冷眼心水股

堡發資源(POHUAT,7088,主板消費股)

-業務管理很好,財務情況很好,股息不錯,越南廠也不錯。

http://klse.i3investor.com/blogs/the_cold_eyed/108100.jsp

冷眼推荐股 : POHUAT

Fair value: RM2.02

POHUAT主要涉及制造及销售木质傢俬,以“AT办公室系统”及“AT家居系统”的品牌推出其办公室家私及家居家私。

POHUAT目前在越南拥有两座厂房,分别座落在Binh Duong和Dong Nai,目前已70%至80%的产能来运作。越南业务的客户包括 Standard 家具、Ashley家具工业和Pulaski家具。

POHUAT这支股可说是很多投资者心中的痛,主要因为今年初其股价因美元快速走低而从顶峰暴跌,而且其业绩也开始走低。

然而,POHUAT的业绩在第二季触底(387万令吉)后,目前已经开始回弹至999万令吉。

在公司最新的季报里头,该公司有解释自该公司推出新款办公司家具后,其需求开始回升。此外,北美的需求也增加,而且预料在美国经济改善下,需求将会持续走高。

以目前的情况来看,虽然业绩要超越2015年财政年已经没有可能,但未来在其业绩逐步改善下,股价将有望逐步走高。

个人预测,POHUAT来临的业绩里其每股净利将会恢复到每股6仙,而家具业领域的整体本益比大约在8倍左右。如果真如我所料,那么其合理价将有望重估至RM2.02。

http://bblifediary.blogspot.my/2016/11/pohuat.html

(Icon) Poh Huat (6) - Time To Huat ?

Now

that we are on the verge of another round of export play, I would like

to once again kick start the new cycle by introducing Poh Huat.

As

I have written about Poh Huat before, I will not go into details

regarding its operations and basic financials. For those readers who are

not familiar with this group, kindly refer to the abovementioned old

articles.

Poh Huat's financial year end is October. Its next quarter result will be announced by end December 2016. In this article, I will focus on its earnings and discuss what to expect for the coming quarter result.

2. Earnings Discussion

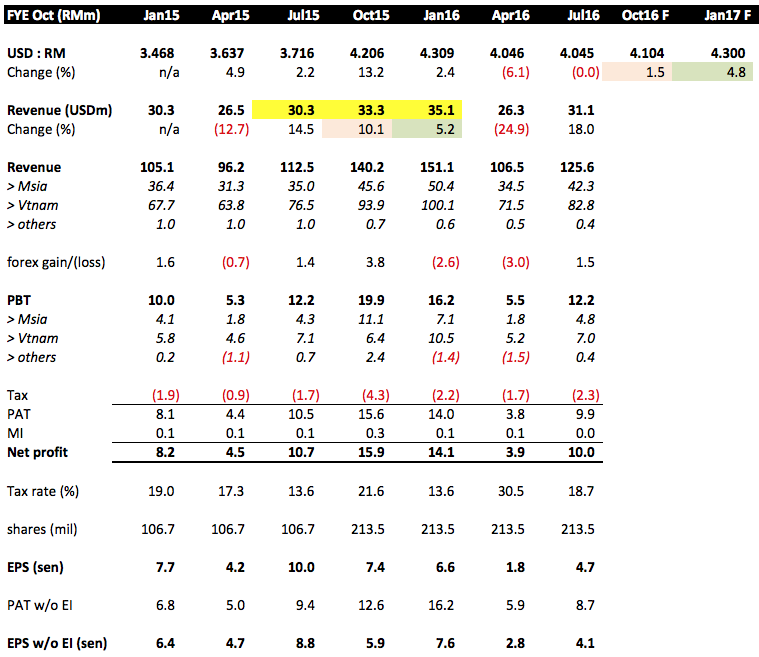

The following is Poh Huat's historical P&L for the past few quarters :-

Key points :-

(a)

Poh Huat's operation is slightly seasonal. The April quarter is

traditionally the weakest. July quarter is higher, but the strongest

quarters are October (the coming quarter) and January. These two

quarters are strong due to demand by customers to meet holiday season

demand.

(b)

In the latest July quarter, the group reported EPS (without exceptional

items) of 4.1 sen. That was based on average exchange rate of 4.045.

The coming quarter result has the potential to be better due to the following factors :-

> Higher revenue In FY2015, October quarter's revenue in USD terms, was 10.1% higher than that of July quarter; and

> Higher USD exchange rate October quarter average USD was 1.5% higher than that of July quarter.

The net effect is that revenue in Ringgit terms could be approximately 11% higher (being 1.101 x 1.015) than that of July.

Based

on assumption that net profit increases proportionately, we could be

looking at core EPS of 4.6 sen for the coming October quarter.

(c) By applying the same method, let us try to work out something for the January 2017 quarter.

In FY2015, January quarter's revenue in USD terms, was 5.2% higher than that of October quarter.

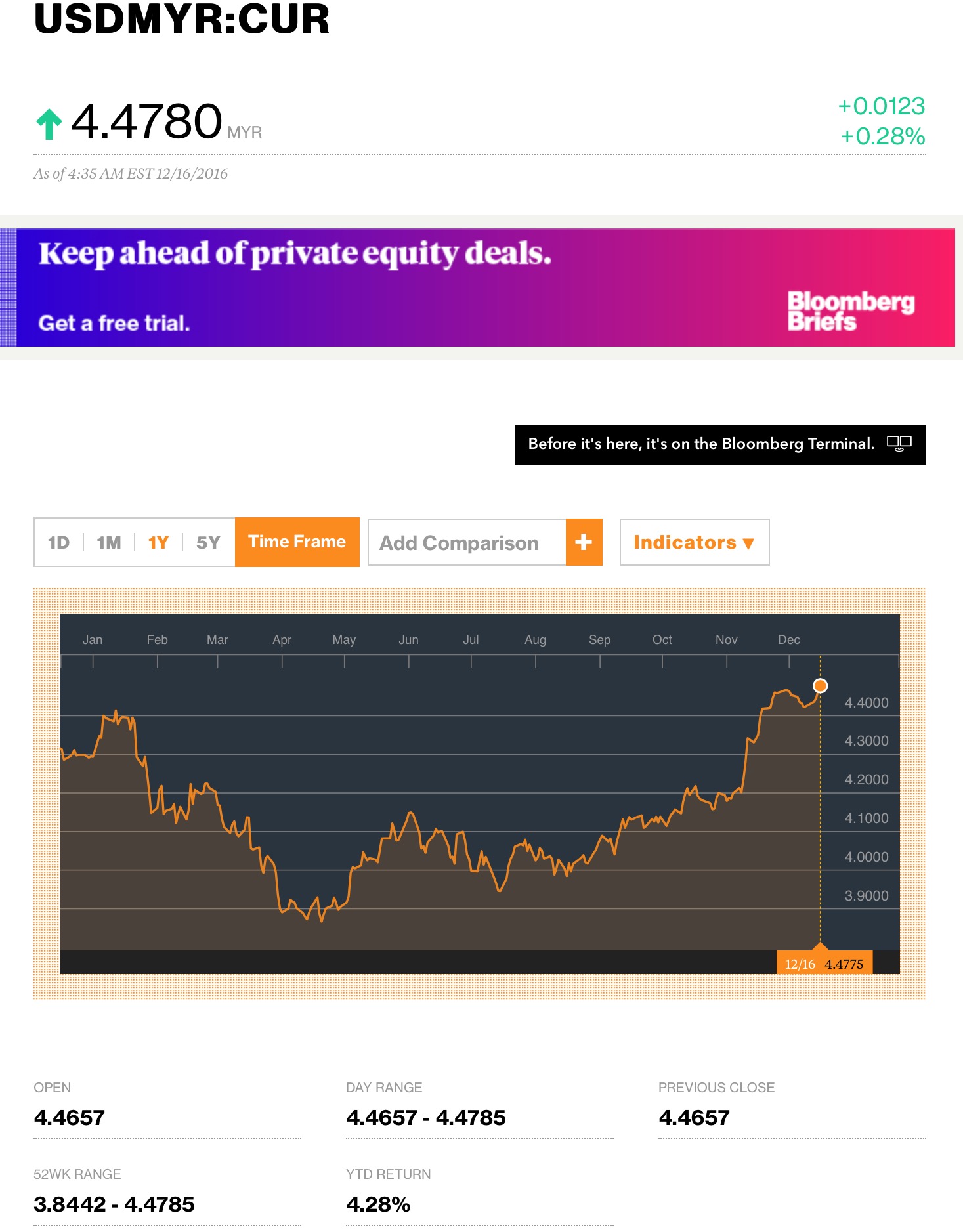

The

average exchange rate for January 2017 quarter (comprises November

2016, December 2016 and January 2017) is still not available. As at

to-date, USD : RM is 4.40 while the average exchange rate for the first

18 days of November 2016 was 4.269. For discussion sake, let's just

assume that average exchange rate for January 2017 quarter is 4.30 (I

believe this is not an aggressive assumption). That will be

approximately 4.8% higher than that of October 2016 quarter.

Based on the above, revenue in Ringgit terms shall be 10.2% higher (being 1.052 x 1.048).

Based

on assumption that net profit increases proportionately, we could be

looking at core EPS of 5.1 sen for the coming January 2017 quarter.

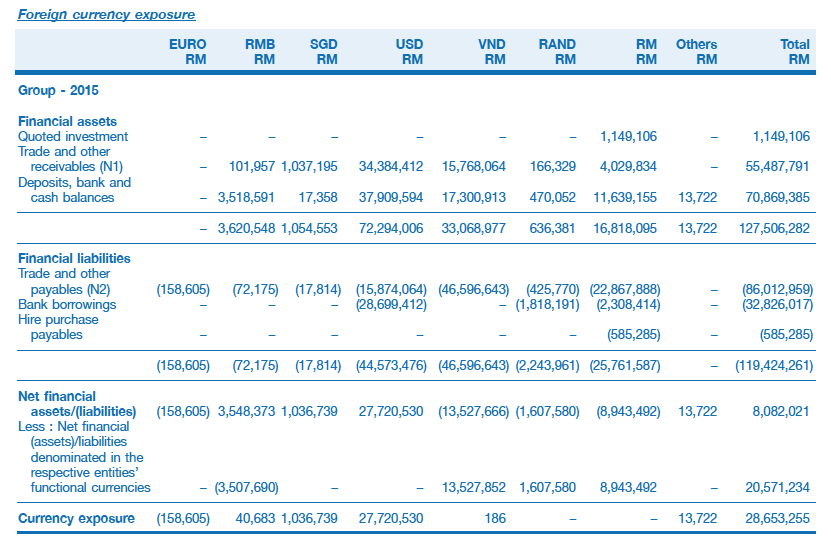

(d) Poh Huat traditionally has more USD assets than USD liabilities. Accordingly, it shall register forex gain whenever USD strengthens.

I

am not able to obtain the latest figures as quarterly reports do not

disclose such information. For discussion purpose, let's just take

FY2015 annual report as example. The net amount was RM27.7 mil.

On

30 July 2016, USD : RM was 4.022. On 30 October 2016, it has increased

by 4.3% to 4.195. If Poh Huat's USD assets was indeed higher than USD

liabilities, it should report forex gain in the coming October 2016

quarter. For illustration purpose, a surplus USD assets of RM27.7 mil

shall result in forex gain of RM1.2 mil.

As we expect USD to be even stronger by end January 2017, the same thing should happen to January 2017 quarter also.

If

there are indeed forex gains, the coming two quarters' EPS will be

further boosted. Even though investors nowadays are quite discerning,

based on my 2015 experience, it will still lead to feel good effect that

have positive impact on share price.

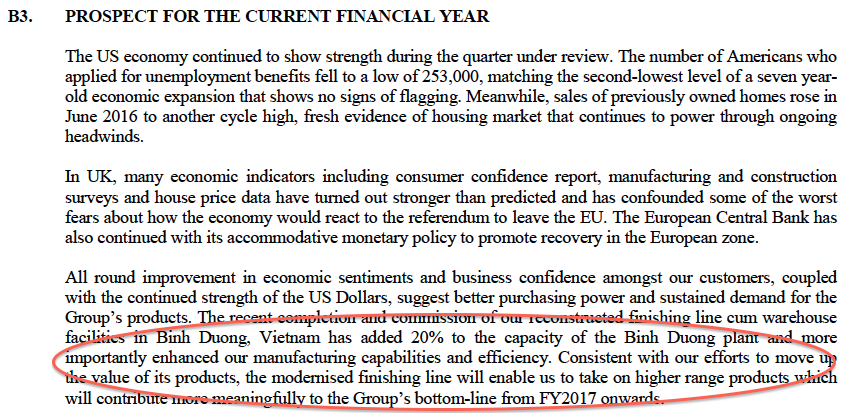

3. Capacity Expansion and Improvement In Efficiency

I picked up the following from the company's July 2016 quarterly report :-

4. Concluding Remarks

My

analysis shows that Poh Huat is entering seasonally strong quarters

soon. Based on previous experience, Poh Huat's management are quite

competent and they usually will be able to avoid negative surprises such

as bad debts, inventories write off, etc (a fire happened in 2015, but I

think that is a different story altogether). The only exceptional item

is usually forex related, which in this case should be favorable due to

stregthening of USD.

Having

said so, I would like to point out that since I don't have insider

information, there is no assurance that the coming quarters' results

will be as good as predicted. If things do not work out as expected,

please don't blame me. Your money, your risk, your reward.

http://klse.i3investor.com/blogs/icon8888/109246.jsp

Ringgit at 4.48 against US dollar