1. Introduction

MKH recently reported two consecutive quarters of strong earnings.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|

| 2016-09-30 | 2016-03-31 | 322,231 | 55,379 | 13.20 | - | 2.8300 |

| 2016-09-30 | 2015-12-31 | 266,365 | 61,570 | 14.68 | 7.00 | 2.7100 |

| 2015-09-30 | 2015-09-30 | 348,710 | 24,411 | 5.82 | - | 2.6300 |

| 2015-09-30 | 2015-06-30 | 255,838 | 20,886 | 4.98 | - | 2.5400 |

| 2015-09-30 | 2015-03-31 | 229,720 | 10,904 | 2.60 | - | 2.4900 |

| 2015-09-30 | 2014-12-31 | 207,634 | 30,129 | 7.18 | 8.00 | 2.4600 |

Are those earnings real ? Are they sustainable ? Let's take a look.

2. Background Information

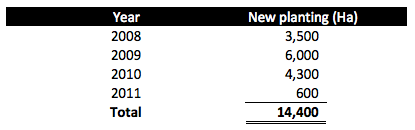

MKH is principally involved in property development. In 2008, it ventured into oil palm plantations in Kalimantan, Indonesia. It completed planting the entire 14,400 Ha by 2011.

Based on 420 mil shares and latest price of RM2.55, market cap is RM1.07 billion. Based on past twelve months aggregate net profit of RM162 mil, historical PER is 6.6 times.

The group has net assets of RM1.2 billion, loans of RM827 mil and cash of RM296 mil. As such, net gearing is 0.44 times.

Out of RM827 mil borrowings, RM326 mil is denominated in US Dollars (which explained why the group incurred huge forex losses in past few years). The USD borrowings were used to finance the group's plantation capex in the past few years.

According to FY2015 annual report, the USD borrowings are repayable over 5 tranches as follows :-

As trees are now matured and producing FFBs, the group should be very comfortable servicing its debt obligations going forward.

3. Historical Profitability

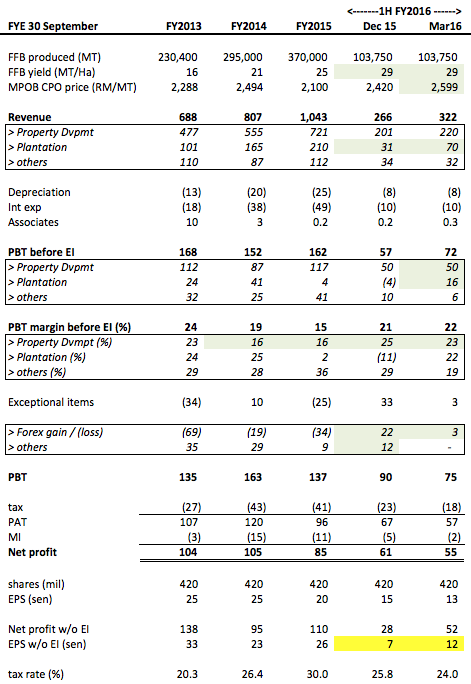

Key observations :-

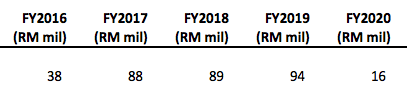

(a) Plantation division reported PBT of RM20 mil in March 2016 quarter. However, there was net forex gain of RM3 mil. Excluding that item, core PBT would be RM17 mil per quarter.

(b) Property division generated PBT of RM62 mil in December 2015 quarter. However, there was a government grant of RM12 mil. Excluding that item, core PBT would be RM50 mil. That translated into PBT margin of 25%. It is not clear whether this high profit margin is sustainable as in FY2014 and FY2015, property division's PBT margin was only 16%.

(c) Property division generated PBT of RM50 mil in March 2016 quarter. That translated into PBT margin of 23%. Same as above, it is not clear whether this high profit margin is sustainable.

(d) After stripping off the forex gain and government grant, MKH's core EPS for 1H FY2016 is 19 sen (being 7 sen + 12 sen).

(e) The following factors will determine whether the recent two quarters' strong profitability can be sustained going forward :-

(i) Property division - It is unclear how much progress billing will be booked in in the coming quarters. However, the group has unbilled sales of RM800 mil plus and will be launching closed to RM1 billion new projects this year.

(ii) FFB yield - At average age of 7 years, the group's palms are still growing. FFB yield is expected to continue to increase over next few years.

(iii) CPO price - During the period from April until June 2016, average CPO price was RM2,599 per MT. This is higher than the March 2016 quarter's RM2,420 per MT.

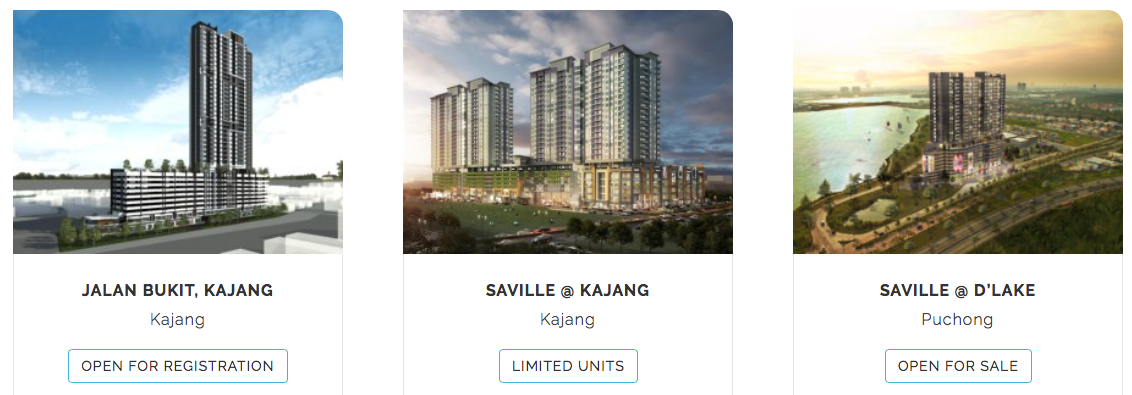

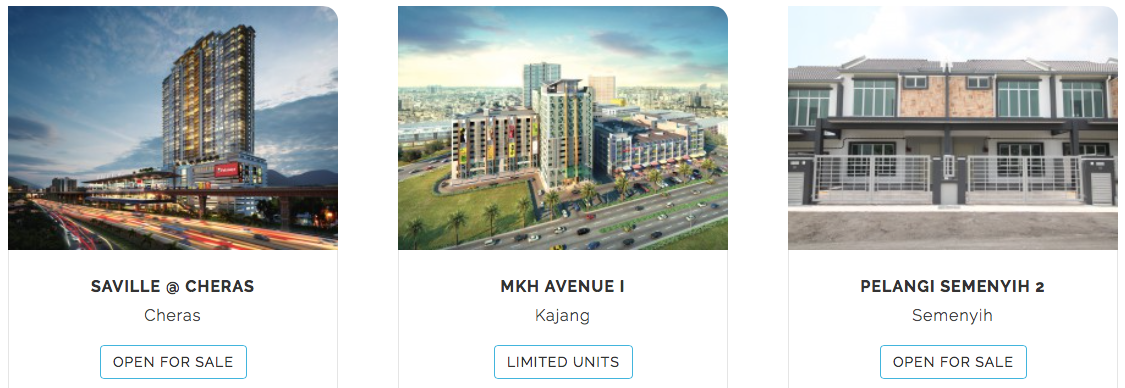

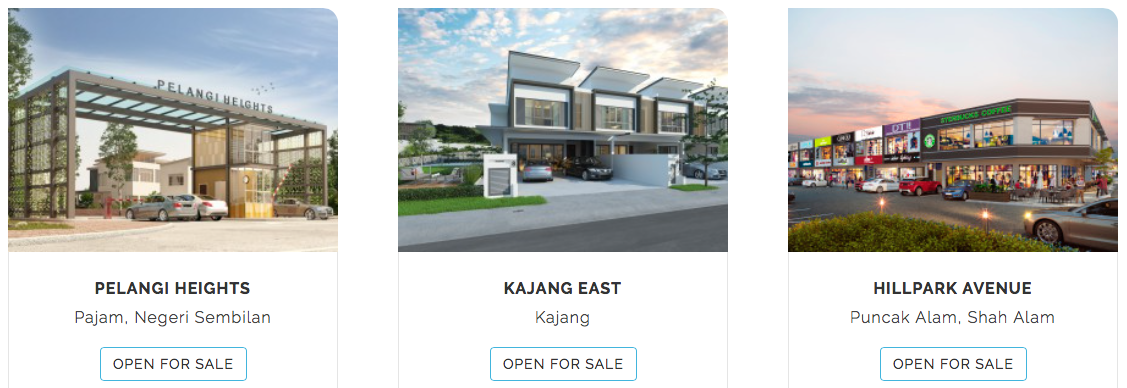

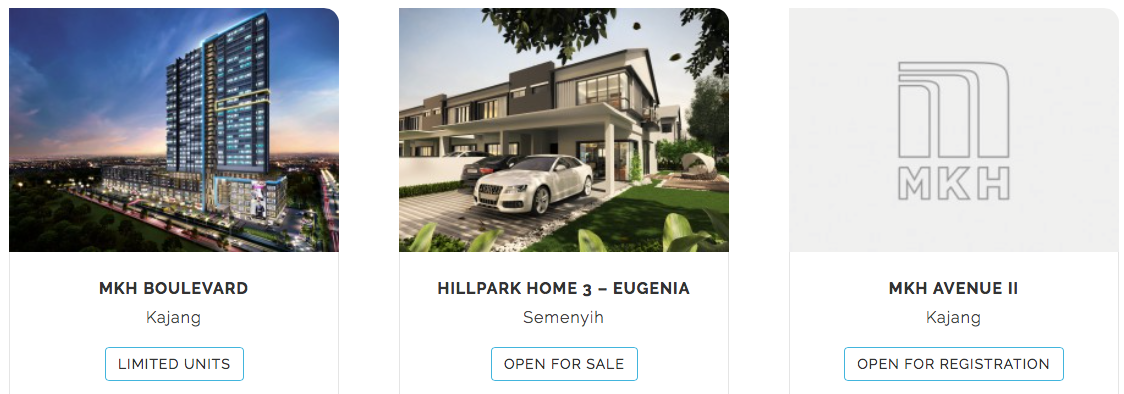

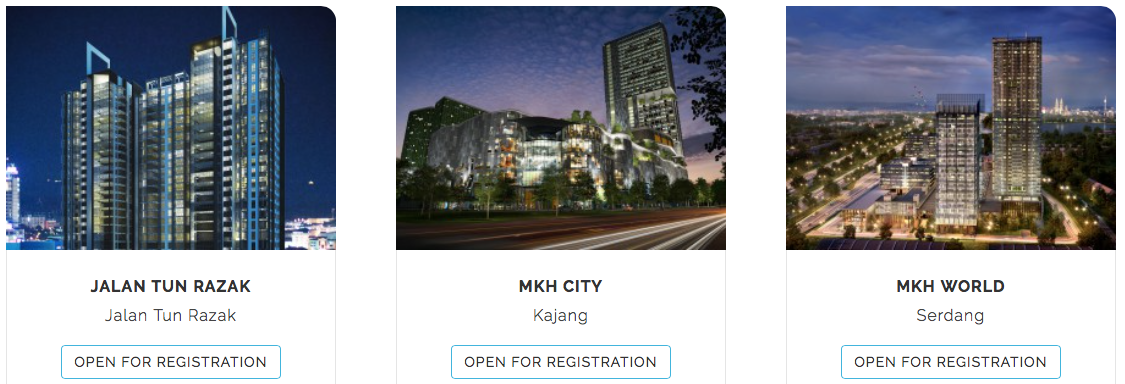

4. Property Projects

The following are the group's ongoing projects :-

I notice that they are mostly located in popular and matured residential areas.

5. Super Trees

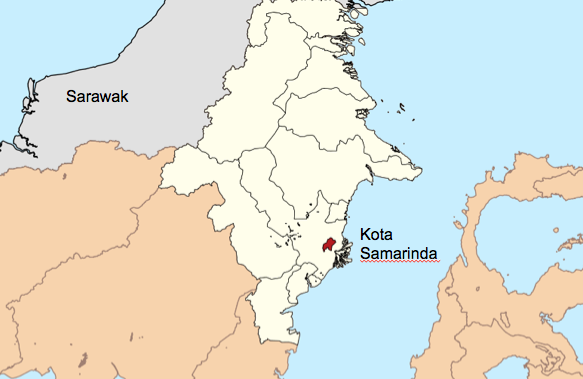

MKH's plantations are located at Kota Samarinda, East Kalimantan. The region was not affected by the recent El Nino. As such, MKH enjoyed the best of both world - high yield + high CPO price during 1H 2016.

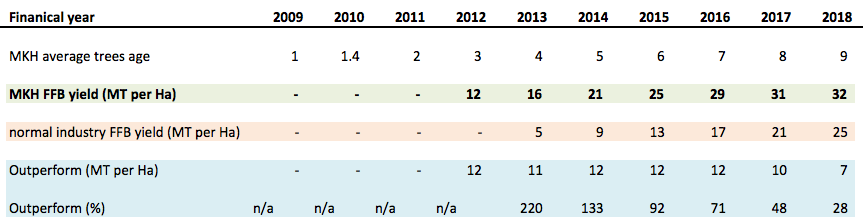

MKH's Kalimantan plantations have exceptionally high FFB yield. A comparison of their yield with industry average is as set out below :-

As shown in table above, MKH's yield are SUBSTANTIALLY higher than industry average.

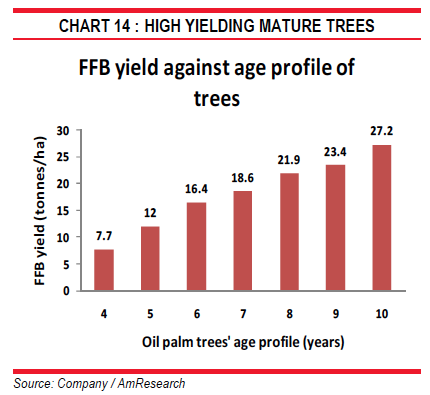

For example, in 2016, with trees at 7 years old, the group's FFB yield is expected to reach an astounding 29 MT per Ha. To get a feel of how good those yields are, just compare it with Uncle Koon's blue eye boy, Jayatiasa. According to this analyst report published by AmResearch in January 2014, Jayatiasa's 7 years old trees are expected to produce 18.6 MT FFB per Ha.

MKH did not explain why its yield is so impressive. However, I did hear before of such cases of exceptionally high yield in Indonesia, especially in region of fertile volcanic soil. If anybody knows the answer for MKH, please drop me a note.

6. Potential Listing Of Plantation Division Soon ?

In an interview with The Edge in May 2016, the company's Executive Chairman mentioned that they might list the plantation division if they were able to secure another 2,000 to 4,000 Ha of plantation land.

His wish came true sooner than expected. On 10 June 2016, MKH announced that it is acquiring 75% of PT Sawit Prima Sakti (PTSPS) for cash consideration of RM15 mil. PTSPS owns 2,445 Ha of plantation land in East Kalimantan.

Does that mean that the listing will happen very soon ? Let's just wait and see.

7. Concluding Remarks

(a) MKH attracted my attention because it has performed well in recent two quarters.

(b) Its plantation division generated core PBT of RM17 mil in latest quarter. For discussion sake, let's assume that the same performance can be repeated in next few quarters (FFB yield expected to remain strong while June 2016 quarter CPO price is higher than that of March 2016 quarter).

Based on annualised PBT of RM68 mil, tax rate of 25% and MI of 5% (Indonesian partners), can this division deliver net profit of at least RM48 mil ?

(c) Property division generated core PBT of RM50 mil in latest quarter. If annualised, full year PBT will be RM200 mil. However, this could be too aggressive. To be prudent, I prefer past 3 years average PBT of approximately RM110 mil.

Based on 75% tax rate, can this division deliver net profit of RM82 mil ?

(d) The group's other divisions (investment properties, trading, etc) generated PBT of approximately RM25 mil per annum in the past.

Based on 25% tax rate, can those divisions deliver net profit of RM19 mil ?

(e) By putting all the above figures together, I arrived at theoretical net profit of RM149 mil. Based on 420 mil shares, EPS is approximately 35 sen. Based on latest price of RM2.55, prospective PER of 7.3 times ?

(f) Can the above EPS be achieved ? Nobody knows. I guess we can only find out over time.

Have a nice day.

Appendix - The Edge Article Dated 23 May 2016

MKH (6114) - (Icon) MKH - Strong Earning Momentum

http://klse.i3investor.com/blogs/icon8888/100411.jsp