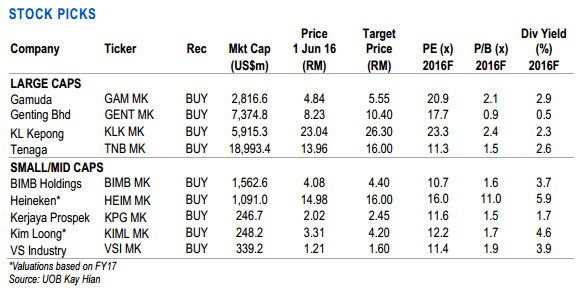

Across-the-board earnings disappointments resurged in the 1Q16 results season, which also saw a sharp sell-down in a handful of past multi-year favourites. Accordingly, we cut our 2016-17 FBMKLCI earnings forecasts by >4%. Although the FBMKLCI now faces the fourth year of earnings doldrums, the recent weeks’ selldown nevertheless provided selected buying opportunities. Top picks are Gamuda, Genting Bhd, and BIMB, Heineken, Kerjaya Prospek, Kim Loong and VS Industry.

WHAT’S NEW

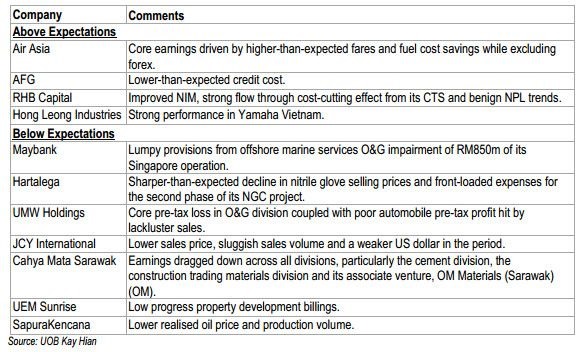

A slow and twisted start to the year. Earnings disappointments resurged in the 1Q16 season, with 28 (32%) of companies under our coverage missing expectations and only 9 (10%) beating expectations (see RHS chart for past quarterly trends). Disappointments or poor starts were found in all key sectors. While naturally the global and domestic economic slowdown has created an earnings downside for cyclical sectors such as automobile, O&G and banking, there were also downside twists in the technology (impact of Apple Inc’s sales slowdown), telecommunications (surge in price discounting) and banking (eg surprising jump in Maybank’s loan loss provision) sectors. There were also negative surprises within the more defensive plantation, gaming and power sectors.

Overall, we have cut our 2016-17 earnings forecasts for the companies under our coverage by 3.7% and 4% (-4.1% and -4.3% for FBMKLCI) on average. 1Q16 estimated core profit on average accounted for 24% of our revised full-year forecast.

ACTION

We trim our end-16 FBMKLCI target to 1,700 (implied 15.7x 2017F PE)., aligned with our bottom-up approach We expect the FBMKLCI to trade in the 1,600-1,728 range (from -0.7 to 0.1SD to the historical mean of 14.7x) in 2H16, based on the implicit assumption that the ringgit would be range-bound at RM4.00-4.10/US$.

Strategy-wise, although we remain somewhat defensive, we advocate having adequate exposure to small/mid caps, which continue to outperform the large-caps (see RHS). Our top picks are Gamuda, Genting Bhd, KLK and Tenaga for large-caps, and BIMB Holdings, Heineken, Kerjaya Prospek, Kim Loong and VS Industry for small-mid caps. We have removed Maybank as a top pick, and added KLK as a top pick.

Situational plays include Genting Bhd (20.7%-owned TauRx’s final clinical trial test result for its Alzheimer’s disease drug should be known by 3Q16), and Bumi Armada, which is highly confident in meeting delivery deadlines (in 3Q16) for two major FPSOs.

Our top SELLs continue to be Hartalega, UMW, Sapura Kencana (SAKP) and TM. Both UMW and SAKP are likely to be removed from the FBMKLCI index in the upcoming review period, and are likely to be replaced by Hap Seng Consolidated and IJM Corp.

A slow and twisted start to the year. Earnings disappointments resurged in the 1Q16 season, with 28 (32%) of companies under our coverage missing expectations and only 9 (10%) beating expectations (see RHS chart for past quarterly trends). Disappointments or poor starts were found in all key sectors. While naturally the global and domestic economic slowdown has created an earnings downside for cyclical sectors such as automobile, O&G and banking, there were also downside twists in the technology (impact of Apple Inc’s sales slowdown), telecommunications (surge in price discounting) and banking (eg surprising jump in Maybank’s loan loss provision) sectors. There were also negative surprises within the more defensive plantation, gaming and power sectors.

Overall, we have cut our 2016-17 earnings forecasts for the companies under our coverage by 3.7% and 4% (-4.1% and -4.3% for FBMKLCI) on average. 1Q16 estimated core profit on average accounted for 24% of our revised full-year forecast.

ACTION

We trim our end-16 FBMKLCI target to 1,700 (implied 15.7x 2017F PE)., aligned with our bottom-up approach We expect the FBMKLCI to trade in the 1,600-1,728 range (from -0.7 to 0.1SD to the historical mean of 14.7x) in 2H16, based on the implicit assumption that the ringgit would be range-bound at RM4.00-4.10/US$.

Strategy-wise, although we remain somewhat defensive, we advocate having adequate exposure to small/mid caps, which continue to outperform the large-caps (see RHS). Our top picks are Gamuda, Genting Bhd, KLK and Tenaga for large-caps, and BIMB Holdings, Heineken, Kerjaya Prospek, Kim Loong and VS Industry for small-mid caps. We have removed Maybank as a top pick, and added KLK as a top pick.

Situational plays include Genting Bhd (20.7%-owned TauRx’s final clinical trial test result for its Alzheimer’s disease drug should be known by 3Q16), and Bumi Armada, which is highly confident in meeting delivery deadlines (in 3Q16) for two major FPSOs.

Our top SELLs continue to be Hartalega, UMW, Sapura Kencana (SAKP) and TM. Both UMW and SAKP are likely to be removed from the FBMKLCI index in the upcoming review period, and are likely to be replaced by Hap Seng Consolidated and IJM Corp.

source: UOBKayHian – 02/06/2016

http://klse-online.blogspot.com/2016/06/malaysian-stock-1q16-results-review.html