Written by Timothy Ho Published: 29 January 2016

If you are rich

enough to be paying income tax, we assume you would interested to pay as

little as possible as well. Even in Singapore, when our income tax rate

is known for being one of the lowest in the world, income tax can also

be a significant chunk of your annual income, particularly if you are

not careful in managing it.

Aside from your

regular monthly income, it is worth noting that income derived from

bonuses, overtime pay and other income sources such as those from rental

also form part of your total taxable income.

How Much Do I Really Pay?Fresh Graduate Who Earns $3,500 Plus A 3-Month Bonus:

Let’s assume you

are a fresh graduate who earns a comfortable $3,500 for your first job

at a MNC. You are also fortunate enough to receive a total of 3-month

annual bonus throughout the year.

In total, your

annual income would be $52,500. At this amount, you will pay income tax

of $1,425 if you do not have any tax-deductible claims.

Middle Aged Person Who Earns $6,000 A Month With 3-Month Bonus:

If you are at the

peak of your career drawing a monthly salary of $6,000 with a 3-month

annual bonus, your annual income would be $90,000. At this amount, your

annual income tax would be $4,500 if you do not have any tax-deductible

claims.

|

Realistic Ways To Reduce My Income Tax

1. Top Up Your CPF Special Account

Providing

a top up to your CPF Special Account is one of the most cost efficient

ways to build up your own retirement portfolio without taking on any

risk.

By

doing so when you are young, it also allows the top up amount to earn

interest over a prolonged period of time. For example, a top up of

$7,000 today would become $22,704 after 30 years based on a 4% per annum

interest. This strategy of building up a retirement portfolio is

practically risk-free and requires zero knowledge to execute.

In

addition, CPF members get a dollar-for-dollar tax relief up to $7,000

per annum for providing top up to their CPF Special Account.

For

example, if our young graduate who earns $3,500 a month provides a CPF

top up of $7,000, he can reduce his income tax from $1,425 to $935, or a

saving of $490. It is like the government giving you extra money to

encourage you to build up your own retirement portfolio.

Similar to donations, you would need to make your top up before the end of the year to qualify.

2. Donate To Approved Institutions

A

donation made to an approved institution would allow the donor to claim

tax relief of 250% of the amount donated. (For 2015, the tax relief is

300%).

For

example, if our middle age person has a habit of donating 10% ($9,000)

of his income to charitable causes, he would be able to claim a tax

relief of $22,500. This would reduce his income tax from $4,500 to

$2,475, a saving of about $2,025.

Do note that all donations must be made before the year end for you to claim your tax relief for 2015.

3. Cost Of Renting Out Your Property

As

mentioned earlier in the article, rental income from your property is

taxable. This could be income from a room you rent out or from the

multiple properties that you own.

Here

is the thing, while you are required to pay tax based on the income you

derived from the rental of a property, you are also allowed to claim

expenses you incur for renting it out.

Claimable

expenses include the interest you paid for the housing loan you took,

property tax, premiums paid on fire insurance, monthly management fee,

repair cost, agent commission and Internet and utility charges.

If

you a landlord who owns multiple properties, we are pretty sure we

don’t need to tell you how costly some of these items can be. So do

claim it Otherwise you will just be paying a higher income tax for no

good reason!

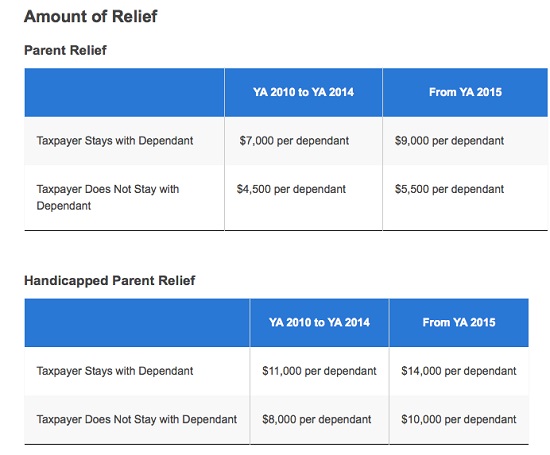

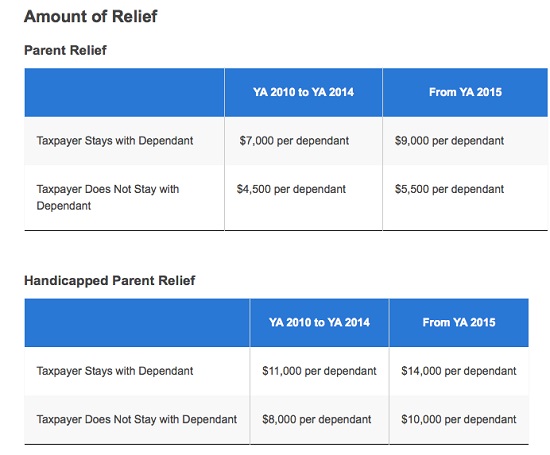

4. Parents Relief

If

you have parents (or grandparents) whom you are supporting, you can

also claim tax relief as well. The following table shows how much relief

you can claim.

Source: IRAS

Source: IRAS

Source: IRAS

Source: IRAS

Do note that you can’t just claim tax relief based on the fact that you have elderly parents(otherwise everyone would be claiming the heck out of it!). Rather, specific conditions must be met.

Based

on our observation, the biggest condition is the fact that your

dependant cannot have an income exceeding $4,000 per annum (or about

$330 per month). These include tax-exempt income such as those from

pension schemes, dividends or bank interest.

In

other words, you must really be supporting your parent(s) who are

reliant on your income for survival, and not simply parent(s) who

happened to be retired but have access to income from somewhere else.

5. Course Fee

If

you are currently furthering your studies while working, there is a

great chance that you would be able to reduce your income tax by

claiming the cost you incur for your studies against your taxable

income. These costs include examination fee, course fee and tuition fee.

You may claim up to $5,500 per annum.

Claim Your Tax Relief And Save Some Money

Some

of the ways we shared have to be executed before the end of the year

for you to earn tax savings. Others can be claimed as long as you keep

supporting proof of the costs you incurred. In any case, they all help

you to save money while concurrently helping you to fulfil your

responsibilities in life. Don’t miss out on them. Do note that there is a

personal tax relief of 50% in conjunction with SG50 celebration (yes, this is one of the rare times when we are truly excited about SG50).