MALAKOF (5264) - Malakoff Corporation – Powering Up The Region - Joey Ho

Joey Ho December 29, 2016

Cities across the world celebrated the year end festive season last week, with Christmas decorations lighting up streets and malls. During these celebrations, people admire the gorgeous displays, with little thought of what goes into powering them up. Imagine Christmas without electricity, not only will street decorations be without light, there will hardly be any festive mood in town.

Malakoff Corporation (Malakoff), an independent power producer (IPP) listed on the Main Board of Bursa Malaysia, is one of the companies which brighten up the festive season and every day of the year.

The Business

Incorporated in 1975, Malakoff started off as a plantation-based company, before a shift in the group’s corporate direction in 1993 led to the disposal of its plantation-based assets and the subsequent venture into the power sector.

The group was subsequently delisted in July 2007, after MMC Corporation’s wholly owned subsidiary, Nucleus Avenue, acquired Malakoff for RM9.3 billion. In 2015, Malakoff re-listed at RM1.80 per share, in one of Malaysia’s largest initial public offerings of the year, valuing the company at RM9 billion.

Currently, Malakoff boasts of an effective capacity of 6,346 megawatts comprising of seven power plants operating on oil, coal and gas. The group is also an international independent water and power producer with overseas projects located in Bahrain, Saudi Arabia, Algeria, Australia and Oman. The overseas projects have a net power production capacity of 690 megawatts and a water desalination capacity of 444,800 cubic metres per day.

Financial Performance

Malakoff’s main revenue comes from the asset management division which is responsible for managing assets to achieve the greatest return and the process of monitoring and maintaining facilities systems.

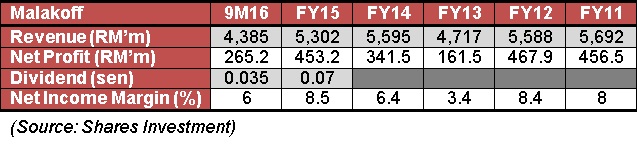

In

FY15, Malakoff reported lower revenue of RM5.3 billion due to scheduled

outages of certain power plants as part of their maintenance cycles, as

well as lower distillate firing. However, the group managed to achieve a

higher net profit of RM453.2 million, boosted by lower finance costs

and higher interest income.

In

FY15, Malakoff reported lower revenue of RM5.3 billion due to scheduled

outages of certain power plants as part of their maintenance cycles, as

well as lower distillate firing. However, the group managed to achieve a

higher net profit of RM453.2 million, boosted by lower finance costs

and higher interest income.While the group’s 9M16 revenue of RM4.4 billion looks set to exceed that of FY15, the bottom line, however, does not look too promising at RM265.2 million, making up just 58.5 percent of FY15 net profit.

Apart from the overall performance, Malakoff maintains a strong balance sheet position with a current ratio of 2.5 times as of 9M16, with cash and equivalents of RM2.1 billion making up 30.1 percent of the group’s total current assets.

Capacity Expansion Plans

In April 2016, Malakoff allocated RM900 million to fund the expansion of its power generation and water production capacity. The group’s expansion plan, which is expected to involve setting up new plants, acquiring other existing plants as well as expanding overseas, is targeted at increasing its power generation to 10,000 megawatts and water production to 677,200 cubic metres per day by 2020.

According to the Asian Development Bank, energy demand is projected to almost double in the Asia and Pacific region 2030. The organization estimates that the majority of the world’s energy poor are living in Asia-Pacific region, with over 700 million people without access to electricity and almost two billion people still burning wood, dung, and crop waste for energy.

The abovementioned indicates the growing demand for energy in the region, which could potentially benefit Malakoff as the countries develop. Apart from seeking opportunities in the Asia-Pacific region, Malakoff is also has its sights on other developed markets as well as the Middle Eastern and North African regions.

Valuation

As at 27 December 2016, Malakoff’s shares closed at RM1.39, representing a year-to-date decline of 13.1 percent.

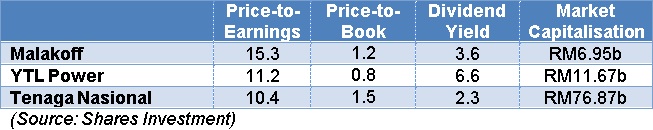

The

table shows a comparison of two other energy producers, YTL Power and

Tenaga Nasional, based on their latest full year results.

The

table shows a comparison of two other energy producers, YTL Power and

Tenaga Nasional, based on their latest full year results.Comparing price-to-earnings (P/E) ratios, Malakoff is currently trading at the highest valuation of 15.3 times P/E, while its dividend yield stands at 3.6 percent, falling behind larger rival, YTL Power. Malaysia’s state-controlled Tenaga Nasional appears to be the more attractive player in the industry, with its shares being traded at the lowest P/E of 10.4 times while still providing a dividend yield of 2.3 percent.

Given the relatively higher valuations and lack of concrete earnings potential ahead, we believe that Malakoff would need to do more to justify current valuations.

MALAKOF (5264) - Malakoff Corporation – Powering Up The Region - Joey Ho

http://aspire.sharesinv.com/38226/malakoff-corporation-powering-up-the-region/