Will JAKS Resources Thrive in the Construction and Property Development Industry?

The business of JAKS was started by founder Datuk Ang Ken Seng in the 60’s from the humble beginning as a plumber providing services to residential premises. With the aim to be a major player in the water reticulation works, Datuk Ang later incorporated JAKS Sdn Bhd (formerly known as Ang Ken Seng & Sons Sdn Bhd) in 1987, which eventually became the core business and subsidiary of JAKS Resources Berhad (JAKS) for its listing on the Main Market of Bursa Malaysia on 1 July 2004.

JAKS’ group of companies is primarily engaged in water supply and infrastructure construction projects, manufacturing, supply and trading of mild steel pipes, steel pipes and other steel related products. From there, the Group expanded its construction activities to cover property construction in recent years. With the experience and skills gained in the construction business, the Group has moved into property development of mixed residential and commercial development projects namely the strategically located projects at Ara Damansara and at Section 13 in Petaling Jaya.

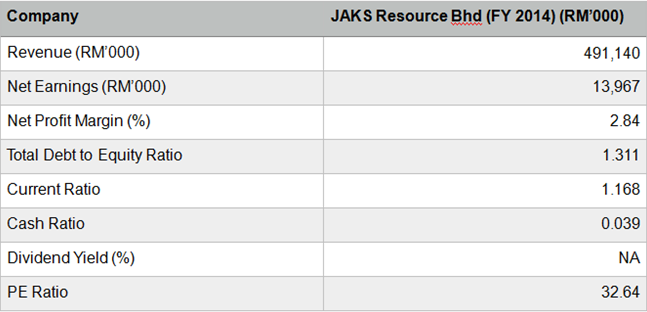

On the international front, the Group is diversifying into power and other large scale infrastructure projects. The strategy to invest overseas is to provide a safeguard against any adverse effects of cyclical local business activities especially in the manufacturing and construction activities. Having annual revenue of close to 500 million, JAKS Resources is considered a medium enterprise with 80% of their revenue coming from the construction and property development divisions. Below are the company’s latest full year financial results.

JAKS Resource Berhad revenue overall have been in an increasing trend for the past 10 years with the exception of Financial Year (FY) 2014 which recorded a decrease of 16% in revenue as compared to FY2013. Net Earnings of the company have been positive and growing well for the latest four financial years with an average year to year increase of 48% from RM2.9 million till today’s RM13.9 million net earnings.

Although the net earnings of the company had been growing well for the past four financial years, its net profit margin is pretty poor ranging from 1.0% to 2.8%. This is mainly due to high cost of revenue which already accounted for 78% of the revenue earned. In general, construction and property development companies could fetch a net profit margin of at least 5% and above.

One notable observation for JAKS Resource Berhad is the company’s current liabilities and long term debts are increasing greatly from year to year. This is an unhealthy sign as the total liabilities currently already exceeded the amount of equity that the company owns, resulting in a total debt to equity ratio of more than 1. Although the company’s current ratio of 1.168 is still acceptable, but the cash ratio of 0.039 is a worrying as this signifies that the company does not have much cash kept as their current asset. It also means that the company has only 3.9% worth of cash in comparison to its current liability value which is detrimental during economy downturns.

In addition, JAKS Resources also does not payout dividends.

In conclusion, JAKS Resource Berhad did well in growing the company’s profit but their total liabilities and cash reserve are not in a healthy state. In view that the construction and property development industry in Malaysia is still sustainable with many ongoing and upcoming projects, no doubt that JAKS Resource has the potential to grow. However the company may need more time to stabilise their company’s financial strength by reducing liabilities and improve in cost controlling to increase profit margin.

iVolume Spread Analysis (iVSA) & comments based on iVSAChart software – JAKS

JAKS is holding just above its support of RM1.00 after making a new 6 months high @ RM1.28. The trend region for JAKS has turned bearish meaning, the market at best will move sideways.

Support @ RM1.00 seen to be holding well and a likely buy trade for JAKS, should the price break above RM1.10.

Based on current market trend, JAKS is biased to move sideways first.

Investment & Market Outlook Conference 2016

- Are you looking for the right investment in share markets for 2016?

- Is this still the right time to buy or keep cash?

- Are you equipped with right skills and knowledge to ride on market upturns?

Join the “Investment & Market Outlook Conference 2016” on 28 Feb 2016 to learn the right investing and trading strategies!

Date: Sunday, 28 Feb 2016

Time: 9.30 am - 5 pm

Fee: RM50. Lunch and refreshment included.

Venue: UEM Training hall, Jalan Templer, Petaling Jaya (off Federal Highway).

Panel Speakers:

1. Mr Nigel Foo (CIMB Top Small Cap Analyst) – Market Outlook 2016 and Beyond plus Stock Picks

2. Mr Martin Wong (Co-founder of iVSAChart) - How I beat stock market last year with minimal effort and maximum profits

3. Mr Ting Kam Cheong (Eden Inc Berhad, Executive Director) – Corporate presentation & outlook on Eden Inc Berhad

For more details: https://www.ivsachart.com/investconference2016.php

For direct registration link: http://www.eventbrite.sg/e/investment-and-market-outlook-conference-2016-tickets-21204671744

Any Query?

- WhatsApp: +6011 2125 8389/ +6018 286 9809

- Email: sales@ivsachart.com

- Follow us on Facebook: https://www.facebook.com/priceandvolumeinklse/ and website www.ivsachart.com

http://klse.i3investor.com/blogs/ivsastockreview/91478.jsp