EG (8907) - Dude, EG is the turnaround story!

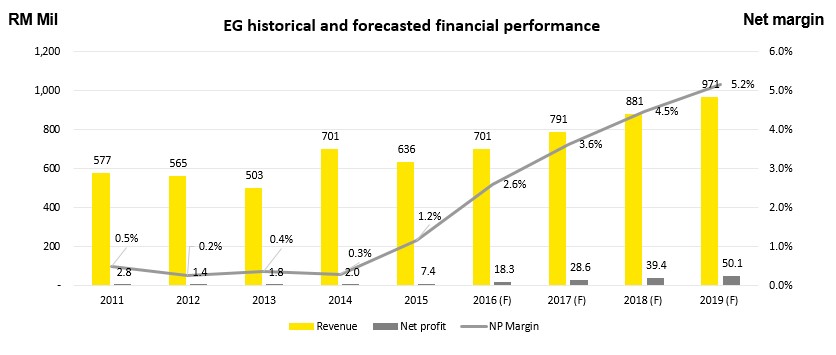

EG Industries Berhad (“EG”) is an example of your classic turnaround story. EG has been listed on Bursa since 1992 and if you look at the years from 2010 to 2014, the company has barely been making any money. However, from 2015 to today, EG’s earnings have exploded and in this article, I am justifying a target price of RM1.36.

Key drivers:

- Major turnaround story with margin expansions leading to core profits increasing by more than 4x from RM7.4mil in 2015 to a forecasted RM32.2mil in 2017 (June year-end)

- Revenue growth driven by box build contracts. These are the two new box build contracts from Trimango and Flic worth a total of USD80m over the last 12 months

- Strengthening EBIT to interest coverage

Recently I have had the privilege to meet EG and management has shed some light on the strategic direction of EG.

Notice how you can barely see the net profit bar on the graph? This is intentional because the profit margins for EG prior to 2015 were obscenely low ranging from 0.2% to 0.5% (at least its black right?). However, in 2015, margins increased three fold from 0.4% to 1.2%.

While a 1.2% margin increase is still considered very low, the beauty of margin expansion stories is that by increasing margins from 1.2% to 3% (which is only 1.8% increase), profits essentially increase by more than 100%.

So what prompted this change? In late 2014, Jubilee Industries from Singapore bought over most of the previous owners (the Tai family) shares, and through a few corporate exercises started to shift the business direction of the company. While the ownership has shifted to Jubilee; which is based in Singapore; business is still being run by local management, with the main strategic direction coming from the CEO, Alex Kang.

Let us start with what EG has been doing all this time, their bread and butter – printed circuit boards (PCB) assembly. Don’t bother with all the “EMS” and other jargons you find on news about EG. EG basically assembles PCBs. A heck of a lot of them. See all those little black chips (transistors) on the PCB? EG takes the little chips and “sticks” it on the PCB (I’m being extremely simplistic here).

I know that you are thinking that they make these things for computers/ smart phones and there is currently a downturn in the smart phone industry. However, in reality every electronic item in the world needs one of these little guys. They are in everything from your car radio to your vacuum cleaner and they come in various shapes and sizes.

(Source: www.ti-electronic.com)

Unfortunately, this is where the bad news starts. Although they look very complex and difficult to assemble (they are, and require very intense machines to perform the assembly), their margins are extremely thin leading to the 0.4% net margin for EG all these years.

PCB assembly requires very expensive machines; such as the one in the picture above; in order to automatically place the little transistors onto the main chip board. This leads to high depreciation cost and significant capex.

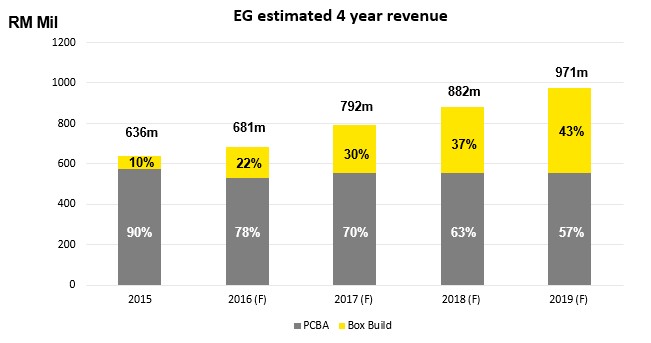

Even today, roughly 80% of EG’s revenue is derived from the assembly of PCBs while the remaining 20% is from the new business, the “box build”.

When I first read the term “box build”, my mind immediately jumped to the wooden box I made in high school ‘kemahiran hidup’ with an LED light inside which would light up when I opened it. I thought box build meant that EG was building some box with some circuit inside to do some electronic stuff. Well, I was mistaken and if you thought so too, you are mistaken too. It is called box build mainly because the industry uses this term which can be ambiguous.

With reference to the Quechua light box pictured above. This is what is referred to as a box build. Actually, it is more like the assembly of the components of the products. For example, EG assembles the various components such as the plastic parts, the electronic and wiring parts and packages it into the box. It’s almost like a turnkey concept, except for manufacturing products.

EG may not manufacture the components of the Quechua light, but is responsible for assembling it together. Compared to the PCB assembly, the box build is more labor intensive but requires significantly less capex and has much higher gross margins of about 10-12% (compared to the PCB assembly business of less than 5%).

Basically, in 2014 EG decided to shift the business from PCB towards more box build businesses. While EG doesn’t intend to stop its PCB business, EG will be hesitant to take new orders unless they are large or jobs from their key customers such as WD and Dyson. EG’s business strategy is now to focus on box builds.

Below are the samples of box build products assembled by EG.

The good thing about box build is that it doesn’t require a lot of floor space or machinery to start. Therefore, since EG has expanded their factory space from the rights issue, they have the ability to double their box build capacity at a moment’s notice. The limiting factor today is orders from customers which EG is actively marketing.

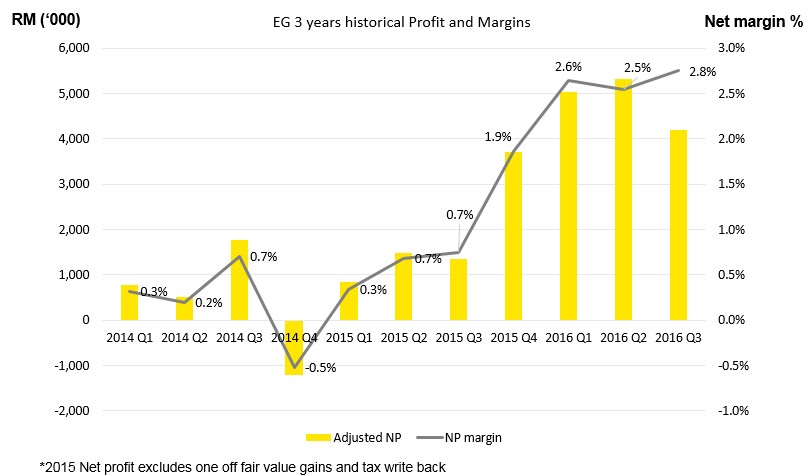

Notice that since 2015 Q4 with the increase in the new box build product mix, net margins increased significantly from below 1% to 1.9%. Fast forward to the latest quarter and you will see net margins are almost 3%. This is significant progress from the days of 0.2% to 0.7%.

Management has given indication that they plan to maintain their PCBA revenue and to increase their box build revenue by RM120m or USD30m per year. I am discounting this by 25% to RM90m/year or USD22.5m/year to be prudent. This is quite conservative seeing that EG has been able to secure a USD50m contract from Tramingo and USD30m contract from Shortcut Labs AB Flic in the last 12 months.

If you want to verify the news on EG’s contracts – do check out https://thefinancialdb.com/ which you are able to search news on EG across different news websites. And if you like it, do check out their app “the exchange” on iOS app store http://theexchangenews.com/ (it's all free and no, these guys aren’t paying me).

By 2019, it is forecasted that EG’s revenue will be RM971m with 43% of revenue derived from box build.

Remember the first graph you saw in this article? Well, if EG is able to secure USD22.5m of additional box build contracts each year, by 2019, net profit will be to the tune of RM50m with a net margin of 5.2% or more than 10X what EG was experiencing before the transition to box build.

One of the red flags for EG is their debt. From their latest quarter report, DE ratio is 0.88, which is not great. Prior to 2016, the EBIT/ interest expense ratio is less than 2 which is very low. There are only two ways any company can manage their debt issues which is 1) paying it back or 2) growing out of it.

The good news is this, EG can achieve #2. When EG starts shifting to box build, their margins and EBIT will increase at a faster pace than interest expense. According to my analysis, I assume that interest expense increases by 10-15% every year – in line with the projected increase in revenue of each year. However due to the shift to box build, EBIT will be increasing at a faster click than interest expense. Therefore, as per the graph above, by 2019, the EBIT/ interest rate will increase from the low of 1.27 to 4.95.

In reality, the interest coverage should be even higher due to repayment of debt once EG starts earning more cash, however I am trying to be prudent once more.

Extract: EG rights issue

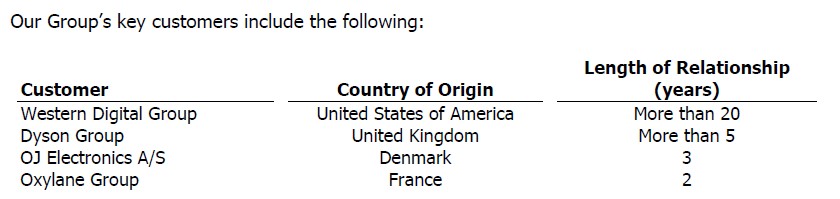

Now you may be curious as to why EG is privileged enough to get all these box build contracts? Can’t any Tom, Dick or Harry Sdn Bhd do the same thing? If you refer to the table above, you’ll notice that EG has been in business with WD for more than 20 years and Dyson for more than 5. These companies are very well known multinational companies which require a high degree of excellence in their manufacturing process which EG has proven for over 20 years.

EG manufactures PCB for WD’s hard disks which requires a very low fault rate (below 0.01% error) as faulty HD will result in data loss which high costs for WD’s customers – data centers. The long contract with WD is a testament to EG’s quality excellence and assurance which in turn allows them to win other contracts for box build (from non WD customers).

Another important question is “why aren’t these companies outsourcing box builds to China when it is cheaper?” The answer is because first of all, wages in China are getting more expensive – the wages advantage is decreasing.

Furthermore, China has a poor reputation for intellectual property. There are many stories about companies in China who are stealing OEM products from their customers and marketing their own imitation products. In fact, there are instances where the Chinese manufacturer steals the design and concept and then sues the original customer for copyright infringement!

Internet of things (“IOT”) is the next big wave in the internet and technology revolution. What is IOT? It’s basically when every object in the word is connected and helping everyday life both for consumers and businesses. Flic, which is a smart button EG is manufacturing is a small instrument in the scheme of IOT.

Ref: https://www.youtube.com/watch?v=MDsjBh2xOgQ

The point here is that moving forward, everything will be connected but for everything to be connected, ordinary objects need to be reimagined with integration of electronics and EG is well positioned to be at the forefront of box building these devises.

Conclusion

So what’s the bottom line? What is EG worth? Here are some considerations:

· Increasing revenue and profitability – growth story (positive)

· Significant margin expansion (positive)

· Reputation of excellence with MNCs such as Dyson & WD (positive)

· Improving debt ratios (positive)

· Forefront to benefit from the revolution of IOT (positive)

· High debt to equity ratio (negative)

· Lack of economies of scale (negative)

· Current low margins (negative)

· Reliance on contracts (negative)

Given the above considerations, I reckon a forward PE of 10 is justified (some might call it low) given the strong growth story. However, I must caveat that EG is not for punters looking for a quick buck. Their transformation started 2-3 years ago and will continue moving forward. Do not expect profits to double in the next year, however using 2015 as the base year, core net profit is estimated to be at a healthy CAGR of 61%! By 2019, net profit is expected to be RM50.1m compared to 2015’s core profits of RM7.4m.

Considering that 2017’s (June year-end) earnings is expected to be RM28.6m, a PE of 10 would yield RM286m or RM1.36/share. That is my TP. Please use your own discretion.

Happy investing.

EG (8907) - Dude, EG is the turnaround story!

http://klse.i3investor.com/blogs/rarecharms/102161.jsp