TECGUAN (7439) - Why Tecguan (RM1.87)? Significant improvement in profit after tax and revenue (palm oil company)

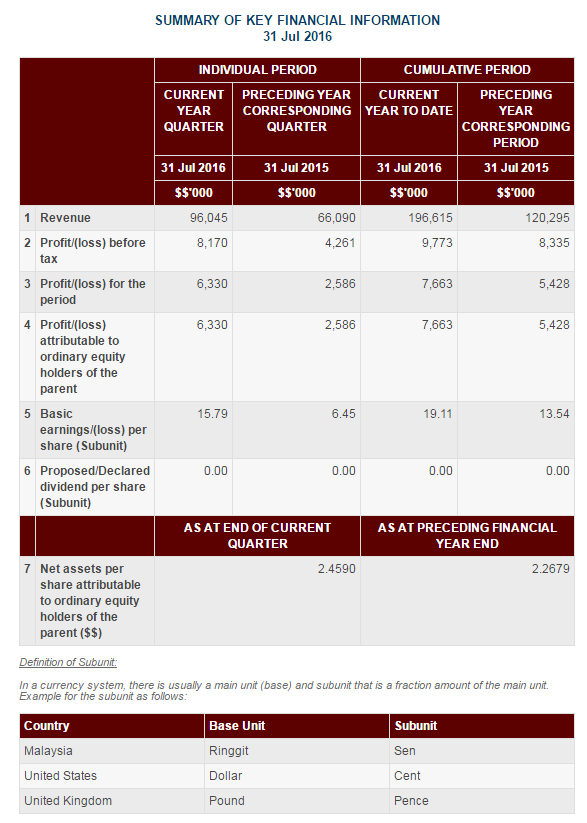

Latest quarter result:

31/7/2016 - 15.79sen

30/4/2016 - 3.32sen

31/1/2015 - 0.04sen

31/10/2015 - 5.59sen

Total - 24.74sen

Current PE ratio : 7.56 (RM1.87)

Net assets: RM2.4590

Company background

Tech Guan is a Malaysia-based diversified multinational founded by the late Datuk Seri Panglima Hong Teck Guan in 1935. The company is principally an investment holding company with its subsidiary companies involved in the integrated and synergistic cocoa operations beside oil palm cultivation.

The company's business involved

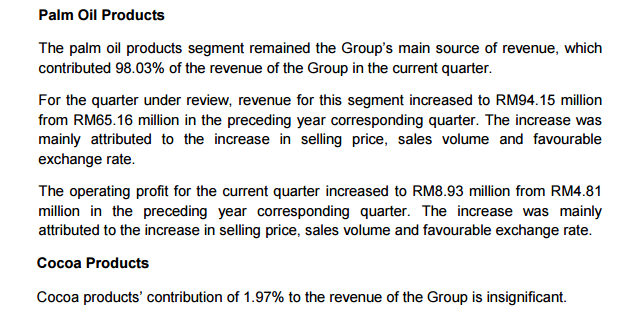

1) Oil palm products (98% of total revenue)

2) Cocoa products (2% of total revenue)

According to annual report 2016, all planted areas under palm oil segment of the Group have attained maturity, with average crop age of 14 years.

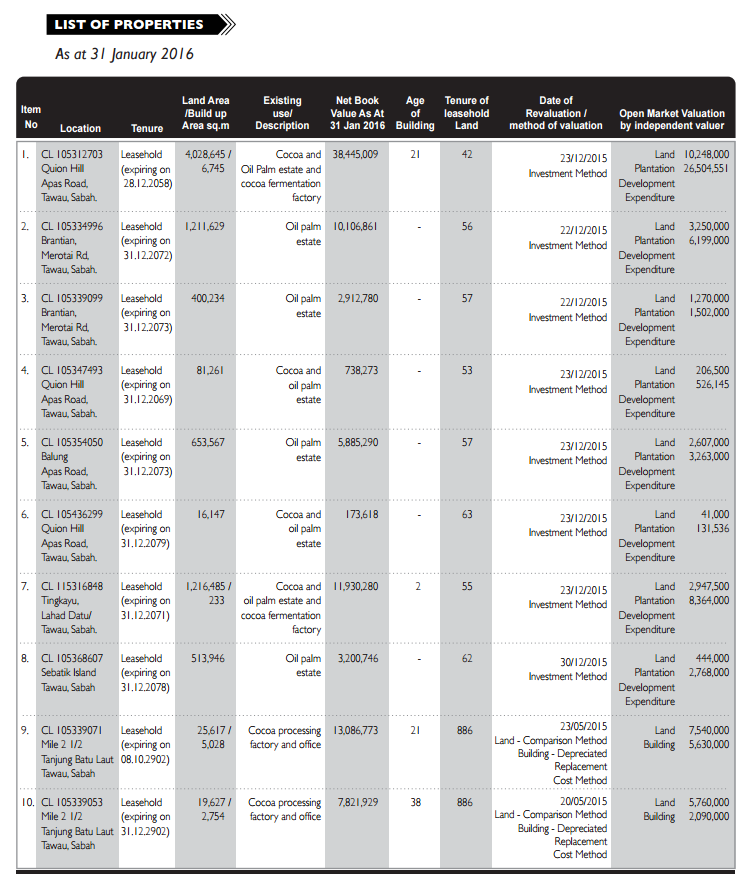

The company have more than 2,000 arces of palm oil and cocoa estate plantation in Tawau, Sabah.

I am here to ANSWER a simple question.

Why TECGUAN?

1) Significant improvement in revenue and

profit after taxation for the quarter ended

31 Jul 2016

2) Improvement in balance sheet

3) Crude palm oil's price increase compare

to prior year

4) Others

profit after taxation for the quarter ended

31 Jul 2016

As per quarter report released on 23 Jun 2016, the company's revenue have significantly improved from 66mil to 96mil (45% increased from last year) and profit also jumped by 245%

As per explanation, the increased was due to increase in selling price, sales volume and favourable exchange rate.

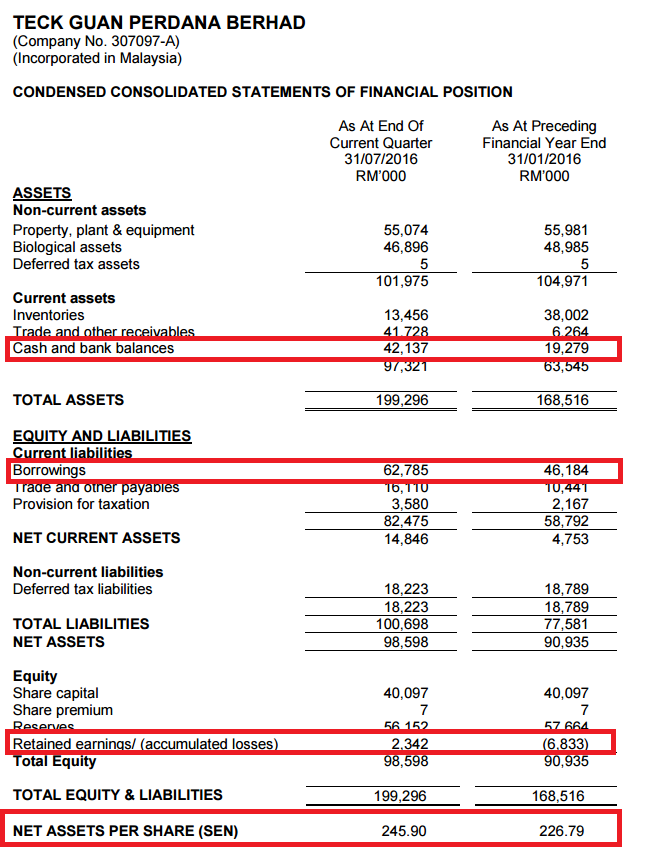

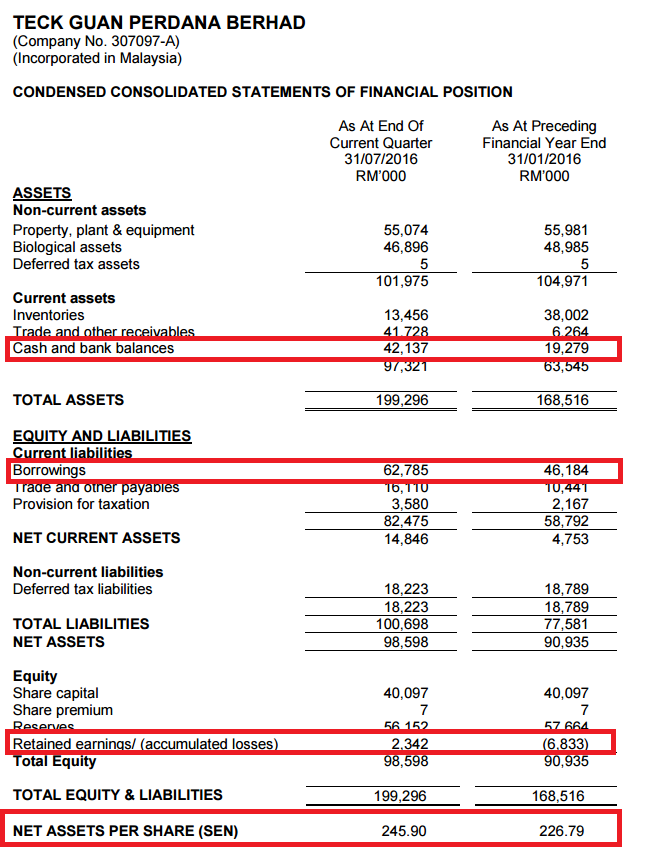

2) Improvement in balance sheet

From the balance sheet as per 31 July 2016, we have noticed that the net debt position have been improved from RM26,905mil to RM20,648.

Net assets position improved from RM2.2679 per share to RM2.4590 per share.

Also, for the first time in many years, the company's finally having retained earnings.

As the company have no declared any dividend since 2007, maybe it is time for them to start rewarding their shareholder again?

3) Crude palm oil's price increase compare

to prior year

Information extracted from: http://www.mpoc.org.my/dailypalmoilprices.aspx?catID=b4ad7d4e-d7d0-410b-be86-9a80af0f4693&print=&ddlID=28abbe06-f695-4fd0-8bde-85d8a2ee9ccd

| Date | CPO price (RM) | Date | CPO price (RM) |

|---|---|---|---|

| 1/8/2015 | - | 1/8/2016 | 2,327 |

| 2/8/2015 | - | 2/8/2016 | 2,338 |

| 3/8/2015 | 2,054 | 3/8/2016 | 2,415 |

| 4/8/2015 | 2,062 | 4/8/2016 | 2,444 |

| 5/8/2015 | 2,037 | 5/8/2016 | 2,407 |

| 6/8/2015 | 2,045 | 6/8/2016 | - |

| 7/8/2015 | 2,042 | 7/8/2016 | - |

| 8/8/2015 | - | 8/8/2016 | 2,439 |

| 9/8/2015 | - | 9/8/2016 | 2,466 |

| 10/8/2015 | 2,029 | 10/8/2016 | 2,500 |

| 11/8/2015 | 2,040 | 11/8/2016 | 2,484 |

| 12/8/2015 | 1,995 | 12/8/2016 | 2,525 |

| 13/8/2015 | 2,014 | 13/8/2016 | - |

| 14/8/2015 | 2,027 | 14/8/2016 | - |

| 15/8/2015 | - | 15/8/2016 | 2,622 |

| 16/8/2015 | - | 16/8/2016 | 2,539 |

| 17/8/2015 | 2,044 | 17/8/2016 | 2,643 |

| 18/8/2015 | 2,060 | 18/8/2016 | 2,576 |

| 19/8/2015 | 2,035 | 19/8/2016 | 2,578 |

| 20/8/2015 | 1,997 | 20/8/2016 | - |

| 21/8/2015 | 1,986 | 21/8/2016 | - |

| 22/8/2015 | - | 22/8/2016 | 2,543 |

| 23/8/2015 | - | 23/8/2016 | 2,578 |

| 24/8/2015 | 1,916 | 24/8/2016 | 2,600 |

| 25/8/2015 | 1,906 | 25/8/2016 | 2,561 |

| 26/8/2015 | 1,867 | 26/8/2016 | 2,552 |

| 27/8/2015 | 1,925 | 27/8/2016 | - |

| 28/8/2015 | 1,991 | 28/8/2016 | - |

| 29/8/2015 | - | 29/8/2016 | 2,517 |

| 30/8/2015 | - | 30/8/2016 | 2,526 |

| 1//9/2015 | 2,013 | 1/9/2016 | 2,520 |

| 2/9/2015 | 1,989 | 2/9/2016 | 2,595 |

| 3/9/2015 | 2,032 | 3/9/2016 | - |

| 4/9/2015 | 2,031 | 4/9/2016 | - |

| 5/9/2015 | - | 5/9/2016 | 2,644 |

| 6/9/2015 | - | 6/9/2016 | 2,629 |

| 7/9/2015 | 2,048 | 7/9/2016 | 2,598 |

| 8/9/2015 | 2,092 | 8/9/2016 | 2,609 |

| 9/9/2015 | 2,113 | 9/9/2016 | 2,640 |

| 10/9/2015 | 2,157 | 10/9/2016 | - |

| 11/9/2015 | 2,134 | 11/9/2016 | - |

| 12/9/2015 | - | 12/9/2016 | - |

| 13/9/2015 | - | 13/9/2016 | 2,592 |

| 14/9/2015 | 2,192 | 14/9/2016 | 2,564 |

| 15/9/2015 | 2,148 | 15/9/2016 | 2,594 |

| 16/9/2015 | - | 16/9/2016 | - |

| 17/9/2015 | 2,128 | 17/9/2016 | - |

| 18/9/2015 | 2,103 | 18/9/2016 | - |

| 19/9/2015 | - | 19/9/2016 | 2,642 |

| 20/9/2015 | - | 20/9/2016 | 2,693 |

| 21/9/2015 | 2,151 | 21/9/2016 | 2,677 |

| 22/9/2015 | 2,183 | 22/9/2016 | 2,725 |

| 23/9/2015 | - | 23/9/2016 | 2,676 |

| 24/9/2015 | - | 24/9/2016 | - |

| 25/9/2015 | 2,342 | 25/9/2016 | - |

| 26/9/2015 | - | 26/9/2016 | 2,715 |

| 27/9/2015 | - | 27/9/2016 | 2,663 |

| 28/9/2015 | 2,394 | 28/9/2016 | 2,605 |

| 29/9/2015 | 2,451 | 29/9/2016 | 2,616 |

| 30/9/2015 | 2,375 | 30/9/2016 | - |

| 1/10/2015 | 2,414 | 1/10/2016 | - |

| 2/10/2015 | 2,387 | 2/10/2016 | - |

| 3/10/2015 | - | 3/10/2016 | 2,636 |

| 4/10/2015 | - | 4/10/2016 | 2,600 |

| 5/10/2015 | 2,415 | 5/10/2016 | 2,556 |

| 6/10/2015 | 2,372 | 6/10/2016 | 2,579 |

| 7/10/2015 | 2,319 | 7/10/2016 | ? |

| 8/10/2015 | 2,276 | 8/10/2016 | ? |

| 9/10/2015 | 2,217 | 9/10/2016 | ? |

| 10/10/2015 | - | 10/10/2016 | ? |

| 11/10/2015 | - | 11/10/2016 | ? |

| 12/10/2015 | 2,257 | 12/10/2016 | ? |

| 13/10/2015 | 2,320 | 13/10/2016 | ? |

| 14/10/2015 | - | 14/10/2016 | ? |

| 15/10/2015 | 2,287 | 15/10/2016 | ? |

| 16/10/2015 | 2,302 | 16/10/2016 | ? |

| 17/10/2015 | - | 17/10/2016 | ? |

| 18/10/2015 | - | 18/10/2016 | ? |

| 19/10/2015 | 2,274 | 19/10/2016 | ? |

| 20/10/2015 | 2,319 | 20/10/2016 | ? |

| 21/10/2015 | 2,367 | 21/10/2016 | ? |

| 22/10/2015 | 2,371 | 22/10/2016 | ? |

| 23/10/2015 | 2,328 | 23/10/2016 | ? |

| 24/10/2015 | - | 24/10/2016 | ? |

| 25/10/2015 | - | 25/10/2016 | ? |

| 26/10/2015 | 2,279 | 26/10/2016 | ? |

| 27/10/2015 | 2,322 | 27/10/2016 | ? |

| 28/10/2015 | 2,341 | 28/10/2016 | ? |

| 29/10/2015 | 2,370 | 29/10/2016 | ? |

| 30/10/2015 | 2,363 | 30/10/2016 | ? |

| 31/10/2015 | - | 31/10/2016 | ? |

| Total (RM) | RM130,048 | Total (RM) | RM115,548 |

| Total days | 60 days | Total days | 45 days |

| Average price (RM) | RM2,167 | Average price (RM) | RM2,568 |

Total increase in average price = RM401

Percentage increase in average price = 18.50%

As per calculation above, the average CPO (crude palm oil) price have been increased by 18.5% (updated until 6 October 2016). With a higher average CPO price, I foresee that the revenue and profit will increased on the next quarter as the total increased in average price will be fully recorded as profit if the cost of sales remain the same.

4) Others

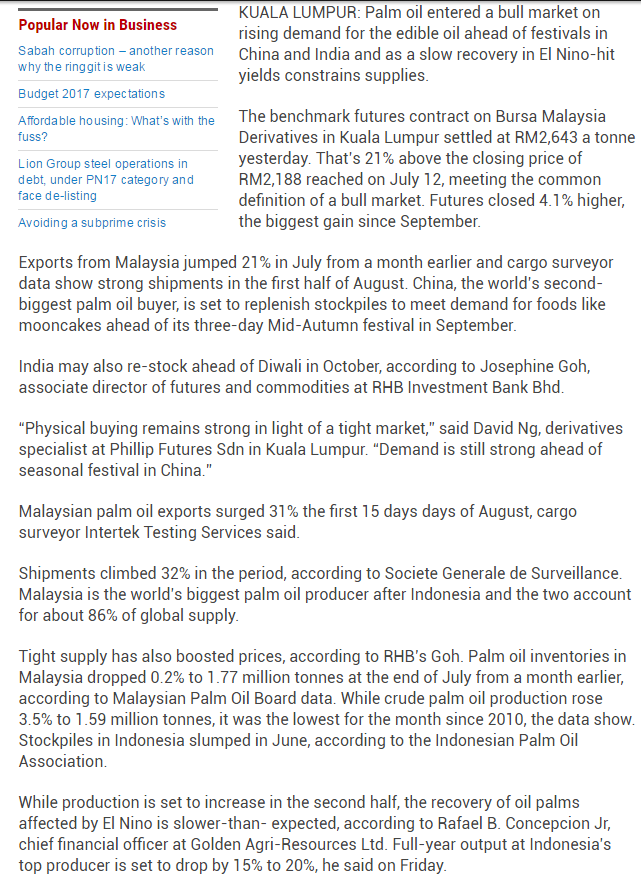

http://www.thestar.com.my/business/business-news/2016/08/18/palm-oil-enters-bull-market-as-demand-rises/

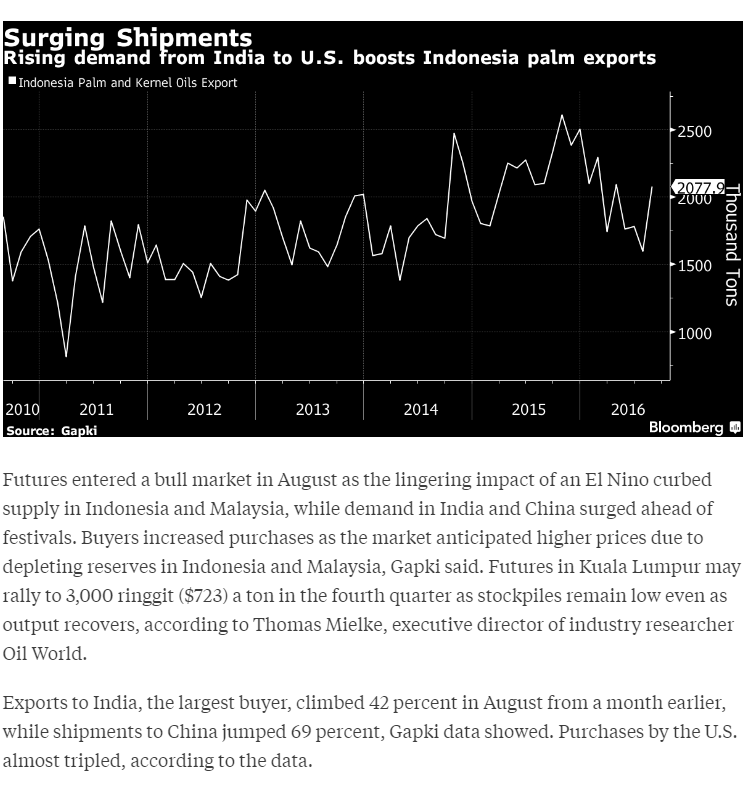

http://www.bloomberg.com/news/articles/2016-10-06/indonesian-palm-reserves-drop-as-exports-jump-most-in-22-months

Thank you for your time. Trade at your own risk!!! Do research before any investment decision!! Happy trading :-)

TECGUAN (7439) - Why Tecguan (RM1.87)? Significant improvement in profit after tax and revenue (palm oil company)

http://klse.i3investor.com/blogs/undervalue/106022.jsp