COMCORP (7195) - Next counter after CSCsteel.

After the last sharing on CSCsteel.

Cscsteel surge up together with those steel related counter.

Those who are gone up in high precentage are basically with huge inventory and HRC/CRC related steel counter as recently many ppl shared the shut down of Megasteel.

After quarter result out , the 2nd major shareholder , Mr Gan had stopped to dispose. (or he had less that 5 percent now) but based on Bursa statement, he still have around 5++ percent.

Personally felt that as long as China have determination on cut down the production supply of steel , surely the steel price can maintain on this level or even higher then.

of course the current share price of steel related company had factor / forecasted the future earning.

Bear in Mind , Q3 result maybe lower than Q2 for cscsteel and half of the steel counter.

Been told that OTB also collecting alot of cscsteel on last month, and he give a very high TP on cscsteel.

Thanks OTB for pushing up cscsteel.

Believe that in 21st jun 2016 , those who have comcorp had a nightmare as the share price plunge around 30 percent in few hours of time.

Many comcorp shareholders start to dispose as they think this counter is manipulate by syndicate/big crock

after some study on Comcorp i believe that comcorp is still doing well- following is some of my sharing.

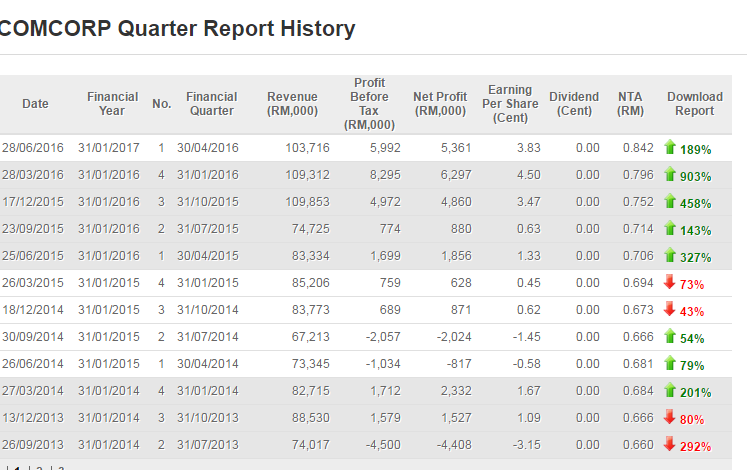

the result of comcorp really attractive me as coming result will surely beat the YoY result and make the EPS stand on 14-16.

By taking 15 x PE7 it should basically worth over rm1.00

VS also doing EMS and marker willing to gave PE10-11 to it.

Give discount of 30 percent because Comcorp never give any dividend before and also margin of safety.

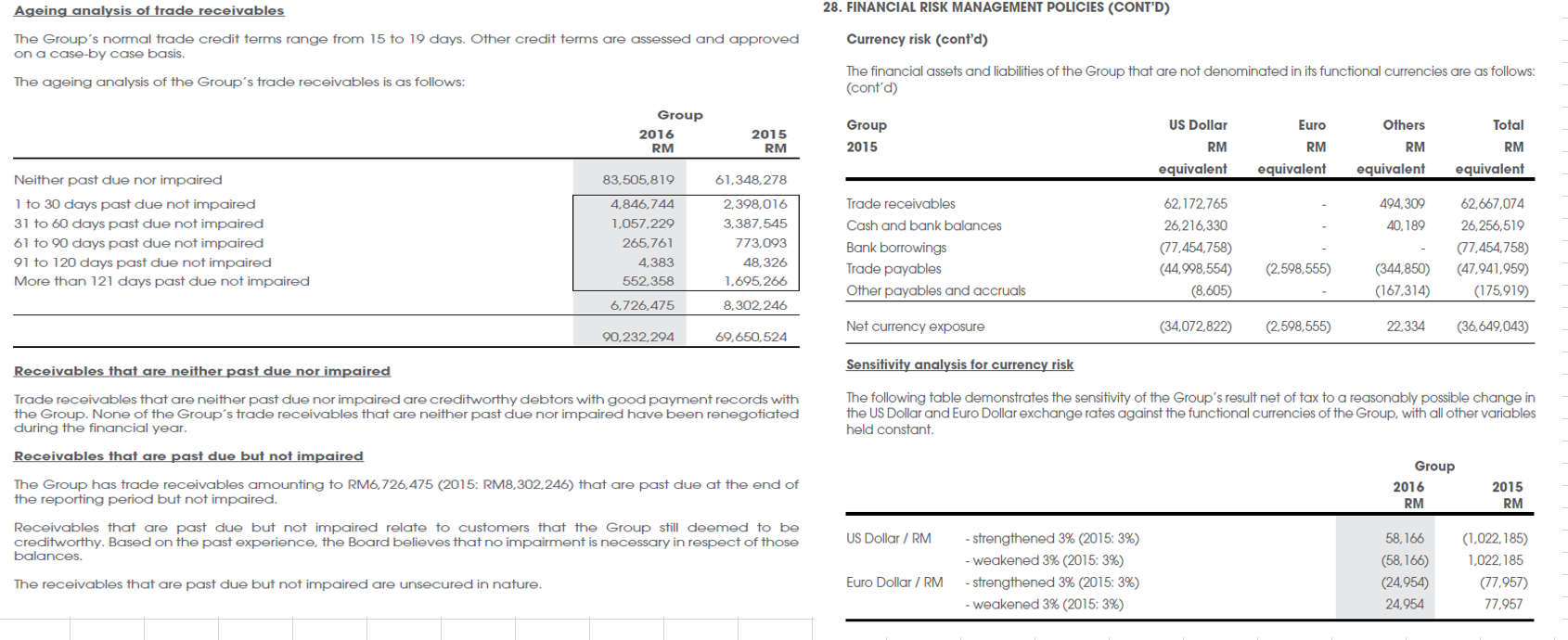

most of the revenue 96 percent are from EMS, and 100 percent of the EMS product is for export.

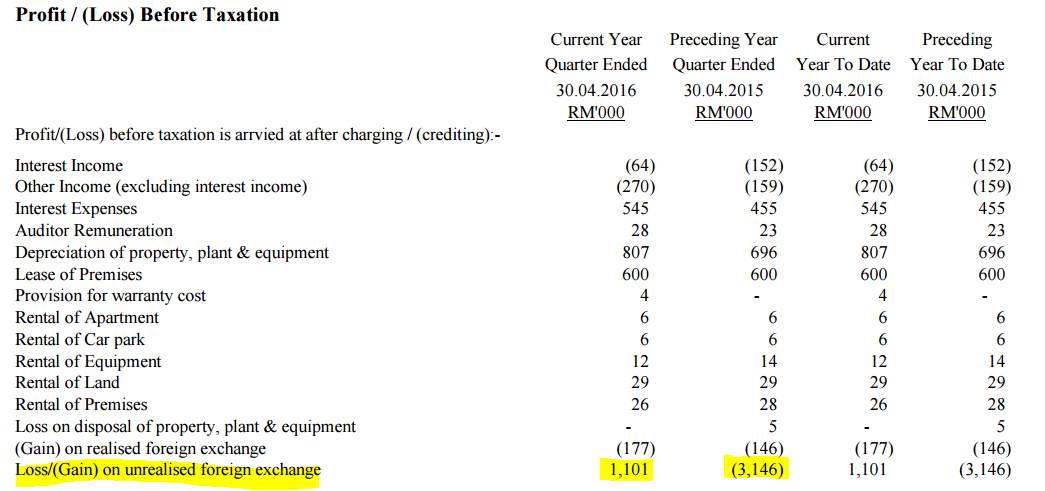

for this coming Q2 the foreign exchange will be positive as below shown the USD to MYR exchange for the month of May to July.

but Forex exchange gain is only the bonus.

The attention should put on the grow of the revenue as they secure the contract

Comintel’s higher shipment of products for the automotive industry includes its global positioning service (GPS) tracking device, called Xirgo.

The product is utilised by North American insurance companies for tracking purposes in order to determine the appropriate insurance premium customers should pay based on the way they drive.

The company is cautiously optimistic on its outlook for Xirgo, citing the possibility of the Malaysian car insurance market moving from being controlled by the central bank to an independent entity.

“It will also open up potential in the domestic market if local insurance companies adopt the GPS tracking practice,” Lim said.

North america had contribute 80 percent of their total revenue. with the current economic on North america look good and dont seem their will be a downturn of demand in Q2 and Q3. so the revenue should be able to sustain in 100mil +-

Risk

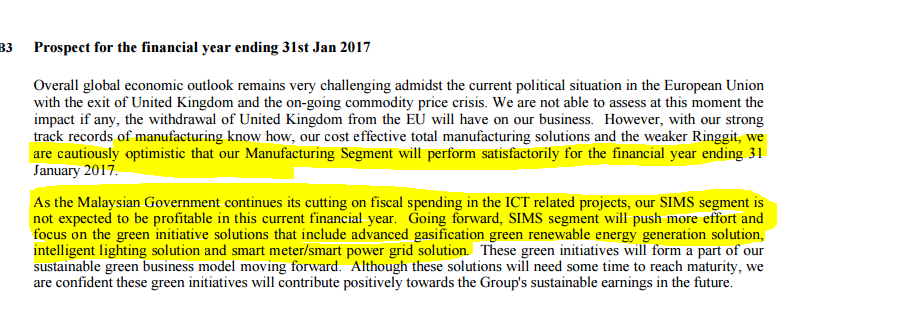

Comcorp will still suffering loss on the SIMS segment but from the annual report/ quarter report. it shown that the loss is getting lesser and lesser.

EMS segment the margin is low. (EG , VS )

Growth prospect

Comcorp will have very high potential if they able to pass the and obtain the certificate from SIRIM for their LED product. which u able to look ant D&O , JHM as their margin if much more higher from the EMS segment.

Further more the LED for the automotive is able to generate even higher margin and the market still have alot of space to penetrate.

Cost effieciency and product improvement also will be the key to increase their margin.

THe balance sheet and cash flow of comcorp consider healthy.

With the share price of 0.830 on 15th September it still consider cheap.

Buy Call for Comcorp.

COMCORP (7195) - Next counter after CSCsteel.

http://klse.i3investor.com/blogs/Learntoinvest/104493.jsp