Thu, 5 Jan 2017, 10:22 AM

COCOLND (7205) - [Infographic] Cocoaland | Too sweet to resist. Suitable for investors who prefer stable growth

Visit http://www.donkeystock.biz/ to learn more.

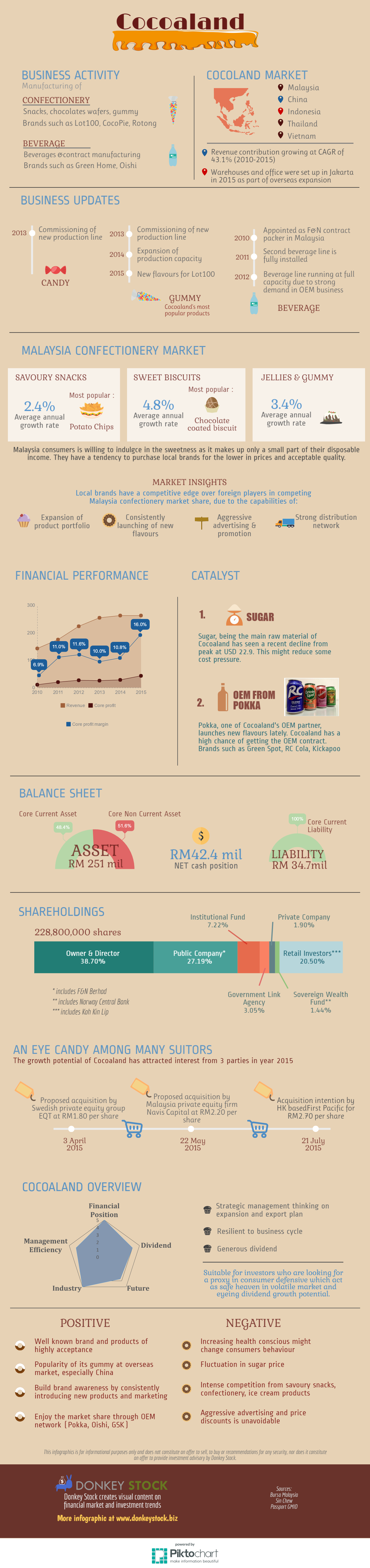

Cocoaland Berhad is a company involved in manufacturing of confectionery (Snacks, chocolate wafers, gummy) and beverage (Beverage and contract manufacturing). Cocoaland possess some of the well-known household brand such as Lot 100, CocoPie, Rotong, Green Home and Oishi.

Cocoaland has a regional presence in Malaysia, China, Indonesia, Thailand and Vietnam. From 2010 to 2015, revenue derived from China has grown at a pace of 43.1% CAGR. In 2015, Cocoaland ventured into Indonesia market and has set up warehouses and office in Jakarta.

Here is an update of Cocoaland different division:

Candy Division:

· Commissioning of new production line in year 2013

Gummy Division:

· Commssioning of new production line in year 2013

· Expaneded production capacity in year 2014

· Launch new flavours for Lot 100 in year 2015

Beverage Division

· Appointed as F&N contract packet in Malaysia in year 2010

· Install second beverage line in year 2011

· Beverage production line running at full capacity due to strong OEM business

Here is an estimated growth rate of Malaysia confectionery market and its respective most popular product.

· Savoury snacks segment is expected to grow at an annual rate of 2.4% where the most popular product is potato chips.

· Sweet buscuits segment is expected to grow at an annual rate of 4.8% where the most popular product is chocolate coated biscuit.

· Jelly and gummies segment is expected to grow at an annual rate of 3.4%

Although facing a huge competition from foreign brand, local brand still command a competitive edge due to this few strong capability:

· Expansion of product portfolio

· Consistently launching new flavours

· Aggressive advertising and promotion

· Strong distribution network

For the past 5 years, Cocoaland has record a consistent growth in both revenue and core profit. Nevertheless, Cocoaland has increase its core profit margin from 6.9% in FY 2010 to 16% in FY 2015. This is a strong signal on management effort to remain cost competitive. Aside from a growing top line and bottom line, it has a strong balance sheet of RM251 million of asset and RM 34.7 million of liability. This translate to an RM42.4 million of net cash position.

2 strong catalyst are also in place to boast Cocoaland revenue and profit in the near future:

· Sugar, being the main cost of Cocoaland has seen a decline from a peak at USD 22.9

· Pokka, which is one of Cocoaland’s OEM partner has launch new flavours recently, which are Green Spot, RC Cola, Kickapoo. We believe Cocoaland may be the beneficiary on Pokka new move.

Cocoaland has received many acquisition offer in FY 2015, Sweedish PE Group EQT, Navis Capital and First Pacific Ltd has offered a price of RM 1.80, RM 2.20 and RM 2.70 respectively. Although the management are not looking to sell off their stake in the near future anymore, we believe this is a good company worth to hold for.

Conclusion

Cocoaland is a company suitable for investors who seek for a safe haven in volatile market and enjoy a potential of growing dividend.

Here is the 3 best things we think on Cocoaland

· Strategic management thinking on expansion and export plan

· Resilient to business cycle

· Generous dividend

Positive

· Well-known brand and products of highly acceptance

· Popularity of its gummy at overseas market especially China

· Building brand awareness by consistently launching new products and aggressive marketing

· Enjoy market share growth via OEM network with Pokka, Oishi and GSK

Negative

· Increasing health conscious might change consumer behaviour

· Fluctuation in sugar price

· Intense competition from savoury snacks, confectionery and ice cream product

· Aggressive advertising and price discount is unavoidable

Visit http://www.donkeystock.biz/ to learn more.

COCOLND (7205) - [Infographic] Cocoaland | Too sweet to resist. Suitable for investors who prefer stable growth

http://klse.i3investor.com/blogs/donkeystocks/113053.jsp