UNIMECH (7091) - (Icon) Unimech - An Interesting Indonesian Recovery Play

1. Introduction

This article that you are reading now was first written by me back in February 2016. However, I did not publish it because I was waiting for the company to turn around (no point writing about a company with low profitability).

That moment has finally arrived. Unimech reported net profit of RM4.6 mil in the latest quarter. All were operating profit, no exceptional items.

According to the company's announcement, EPS was 3.86 sen. However, that was based on ordinary shares of 119 mil. After factoring in 30 mil ICULS outstanding, fully diluted EPS should be approximately 3.1 sen.

Based on existing price of RM1.12 and annualised EPS of 12.4 sen, the stock is trading at PER of approximately 9 times.

2. Background Information

Unimech is principally involved in manufacturing and trading of valves and fittings for instrumentation and other purposes.

A valve is a device that regulates, directs or controls the flow of a fluid (gases, liquids, fluidized solids, or slurries) by opening, closing, or partially obstructing various passageways. Valves are technically fittings, but are usually discussed as a separate category. In an open valve, fluid flows in a direction from higher pressure to lower pressure.

(Source : Wikipedia)

(Industrial valves) (Marine valves) (Control valves)

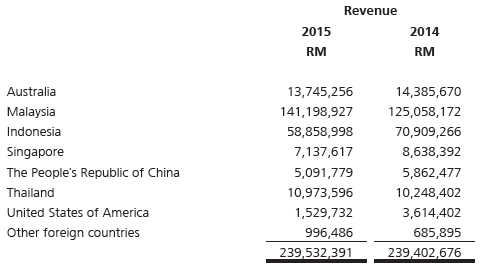

Apart from Malaysia (its primary market), the group also sells its products to Indonesia, Thailand, Australia, etc.

The group has net assets of RM244 mil, loans of RM125 mil and cash of RM34 mil. As such, net gearing is approximately 0.37 times.

3. Historical Profitability

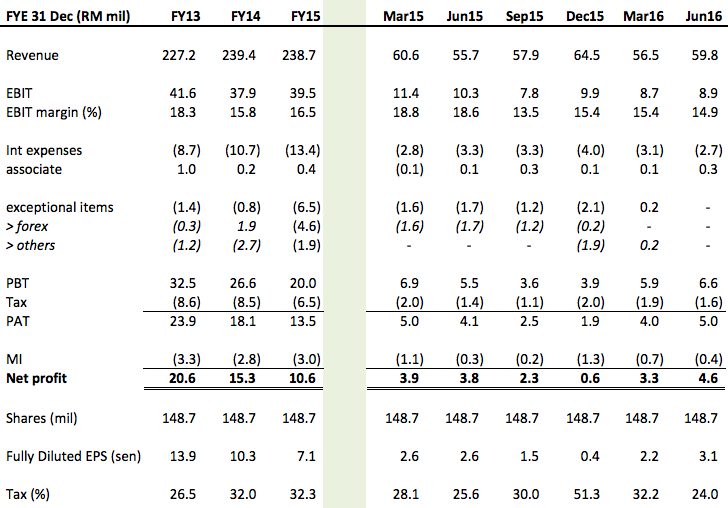

Key observations :-

(a) FY2015 was a difficult year as forex losses and impairment of receivables caused earnings to drop by closed to 33% from RM15.3 mil to RM10.6 mil.

(b) However, if the exceptional items are removed, the group's performance was actually quite stable and resilient, with EBIT of approximately RM40 mil per annum over past three years.

(c) With the absence of exceptional items, the group's latest profitability almost returned to its 2013 level of approximately RM20 mil per annum (if RM4.6 mil is annualised).

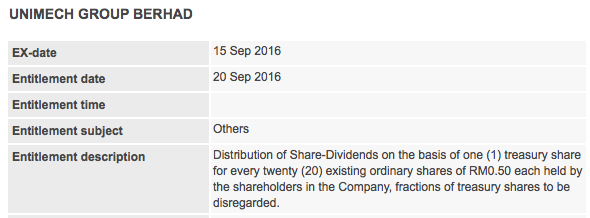

4. Distribution of Treasury Shares

Unimech has been consistently buying back shares. On 1 September 2016, the company announced that it will be distributing the treasury shares to shareholders on the basis of 1 share for every 20 shares held. Based on latest price of RM1.12, that amounts to distribution of 5.6 sen (dividend yield of 5%).

The distribution will go ex on 15 September 2016.

5. Evil Delicious Warrants

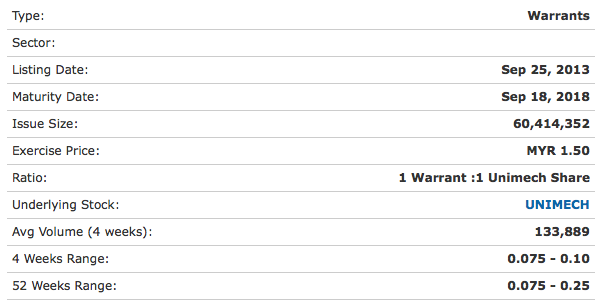

Unimech's Warrants is currently trading at 9 sen. Its exercise price is RM1.50. Expiring in September 2018 (two more years to go).

6. Concluding Remarks

(a) I first noticed Unimech back in February 2016. I like their business. I wrote an article but decided to withhold from publishing as the group's profitability was still weak.

(b) The stock used to trade as high as RM1.75 back in 2013. It retraced to approxmiately RM1.10 recently.

At current price, the stock is not really significantly undervalued (prospective PER of 9 times).

However, the Warrants did look interesting. When I first looked at it in early 2016, it was trading at approximately 13 sen. With two more years to go, I felt that there is a reasonable chance of making money (I am very comfortable with their business in the first place).

During a period of 6 months, I consistently bought the Warrants from 13 sen all the way down to 9 sen. My average cost now is approximately 11 sen.

(c) One recent positive development is the recovery of Indonesian economy. Indonesia is one of the most important markets for Unimech, accounted for closed to 25% of its revenue.

It is widely expected that Indonesia's economy will further strengthen in 2H of 2016. I hope that will spill over to benefit Unimech.

UNIMECH (7091) - (Icon) Unimech - An Interesting Indonesian Recovery Play

http://klse.i3investor.com/blogs/icon8888/90696.jsp