Tong’s Momentum Portfolio - March 10, 2015

REGIONAL markets mostly ended in the red yesterday, in tandem with losses in the US markets last Friday. Only the Shanghai Composite Index bucked the trend, rising 1.89% to close at 3,302.41.

The US reported better-than-estimated jobs data, strengthening the chances of a decision by the Fed to raise rates by mid-2015. The Dow and S&P 500 fell 1.54% and 1.42%, respectively.

Crude oil price dropped on the back of the stronger US dollar. Brent crude and WTI crude are hovering around $59 and US$50 per barrel, respectively - at the time of writing.

On the home front, the FBM KLCI Index closed 15 points or 0.84% lower at 1,791.74. Market breadth was negative with decliners outpacing gainers by a ratio of two-to-1.

Meanwhile, the ringgit slumped to a six-year low against the greenback, down 0.9% to RM3.68 following the favourable US jobs data and rising expectations of a rate hike. Weaker than expected imports by China (down 20% y-o-y in Jan-Feb 2015) our second largest export market, did not help matters.

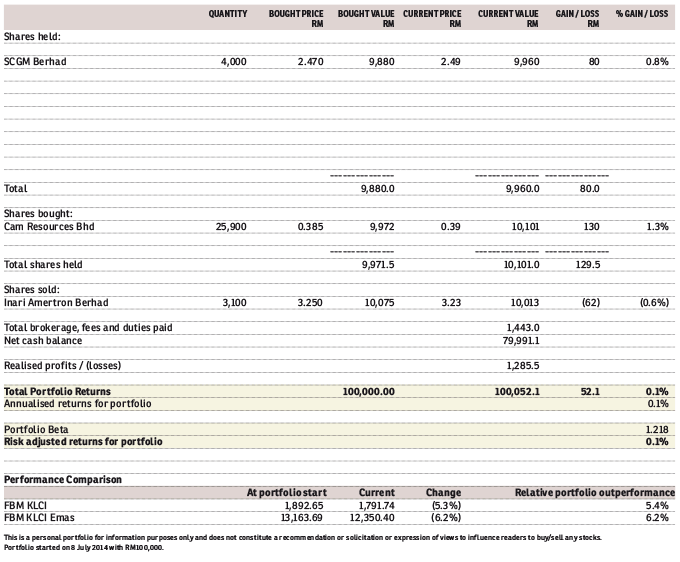

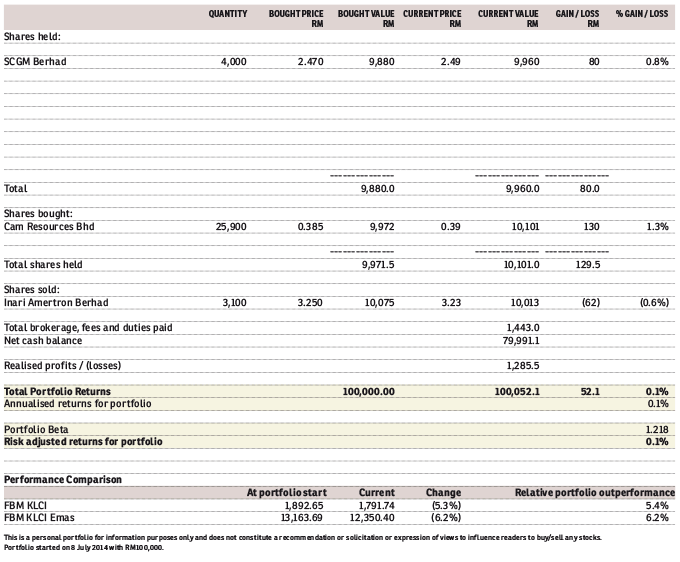

I bought 25,900 shares of Cam Resources at 38.5 sen each.

I also disposed of my entire stake of 3,100 shares in Inari at RM3.23.

I continue to hold SCGM (+0.8%).

My portfolio now has a total value of RM100,052.10 and is up 0.1% since inception. It has outperformed the benchmark FBM KLCI by 5.4%.

http://www.theedgemarkets.com/my/article/tong%E2%80%99s-momentum-portfolio-march-10-2015

REGIONAL markets mostly ended in the red yesterday, in tandem with losses in the US markets last Friday. Only the Shanghai Composite Index bucked the trend, rising 1.89% to close at 3,302.41.

The US reported better-than-estimated jobs data, strengthening the chances of a decision by the Fed to raise rates by mid-2015. The Dow and S&P 500 fell 1.54% and 1.42%, respectively.

Crude oil price dropped on the back of the stronger US dollar. Brent crude and WTI crude are hovering around $59 and US$50 per barrel, respectively - at the time of writing.

On the home front, the FBM KLCI Index closed 15 points or 0.84% lower at 1,791.74. Market breadth was negative with decliners outpacing gainers by a ratio of two-to-1.

Meanwhile, the ringgit slumped to a six-year low against the greenback, down 0.9% to RM3.68 following the favourable US jobs data and rising expectations of a rate hike. Weaker than expected imports by China (down 20% y-o-y in Jan-Feb 2015) our second largest export market, did not help matters.

I bought 25,900 shares of Cam Resources at 38.5 sen each.

I also disposed of my entire stake of 3,100 shares in Inari at RM3.23.

I continue to hold SCGM (+0.8%).

My portfolio now has a total value of RM100,052.10 and is up 0.1% since inception. It has outperformed the benchmark FBM KLCI by 5.4%.

http://www.theedgemarkets.com/my/article/tong%E2%80%99s-momentum-portfolio-march-10-2015