Ge-Shen, a company that need no introduction in bursa as BursaDummy has already written several articles about its and the share price has since appreciated quite impressively over the past 1 year due to great finanancial result.

I'm here to write about this company, to explain a little the reason why i pick up Geshen as one of my stock pick in latest 2016 Stock Pick Challenge.

If you have followed closely on the result, you should know that i ranked the rock bottom during the 2014 stock pick challenge

http://klse.i3investor.com/blogs/stock_pick_2014/67447.jsp

Then, in 2015 Stock Pick Challenge, i again ranked the bottom of the 20

http://klse.i3investor.com/servlets/pfs/41634.jsp

I must thanks both my sifu, Mr. KCCHONG and Mr. Ooi Teik Bee for their superb guidance for 2015 result, which i will interprete as from - 70% to +21%. And, i can proudly tell both sifus that my actual returns in real world is few fold better than the 2015 Stock Pick Challenge result.

50% is my target for 2016 stock pick challenge. This challenge is a challenge to my ownself. A challenge to the past of me.

Very much Appreciate!!!

Below my 2016 Stock Pick,

http://klse.i3investor.com/servlets/pfs/54243.jsp

The reason i pick TGUAN-WA:

I wrote a long long story.

http://klse.i3investor.com/blogs/thongguan/88654.jsp

http://klse.i3investor.com/blogs/thongguan/88661.jsp

http://klse.i3investor.com/blogs/thongguan/88677.jsp

The reason i pick Tien Wah:

I have chosen Tien Wah not because of using 1 quarter result and risking myself to annualized and get a TP, i like Tien Wah because i know that now the new management has taken over the biz and make the biz back to good track by showing an impressive result. I hope they continue the good work.

http://klse.i3investor.com/blogs/TIENWAH/86119.jsp

The reason i pick MudaJaya:

http://klse.i3investor.com/blogs/mudajaya/83177.jsp

Below is for Ge-Shen:

From RM 0.80 sen to RM 2.90, many will get scared away due to the impressive run on stock price, 360%.

Will the price continue to rise?

Not many will realised that the share price of good companies, will definetely go higher and higher, if they continue to strive to be a great companies. See below:

.

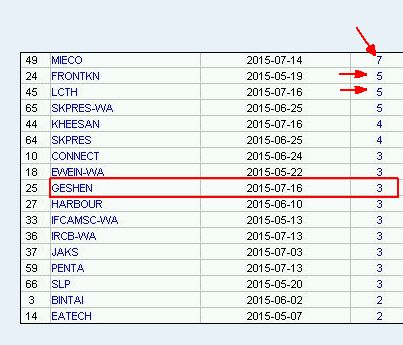

.The last column indicated the numbers of price breakout of particular stock which Mr. Ooi's system able to capture when i first signed up with Mr.Ooi. Since then, i believe GeShen has broken out more than 3 times already. I still remember the price was about RM 0.90 at that time.

I think this give and answer to the myth : "Wow...already up so much, still can go up meh?"

While you still in doubt about the myth, the share price just keep going up. And you keep "dam sam guat"

Now, let back to GeShen,

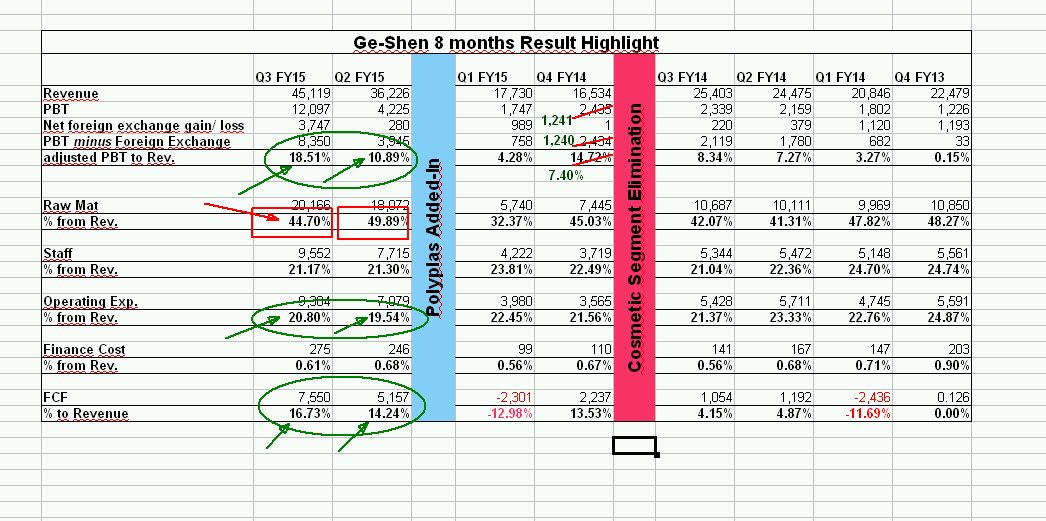

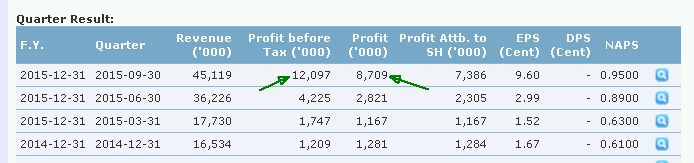

I tabulate above result based on rolling 8 quarters. I want to see:

1) what is the likely effect of Polyplas to the top and bottom line

2) how much is the foreign exchange and the impact if i would exclude such non-operation income to the PBT

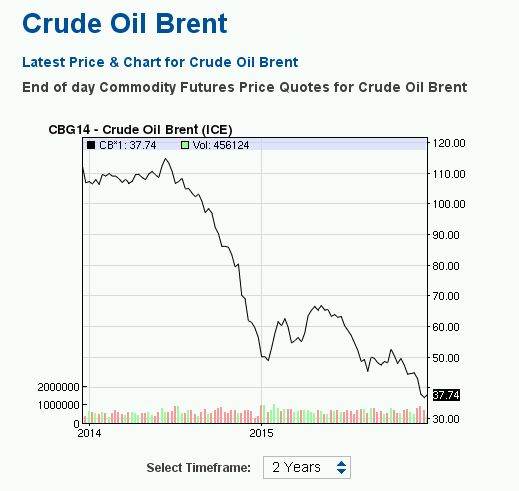

3) raw material trend since the industry is also closely related to crude oil price

4) i want to see if such good result can be maintained and also to see the changes in company cost structure.

Below my interpretation:

1) The "post-polyplas era" after adjusting PBT (by excluding currency gain) is still in fantastic double digit percentage compared to previous 6 quarters. Notable Q3 FY15 is the quarter that first include all result from Polyplas. This serve as a rough guide for me on the upcoming PBT margin.

I expect Geshen will be able to maintain such operating performance due to:

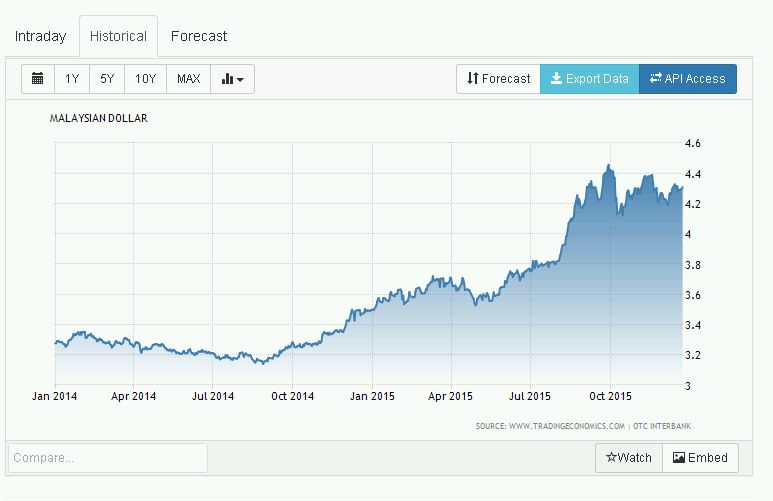

a) both Ringgit and Oil are in very favaurable situation to GeShen

b) Geshen finance cost remained low.

c) Well control staff & operation expenses eventhough after acquire Polyplas.

2) The Free Cash Flow (FCF) of latest 2 quaters has been improved significantly compared to previous 6 quarters.

4) I noticed approximately 5% lesser of raw material cost on latest Q compared to previous Q. This is about RM 2.26 million of the registered revenue. With the oil price continue to fall, i think low raw material cost will benefit the coming quarter results, and i expect the figures to be substantial.

5) Let made a super speculation:

IF,

GeShen Post-Polyplas era able to achieve RM 10 million profit (by maintain their cost+ better revenue + lower raw mat cost), that will translate to RM 40 million of profit per year (excluding minority interest) or RM 0.52 EPS. Net out foreign currency gain, which i am aiming RM 35 million or RM 0.45 EPS.

Is this figure achieveable?

How about Q3, 2016? (See bottom for detail of this)

Current Share Price of RM 2.73 is definetely worth a consideration.

Again, this is only the first quarter that fully include Polyplas result, all above encouraging data remained to be tested.

However, i still choose to pick GeShen, based on my interpretation on

1) recent sharp fall on oil price - 天时

2) a land with currency keep depreciating - 地利

3) their cost control and full roll in of Polyplas - 人和

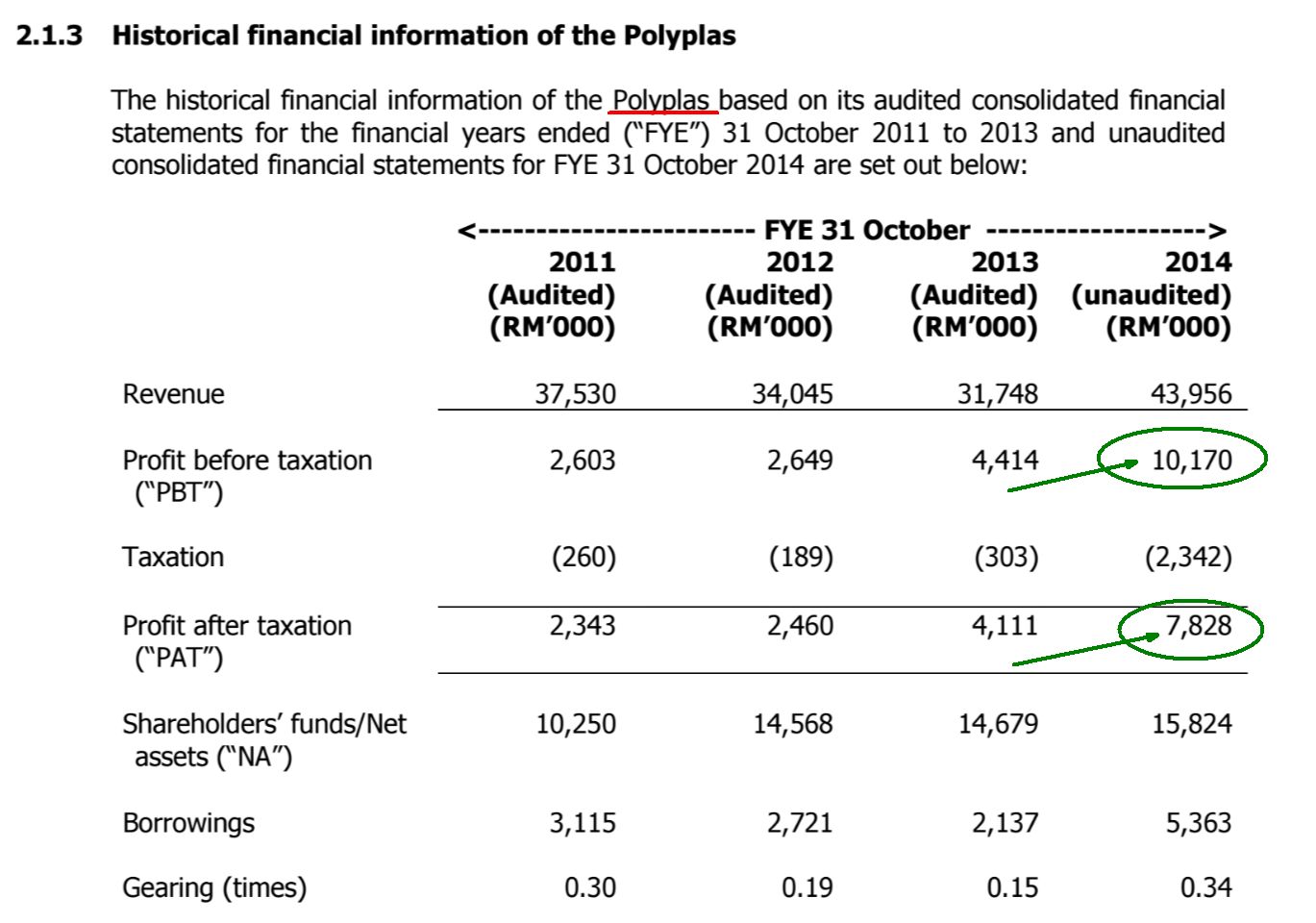

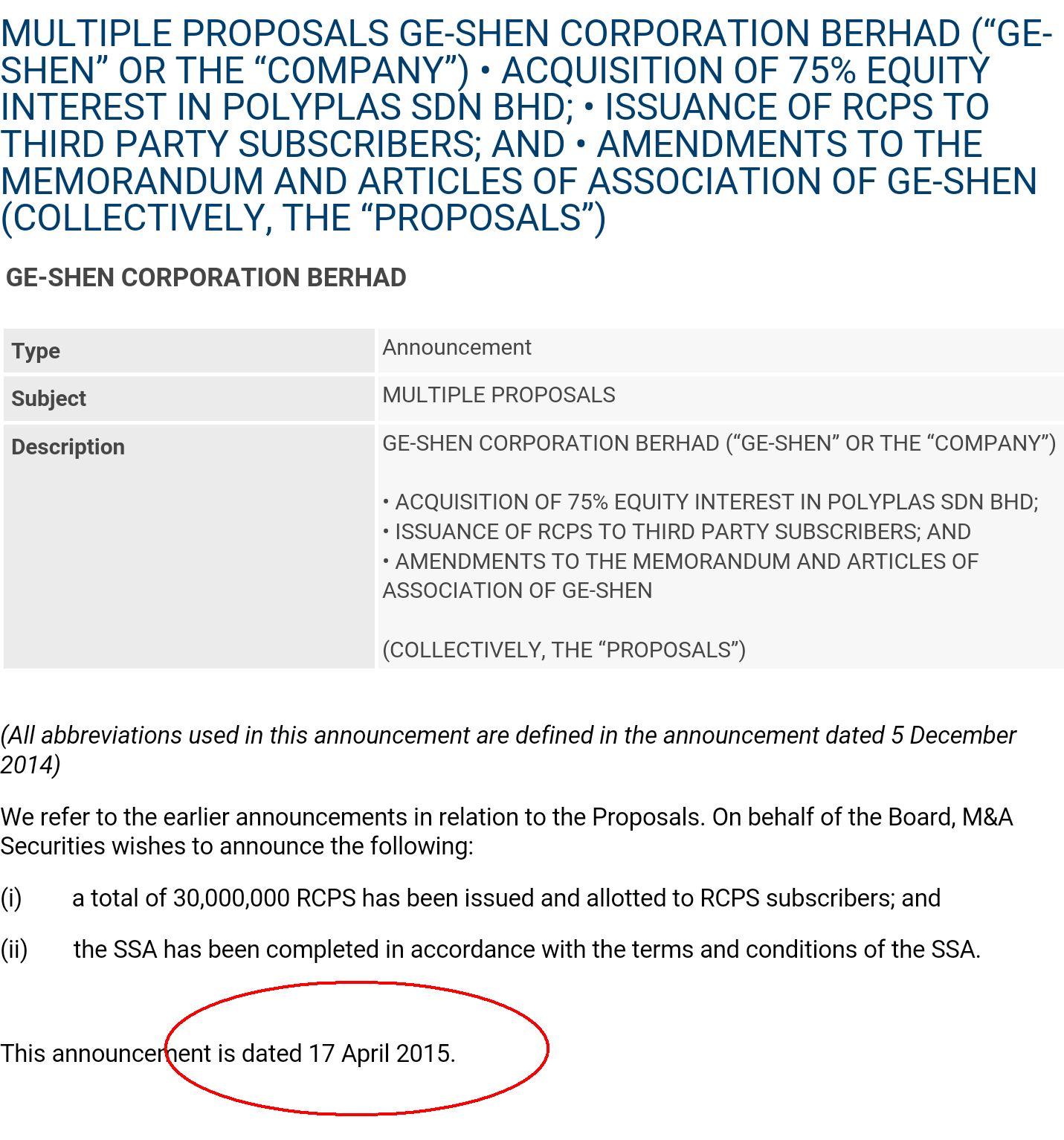

Now let see a little detail on the Polyplas and the SSA signed between GeShen and Polyplas.

The Company registered a PROFIT BEFORE TAX of 23.4% against revenue for the full financial year of 2014.

Other than above, i do not have any other financial data about Polyplas.

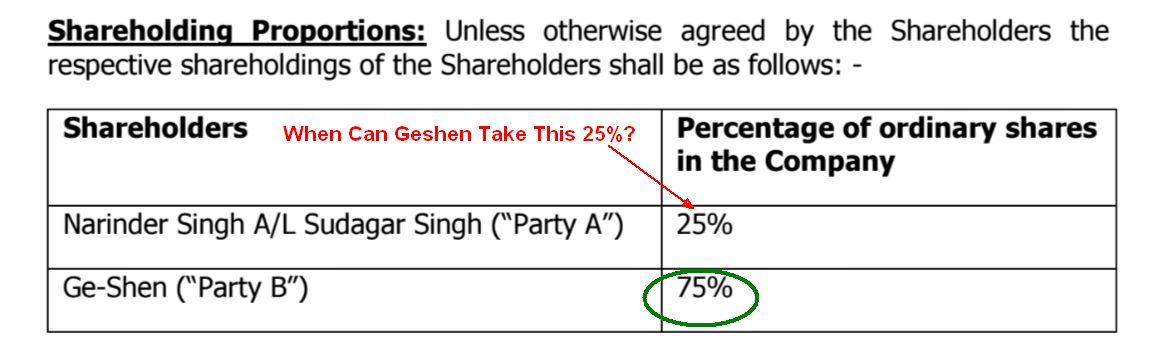

Based on above term, i try to search on the annoucement and found below COMPLETION DATE of above SSA.

So, Within 15 months (12 + 3), which is by 17 July 2016 => Q3, of 2016. Which means, the profit after tax of GeShen MAY get a push if such acquisition take place. This is not really far away as we are now already in Q1, 2016

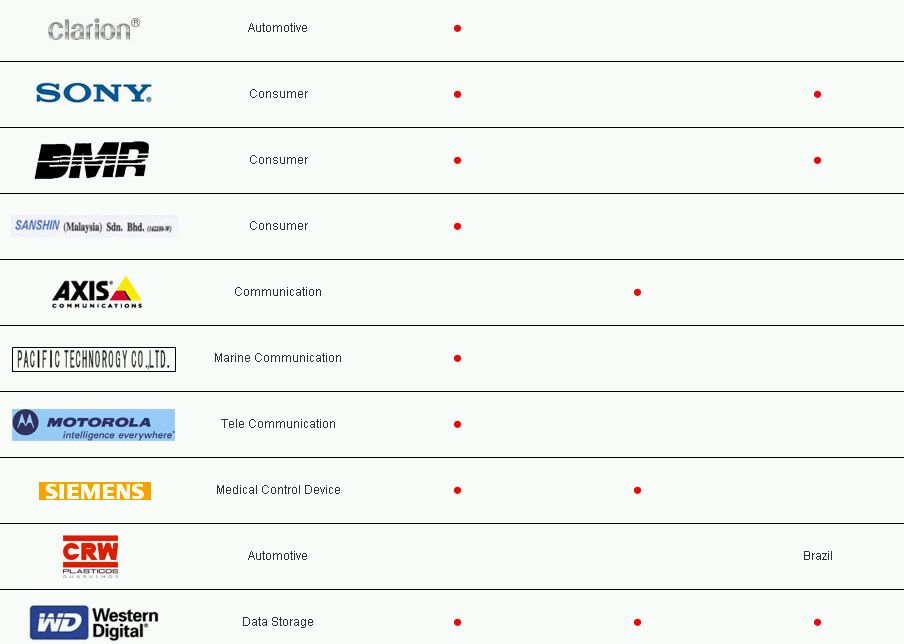

The company focuses on segment customer as per below:

Service Provided Are:

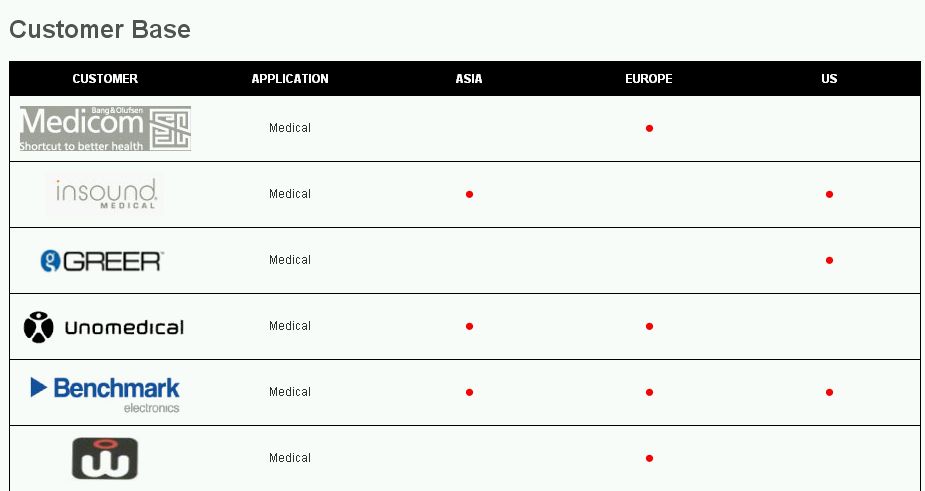

PolyPlas Customer are mainly multinational:

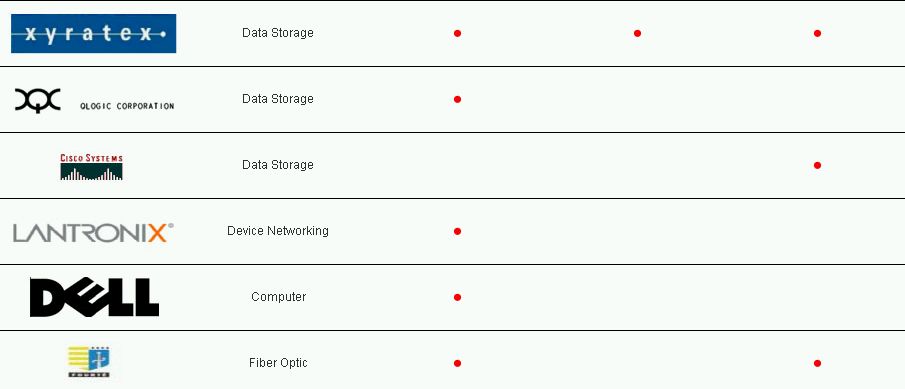

And The Products are shipped worldwide:

Cheers,

YiStock

Additional Note:

All my articles are for reading pleasure only and should not be treated

as buy/ sell call on any particular company mentioned in the articles.

I can never be 100% sure on the data i sourced and correctly predict

the performance of the company I mentioned in the articles.

My investment strategy is very simple, If the business fundamental is

improving, i will buy in whatever amount i can. On the other hand, once i

start noticing sign of deterioration, i will immediately cut the profit

/ losses. I only take care of downside, the upside will take care of

itself

If i missed any investment opportunity, i will acknowledge i missed it.

If i make a mistake on judging the source of info or material i read on

certain company i invest in, i will only blame myself and vow to do

better in future.

My strategy is FA come first, and forever FA.

I only have 2 sifu, one is KCChong, One is OTB. Take courses from these

2 sifu, and do my own practice. I believe in: the master leads you to

the door, the rest is up to you.

I have 2 idol, Mr ColdEye and Bursa Dummy.

I have several investors that i pay high regards to: SooJinHou, Noby, ICON8888, RicheHo, Justabouttheprofit, EzraInvestor, Pakcik Saham

I have an enemy: FEAR

GESHEN (7197) - GESHEN - 天时, 地利, 人和 - YiStock

http://klse.i3investor.com/blogs/geshen/89479.jsp