This article first appeared in The Edge Financial Daily, on June 27, 2016.

SCGM Bhd (-ve)

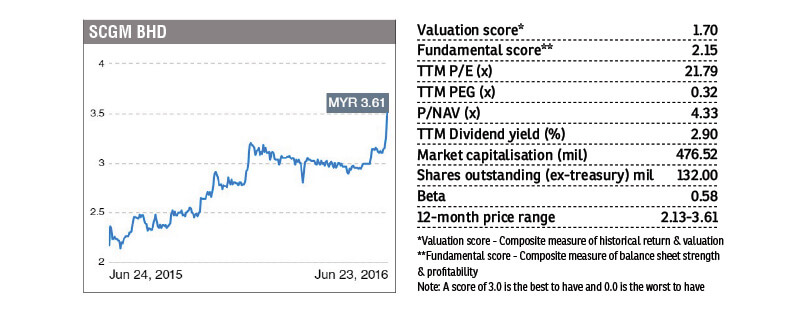

SCGM Bhd (fundamental: 2.15/3, valuation: 1.7/3) fell by as much as 46 sen or 12.74% last Friday to RM3.15, snapping its four-day rising streak prior to that, right before it announced a 32.61% drop in its latest quarterly earnings.

Net profit for the fourth quarter ended April 30, 2016 (4QFY16), came in at RM3.46 million, weighed down by a weaker ringgit, and higher depreciation charges and finance costs.

Nonetheless, the plastic product manufacturer recorded a 30.65% growth in FY16 net profit to RM20.19 million — its highest since the group was listed in 2008.

SCGM’s full-year bottom line growth from FY13 to FY15 ranged from 34.52% to 46.54%, outsizing its turnover increases of 6.31% to 18% in the same period.

At last Friday’s close, its shares ended at RM3.40 after paring some losses, still down 21 sen or 5.82%.

At the current share price, SCGM is valued at 21.78 times its trailing 12-month earnings per share. Its shares have multiplied in value since 2014, when it was trading at around 50 sen apiece.

SCGM (7247) - Stock With Momentum: SCGM

http://www.theedgemarkets.com/my/article/stock-momentum-scgm-3