Company background

Malaysia Marine and Heavy Engineering Holdings Berhad (MHB), formerly MSE Holdings Berhad, is a Malaysia-based company. The Company is engaged in the provision of heavy engineering and marine services, which focuses on the oil and gas sector. The Company operates in two segments: engineering and construction, and marine conversion and marine repair. Its engineering and construction business offers a range of oil and gas construction and engineering services, from detailed engineering design and procurement to construction, installation, hook-up and commissioning. Its marine conversion business includes converting vessels, such as very large crude carriers (VLCCs), Aframax tanker and offshore oil rigs into floating structures for the offshore and gas industry. Its comprehensive marine conversion services range from engineering design to fabrication, installation and commissioning of these structures. In October 2011, it dissolved its wholly owned subsidiary MSE Corporation Sdn Bhd.

MALAYSIA MARINE AND HEAVY ENGINEERING HOLDINGS BERHAD (MHB) IS A LEADING OFFSHORE

AND MARINE SERVICES PROVIDER IN MALAYSIA, FOCUSED PRIMARILY ON THE OIL AND GAS SECTOR.

Current price (1/11/2015) : RM 1.10

Target price by year end 2016 : RM 2.50 (given crude oil hovers at $USD 60 per barrel).

WHO OWNS THE COMPANY?

MMHE is an indirect associate of Petronas via its 62.6% stake in MISC Bhd, which in turn owns 66.5% of MMHE. (Even if O&G are doing not too good, MHB's parent (MISC) can utilize the yard to service and repair their LNG Tankers, please remember, MISC is among the THIRD LARGEST SHIPPING COMPANY IN THE WORLD!).

The interesting fact is that, most of them did pay RM 3.80 per share which they had obtained from its initial public offering (IPO) back then.

Due to the fact that the price of crude oil has been heading downhill for the past 2 years, the share price has dropped drastically and I think it has reached its bottom at 90 cent few months back.

Their 3 main core businesses are as follow :

1) EPCIC construction services for the offshore <--- by="" crude="" falling="" greatly="" impacted="" oil="" price.="" span="">

and onshore oil and gas industry.

EPCIC services include:

• Deepwater facilities

• Integrated platforms

• Wellhead platforms

• Compression, dehydration and water injection modules

• Topsides and hulls

• Jackets

• Living quarters

• Turrets and mooring buoys

• Enhanced Oil Recovery facilities

2) OFFSHORE CONVERSION <--- by="" crude="" falling="" impacted="" oil="" price.="" span="">

One-stop centre for converting vessels such as VLCCs,

Aframax tankers, offshore oil rigs and LNG carriers into

floating structures such as:

• FPSOs

• FSOs

• MOPUs

• MODUs

• FSUs

3) MARINE REPAIR <--- here.="" interesting="" is="" part="" span="">

Comprehensive marine services include repair,

refurbishment and upgrading of a wide variety of vessels,

including energy-related vessels such as:

• ULCCs/VLCCs

• Crude oil tankers

• LNG Carriers

• LPG Tankers

• Offshore Support Vessels

• Offshore Rigs

Ability to undertake complex and higher value projects

such as repair and life extension of LNG carriers and

offshore rigs. Other key services include ‘jumboisation’

and newbuilding of vessels such as tender barges.

Based on their 2014 annual report. Their secured orders are as follow :

1) OFFSHORE BUSINESS UNIT (OBU) -

RM 1.6 Billion which includes FPSO Cendor conversion for MISC Berhad, KBB Topside for KPOC, Tapis-R topside for EMEPMI, SK316 for PCSB and Malikai TLP deepwater for Sabah Shell Petroleum Company (SSPC).

MHB was also awarded the PCC Besar A topside and jacket project in September 2014 by Petronas.

MHB received a Subcontract Agreement from Hyundai Heavy Industries (HHI) on 2 October 2014 for the fabrication of well head platform, jackets and the connecting bridge for the Bergading Complex, located offshore Peninsular Malaysia, within Block PM302 immediately south of the Malaysia-Thailand Joint Development Areas (MTJDA), approximately 150 kilometres North East off Kota Bharu in 55 to 60 m water depth. Total estimated weight of all structures when completed is approximately 14,800 MT and is scheduled for sailaway and delivery to the project’s ultimate client, Hess E&P Malaysia BV by April 2016.

2) MARINE REPAIR BUSINESS UNIT (MBU) -

MHB has over four decades of experience. They have served more than 3,700 vessels and rigs for both local and international clients.

The yards are in full occupancy of 15 vessels and rigs for repair and refurbishment works at the same time.

Throughout 2014, some of their notable projects include LNG vessel repairs for LNG Hyundai Utopia, LNG Puteri Firus and LNG Seri Anggun.

3) SUBSIDIARIES, ASSOCIATES AND JOINT-VENTURES (JVS) -

Technip MHB Hull Engineering Sdn Bhd (TMH) -Malikai TLP project.

MHB-SHI LNG Sdn Bhd (MSLNG) - Cargo Tanks for two LNG vessels (Puteri Nilam and Puteri Delima of MISC Berhad)

Delivery of one LNG Carrier “Shen Hai” for an intermediate dry-docking repair (Singapore).

MMHE-ATB Sdn Bhd - In the last quarter of the year, the company has been awarded major pressure vessels and tanks orders from SAIPEM France for the Kaombo Project in Angola and from South Korea’s HHI.

Possibly the biggest beneficiary of RAPID.

Source : The Star

With the recent announcement of Budget 2016, Investment of RM18 billion estimated in 2016 for the Refinery and Petrochemical Integrated Development Project (RAPID) Complex in Pengerang, Johor.

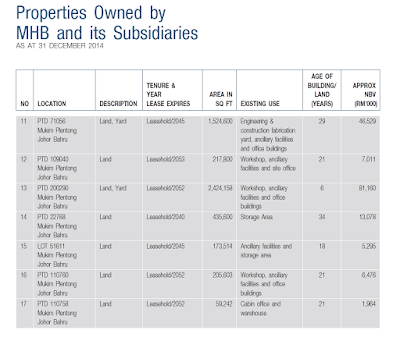

I like the properties and land that they own, with a combined area of

25.545 million square feet which in turn is equivalent to 573 acre in

both Plentong and Pasir Gudang. Which means they have the real

capability of competing with other big players.

If the price of crude oil could reach $USD 60 per barrel in 2016, we

could see the share price of MHB rising to RM 2.00 at least.

MHB has RM 714.555 million of cash in hand, their total number of shares

issued is 1.76 billion which in turn gives us RM 0.405 of cash value

from the current share price of RM 1.10. So you are only paying RM 0.70

for MHB's share and I have mentioned earlier there are only 7.38% of

shares not held by the TOP 30 big boys.

This might be one of the play of ValueCap fund.

We want this kind of company because they hardly have any debt/borrowings.

MHB (5186) - Malaysia Marine & Heavy Engineering Berhad (MMHE - MHB 5186)

http://stocksmalaysia.blogspot.my/2015/11/malaysia-marine-heavy-engineering.html