Regardless whether it is good or bad in economy, the demand for foods & essential consumer products are relatively staple & constant.

As the consumers' purchasing power continue to be weaken in a inflationary environment (in Malaysia), the consumers are going to seek bargains with local quality brands. When incomes decline, consumers are going to look for ways to save money and spending RM1 on needed items versus 2-3 times this amount will be one way to save.

Malaysian stock market has been riding a roller coaster in 2015 & in the first few months of 2016, and it has not been fun if you did not make profit out of it. WIth so many uncertainties prevailing over the Malaysia & global financial markets, you might want to consider reducing exposure to growth stocks and increasing exposure to consumer defensive stocks.

Consumer stocks are always the attractive investment choices for investors seeking slow and steady growth, be it in bull or bear markets.

I will discuss on the home electrical appliances producers that listed in Bursa by taking a look at their past years growth and profitability as well as their market valuations. Which of them are better companies worthy of investing?

While it's possible that this analysis is incorrect, you are freely to decide how to spend/invest on your money. But one thing for sure is, this article is not for KAKI GORENG, beware!!!

PENSONIC & Panasonic: Winners of GST & Weak Ringgit Attacks

Many were of opinions that consumer stocks would suffer the most following the introduction of GST on 1 April 2015 and the depreciation of Ringgit Malaysia against USD in the 2nd half year of 2015, some consumer stocks, however, had in fact delivered very outstanding results during that challenging period.While Panasonic continue to be the market leader, PENSONIC has stood up to become the new star among others.

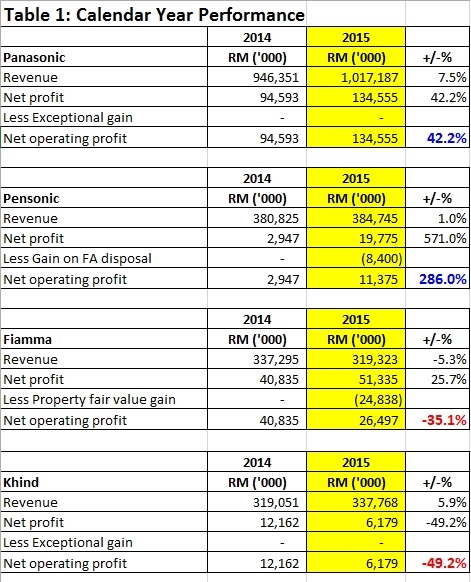

Please refer to Table 1 for the performances of 4 companies during the last 2 calendar years.

(Note: While the above results were extracted from quarterly reports, Pensonic was in respect of period from 1/12 to 30/11, others were 1/1 to 31/12.)

Pensonic has commented the following in its Quarterly Report for period ended 28/2/2015:

"The Group will continue explore new market , product innovation, maintaining excellent customer relationship, placing emphasis in cost control, inventory management and overhead cost rationalisation."

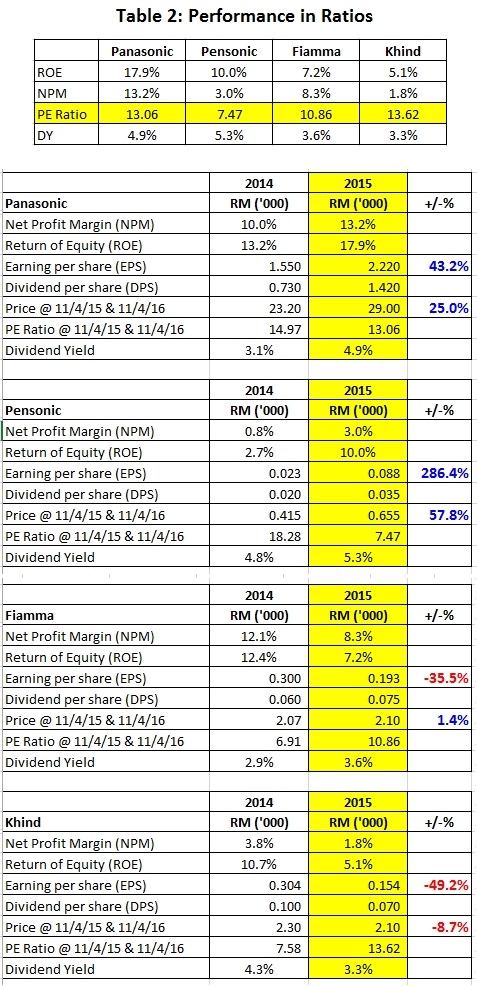

PENSONIC: Attractive Valuation among the peers

(Note: While the above results were extracted from quarterly reports, Pensonic was in respect of period from 1/12 to 30/11, others were 1/1 to 31/12.)

WHY PENSONIC?

The reasons I invested in this company are as follows:1. Net profit margin & Net profit are improving over the latest 4Q continuously (YoY)

2. PE is lowest (7.5 times) among the peers

3. Highest dividend yield of 5.3% in 2015 among the peers

4. Resilient stock for uncertained financial markets

5. Credit to the Management for the delivery of promises in enhancing profitability by focusing in cost control, inventory management and overhead cost rationalisation

6. Company suffering huge exchange loss of RM4mil in the last 2Q but yet still deliver solid & outstanding results. Following the appreciation of RM recently, the situation is definitely in favour of the Company.

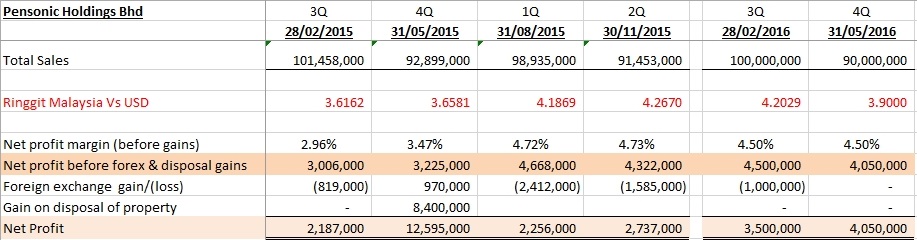

PENSONIC benefits from strong Ringgit!

Pensonic was suffering huge foreign exchange losses totalling to RM4 million in the last 2 quarters (from 1/6/2015 to 30/11/2015) when RM was depreciated from RM3.66 to RM4.27 against USD during the same period.What can we expect NOW?

The situation is very positve to the Company by referring to the following senarios:

1. Strong RM (3.90) = Cost reduced & forex gain = profit margin improved

2. Weak RM (4.20) = Little or NO forex loss = profit margin improved

Table 3: Effect of Foreign exchange (RM vs USD)

Target Prices for PENSONIC

Table 4: Estimation of Next 2 Quarterly Results

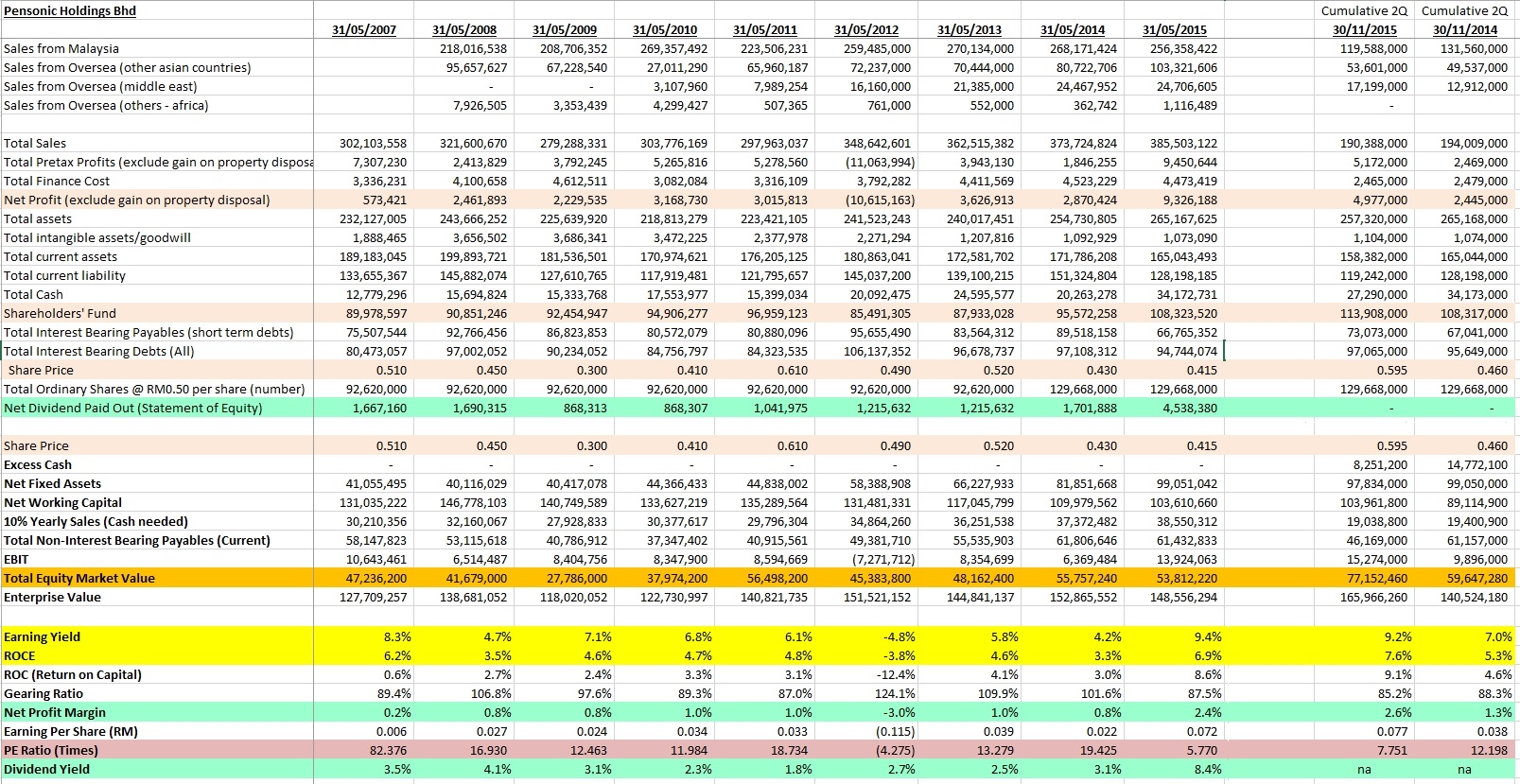

Table 5: Audited Financial Information for the past 9 years

Property Market ≠ Electrical Appliances Sales?

Many have mistakenly viewed that the sales of electrical home applicances are connected to the performance of property industry, in fact, it should be related to the growth of population.Property units which were successfully sold by developer could be left unoccupied for a long time by the purchaser, until may be some day the unit was managed to sub-sale to a newly married couple. The couple will then start BUYING electrical appliances & renovate their lovely home.

As long as the population is growing, the demand for home appliances will continue to grow.

Something worth to know:

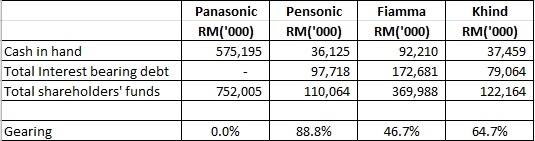

Table 6: Cash in Hand & Gearing

Other useful articles & resources:

1. (RICHE HO) Pensonic Holdings Berhad - Premier Malaysian Electrical Home Appliances Brand2. Pensonic - Penning Higher Growth

3. Pensonic Holdings Berhad - Quarterly Result Review

4. Statistic Report for Home Appliances in Malaysia

2. Malaysia Retail Report Q2 2016

3. Market Watch Report 2012: Electrical & Electronic Industry in Malaysia

4. Marketing Analysis of Household Appliances Market

The following is extracted from the report: Consumer Appliances in Malaysia

The Malaysian consumer appliances market is dominated by international companies that have invested in Malaysia for more than 30 years. Companies such as Panasonic Malaysia Sdn Bhd, Sharp-Roxy Sales & Service Co (M) Sdn Bhd and Philips Malaysia Sdn Bhd have well-known brands in the country. However, competition from Korean companies such as Samsung Malaysia Electronics Sdn Bhd and LG Electronics (M) Sdn Bhd and Chinese players such as Haier Electrical Appliances (M) Sdn Bhd is really pushing the more-established companies hard. Companies have continued to roll out innovative and sophisticated appliances to help drive their revenue. The only prominent domestic manufacturer from Malaysia is Pensonic Holding Bhd. (Note: not sure why did not include Khind)

Declaration & Disclaimers:

I have interest & own shares in this company.

All the above are merely presented &

written for sharing, educational & reference purposes and does not

constitute as recommendation to purchase/buy or sell. You should make

your investing decision based on your own judgement & at your own

risk.

If you buy & make money because of my

article, no need to thank me, it's your decision & your money. AND

If you buy & lose money because of my article, please don't blame

me, because you didn't pay me anything at the first place.

I will not be responsible nor liable for your action. Good luck & Happy Investing.

PENSONI (9997) - (SuperMan 99) PENSONIC HOLDINGS - Consumer Stock with Attractive Valuation (TP = 0.77, 0.87 & 0.97)

http://klse.i3investor.com/blogs/hardworkeasylifesuperman99/94520.jsp