When I saw the newspaper dated 29 December 2015 (Appendix 1) which is

about pessimistic about the outlook economy of Malaysia, slumping

Ringgit, oil price, business and consumer sentiment. Do this means that

it is over for stock market in 2016? I don’t think so, we should look

for the optimistic side which is export related counters.

How to win big in share market? The tips are if you able to predict a lost making company to a profitable company, then you able to make handsome profits. But rarely you can identify it. Just like last time Hovid under PN17 and now turn to profitable company. I am not God, I just can forecast based on the information that provided by the management of the company.

This counter really attracts my interest to share at here, eventually I queuing to buy at 0.14 this morning and I not managed to get it. In the end I decided to buy at 0.155. By the way, I feel shock when the volume spikes up a lot today. I wonder, are those big player awake that LNGRES also benefited from appreciation of USD? Due to I tracking this company after they announced their Q3 on 26 November 2015 but the volume not that high as TODAY! This is abnormal.

LNG Resources Berhad operates through three business segments: precision engineering, precision plastic injection molding, and precision machining and stamping. This company is benefit from weak Ringgit indeed.

Let me show you.

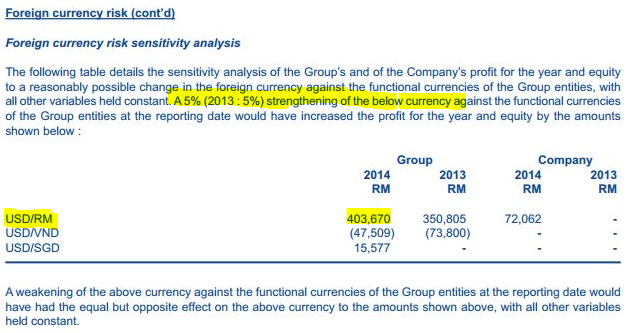

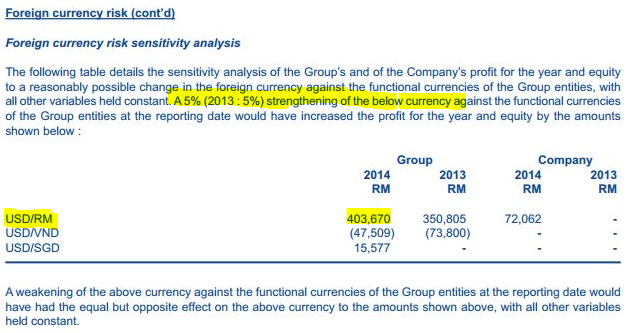

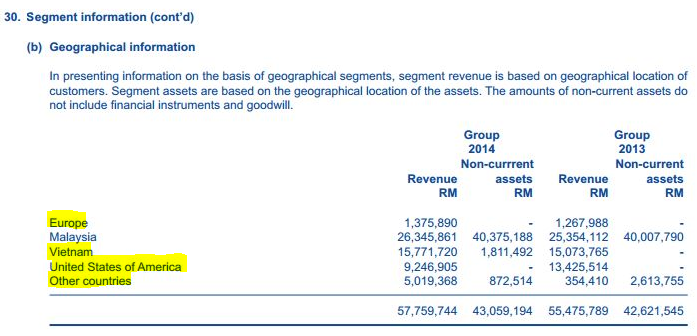

1. What is the functional currency of LNGRES? The answer has shown in the above appendix which in Annual Report 2014.

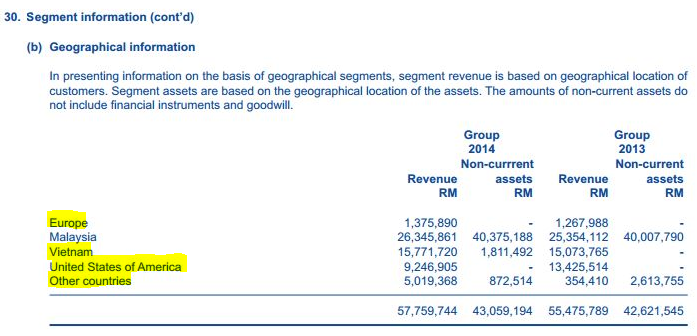

2. How much revenue of LNGRES under export? During 2014, it was 55% under segment information below.

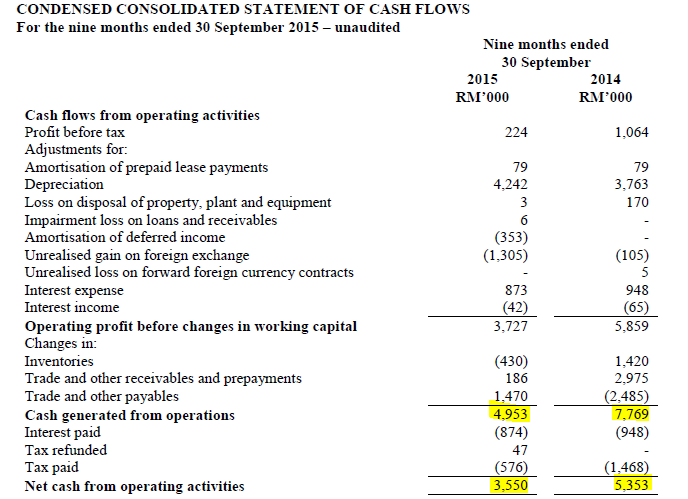

The operating review of Lngres is challenging, overall current year

today Lngres still making loss per share of 0.19 sen. But strong recover

on 3Q15, it was 0.38cents. It much depends on whether it can maintain

3Q performance until 4Q.

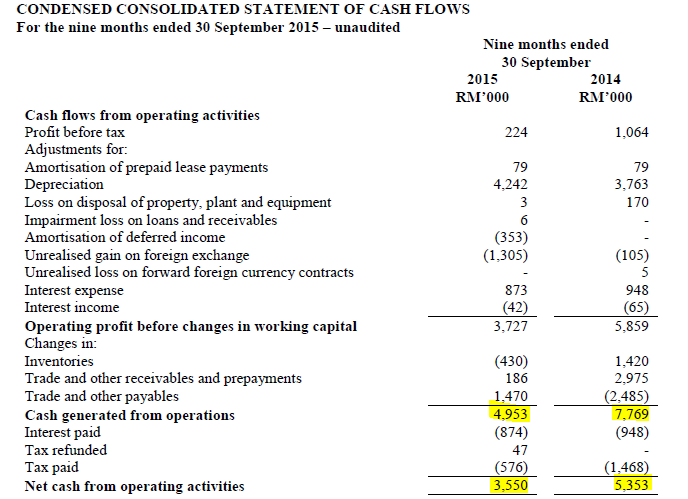

Besides that, I notice that the operating cash flow still remain positive and management strives hard to reduce the gearing of the company. The debts level has reduced as company repays the debtors instead to distribute as dividend.

As a summary, to me, the price is near record low which is only close at 0.155 today. The lowest is 0.12 during 52 weeks. Will it shine on 2016? Highly probable, as favorable exchange currency, export company like LNGRES should doing well. I foresee the price will back to previous level which is 21cents during 2014. Do invest on your own risk.

Appendix 1

How to win big in share market? The tips are if you able to predict a lost making company to a profitable company, then you able to make handsome profits. But rarely you can identify it. Just like last time Hovid under PN17 and now turn to profitable company. I am not God, I just can forecast based on the information that provided by the management of the company.

This counter really attracts my interest to share at here, eventually I queuing to buy at 0.14 this morning and I not managed to get it. In the end I decided to buy at 0.155. By the way, I feel shock when the volume spikes up a lot today. I wonder, are those big player awake that LNGRES also benefited from appreciation of USD? Due to I tracking this company after they announced their Q3 on 26 November 2015 but the volume not that high as TODAY! This is abnormal.

LNG Resources Berhad operates through three business segments: precision engineering, precision plastic injection molding, and precision machining and stamping. This company is benefit from weak Ringgit indeed.

Let me show you.

1. What is the functional currency of LNGRES? The answer has shown in the above appendix which in Annual Report 2014.

2. How much revenue of LNGRES under export? During 2014, it was 55% under segment information below.

| Current Financial | ||||

| Year |

31-Mar-15

|

30-Jun-15

|

30-Sep-15

|

30-Dec-15

|

| Status |

Actual

|

Actual

|

Actual

|

Forecast

|

| Quarter |

1

|

2

|

3

|

4

|

| EPS | (0.22) | (0.34) | 0.38 |

???

|

| NTA | 0.24 | 0.24 | 0.24 |

0.25

|

Besides that, I notice that the operating cash flow still remain positive and management strives hard to reduce the gearing of the company. The debts level has reduced as company repays the debtors instead to distribute as dividend.

As a summary, to me, the price is near record low which is only close at 0.155 today. The lowest is 0.12 during 52 weeks. Will it shine on 2016? Highly probable, as favorable exchange currency, export company like LNGRES should doing well. I foresee the price will back to previous level which is 21cents during 2014. Do invest on your own risk.

Appendix 1

LNGRES (0025) - Lngres (0025) Sign of Recovery???

http://klse.i3investor.com/blogs/LNGRES/88903.jsp