LEESK (8079) - LEESK - The Sleeping Expertise

LEESK – The Sleeping Expertise

Company Background: LEESK is engaged in the manufacture, trading, distribution, and marketing of mattresses, bedding accessories, laminated foam, polyurethane foam, natural latex foam, and other related products in Malaysia.

Capacity: LEESK owns two manufacturing facilities (fully run) that occupy a total land area of 440,000 square feet. LEESK is one of the most extensive mattress manufacturers in South East Asia with one stop production lines including natural latex foam, polyurethane foam and various spring productions. The Group has actively acquired more property, plant and equipment to expand production capacity for 2017.

Sales & Marketing: LEESK operates a retail chain store under International Brands Gallery – IBG, that promotes Ergonomic beddings and furniture.

Export Play: More than 50% of LEESK products are exported. Hence strengthen of USD against MYR is beneficial to company’s prospect in term of profit and revenue. The foreign gain will resulted of at least RM1mil additional to the assets.

Balance Sheet: LEESK has strong balance sheet with only net debt of RM300k as at September 2016. Quick fact: In 2012 the Group is in net debt position of RM12.13mil but in a 4 years’ timeframe, the net debt has been decreased by approximately RM12mil.

4th Quarter Result: LEESK tends to enjoy good Q4 result in which you can refer to the past years because the business activities of the Group tend to have higher sales near the year end festive season.

Return on Equity: Company with ROE above 10% is categorised as growth compamy, LEESK ROE is lies at 13.7% which is high growing company.

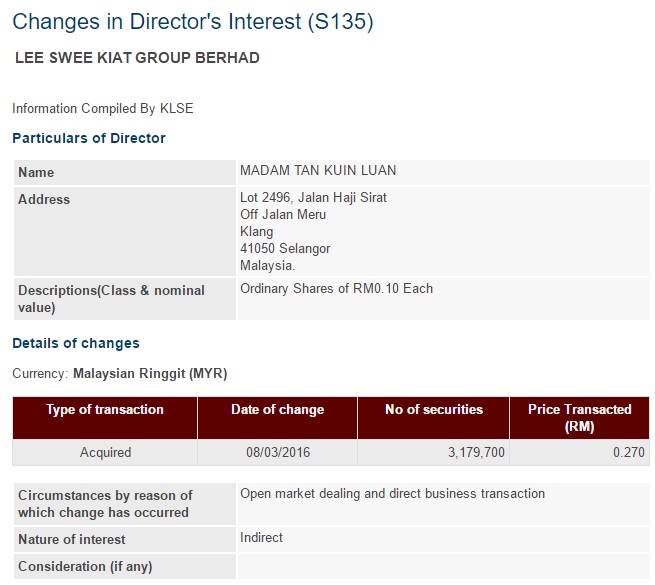

Director Share Acquisition: For the past one year in 2016, the directors have actively bulk acquired of the company shares in months of March and October with total 6.2million shares traded at RM0.28-RM0.30. Interestingly we noticed that upon director share acquisition, the shares will move up (check March and May J)

More prospects: Malaysia is set to pursue free trade agreement (FTA) negotiations with Iran (population of Iran is at 82million, 2 times more than Malaysia) by this month. FTA was a good move and would make Malaysia more competitive as it would provide a huge opportunity for Malaysian products (i.e. Furniture and Beddings) to export into Iran. So, question is who is the leading bedding and furniture in Malaysia? Quick fact: Iran is the second largest nation in Middle East.

Technical Analysis: LEESK one year downtrend has been broken, with significant buying interest today. MACD and RSI give buying signal, with resistances at RM0.35 and RM0.39.

Conclusion: With the above facts, we forecasted the EPS to achieve new high in 2016 with forecasted EPS of 3.5cents, with slight PE ranged between 11 to 15, the price should be priced in around RM0.38 – RM0.45 with comparison of PE with peers i.e. Nylex (PE11, price 0.57), Euro (PE19, price 0.235).

Stock Alliance

The information contained in this channel is for general information purposes only. Any reliance you place on such information is therefore strictly at your own risk.

We hope to bring profit to everyone as we did in today.

Do help us share out our channel link

Add our new fb:

https://www.facebook.com/stockalliance

Join our Channel and check out our performance.

https://telegram.me/stockalliance

The information contained in this channel is for general information purposes only. Any reliance you place on such information is therefore strictly at your own risk.

We hope to bring profit to everyone as we did in today.

Do help us share out our channel link

Add our new fb:

https://www.facebook.com/stockalliance

Join our Channel and check out our performance.

https://telegram.me/stockalliance

LEESK (8079) - LEESK - The Sleeping Expertise

http://klse.i3investor.com/blogs/stockalliance/114018.jsp