Its quite sad to see that many people still like to follow blindly without doing much research when a prominent investor make a move. I don't blame the newbies if they are attracted into buying these shares based on the reasoning by this prominent investor. That's why the rich will become richer while poor will become poorer. Lets take a look what has happened recently to Focus Lumber.

The share has been on downtrending from the high of RM3.00. It drop to almost RM2.05 then up to RM2.60 when this prominent investor promoting Focus Lumber using margin financing. Its trading flat and begin to shot up to RM2.45 when the prominent investor emerge as substantial share holder announcement on 10th May 2016. Little that everyone know that the company didn't do well on 1st quarter of 2016. This stock is not for holding for long time as the prominent investor may dump any time when the price is right. Based on what I have seen from his previous recommendation such as Geshen & Johore Tin, Focus Lumber has a very high potential of gap down on monday based on what happened to Taann (similar timber industry). This stock has a strong support on RM2.00. If break, it may go to RM1.70 and RM1.60. If it go to RM1.70 or RM1.60 then it will have same fate as Geshen and Johore Tin.

We can't sure whether the falling stock will rise again to the level that we brought but during that period of time our money will be locked and we lost the opportunity of investing in other more profitable stocks. Do take note that when Focus Lumber has an EPS of 3.2, its share price is only RM1.60 on April 2015. Do think twice before follow this prominent investor move as you are just enriching him and his advise on using margin financing is the most misleading of all. Also you never know if Focus Lumber will have rising profit in the next quarter. So, lets manage our risk well and be careful especially end of May 2016 as so far we have many companies missed their earning expectation and created bull traps.

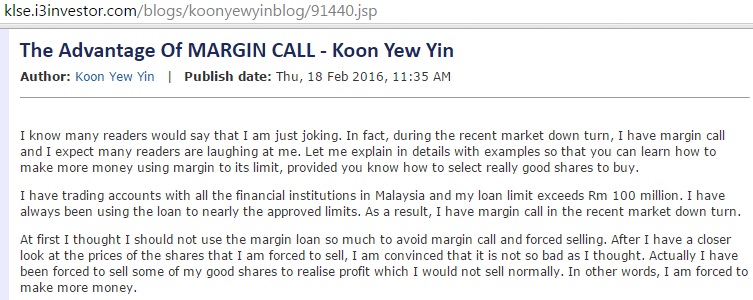

What? You encourage people to use margin to buy your recommended shares? Its a trap to just enriching this prominent investor. Becareful newbies of this trap.

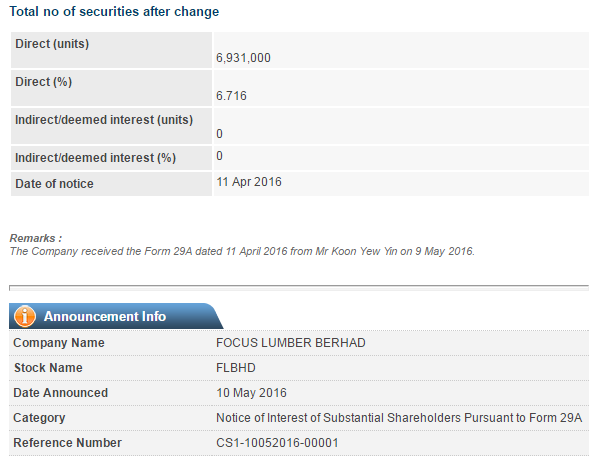

Wah, he brought 6 million shares. So everyone follow. But we don't know when he will dump as he can delay the announcement of up to 2 months (Latitude example). How do we sure that he is always right and we don't buy rotten log?

Focus Lumber has a rising profit and from June 2015 to Dec 2015. But earning for first quarter of 2016 drop almost 60% compared to the previous quarter.

This prominent investor keep pushing Johore Tin until price of RM2.20. When earning not within expectation, it gap down from RM2.05 to RM1.85 in just a day. Then continue to drop to RM1.70. This stock although seems to be on increasing trend now, but your money will be locked for at least 6 months and we don't know whether it will hit RM2.00 again.

Johore Tin did very well on second quarter of 2015 but the earning drop by half on third quarter of 2015.

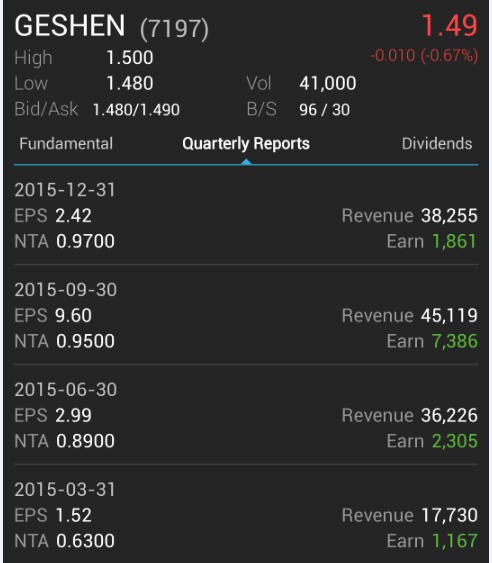

Geshen: Missed earning expectation. So gap down from RM2.60 to RM1.90 during 1 day period.

See the quarter 3 of 2015. Earning of RM7.3 million but drop to RM1.8 million during last quarter of 2015. So huge drop on stock price.

Taann: This stock is not recommended by this prominent investor. I show this as Taann is same industry with Focus Lumber. But as you can see that the stock has a huge drop two days before the first quarter of 2016 financial result announcement. It drop more than 10% within a few days. It could be the big boys already know the result ahead of time.

Taann made RM57 million during the fourth quarter of 2015 but first quarter of 2016 only made RM12 million. So there is huge drop example. When earning missed estimate, the share price will follow as well.

This post is continuous from my previous post that we need to becareful when someone recommending their stocks.

FLBHD (5197) - Follow blindly when prominent investor buy. What will happen to Focus Lumber on monday?

http://klse.i3investor.com/blogs/marketcheck/96902.jsp