MAGNI (7087) - 2017 defensive stock + Growth stock - 我下一任女友-美女

2017 defensive stock + aggresive stock - 我下一任女友-美女

2017 will be a year full of uncertainty as many investor afraid of economic crisis that happen 10year once (1997 ,2007).

The 1st pick on the start of 2017 will be a defensive + growth stock --> Magni.

With the 2017 1st half, Magni revenue had a growth of 29 percent revenue and 27 percent of it profit.

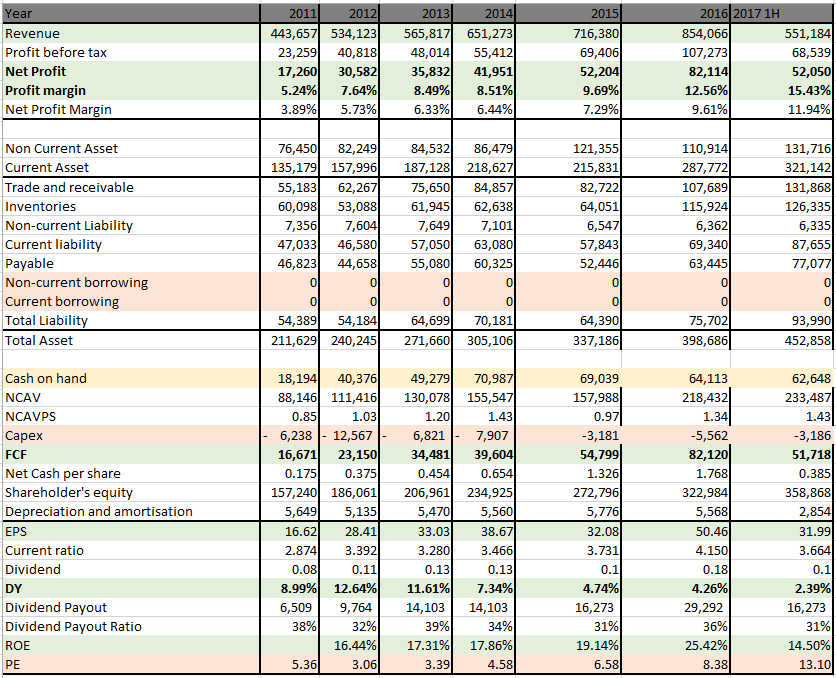

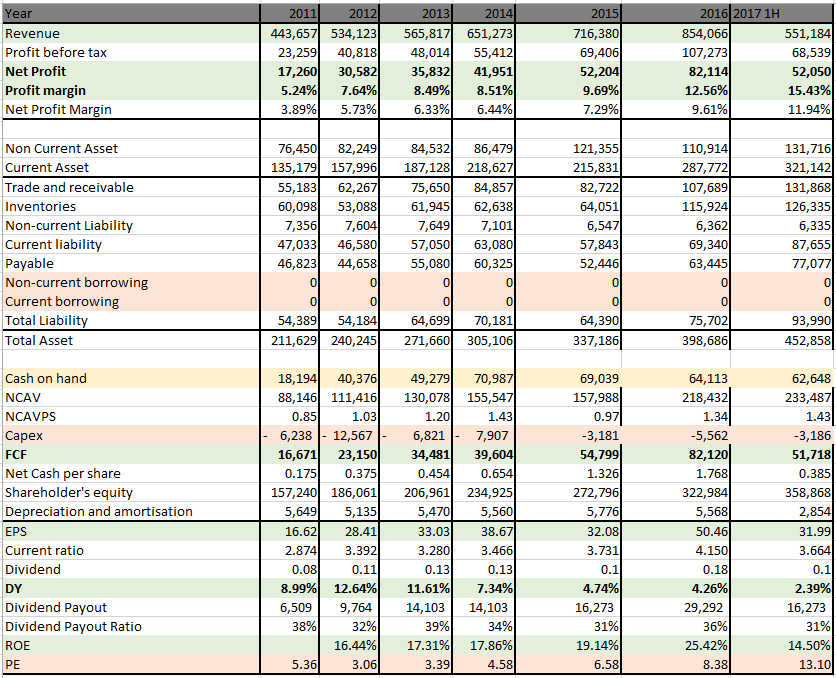

hereby to attach the 5 year data of Magni.

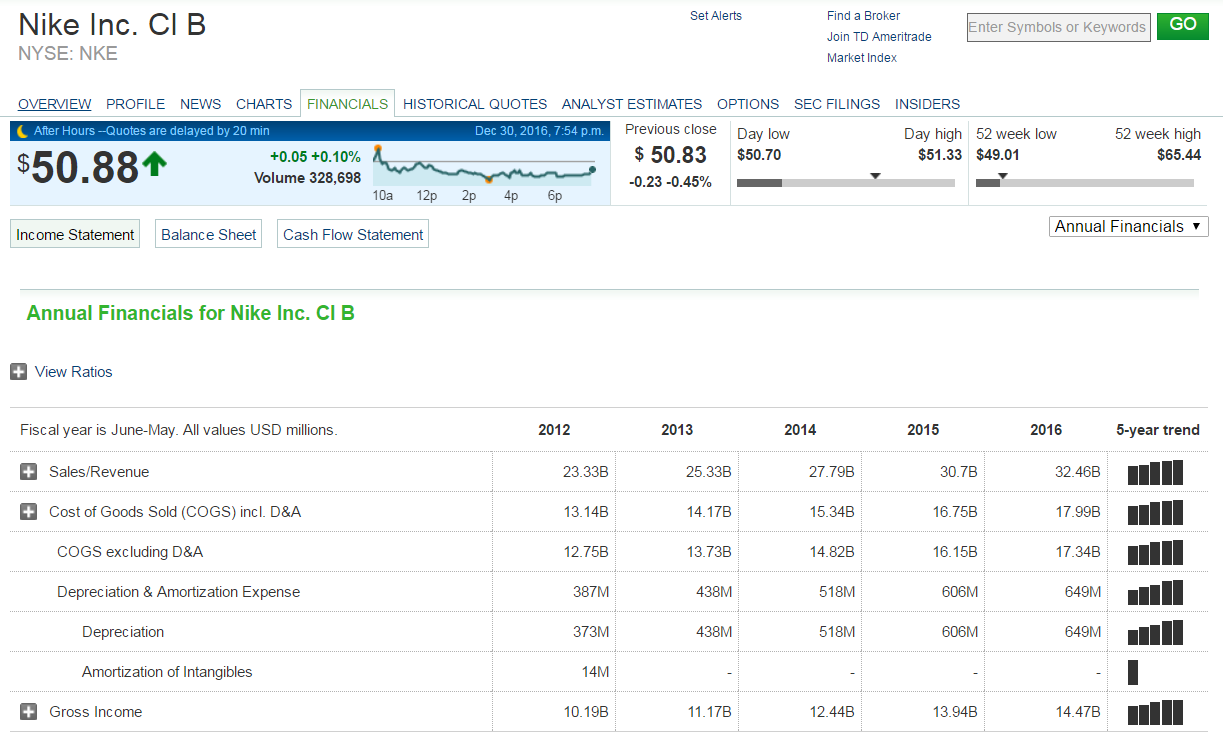

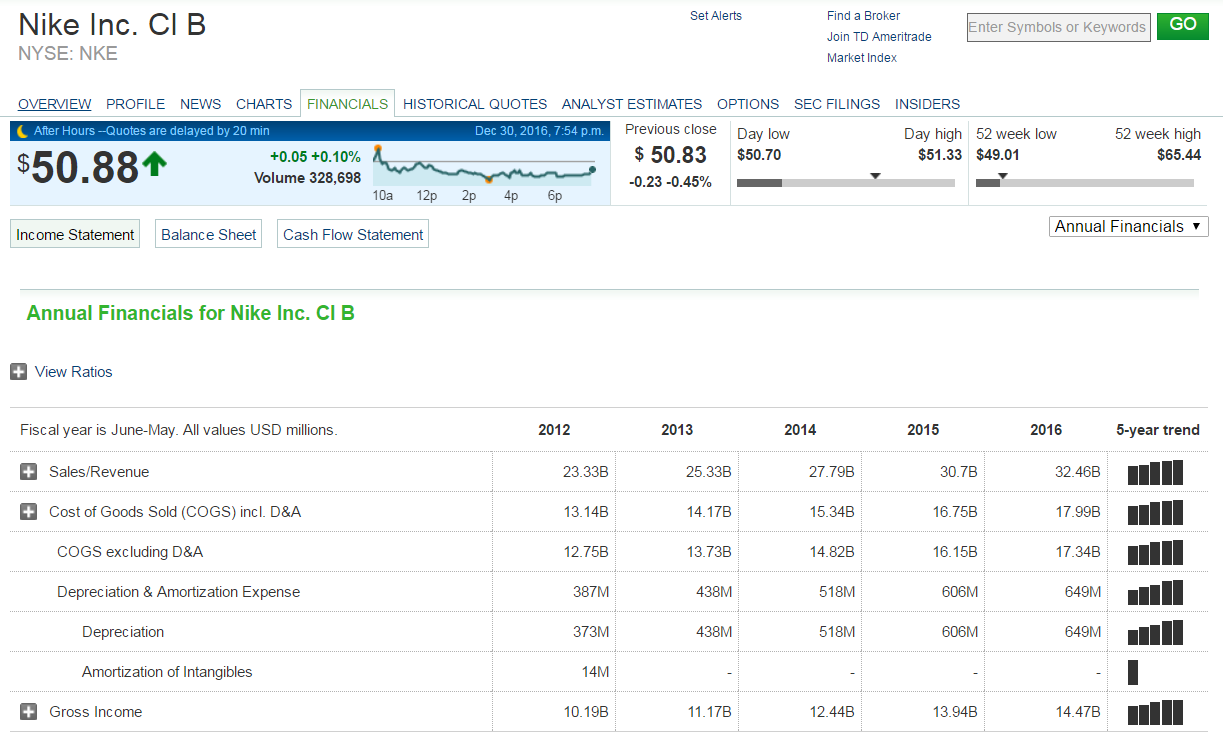

from the data we can know that Magni revenue had a consistent grow, so that it customer (Nike)

Positive

-- Cotton price remain low

-- USD remained strong

-- Expanding plan of Vietnam factory from current 35 million to 41 million.

-- cease of packaging company ( focus on Garment company)

-- High dividend yield - almost 5 percent.

-- Growth/Beautiful of all kind of financial ratio ( ROE, PROFIT MARGIN , Revenue, NO BORROWING At ALL , healthy current ratio)

-- Inventory went up , maybe signal of revenue hike for coming quarter as NIke recent result also shown a positive improvement

Negative /RIsk

- Donald trump wanna pull all OEM/ODM manufacturing back to US. ( It will definately take years for this policy)

- SIPP cease will need a cost of 2miilion, estimate it will reflect on April result report.

- Too rely on one customer . THat why market give Magni a very low PE compare others OEM/ODM .

-- LOSS NIKE AS CUSTOMER.

-- Inventory and investment securites increased. ( Scare of Fraud)

Never expect market will give a high PE for Magni.

Estimate will be around 7 to 8.5 as a fair value. Anything below will be a good chance to collect. ( Premisely there are no change of it fundamental)

AGM Update

Cease of the packaging company ( SIPP)

The time attend AGM, there an shareholder ask why dont Magni shut down the packaging subsidiary that have very low profit margin but the top management responded firmly that they have to take care of their employee as employer had been followed them for a long time and employee also one of their greatest asset.

But somehow on DEC Magni come out with this annoucement.

As a investor we wish Magni can continue to focus and grow their Garment business, but on the other hand top management seeking for opportunity to go into new business that may totally not related of their current business.

That is maybe why there are increase of the investment securties on the recently few quarter report even though the investment yield is not very attractive rathen than Magni execute share buy back that have much higher return. that the only reason i can think of where top management intended to keep money on hand so able to M&A some new company when there are any opportunity.

If it did happened , i may withdraw out my investment from MAGNI as i dont like company diversy to different kind of business model. In fact, it is good for Magni to less dependent on NIke.

Summary

Not to lose your money at the 1st place when we invest. Magni definately will be the choice of mine for 2017 1st Quarter.

MAGNI (7087) - 2017 defensive stock + Growth stock - 我下一任女友-美女

http://klse.i3investor.com/blogs/Learntoinvest/112865.jsp

2017 will be a year full of uncertainty as many investor afraid of economic crisis that happen 10year once (1997 ,2007).

The 1st pick on the start of 2017 will be a defensive + growth stock --> Magni.

With the 2017 1st half, Magni revenue had a growth of 29 percent revenue and 27 percent of it profit.

hereby to attach the 5 year data of Magni.

from the data we can know that Magni revenue had a consistent grow, so that it customer (Nike)

Positive

-- Cotton price remain low

-- USD remained strong

-- Expanding plan of Vietnam factory from current 35 million to 41 million.

-- cease of packaging company ( focus on Garment company)

-- High dividend yield - almost 5 percent.

-- Growth/Beautiful of all kind of financial ratio ( ROE, PROFIT MARGIN , Revenue, NO BORROWING At ALL , healthy current ratio)

-- Inventory went up , maybe signal of revenue hike for coming quarter as NIke recent result also shown a positive improvement

Negative /RIsk

- Donald trump wanna pull all OEM/ODM manufacturing back to US. ( It will definately take years for this policy)

- SIPP cease will need a cost of 2miilion, estimate it will reflect on April result report.

- Too rely on one customer . THat why market give Magni a very low PE compare others OEM/ODM .

-- LOSS NIKE AS CUSTOMER.

-- Inventory and investment securites increased. ( Scare of Fraud)

Never expect market will give a high PE for Magni.

Estimate will be around 7 to 8.5 as a fair value. Anything below will be a good chance to collect. ( Premisely there are no change of it fundamental)

AGM Update

Cease of the packaging company ( SIPP)

The time attend AGM, there an shareholder ask why dont Magni shut down the packaging subsidiary that have very low profit margin but the top management responded firmly that they have to take care of their employee as employer had been followed them for a long time and employee also one of their greatest asset.

But somehow on DEC Magni come out with this annoucement.

As a investor we wish Magni can continue to focus and grow their Garment business, but on the other hand top management seeking for opportunity to go into new business that may totally not related of their current business.

That is maybe why there are increase of the investment securties on the recently few quarter report even though the investment yield is not very attractive rathen than Magni execute share buy back that have much higher return. that the only reason i can think of where top management intended to keep money on hand so able to M&A some new company when there are any opportunity.

If it did happened , i may withdraw out my investment from MAGNI as i dont like company diversy to different kind of business model. In fact, it is good for Magni to less dependent on NIke.

Summary

Not to lose your money at the 1st place when we invest. Magni definately will be the choice of mine for 2017 1st Quarter.

MAGNI (7087) - 2017 defensive stock + Growth stock - 我下一任女友-美女

http://klse.i3investor.com/blogs/Learntoinvest/112865.jsp