-

Proxy to higher USD. The market is expecting at least

one interest rate hike in US although when it will happen is still

everyone’s guess. This should lead to stronger USD. After witnessing the

volatile USDMYR movement in the past one year, I have learned to have a

view longer than one year. And my view is now stronger USD is the trend

for the next 3 years. Historically, we can see that despite the volatility, long term trend is for USD to appreciate against Ringgit.

-

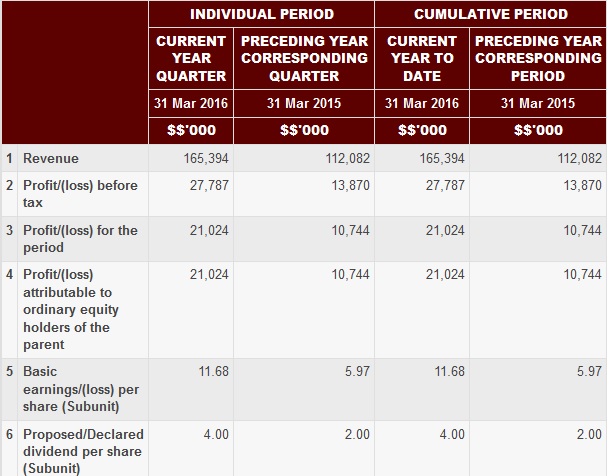

Strong 1Q result. You can see from this picture below

as earnings grew 96% yoy to RM21.0m. I quote directly from their Bursa

announcement – “The increases were mainly contributed from the increased

in orders of the Group’s products by 27% and the strengthening of the

US Dollar against RM. The average USD in 1Q16 was at 4.20 vs. 1Q15 3.55

(or +18%yoy). My take: I am impressed by the increase in orders

by 27% which means that the Company is growing by itself and not only

dependent on USD strength alone.

- Strong balance sheet with net cash. Total cash is RM113.8m with total debt RM31.8m. So net cash is RM82m or 45.6 sen per share.

-

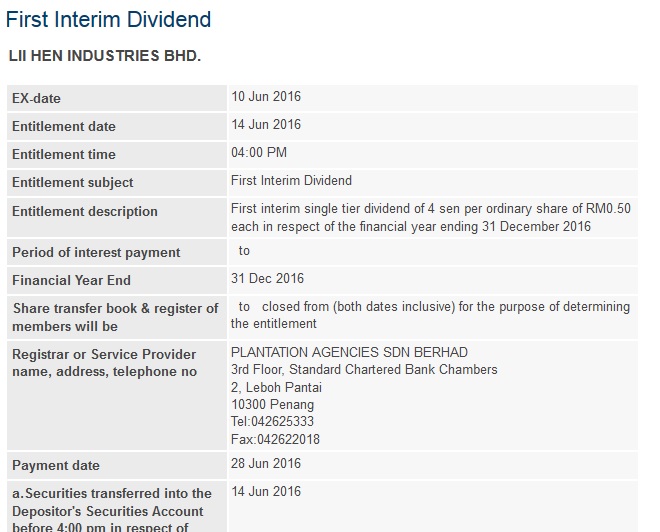

High dividend yield with dividend paid every quarter.

The Company paid its dividend on a quarterly basis. My conservative

assumption shows that the Company dividend yield is higher than 7.5%

assuming USDMYR of more than 4.0 and pure order growth of more than 10%

annually. The best thing is the next dividend is only one month away. Ex-date is 10-Jun while the payment date is 28-Jun.

-

Undervalued at PE less than 10x. The Company made

RM57.6m in FY15 in which the USD rate was 3.87. For this year, I am

assuming average USD rate of 4.00. Coupled with higher volume of orders

expected for LIIHEN’s furniture, my simple calculation shows that LIIHEN

is able to achieve at least RM62m. This means that market is only

giving PE of 7.3x based on market price of RM2.51. As a result, I think

his company is still undervalued.

My long term fair value for the Company is around RM3.50.

-

Short term risk is that Mr. Koon Yew Yin (KYY) is a substantial shareholder. Recently

many bloggers and market participants are against any stock in which Mr

KYY is a major shareholder. I do agree that Mr KYY should not disclose

its change in buy/sell too late to Bursa. And in a fair market, Mr KYY

can actually sell his shares to capitalize on the good earnings in 1Q16.

So you better prepare for short term volatility.

But good company fundamental means long term share price appreciation is likely. As a result, I think that Mr. KYY negative impact on LIIHEN might persist in the short term but fundamental will prevail in the long run. Why? As more shareholder receive the quarterly dividend with increasing earnings, LIIHEN naturally will attract more pure investors and lead to higher share price.

LIIHEN (7089) - (fayeTan) - 5 reasons why I like LIIHEN

http://klse.i3investor.com/blogs/genzinvestor/96931.jsp