It had been a month since i land my fingers on the keyboard to write a

post. Lately had been busy. The market going sideway, absolutely

directionless... This is the month of February whereby a lot of

companies are announcing their Q4 results. And we will be expecting a

lot of annual reports in the month of April. I actually had been waiting

for a few companies to release the Q result. One of it is LIIHEN[1]. But before i further into LIIHEN, let me just talk on a few things.

|

| USD/MYR monthly chart |

First is the USD/MYR. Our Ringgit is getting stronger alongside with the

recovering Brent Crude Oil. Above is the monthly chart of the USD/MYR.

Monthly chart usually precedes the weekly chart and also daily chart,

providing a better forecast. From the chart, we can saw a descending

triangle, which signifies that it is actually a downtrend. Next is the

Brent Crude Oil monthly chart. Two hammers seen, signifying that the oil

might be rebounding. Well, these are my observations. It needed to be

equipped with the fundamental news. With the Saudi and Russia to freeze

the oil production, which might bring some impact to the oil price. We

will need to be keen of the global news. For me, oil price might rebound

with the potential strengthening Ringgit.

|

| Brent Crude Oil Monthly Chart |

Now, lets come back to our highlight of the post, LIIHEN.

1. Fundamental Analysis:

|

| LIIHEN Q4 2015 Result [2] |

LIIHEN announces their Last Quarter Result on 24 February 2016. By comparing the same quarters, LIIHEN registered a triple digit growth in net profit, 143.17% while the revenue increased 47.81% due to the increase in sales. The breakdown of the 47% is 30% of forex exchange (3.29 vs 4.27) while another 15% is contributed by the sales[2]. When we are comparing the Q3 and Q4, the revenue and net profit increased 6% and 18% respectively, mainly because of the MYR strengthening

(4.02 vs 4.27). One point when i am analyzing its balance sheet, its

intangible assets had decreased from RM4,813k to RM541k due to the use

of 3,473 hectares of permanent reserve forest land for planting and

cultivation of rubber wood trees.

|

| Revenue and Net Profit from 2011 to 2015 |

By observing from 2011 to 2015, the revenue and net profit had been increasing consistently. The net profit margin for 2015 is 10.46%, averaging around 6.65% from 2011 to 2015. LIIHEN is still a net cash company with RM89,715k, with RM0.4984 net cash per share. In the current year prospect, the management mentioned that the main challenges for 2016 are local issues, such as acceleration of production costs and shortages of workforce.

In view of that, the management will focus on three solutions, first,

continue to diversify product range to strengthen the market position,

second to expand the customer base and third to continue to adopt

effective cost management. With better controllable cost structure and

wider sales market base, the management is committed to deliver a

favourable result for year 2016.

|

| LIIHEN Market Distribution |

Basically for the market distribution on revenue, Australia market

increased the most with 113%, followed by Malaysia (73%), Africa (49%),

Asia (41%), America (34%) while Europe's market decreased by 31%. But

the biggest contributor is still from America, generating 78% of the revenue. Hence, it is important to monitor US's GDP as major LIIHEN's furnitures were exported to US. LIIHEN also entered a foreign currency contracts to hedge its foreign currency. It is worth to take note as well.

LIIHEN announced 6 cents dividend and proposed a 4 cents dividend[3][4]. As of 26 February 2016, with the share price of 2.56, the Dividend Yield is 5.21%. The inventory turnover had decreased from 70 days to 47 days.

The inventory turnover measures the average number of days the

inventory takes to be sold. A lower number may indicate stronger sales

and vice versa. The Return of Equity (ROE) had increased to 25%

in 2015. ROE is how much profit a company makes from shareholder equity.

The higher the ROE, the better the company is at generating profit for

shareholders.

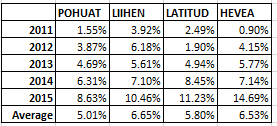

I also made a simple peer comparison in terms of net profit margin among POHUAT, LIIHEN, HEVEA and LATITUD.

|

| Net Profit Margin among Peers: POHUAT, LIIHEN, LATITUD, HEVEA |

The net profit margin is calculated from 2011 to 2015. If we notice, all

the net profit margin increased in the year 2014, due to the weakening

Ringgit. And it continues to gone berserk. From the result, LIIHEN seems to have favourable average net profit margin,

followed by HEVEA. But currently their share prices are not responding

too well to that. 2015 had been a tremendous year for HEVEA, but lately

HEVEA had been under attack from a blogger, but still the fundamental is

there. Personally for me, i will try to avoid the counter.

And i believe 2016 will be another favourable year for furniture counters,

despite a huge drop for the export counters for the last few week due

to Ringgit strengthening. Export counters can still hold for another 2

to 3 quarter. The reason is obvious when we look at the average of 12

months for 2013 (3.15), 2014 (3.27), 2015 (3.90) and 2016 (if 2016, the

USD/MYR still maintains above 4.00) Let's imagine for 2016, the USD/MYR

is 4.20, from 2015 to 2016, the change is 7.69%; whilst from 2014 to 2015, the change is 19.27% [5].

The impact will not be as high as 2014 and 2015. Therefore, i think

the share price still have rooms to go up, but the impact might not be

as high as 2015. So export counters still react as a theme.

2. Technical Analysis:

|

| LIIHEN Daily Chart |

In terms of technical chart, LIIHEN had been in downtrend from December

to February, but a reversal of hammer alongside with RSI oversold

appeared in the middle of February. Previously, I had drawn a support at

2.60 and 2 resistances at 2.78 and 3.00 respectively. Now i would like

to add another support at 2.37. In terms of MACD, it is still bullish. The chart had not fall below the middle band, so

LIIHEN is still healthy at the moment. There is a huge volume on 25

February 2016, the next day after LIIHEN announce the Q4 Result. The

huge volume follows by a price drop. It might be some investors sold

their shares after the Q Result. And there might be some other investors

bought the shares because of the dividends and strong fundamental

reason.

3. Projection Analysis:

The EPS of LIIHEN for 2015 is 0.317. In my data as of now, the average

PE for furniture stocks are around 9. The price (assume PE = 9) is

2.85.

Now, for another assumption, let's assume the PE = 10, therefore the Price = 0.317 x 10 = 3.17.

With the current price of 2.56, i still think the valuation for LIIHEN

is not fairly done and it is still lagging behind its true value.

Summary:

With LIIHEN announcing amazing Q4 results, we can calculate its revenue

and net profit for the whole 2015 already. Now just waiting for its

Annual Report so that we can know in more detail about management's

direction.

- Revenue and net profit surpassed last year by 37% and 104% respectively.

- Net cash company with RM89,715k and net cash per share of 0.4984.

- In the Q Report, the management mentions the current obstacles are the increasing production cost and shortages of manpower. Hence, they will focus to diversify product range , expand customer base and continue to enhance the production facilities.

- Generously giving out dividends every Quarter, the latest Q4 is giving out 6 cents and proposing 4 cents with current Dividend Yield of 5.21%.

- In the Q Report, the management mentions the current obstacles are the increasing production cost and shortages of manpower. Hence, they will focus to diversify product range , expand customer base and continue to enhance the production facilities.

- Generously giving out dividends every Quarter, the latest Q4 is giving out 6 cents and proposing 4 cents with current Dividend Yield of 5.21%.

- Have an excellent inventory turnover and ROE, favourable for long term investors.

- Have the best Net Profit Margin (average of 6.65% from 2011 to 2015) compared among its peers, HEVEA, POHUAT and LATITUD.

- Have the best Net Profit Margin (average of 6.65% from 2011 to 2015) compared among its peers, HEVEA, POHUAT and LATITUD.

- Major business in overseas as America's

market is 78%, benefiting from strong USD. 2016 will still be another

favourable year for export counters, as long as USD/MYR stays above

4.00. The average of 2015 is RM3.90. If it stays above 4.00, there are

still chances for the share price to break new high, but the impact is

minimal unlike last year.

- LIIHEN is enhancing the production

facilities with automation, modern and state of the art machinery to

boost up the production to meet the increasing demands.

- Supports at 2.60 and 2.37 and 2 immediate resistances at 2.78 and 3.00 respectively. If breach 3.00, then sky is the limit.

- By assuming the PE of 10, the price for

LIIHEN should be around 3.17. The current price of LIIHEN (around 2.5)

is actually lagging behind its supposed value.

- Respect the cut loss point very much during these volatile weeks.

Gainvestor short term TP: 3.00 (maintain)

Gainvestor short term TP: 5.00 (maintain)

Gainvestor short term TP: 5.00 (maintain)

Let's Ride the Wind and Gainvest

Gainvestor 10sai

29 February 2016

1.47am

Sources:

[1]: http://gainvestor10sai.blogspot.my/2016/01/liihen-time-to-shine.html

[2]: Q4 2015 Result: http://www.bursamalaysia.com/market/listed-companies/company-announcements/5007817

[3]: http://www.bursamalaysia.com/market/listed-companies/company-announcements/5007877

[4]: http://www.bursamalaysia.com/market/listed-companies/company-announcements/5007897

[5]: http://www.x-rates.com/average/?from=USD&to=MYR&amount=1&year=2016

[2]: Q4 2015 Result: http://www.bursamalaysia.com/market/listed-companies/company-announcements/5007817

[3]: http://www.bursamalaysia.com/market/listed-companies/company-announcements/5007877

[4]: http://www.bursamalaysia.com/market/listed-companies/company-announcements/5007897

[5]: http://www.x-rates.com/average/?from=USD&to=MYR&amount=1&year=2016

http://gainvestor10sai.blogspot.my/2016/02/liihen-post-q4-2015.html