has outperformed the benchmark FBM KLCI by 5.2%.

This article first appeared in The Edge Financial Daily, on February 10, 2015.

http://www.theedgemarkets.com