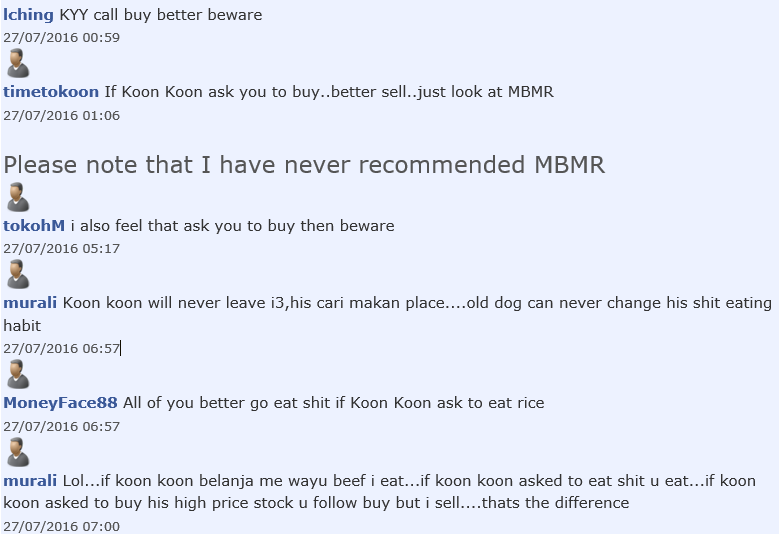

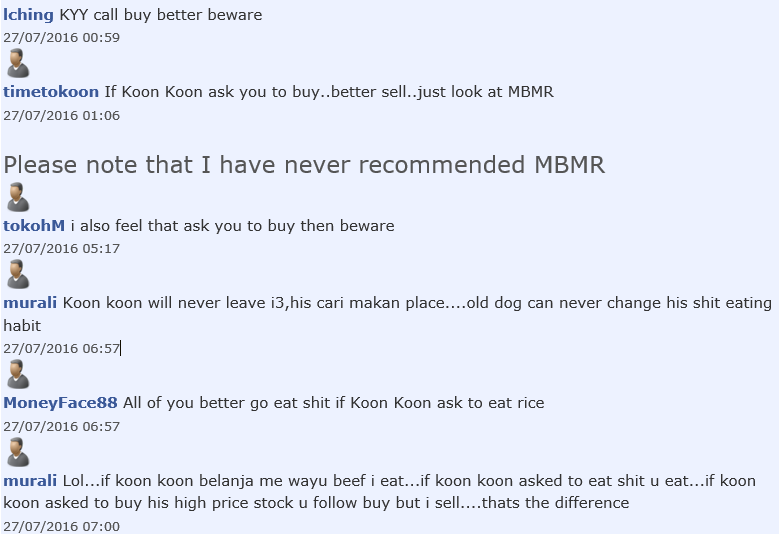

Koon Yew Yin 官有缘 - Believe me or not? Koon Yew Yin

After I read some of the senseless commentaries of the articles I

posted, I feel obliged to write this piece. Here are some examples I

found in i3investor.com.

They want readers to think they are smart! They have to examine their track record. How much money did they make from the stock market?

As you know, I started posting articles about 2.5 years ago. The first share I recommended was Latitude which went up from Rm 1.00 to above Rm 8.00 within 24 months.

The 2nd share I recommended was VS Industry which went up 550% within 18 months. While most people sold, I bought a total of 106 million shares as reported in its 2015 annual accounts and I became the 2nd largest shareholder of the company.

My 3rd recommendation was Lii Hen which also went up more than 500% within 18 months. I am the 3rd largest shareholders.

Gamuda WE

On 26th Aug 2016, I post my article with the title “Gamuda WE is a safe and good bet” when its price was Rm 1.11. Today the price closed at Rm 1.35, a profit of 24sen or 22% in 9 trading days.

The following is an extract of my article quote:

The closing price of Gamuda WE is Rm 1.11

The expiry date of warrant is 6th March 2021 and Conversion price is Rm 4.05

That simply means you can double your money if you buy Gamuda WE at Rm 1.11 when the mother share goes up to Rm 5.70. The question is when?

Besides Affin Hwang, Malaysia Equity Research and Hong Leong Investment Bank also have strong buy recommendation for Gamuda.

Instead of buying one Gamuda share, you can buy nearly 5 warrants and your profit will be 5 times.

My wife and I have more than 50 million Gamuda WE.

Mr Ooi Teik Bee is managing part of my money and he has bought 13 million Gamuda WE for me.

Does it make any difference if you sold a few hundreds shares just to spite me?

Gadang

On 10th August 2016, I posted the article “Gadang is showing a strong buying signal” when its price was Rm 2.50 per share. The chart was showing the formation of a cup and handle which is a strong signal for buying.

Today the price of Gadang closed at Rm 2.98, a rise of 48 sen, 19% in 28 trading days.

You can see its annual profit of 40 sen per share as shown on its recent announcement in Bursa.

On 25th Aug 2016, the company made a multiple proposals, the details of which you can read from Bursa announcement. Briefly they are:

I also have a lot of this share and I am still accumulating.

I am sure those who sold just to spite me, would have performed poorly. They must bear in mind that there are a lot of smart people reading their stupid comments. Why don’t they write and post an article to show how clever they really are? My advice to them is that they must change their attitude and read the 10 investment lessons I posted on my blog: koonyewyin.com.

Koon Yew Yin 官有缘 - Believe me or not? Koon Yew Yin

http://klse.i3investor.com/blogs/koonyewyinblog/104144.jsp

They want readers to think they are smart! They have to examine their track record. How much money did they make from the stock market?

As you know, I started posting articles about 2.5 years ago. The first share I recommended was Latitude which went up from Rm 1.00 to above Rm 8.00 within 24 months.

The 2nd share I recommended was VS Industry which went up 550% within 18 months. While most people sold, I bought a total of 106 million shares as reported in its 2015 annual accounts and I became the 2nd largest shareholder of the company.

My 3rd recommendation was Lii Hen which also went up more than 500% within 18 months. I am the 3rd largest shareholders.

Gamuda WE

On 26th Aug 2016, I post my article with the title “Gamuda WE is a safe and good bet” when its price was Rm 1.11. Today the price closed at Rm 1.35, a profit of 24sen or 22% in 9 trading days.

The following is an extract of my article quote:

The closing price of Gamuda WE is Rm 1.11

The expiry date of warrant is 6th March 2021 and Conversion price is Rm 4.05

Total Rm 5.16

The closing price of Gamuda is Rm 4.86

Rm 5.16 /4.86 = 6.2% premium

Affin Hwang’s target price for Gamuda is Rm 5.70

Potential gain Rm 5.70 – Rm 4.86 = 84 sen.

If you buy one Gamuda WE at Rm 1.11, the potential gain is 84 sen,

provided the premium remains at 6.2%. But in most cases if Gamuda share

goes up to Rm 5.70, it is most likely the premium will be higher because

it requires much less capital to buy warrant than the mother share.

Assuming its premium is 10% ( usually more for a good quality stock) the

warrant price will be Rm 5.70 X 1.10 = 6.27 – 4.05 = Rm 2.22 .That simply means you can double your money if you buy Gamuda WE at Rm 1.11 when the mother share goes up to Rm 5.70. The question is when?

Besides Affin Hwang, Malaysia Equity Research and Hong Leong Investment Bank also have strong buy recommendation for Gamuda.

Instead of buying one Gamuda share, you can buy nearly 5 warrants and your profit will be 5 times.

My wife and I have more than 50 million Gamuda WE.

Mr Ooi Teik Bee is managing part of my money and he has bought 13 million Gamuda WE for me.

Does it make any difference if you sold a few hundreds shares just to spite me?

Gadang

On 10th August 2016, I posted the article “Gadang is showing a strong buying signal” when its price was Rm 2.50 per share. The chart was showing the formation of a cup and handle which is a strong signal for buying.

Today the price of Gadang closed at Rm 2.98, a rise of 48 sen, 19% in 28 trading days.

You can see its annual profit of 40 sen per share as shown on its recent announcement in Bursa.

On 25th Aug 2016, the company made a multiple proposals, the details of which you can read from Bursa announcement. Briefly they are:

- Proposed share split

- Proposed bonus issue of shares

- Proposed bonus issue of warrants

- Proposed ESOS

- Proposed increase of authorized share capital

I also have a lot of this share and I am still accumulating.

I am sure those who sold just to spite me, would have performed poorly. They must bear in mind that there are a lot of smart people reading their stupid comments. Why don’t they write and post an article to show how clever they really are? My advice to them is that they must change their attitude and read the 10 investment lessons I posted on my blog: koonyewyin.com.

Koon Yew Yin 官有缘 - Believe me or not? Koon Yew Yin

http://klse.i3investor.com/blogs/koonyewyinblog/104144.jsp