Stock Valuation 股票“估”价之SKL on KULIM, HEXZA, and PBA

Intro

时间,人物,地点(=事件)每天都在变。思想会在某个时间点,或某个地点,或面对某些人物因而有所改变。Everything changes and nothing stand still. As quoted by Plato in Cratylus, “change is the only constant.”

Stock prices change every day (except Saturday, Sunday, and public holidays). 股价上下是股市里不变的常态。在这样的前提下,要如何去理解,掌握及预测一直在变的“东西”。

选股,买股,卖股和股票管理:冷眼前辈有一套,I3investor里也有几套值得参考的方法。客观的,需要“深入”; 主观的则要“浅出”。SKL(仙家Lin)的, 每天都有。平时工作忙碌,大部分时间都在做股票分析,思考,及买卖,没闲情花时间去写文章。今天心血来潮,也来SKL一下。

Firstly, disclaimer 免责声明:写此文章之目的主要是“自己写,自己爽”,无它。当然,如果看了此文章而有点“爽”或有高见,谢click “like” 一下,或留言。买卖决定之后果,自负。

Ok, 废话…能免则免,尽量只说重点。

On 3298 HEXZA

之前写过了,有兴趣按这边 HEXZA: My Selected Viewpoints Retraced.

还有糊涂兄的文章,小弟拍桌叫好![转贴] Hexza Q4'15 成绩单 - 糊涂

看了最新的年报,同时回顾过去十年的年报,小弟的结论是:

Stock: [HEXZA]: HEXZA CORPORATION BHD

Nov 4, 2015 12:08 PM | Report Abuse

“some small fish grew, some small fish gone, some small fish still there;

some big fish grew bigger, some new big fish coming in, and more small fish gone.

Yes, it needs time to grow. I think not too long. Perhaps in one year will see significant changes.

Some say they wish to see crocodile to come to join the party. Coming soon!”

On PBA

Stock: [PBA]: PBA HOLDINGS BHD

Nov 20, 2013 05:21 PM | Report Abuse

“should be, just a matter of timing. have been holding since 2008. so long as PBA is making profit and giving dividends twice a year, i find no reason to dispose it. waiting for special dividend, don't mind to wait for another 5 years. yes, you might say how many ten years do we have. haha, I'm thinking if I can't enjoy it, just give it to my children. if i don't get capital appreciation (which i don't believe it won't appreciate), at least i got peace of mind.”

Stock: [PBA]: PBA HOLDINGS BHD

Apr 20, 2014 11:43 PM | Report Abuse

“up, up, up! None of my biz. I wouldn't sell mine, at least for the next 5-10 years. Perhaps it's a good idea to leave it to my love one, hahaha! What if it dropped. Lagi bagus! You should know what I mean and I didn't mean to hurt if you're thinking to sell yours. Just wish you get yours at your desired conditions.”

Stock: [PBA]: PBA HOLDINGS BHD

Nov 4, 2015 11:42 PM | Report Abuse

To my knowledge, Sifu and his members have been there since n years ago. Last year high 1.6+ also didn't sell. I believe they might have bought more before and/or after the release of last quarter financial results. You and me know this is a solid counter, they know even better than us. What say you? What next?

On 2003 KULIM:重点回顾

1st wrote on Mar 2, 2015 02:25 AM

KULIM's share price closed 3.28 on 27-02-2015: Buy or sell?

To buy: If share price is expected to go up. Why go up?

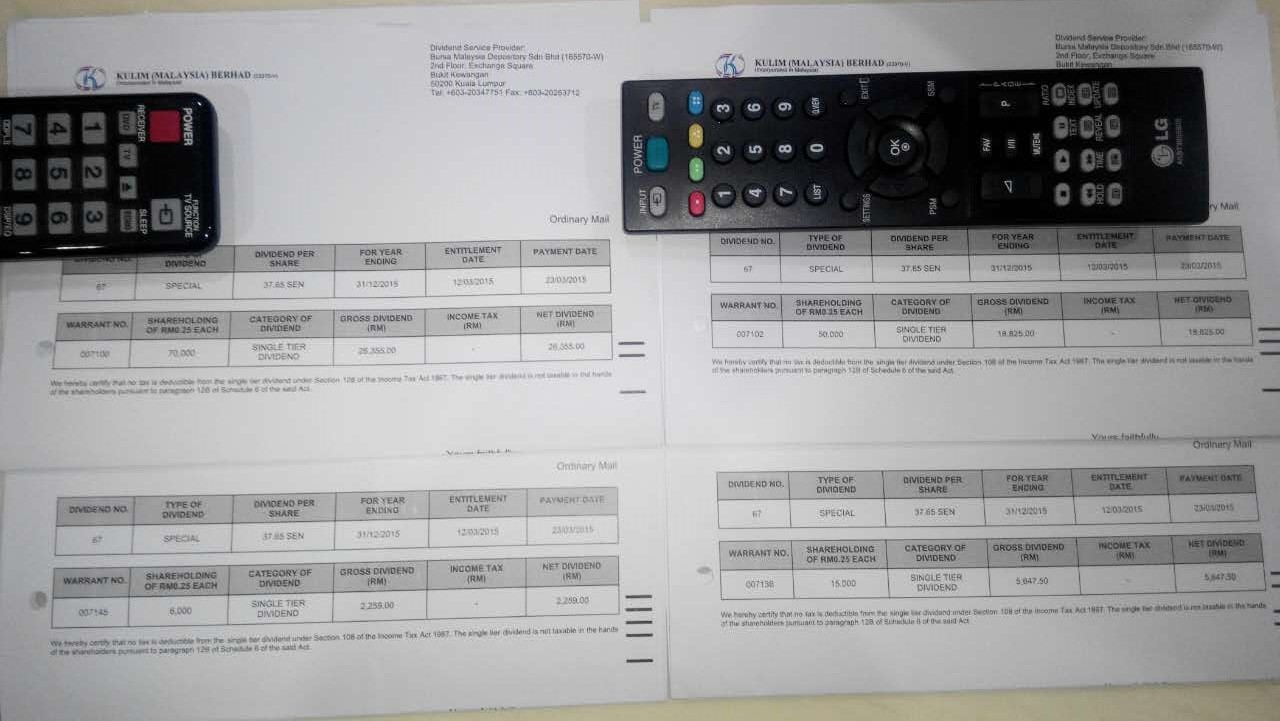

1. Special dividend of RM0.3765 per ordinary share, from the disposal of 73,482,619 ordinary shares in New Britain Palm Oil Limited (“NBPOL”), for a disposal consideration of approximately GBP525.40 million, ex on 10/03/2015 and to be paid on 23/03/2015.

2. And there will be another special dividend of about the same amount as above to be paid next year.

3. Kulim expects to realise a gain on disposal of approximately RM1.56 billion. Expect next quarter financial results will be very good!

4. On 26 February 2015, the company announced that that the Disposal was completed on

even date, following the receipt of the Disposal Consideration from Sime Darby

Plantation. CASH GBP525.40 million @ RM 5.5 - 5.6 per Pound or about RM 3 billion!

5. (EATECH, 5259) market cap and its forthcoming 1 cents per share dividend.

6. 13,656 (51, 160) hectares land banks in Johor which valued mostly dated back in 1997-98.

7. Johor Corporation and its related parties portions of warrants already converted into mother shares. RM 150 million cash.

8. ...The share price is expected to go up some more on and/or before the ex-date, then adjust for the dividend, then go up some more in end of May to reflect the profit from the sale of NBPOL, then...then...then...

To sell: If share price is expected to go down. Why go down? ...To be continued...

Good luck to the shareholders of KULIM!

Then on Mar 23, 2015, I received the following:

Then on 8 Apr 2015, 02:24pm, please click KULIM: Selling by KWAP, The Reason Why Its share price Dropped

Then on Apr 13, 2015 03:07 PM | Report Abuse

Why? I bought 3, 3.05, 3.1, 3.2, 3.3 and highest 3.35 b4 ex. then 2.80, 2.7, 2.65 and now waiting for 2.60. Getting more and more attractive! Don't you think so? Why feel so........ I think it's a good opportunity to accumulate more when the price become cheaper. I believe the price is going to rebound soon. Hopefully before the release of next quarter result. See whether I'm right.

On 5/11/2015, Johor Corp intends to take Kulim private at RM4.10 per share.

The official statement, here and the offer document here.

Then RHB Research has issued a report the following day, pls click Kulim Malaysia - Privatisation Offer Of MYR4.10

Ok, as a minority shareholder, what next?

Basic Info for decision-making:

Share price on 6/11/2015: 3.86 - 3.93, closed @ 3.87, + 0.57 with trading volume: 7,736,700

The privatisation. Kulim Malaysia’s (Kulim) controlling shareholder Johor Corp, which holds a 61.87% stake, has informed the company of its intention to privatise it. Entitled shareholders are expected to receive an estimated capital repayment of MYR2.2bn in cash or MYR4.10/Kulim share. Entitled shareholders are basically any shareholder other than Johor Corp or its affiliated companies. Entitled shareholders need to accept the offer by 20 Nov. (Note: The Board of KULIM)

Subject to conditions. The privatisation is subject to the typical conditions such as: i) 50% approval from entitled shareholders at its EGM with 75% in value, ii) must not be voted against by >10% of entitled shareholders, and iii) other regulatory approvals.

Likelihood of success. We believe the privatisation attempt is likely to be successful given the generous price offered, which is 24% above its last closing price. The offer price has also taken into consideration the promised special dividend amounting to an estimated 37 sen from the sale of New Britain Palm Oil Ltd (NBPOL). That said, Kulim has around 16% institutional shareholding, which collectively could block the privatisation exercise.

(Source: RHB Research)

Options:

a) Buy more, as there are some upside potential to RM 4.10, or perhaps higher with revised offer.

b) Sell at market at the price 3.8x or 3.9x. Forget the offer, the money is now in your pocket.

c) Wait and see

d) None of the above.

好像写了很多“废话”。Ok, 回到去最基本的问题:KULIM到底值多少钱?JCorp讲RM4.10, 但我认为应该要重估了它的地库后才出价会比较公平。接下来董事局会接受offer吗? “独立” 投资银行会给予怎样的建议?EGM会通过吗?

最后,在KULIM要被私有化的这个游戏里,what do you think? 是“肉在砧板上”还是“禾草盖珍珠”?

8/11/2015, 11.30PM, 此时此刻,我想比较关键的思考应该是在于此offer成与否的后果。What say you?

Just for sharing.

By Bugle

i3investor.com