Export theme stocks do take a breath in the recent market. Although their share price took a hit on appreciation of Ringgit but it won't stop me to identify good stocks. What theme to buy now?

What's has come to my attentions?

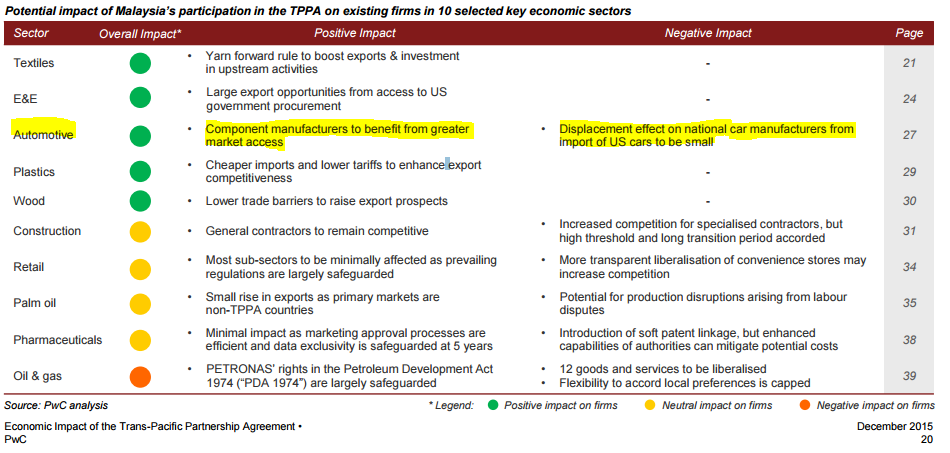

Twelve countries including Malaysia have finally signed the ambitious Trans-Pacific Partnership Agreement (TPPA) on February 2016. Share price from steel industry has rebound from all-time low. Will TPPA benefits to automotive industry?

Future Industry Prospect

TPPA will provide opportunities for the automotive industry players, especially the automotive component manufacturer, to tap into a bigger market and grow their businesses, says Ministry of International Trade and Industry. Minister of International Trade and Industry II Datuk Seri Ong Ka Chuan said the industry players will benefit from the agreement as it will enable them to enter into other countries under TPPA without being subjected to tax or custom barriers. Malaysia has been very competitive in terms of automobile as well as parts manufacturers. Those days, they were restricted in the Malaysian market, but now, they can enter into other countries under TPPA. So, this will be a new age for the industry and it is an industry that we need to promote which involves a lot of research, development and innovations (Adopted from The Malaysian Reserve). Do further readings on link below,

http://www.themalaysianreserve.com/new/story/tppa-provide-opportunities-automotive-industry-players

3 Simple Reasons I Choose SAPIND:

1. Lower PE and better of ROE compared to its peers

2. Improvement in EPS in recently quarterly announcement 4th Quarter

3. Dividend payout consistently

Solid Background

Sapura Industrial Berhad started its business in automotive components manufacturing in the early 1980s through an acquisition of a coil spring business from Henderson’s Ltd, Australia. Taking off from just the coil spring – Sapura Industrial has since expanded its business to include the manufacture of high value-added machined engine, transmission & brake components as well as stabiliser bars and chassis module assemblies for the automotive industry and cold drawn high-grade structured steel bars used in the automotive, electrical & electronics industries (Adopted from Annual Report 2015).

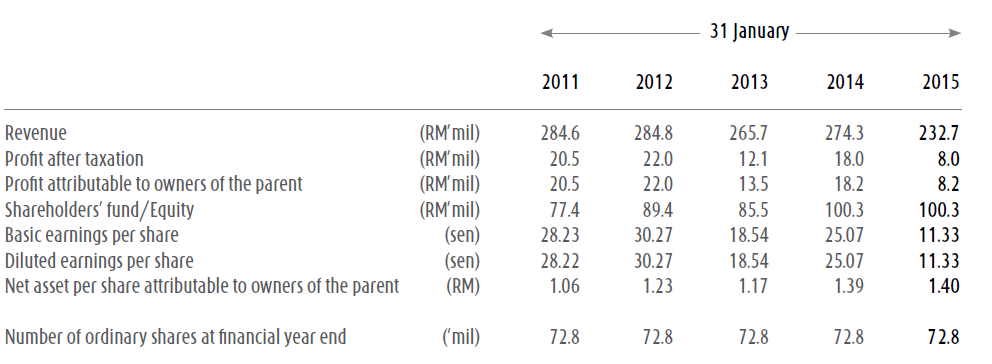

Better Profit Margin and EPS

Based on 4th Quarter result, gross profit margin increased from 14.85% to 17.9% comparing to last year. Net EPS improved from to 5.2 cents if we excluded the tax return from Inland Revenue Board which was approximate RM1.2 million. Return on equity close to 7%.

Consistent Dividend Payout

The Board recommends a single tier final dividend of 3 sen per ordinary share for the financial year ended 31 January 2016 for shareholders' approval at the forthcoming Annual General Meeting of the Company, which will be paid on a date to be determined (Adopted from 4th Quarter Financial Report). At current price of RM1.02, dividend yield stand stood at 5.8%.

Recent Awards

Perodua Excellent Cost Reduction Contribution Vendor 2014

Drawbacks

Decreasing Market Share

SAPIND suffer intense competition from industry peers like NHFATT, HIL and APM. However this applies for all players in the Malaysian automotive industry. The steep decline in oil prices in the second half of the year and the depreciating value of the Ringgit took its toll on many industry players. Against the backdrop of a challenging macroeconomic environment, the directors of SAPIND were able to perform better than many of industry peers has reaffirmed the Group’s resilience in coping with adversity and the fundamental strength of its business model.

Recovery Share Price from Recent Low

Share price of SAPIND took a hit of 89cents before announcement of 4th quarter result. After that, it was never return to the fresh low again. Indeed, the price of SAPIND stabilizing around RM1 and above. Trading volume starts improving after announcement of quarterly result.

SAPIND trading at RM1.02 which was below the NTA 1.43. Gearing ratio decreased comparing with last year.

Could SAPIND’s share price return to RM1.4 just like 3 years ago? You decide.

Once again, invest on your own risk.

SAPIND (7811) - SAPURA INDUSTRIAL BHD SAPIND (7811) Benefits from TPPA and Recovery On Track???

http://klse.i3investor.com/blogs/SAPIND/95067.jsp