Most of the extremely successful investors are long term investors like Warren Buffett, Peter Lynch and Fong Siling (Cold Eye) to name a few. They buy and hold stocks for the long term.

Warren Buffett holds stocks for an average of four to five years (according to data that I am unable to retrieve for the moment). However, everyone knows that his favourite holding period is forever.

Our favorite holding period is forever. – Warren Buffett

Peter Lynch mentioned in his book One Up On Wall Street that most of his big winners take three to ten years or more to play out.

Fong Siling too is a major proponent of long term investing and he made it very clear in all his books and writings and talks.

There is no doubt that going long term is the right choice when investing instead of going short term or speculating. Going long term means you are going for the biggest profits instead of quick tiny profits that do not last long.

It also means buy-and-hold. You buy a stock and hold it for as long as it is generating profit for you. You don’t sell unless something goes wrong with the company’s fundamental.

Buy and hold is a simple concept. However, I am not satisfied with it because the “hold” signals that there is extra effort needed.

Buy and Forget

I have another idea: Buy and forget. This strategy is more relaxing.

By replacing the word “hold” with “forget”, you remove one dimension of consideration out of the investing equation: you no longer need to worry about the “selling” decisions.

This also means that you do your investment homework only once that is valid for life. You make your buying decisions once. Instead of doing homework that is only valid for 1 or 2 days or even 1 or 2 minutes as in trading, you learn from Buffett where you look for a business: “where you have to be smart only once instead of being smart forever.” It is easier to be smart once rather than to be smart forever, right? One smart choice, and you will be good forever instead of the other way around.

Call that extreme lazy investor. I am that lazy.

Businesses can last forever. Especially the good businesses. That is what I believe.

Just look for humble business that are available around you: the honest, disciplined and frugal kedai runcit that survived and thrive till this day. It is a small but profitable business that allows the owner to feed a whole family and even send all the kids to university. In the end, each kid becomes independent and generates new income on their own. That is explosive growth from the way I see it.

It makes sense for me to adopt the minimal-effort investment philosophy: buy and forget because time is the friend of the wonderful company, the enemy of the mediocre. You don’t have to worry about wonderful company because it will take very good care of itself.

Time is the friend of the wonderful company, the enemy of the mediocre. – Warren Buffett

In order to implement the buy and forget investment philosophy, you would need to have free cash to invest. My idea is that people can only have more money if they don’t need the money now. How? You need to figure this one out yourself.

Examples from my own experience

I started the buy and forget investment experiments since 2013. Here are some of the best results:

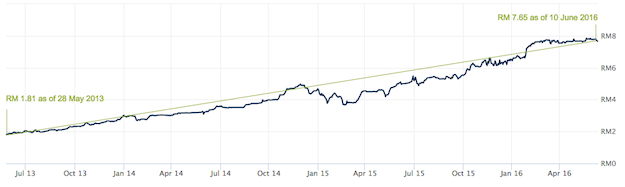

I bought HAPSENG (3034) since 28 May 2013. After 36 months, the stock price moves from RM 1.81 to RM 7.65. It is a 322.65 % movement.

I bought LIIHEN (7089) since 3 September 2013. After 33 months, the stock price moves from RM 0.447 (split-adjusted) to RM 3.35. It is a 649.44 % movement.

Of course, there are losers. The worst performer is ZHULIAN (5131) which is down 53 %.

Note: I don’t even include dividend incomes in the above calculation.

You can do the math and see if buy and forget is worth your attention. Best performer: + 649.44 %. Worst performer: – 53 %. The downside is limited but the upside is unlimited.

The risk is low because all the stocks I bought pay dividends. Even if the best performing stock return back to it original price, I still gain something.

The worst case is for all the companies to go belly up. What is the odd? If that is the case, then there is something wrong with the country’s economy. We all should migrate.

The essence

You can have more money if you don’t need the money now.

You can have more money by investing the money you don’t need now.

You can adopt the least effort investment philosophy: buy and forget if you are too busy to keep up with your portfolio by doing it right at the beginning.

As Peter Lynch said, you don’t have to have 10 winning stocks out of 10 to make money in the market. 6 winnings stocks out of 10 are enough to generate decent returns. I can use the above experiment results to back that up.

Warren Buffett holds stocks for an average of four to five years (according to data that I am unable to retrieve for the moment). However, everyone knows that his favourite holding period is forever.

Our favorite holding period is forever. – Warren Buffett

Peter Lynch mentioned in his book One Up On Wall Street that most of his big winners take three to ten years or more to play out.

Fong Siling too is a major proponent of long term investing and he made it very clear in all his books and writings and talks.

There is no doubt that going long term is the right choice when investing instead of going short term or speculating. Going long term means you are going for the biggest profits instead of quick tiny profits that do not last long.

It also means buy-and-hold. You buy a stock and hold it for as long as it is generating profit for you. You don’t sell unless something goes wrong with the company’s fundamental.

Buy and hold is a simple concept. However, I am not satisfied with it because the “hold” signals that there is extra effort needed.

Buy and Forget

I have another idea: Buy and forget. This strategy is more relaxing.

By replacing the word “hold” with “forget”, you remove one dimension of consideration out of the investing equation: you no longer need to worry about the “selling” decisions.

This also means that you do your investment homework only once that is valid for life. You make your buying decisions once. Instead of doing homework that is only valid for 1 or 2 days or even 1 or 2 minutes as in trading, you learn from Buffett where you look for a business: “where you have to be smart only once instead of being smart forever.” It is easier to be smart once rather than to be smart forever, right? One smart choice, and you will be good forever instead of the other way around.

Call that extreme lazy investor. I am that lazy.

Businesses can last forever. Especially the good businesses. That is what I believe.

Just look for humble business that are available around you: the honest, disciplined and frugal kedai runcit that survived and thrive till this day. It is a small but profitable business that allows the owner to feed a whole family and even send all the kids to university. In the end, each kid becomes independent and generates new income on their own. That is explosive growth from the way I see it.

It makes sense for me to adopt the minimal-effort investment philosophy: buy and forget because time is the friend of the wonderful company, the enemy of the mediocre. You don’t have to worry about wonderful company because it will take very good care of itself.

Time is the friend of the wonderful company, the enemy of the mediocre. – Warren Buffett

In order to implement the buy and forget investment philosophy, you would need to have free cash to invest. My idea is that people can only have more money if they don’t need the money now. How? You need to figure this one out yourself.

Examples from my own experience

I started the buy and forget investment experiments since 2013. Here are some of the best results:

I bought HAPSENG (3034) since 28 May 2013. After 36 months, the stock price moves from RM 1.81 to RM 7.65. It is a 322.65 % movement.

I bought LIIHEN (7089) since 3 September 2013. After 33 months, the stock price moves from RM 0.447 (split-adjusted) to RM 3.35. It is a 649.44 % movement.

Of course, there are losers. The worst performer is ZHULIAN (5131) which is down 53 %.

Note: I don’t even include dividend incomes in the above calculation.

You can do the math and see if buy and forget is worth your attention. Best performer: + 649.44 %. Worst performer: – 53 %. The downside is limited but the upside is unlimited.

The risk is low because all the stocks I bought pay dividends. Even if the best performing stock return back to it original price, I still gain something.

The worst case is for all the companies to go belly up. What is the odd? If that is the case, then there is something wrong with the country’s economy. We all should migrate.

The essence

You can have more money if you don’t need the money now.

You can have more money by investing the money you don’t need now.

You can adopt the least effort investment philosophy: buy and forget if you are too busy to keep up with your portfolio by doing it right at the beginning.

As Peter Lynch said, you don’t have to have 10 winning stocks out of 10 to make money in the market. 6 winnings stocks out of 10 are enough to generate decent returns. I can use the above experiment results to back that up.

http://www.chokleong.com/2016/06/12/buy-and-forget-the-minimal-effort-investment-philosophy/