MASTEEL (5098) - MASTEEL, STEELING YOUR WAY TO 100% PROFIT

In the last 2 weeks, the steel industry stocks has been climbing very aggressively. There has been plenty of articles on specific steel players. However, what I’ve noticed is that a majority of the articles tend to focus on the steel sheet players.

Therefore, for the purpose of this article, I want to both educate and learn from the i3 community regarding the steel industry. Therefore, if I do make any mistakes in this article, please feel free to correct me because I am merely a novice investor who is trying to learn. This article will give a wide angle on the steel industry and then focus on rebar players, specifically MASteel which had rallied by 9% last Friday to a closing price of RM0.895.

First off, please prepare your brains if you’re not familiar with the steel industry because I’m giving you a lot of information.

Please digest this table properly because this will set the overall context of steel players in the industry. First of all, there are the upstream and downstream players. I am going to ignore the true upstream of iron ore mining and coke manufacturing because it is not prominent in Malaysia.

Therefore, broadly, the upstream players are divided into the sheets and the long steels. Sheets are basically flat steel as per the picture below which are usually sold in coil form. There are two kinds of sheets the HRC (hot roll coil) and the CRC (cold roll coil). It’s not that the HRC is hot when you touch it, but rather it was produced under high temperature. CRC uses HRC as a raw material to make the steel coils stronger/ thinner under non heated environment.

(http://blog.steelfromchina.com/differences-between-hot-rolled-coil-and-cold-rolled-coil/#sthash.CAexc4YZ.dpbs)

Recently, with the closure of Megasteel, the CRC steel players have been rallying because previously Megasteel was charging a higher price for HRC used to manufacture CRC compared to HRC imported from China. Quick note, while many sources state that Megasteel is a monopoly on production, there are other players such as SSteel & Eastern Steel (JV of Hiap Teck) which have license for production but are not producing HRC (from my research).

I am not going to write anymore about CRC because there are many articles on it already. We all know that these players have a good potential to realize higher profits in the future.

http://klse.i3investor.com/blogs/koonyewyinblog/104931.jsp

http://klse.i3investor.com/blogs/undervalue/103112.jsp

http://klse.i3investor.com/blogs/wealth123/103812.jsp

Skipping ahead to the downstream players, these are basically users of HRC, CRC, wire rods and rebars which cut or mold the steel to manufacture end products. For example, Prestar is in the business of slitting HRC and CRC into more narrow sheets, manufacturing hollow tubes, highway rails and steel racks. Basically the end or close to end product.

Touching slightly on whether Megasteel closing has an impact on downstream producers such as Prestar or recently popular ChooBee is an interesting question.

http://klse.i3investor.com/blogs/Insight1/104546.jsp

I was reading the article above which mentioned that ChooBee uses scrap based HRC to manufacture their products. Therefore with Megasteel out of the picture, ChooBee should benefit from lower raw material prices (imported HRC from China). I do not know the extent of application of HRC by ChooBee of Prestar, however if there are some applications of HRC, then they will benefit from lower raw material prices.

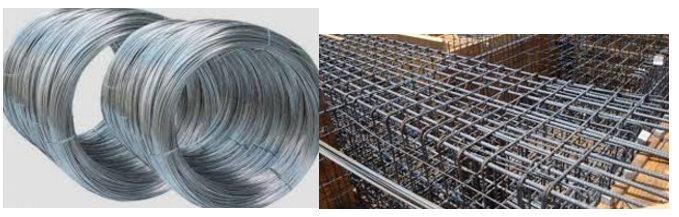

Finally, let’s talk about wire rods and rebars. These are known as the long steel products. Wire rods are typically used to manufacture bolts, nuts, nails, screws, wire ropes, bearing steel and vehicle tires. Rebars are used mainly in construction for structural integrity.

Source: http://www.steel-n.com/esales/general/us/catalog/wire_rod/use.html

The main players in this segment are MASteel, AnnJoo & SSteel. These players exclusively do not benefit from Megasteel’s closure because they do not use steel sheet products in their manufacturing.

http://klse.i3investor.com/blogs/koonyewyinblog/104931.jsp

This author is quite on point with his argument on the rebar and wire rod players. However, he has pointed out a few good arguments which I wish to borrow:

- Steel prices have been recovering since the beginning of 2016 and have gone up more than 40%

- In June 2016 the Edge reported that rebar players have lodged a complaint to MITI on steel dumping by China and are currently awaiting result pending investigation. If successful, they will be protected by the government imposing a safeguard tax on imported steel bars.

Source: http://steelbenchmarker.com/files/history.pdf

From 2011 to early 2016, Chinese rebar has been dropping from the high of USD660/MT to the low of 250/MT (we are using China because they produce more steel than the rest of the world combined). That is a whopping 62% drop. In the meantime, all steel players have been suffering with high inventory write downs and continuous lower average selling price. It’s no surprise that many steel players were in the red in 2015. However, in 2016, there is a change in wind where steel prices have staged a rebound. The current steel price of USD312/MT is not even half of the peak in 2011.

This is why although Megasteel closure does not affect rebar players, they have also rallied with strong Q earnings.

Going back to point #2, this is something that happened very recently – the MITI application for import duties for rebar & wire rods from Chinese dumping. Now read carefully. Just on Friday, at 3PM, our Malaysian government applied a safeguard duty rate of 13.42% for rebars and 13.9% for wire rods and deformed bar in coils.

https://www.steelorbis.com/steel-news/latest-news/malaysia-imposes-preliminary-safeguard-duty-on-rebar-imports-950462.htm

https://www.steelorbis.com/steel-news/latest-news/malaysia-sets-preliminary-safeguard-duty-on-imports-of-wire-rod-950463.htm

Now we know why MAsteel, SSteel & Annjoo were flying on Friday afternoon.

So the next logical question is whether this import duty will have a financial impact on the rebar & wire rod players and the answer is a resounding YES. Imagine, if our local players had to previously compete with the Chinese exporters, and had to lower their prices to match them, now they can afford to increase their prices by a 13.42%. Or at least 10% - while being able to give a discount.

While 10% may not seem like a whole lot, we must remember that the steel players are all suffering from terribly low or sometimes even negative margins.

Now we should compare the 3 main steel rebar players:

- First of all notice that MASteel is

the most specialized that they only produce steel bars and billets

unlike AnnJoo & SSteel which produces other downstream end products

as well. This means that MASteel will benefit the most from the

protection duty.

- MASteel has the best DE ratio among

the 3 despite the fact that they recently completed their expansion

adding another 150,000MT production from previously 450,000MT or a 33%

increase.

- MAsteel has the deepest discount to NTA of 65% even comparing to all other steel players

- MAsteel has the lowest market cap

- For adjusted EPS, I used the latest Q

less any inventory write off or asset impairment given the assumption

that steel prices are stabilizing/ recovering. Therefore based on the

latest Q, using a lazy simplistic method of multiplying the latest Q by

4, MASteel has the highest PE of 4.5 compared to 2.7 for the other two.

This is mainly because MASteel has the lowest net profit margin currently. I believe that this is due to the excessive dumping of steel from China, and therefore since they are specialized in steel rods and billets, they are the most impacted compared to SSteel and AnnJoo. However in the coming quarters, with the safeguard tax, MASteel’s margin will improve significantly.

- This brings us to the Net profit %.

In addition to my previous explanation of low profits, MASteel also

recently expanded their capacity, which usually impacts profitability

before reaching a normalized utilization. This part is important because

assuming that the safeguard tax increases each player’s NP by 10% (not

13.42%),MASteel will stand to increase profit by 250% while

AnnJoo and SSteel will increase 64% and 121% respectively. There is a

saying – when an industry turns around, the players with the worst

profit margins will benefit the most because the improvement in margin

is exponential.

- Finally, of the 3, MASteel has the highest inventory/share. While usually high inventory is a bad thing because it denotes poor use of capital, when steel prices are rising, this is a good thing because it has a higher stockpile of cheap inventory that will be sold at a higher price. In MASteel’s 2015 Annual Report, roughly 90% of inventory are raw material – which means that the high inventory is not due to its inability to sell to customers but due to MASteel stocking up in 2015 when raw materials were at its cheapest (MASteel doubled its inventory from 2014 to 2015)

So what’s the valuation? Really, it depends on the market. If you want to use PE, you need forward earnings. Historical earnings aren’t going to help you. However, as a start, I think it is safe to assume that MASteel’s profit will at least double from the import duties and the sustained steel prices.

Therefore, a full year EPS of 28.8 (4.4c * 4Q * 2) shouldn’t be too surprising. Assigning aPE of 5 would yield a TP of RM1.76, close to double the current price.

Finally, if you haven’t seen a cup and handle, this is a perfect one. In technical trading, what usually follows is "The Sky is the Limit."

Conclusion

While I think that all steel players are poised to benefit from the recent increase in steel prices, we have to be strategic in picking the counter which we want our money to grow in.

Therefore, in my opinion, due to the recent safeguard duty imposed by the government, rebar players have the highest potential – similar to how sheet players benefited the most from the closure of Megasteel.

I understand that many retail investors are afraid of heights, looking at how high steel players have come from 1 month ago, however I must encourage you that there is still a lot of room. This is because:

- Steel players at their low were

clearly trading as if they were going bankrupt. MASteel was at a low of

40c with an NTA of RM2.2. People are only now starting to invest as if

these steel companies can survive and generate profit.

- Newspapers & investment banks

have not started to cover steel stocks extensively. Have you noticed

that coverage usually starts very late? This weekend’s edge only started

covering Mycron – one of the CRC players.

- The cash flow and profitability

haven’t even started to show – the potential is extremely big. Don’t

think about where the stock is today. Think about where it will be

tomorrow (or next year)

Thank you.

Appendix

I realized that the steelorbit webiste makes it difficult to view the import duty news, therefore I am copying it into the appendix.

Please excuse the small words. You may right click and open in a new tab for better clarity.

MASTEEL (5098) - MASTEEL, STEELING YOUR WAY TO 100% PROFIT

http://klse.i3investor.com/blogs/100percentprofits/