1. Introduction

First of all, hat tip to forum members Bonescythe and Yoloooo for discovering and promoting this interesting stock.

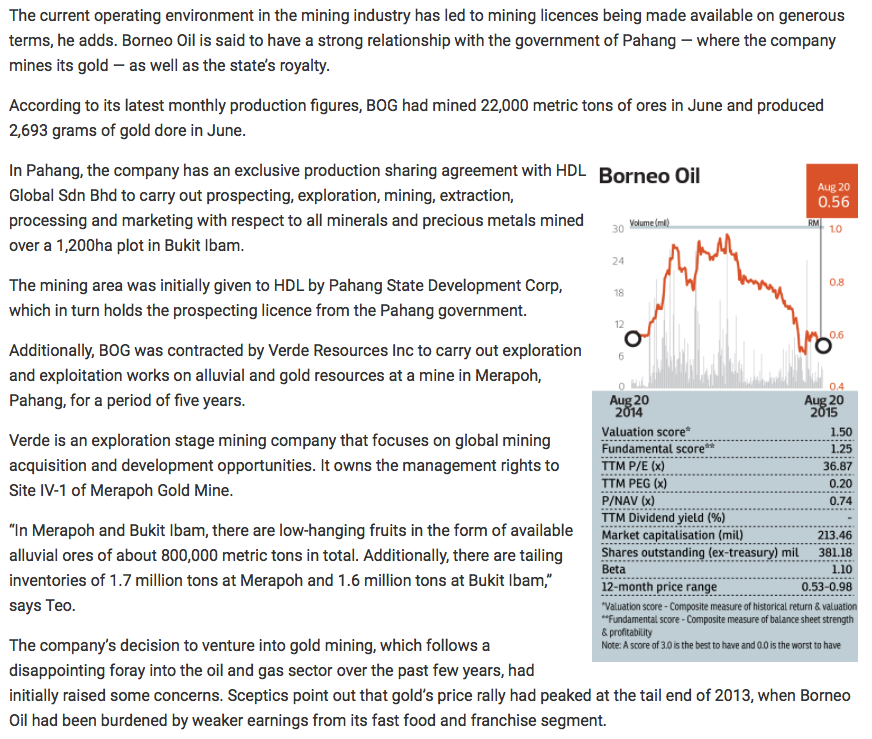

Borneo Oil was previously known as Sugar Bun. It is now controlled by the Lau family, which also owns majority stake in Hap Seng Consolidated Berhad.

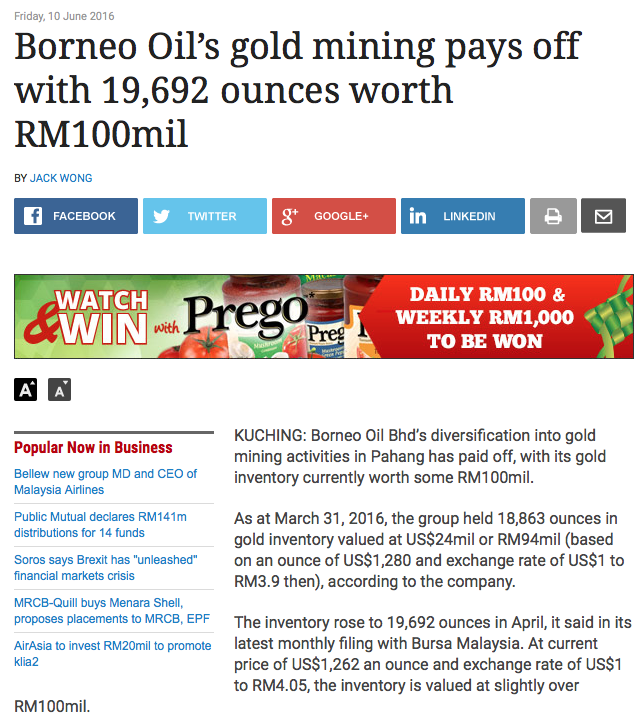

In 2015, Borneo Oil ventured into gold mining in Pahang. Many people criticized that move. It turned out that the critics were wrong. The gold mining division has been doing well.

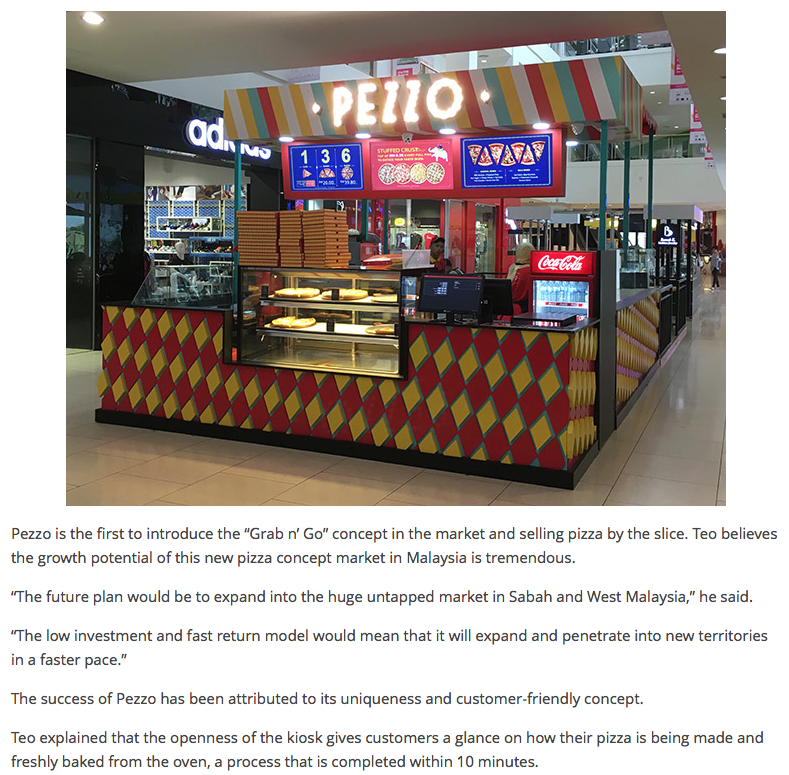

Borneo Oil has maintained Sugar Bun's business. On top of that, they started a new franchise Pezzo Pizza.

2. Background Financials

Based on 2.97 billion shares and 15 sen, market cap is RM446 mil. The reason the share cap is so big is because it just completed a massive rights issue by end 2015.

The group has strong balance sheets, with net assets and cash of RM550 mil and RM71 mil respectively. It has zero loan.

Based on past 12 months aggregate net profit of RM21.4 mil, historical PER is 21 times.

3. Historical Profitability

The company has just released its April 2016 result yesterday. Net profit came in at RM10.7 mil, an all time high. Most of us (forum members) are very happy and satisfied.

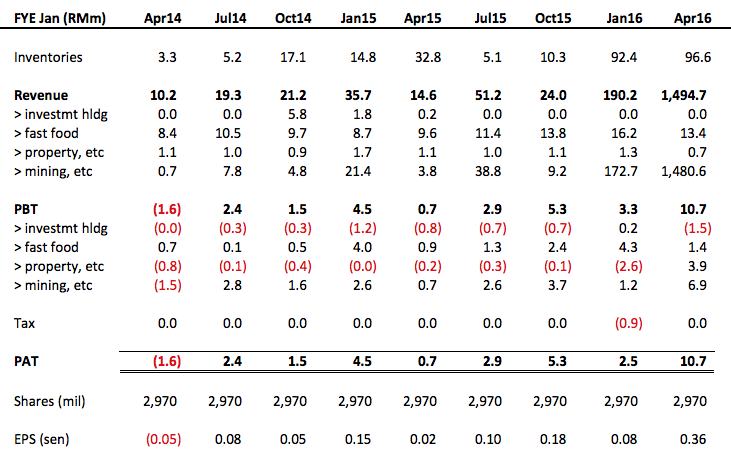

The table below sets out the group's past few quarters' performance.

Key observations :-

(a) Unlike many companies that I have written before, Borneo Oil currently is not reporting strong and consistent profit. However, in my opinion, this does not necessarily mean that it is not profitable.

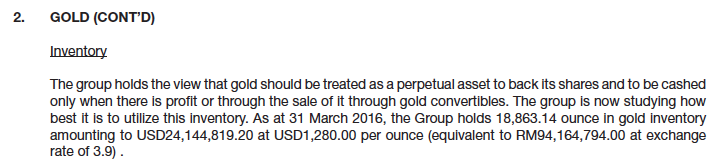

If my understanding is correct, the group will only book in revenue and profit for its mining operation when the gold is sold.

However, it seemed that the group has been holding on to the bulk of its gold as inventories (which explains why it keeps going up). As a result, quarterly profit is not a good indicator of how well the group is doing. Inventories is a better gauge.

(b) In the latest quarter, mining operation generated staggering revenue of RM1.48 billion. However, it only generated PAT of RM6.9 mil. The company did not provide further details. However, I suggest not to simply jump into conclusion that the RM1.48 billion revenue is entirely due to sale of gold extracted from mines. I don't think they have so much gold in the first place. Has the group been trading gold ? Is that why the revenue was so huge ? Hopefully the company can provide further details in the future.

(c) Fast food business generated net profit of approximately RM9.4 mil per annum. Nice.

4. Details of Mining Agreements

Mukim Batu Yon

(a) On 14 March 2014, Champmark Sdn Bhd (CSB) appointed Borneo Oil to be the subcontractor to carry out prospecting and mining of gold on exclusive basis in Mukim Batu Yon with total area of 162 hectares.

(Mukim Batu Yon is part of Merapoh Area, the mining right of which originally belonged to Bursa listed MMC. MMC granted the mining rights for Mukim Batu Yon to CSB in 2004)

(b) Borneo Oil shall undertake prospecting and mining at own risk with no recourse to CSB.

(c) Borneo Oil shall pay tribute to CSB. If revenue is more than RM2 mil per month, amount to be paid is up to 12% of revenue for alluvial (sediment) and 14.5% for lode gold (hard rock).

(d) The agreement only covers gold. If other minerals are detected, Borneo Oil needs to seek consultation with CSB.

(Note : that is probably why Borneo Oil reports gold and gold dore seperately (gold dore is roughly 70% gold, 30% silver))

(e) CSB is responsible for paying tribute to MMC and PKNP and 5% to Pahang Government (5%).

(Note : if Borneo Oil pays CSB 12% and CSB pays MMC, PNKP and Pahang Government 12% (in total), what is left for CSB ? Does CSB have a share of the gold produced by Borneo Oil ?)

Mukim Hulu Jerai

(a) On 5 January 2015, Jusra Mining Merapoh Sdn Bhd (JMMSB) appointed Borneo Oil to be the subcontractor to carry out prospecting and mining of gold on exclusive basis in Mukim Hulu Jerai with total area of 203 hectares.

(Mukim Hulu Jerai is part of Merapoh Area, the mining right of which originally belonged to Bursa listed MMC. MMC granted the mining rights for Mukim Hulu Jerai to JMMSB in July 2014)

(b) Borneo Oil shall undertake prospecting and mining on exclusive basis.

(c) Borneo Oil shall pay tribute to JMMSB amounting to 10% of revenue from gold sale.

(d) The agreement only covers gold. If other minerals are detected, Borneo Oil needs to seek consultation with JMMSB.

(e) JMMSB is responsible for paying tribute to MMC and PKNP and 5% to Pahang Government (5%).

(Note

: if Borneo Oil pays JMMSB 10% and JMMSB pays MMC, PNKP and Pahang

Government 12% (in total), what is left for JMMSB ? Does JMMSB have a

share of the gold produced by Borneo Oil ?)

Mukim Keratong

(a)

On 11 March 2015, HDL Global Sdn Bhd (HDL) appointed Borneo Oil to be

the subcontractor to carry out prospecting and mining of gold on

exclusive basis in Mukim Keratong with total area of 1,200 hectares.

(HDL obtained the rights from PKNP in May 2010)

(b) Borneo Oil shall undertake prospecting and mining of gold in the relevant area.

(c)

Borneo Oil and HDL shall split the Net Profit After Tax on 60 : 40

basis. NPAT is calculated based on revenue less operational cost less

tributes and tax.

(d) The agreement only covers gold. If other minerals are detected, Borneo Oil needs to seek consultation with HDL.

(e) The tributes payable by Borneo Oil to PKNP and Pejabat Tanah and Galian shall not be more than 2.5% and 5% respectively.

According to Circular to shareholders dated July 2015, Mukim Batu Yon has started production for more than 2 years. Borneo Oil is still undertaking exploration activities for Mukim Hulu Jerai and Mukim Keratong.

5. Production Data and Inventories

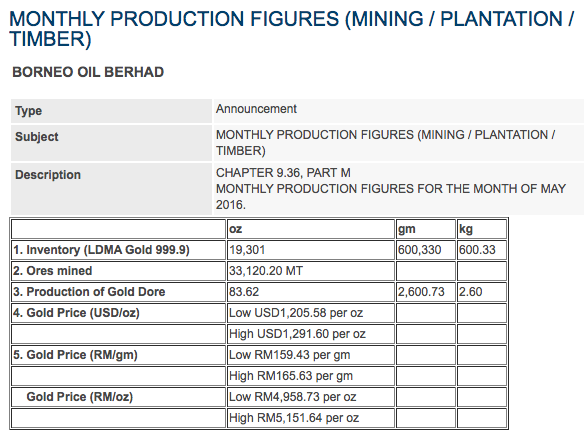

As

a mining company, Borneo Oil makes announcement of production data on

monthly basis. A typical announcement will look like the following :-

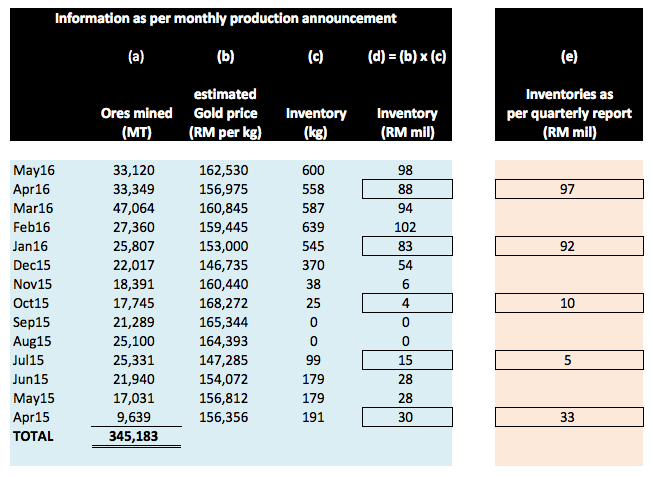

I have extracted the relevant information and put them in the table below :-

There

are not many mining companies in Malaysia. Many investors (forum

members) don't really understand how to interprete the data (including

me).

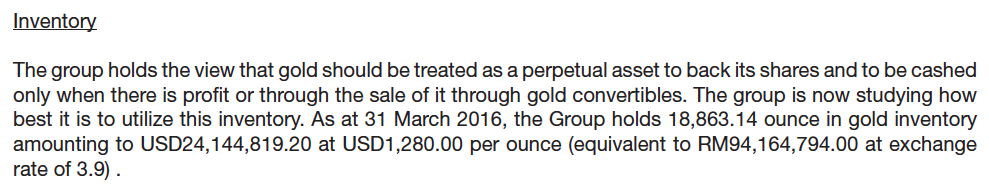

Inventories

In

the monthly announcement, there is an item called "inventory", which is

measured in kilograms. This item generated a lot of confusion. For

example, in May 2016, Inventory is 600 kg. There is intense debate among

forum members what exactly does that mean ?

Does it mean "the company produces 600 kg of gold in the month of May 2016" or "gold inventory as at May 2016 is 600 kg" ?

After

studying the data carefully (including making comparison with balance

sheet inventories figures in quarterly reports), I arrived at the

conclusion that "600 kg" most likely means "as at 31 May 2016, the group

onws 600 kg of gold".

I

am pretty confident that this interpretation is correct because item

(d) in table above matches (e) quite closely. The small differences are

most likely due to (b) is an estimated figure by me (the company

announced highest and lowest gold price during the month, I took the

average and called it (b)).

Ores

As shown in table above, the group has processed 345,183 MT of ores so far.

According

to an interview with The Edge in September 2015, the Company mentioned

that Merapoh and Bukit Ibam mines' total alluvial ores is approximately

800,000 MT. As such, there is still approximately 455,000 MT of ores

remained.

At

the rate it is going, it will probably take them another two years to

finish processing. As 345,183 MT of ores produced more than 600 kg of

gold (the group has sold some gold along the way). Can the remaining ore

produce at least another 600 kg of gold for the group ?

(Note

: based on conservative RM150,000 per kg, 1,200 kg of gold is worth

approximately RM180 mil. Based on 2.97 billion shares, gold per share

will be 6.1 sen, 40% of current share price of 15 sen)

During

that interview, Borneo Oil mentioned that apart from the 800,000 MT of

alluvial ores (as discussed above), there are tailing inventories of 1.7

mil tonnes and 1.6 million tonnes at Merapoh and Bukit Ibam

respectively. The figures looked very substantial. However, I am not

able to determine how much gold those tailings can produce. I will write

about them if I managed to find out more info in the future.

6. Potential Gigantic Reserve ?

However, before you pour your entire savings into Borneo Oil, let me just caution you that you should not take the above information too seriously. The information is quite outdated, and there is no further update since the article was published. It is better to take a conservative stance by ignoring it until further information, if any, is made available to us.

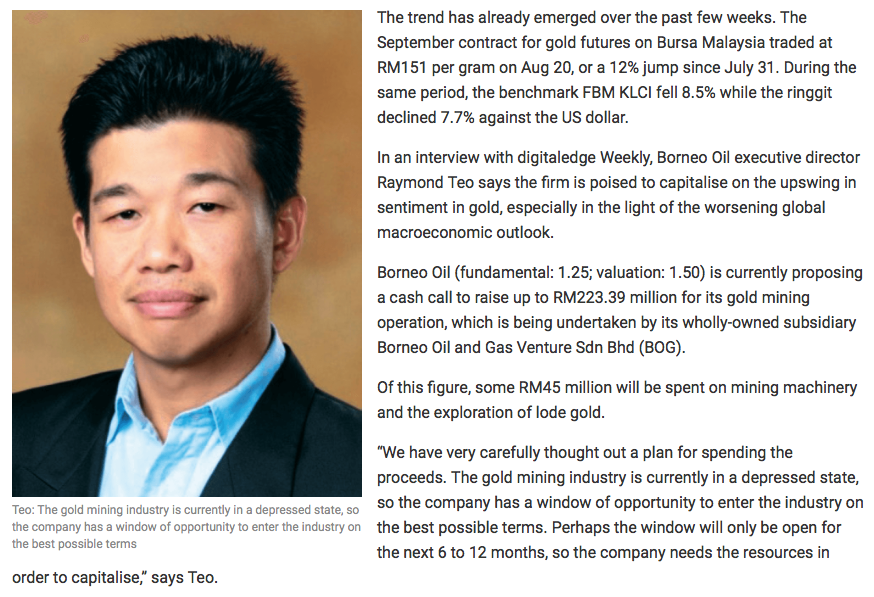

7. Impeccable Timing

Borneo Oil obtained the rights to mine gold in Pahang at very cheap price (please refer to newspaper clipping below).

In this world, nothing comes free. When something is lucrative, you need to pay a huge amount to get it. Why is it that Borneo Oil can get it so cheap ?

This is because they entered the industry at the bottom of the cycle.

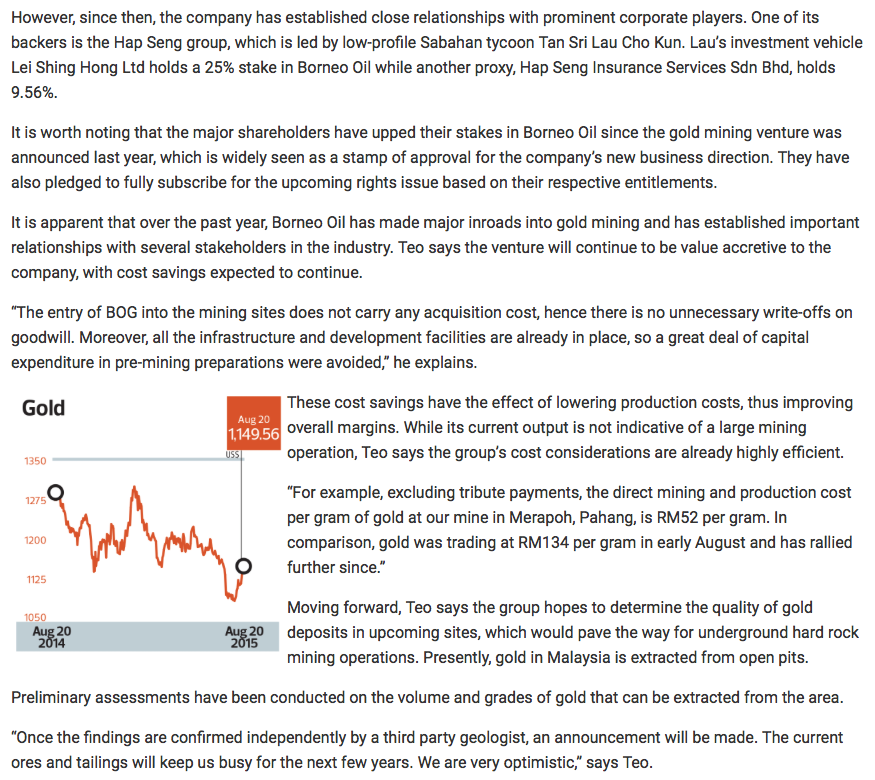

Gold peaked in 2012 at more than USD1,800 per oz. It entered bear market between 2013 and 2015, touching as low as USD1,100 per oz.

Due to the bearish sentiment, in the past two years, many people were willing to let go of gold assets at depressed price. It was during that time that Borneo Oil stepped in to scoop up the assets.

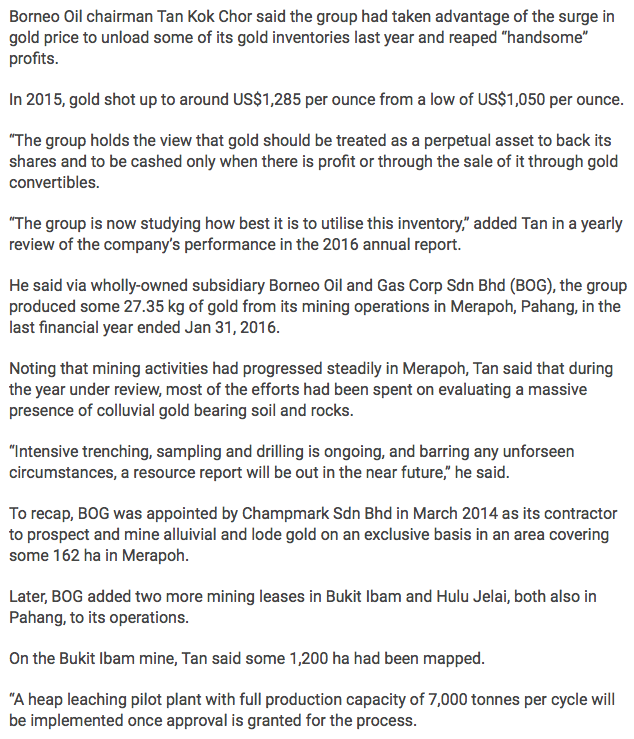

It turned out that their timing of entry has been excellent. In 2015, the Ringgit started depreciating. This benefited Malayaian gold miners as gold are sold in USD pricing. To add fuel to fire, at beginning of 2016, gold price (in USD) started going up. As at the date of this article, gold price is trading at approximately USD1,320 per oz.

8. Limestone Reserve

Apart from gold mines, the group also has limestone reserve in Lahat Datu, Sabah.

9. Future Prospects ?

The following is extracted from annual report.

I can't help but to notice the company's statement above, "gold is trading below what we called total cost (direct production cost, investment cost, development cost, all added up)", as though the group's operation is hardly profitable.

On the other hand, it stated that, "we unloaded some of our inventories and made some handsome profit".

The two statements seemed to contradict each other. What is the real picture ? Is the group's gold mining operation profitable or not profitable ?

According to past few quarters' results, it seemed that sale of gold inventories brought in good profit. Please refer to table in Section 3 above.

And also, as highlighted in Section 7 above, the group acquired the mining rights at cheap price. The existence of infrastructure also leads to low production cost.

If that is the case, is the statement "gold is trading below total cost" a miscommunication ? A careless attempt to try to portray how undervalued gold is from international mining point of view, but instead lead to misunderstanding of poor business economics ? Different people will have different view. I will leave it to you to decide.

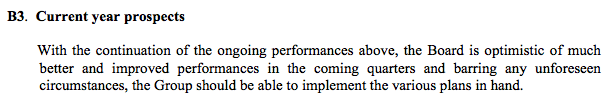

Apart from the annual report, the company also discussed its prospects in the latest quarterly report.

This round, the message is quite clear, the company is expecting "much better" performance ahead. As usual, we should take all these mesaages with a pinch of salt. Let's wait for next few quarters to find out whether they can really deliver.

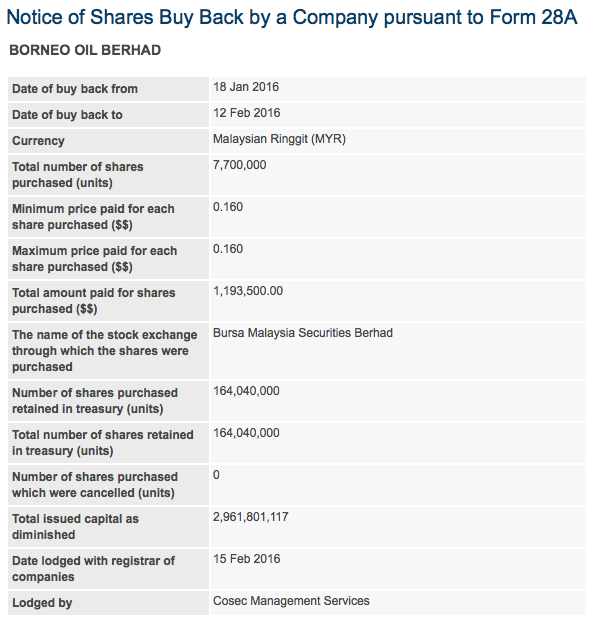

10. Shares Buy Back

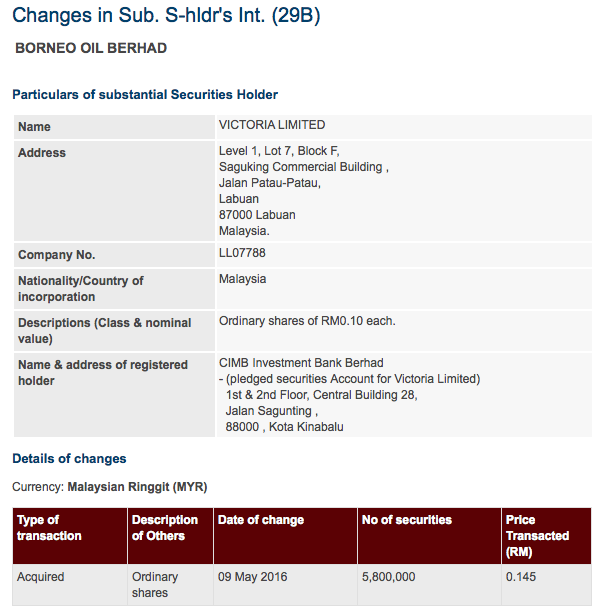

So far, the company has purchased 164 mil shares from open market. I believe the constant buy back activities is the main reason share price has sustained around 15 sen (very resilient). With zero loan and cash of RM71 mil, I believe it is not difficult for the company to continue to do so in the future.

Major shareholder has also been buying in the market recently (of course now we know why, he knew the coming quarter result will be good).

11. Concluding Remarks

I first bought Borneo Oil in February 2016. However, very soon, I disposed all at a small loss.

There were two major reasons.

Firstly, the group lacked strong earnings. As many of my readers would have known by now, strong earning is the key criteria for me when come to stock picks. Without that, I felt like hovering in mid air. I didn't like that feeling.

Secondly, there were too many things I didn't understand about the group. I was particularly wary of the inventory data. Was it really referring to gold dug out from the ground ? If yes, it would be very valuable. However, there were forum members which debated that it could represent gold acquired for trading purpose. If that was the case, we are looking at potentially very thin profit margin when they were sold off.

The above major concern was addressed when the annual report for the financial year ended 31 January 2016 was released few weeks ago. This particular paragraph gave me a lot of comfort.

Even though the company still hasn't explicitly stated that the gold is not bought from market for trading purpose, the way they presented it more or less confirmed that it originated from own mining operation (you don't brag about the value of gold you bought from somebody else. You didn't get it for free, you pay for it !!!)

With that issue out of the picture, I am also no more so concerned about lack of strong earnings over the short term. When the gold is sold, the money will come in.

How about Target Price ? Due to lack of understanding for the group's operation, I don't really know how to set the Target Price. However, I believe 50% return over let's say, a period of two years, is not impossible. The group's operation seemed to be on right track. The potential to strike gold (pun intended) is there. Furthermore, balance sheets is squeaky clean and major shareholder is strong.

I don't know when the stock will be re-rated. But I am optimistic. One day, it will happen.

Appendix - Newspaper Articles

BORNOIL (7036) - (Icon) Borneo Oil - Hiding Light Under A Bushel

http://klse.i3investor.com/blogs/icon8888/92402.jsp