FPI (9172) FORMOSA PROSONIC INDUSTRIES - High Five

Why we think FPI is another MAGNA in making.

Company background

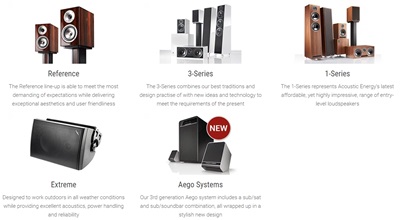

FPI, together with its subsidiaries is engaged in the manufacture, assembly, and sale of speaker systems primarily in Malaysia. It offers micro speaker systems, hi-fi speakers, home theater systems, multimedia speakers, car speakers, flat speakers, projection television cabinets, audio panels, and car and audio amplifiers. FPI offers consultancy services, system development, and integrated solutions for business application software, and also provides engineering design and marketing services.

For more product details, kindly refer to their website product range: http://www.fp-group.com/prosonic/about-fpi.html

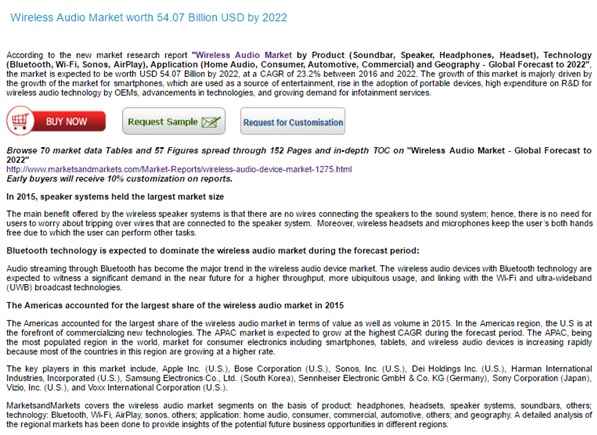

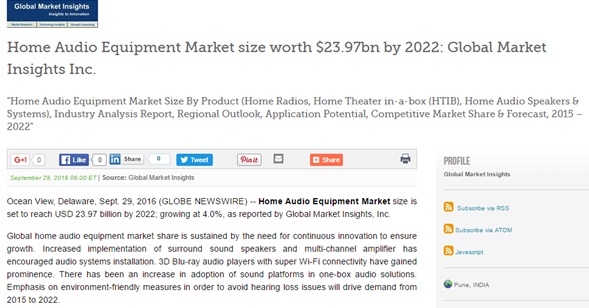

Wireless/ HIFI forecasted market share by 2022

Based on our research on few articles highlighted that wireless audio market, home audio equipment market and many more, the growth rate of the sector is expected to grow at at least 20% CAGR between 2016 and 2022. This will inevitably benefit FPI in term of sales of its products.

Competency of Management

What amaze us is the management competency on decision making i.e. disposal of subsidiaries and disposal of associates. The intention is stated as below:

- The Board of Directors of Formosa Prosonic Industries Berhad (“FPI” or “the Company”) wishes to announce that Formosa Prosonic Manufacturing Sdn Bhd (“FPM”), a wholly-owned subsidiary of the Company, had on 29 January 2016 disposed of its entire 46,442,474 ordinary shares of RM0.50 each representing 27.787% of the issued and paid-up share capital of Acoustech Berhad (“AB Shares”) for a total cash consideration of RM34,831,855.50 or RM0.75 per share via direct business transaction. According to a source, the main reason for FPI’s disposal of a 27.8% stake in Acoustech was due to the latter’s intention to diversify into other business such as property development.

Acoustech Berhad share price as at 29 December 2016 priced at RM0.64. The recent decline is price is due to loss incurred in Q3 FY2016.

- On 30 July 2015, Winmax Holdings Group Limited entered into a Sale and Purchase agreement (“SPA”) with Tonly International Limited (“Tonly”) to dispose of its equity interest of 100% in a subsidiary, FP Group Limited and its wholly owned subsidiary, FP Group (Dongguan) Limited (collectively known as “FPG Group”), which was part of the operating segment in Asia, for a total cash consideration of USD14,302,166 (equivalent to approximately RM59,353,988), which is the disposal consideration subject to further adjustments. The decision to dispose of FPG Group was driven by the long term strategy of the Group in focusing on the audio speaker business in Malaysia.

We are further enlighten by the management intention to further invest in equipment and production enhancement. FPI appears to be committed to the manufacturing and selling of high quality speaker systems.

Both funds derived from disposal will be utilised according to the management shown in Bursa Announcement.

Cash Rich Company

As at 3Q FY2016 the company cash/ short term funds stand at approximately RM152mil equivalent to RM0.62 with no loan and borrowing whatsoever. FPI’s cash in hand alone represents a whopping 71% of its share price at the moment.

“It will be important to have a strong cash buffer during a slowdown in the economy. We have also invested quite a fair bit into machinery. When the need arises, the company will not hesitate to invest, whether in new products or to expand capacity” said by one of the company officials and further shared that the cash buffer is a strategic asset for the group.

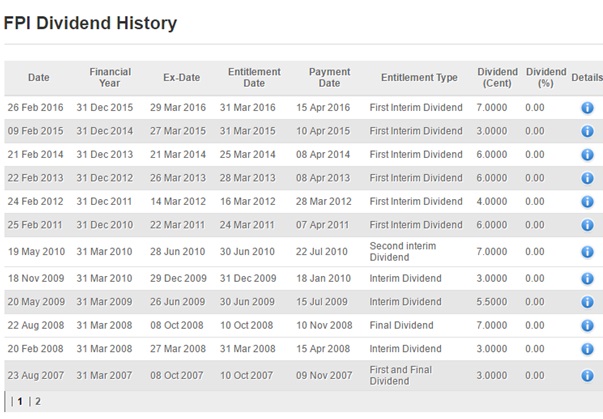

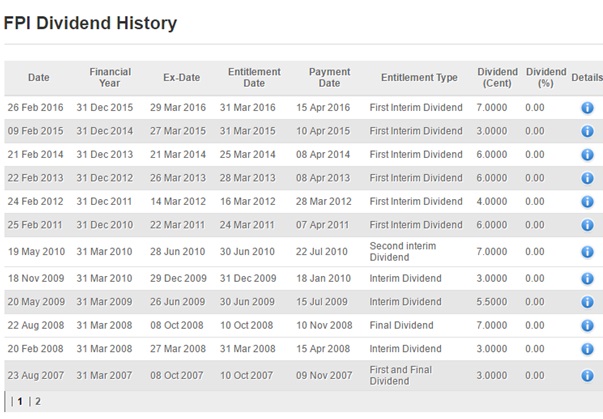

Generous Dividend Payout

An investor who invested in FPI for the long term in the past would have been well rewarded. Its annualised return inclusive of the reinvestment of dividends paid over one-, five- and 10-year periods are 25.29%, 8.71% and 15.31% respectively.

(Source: TheEdge Market)

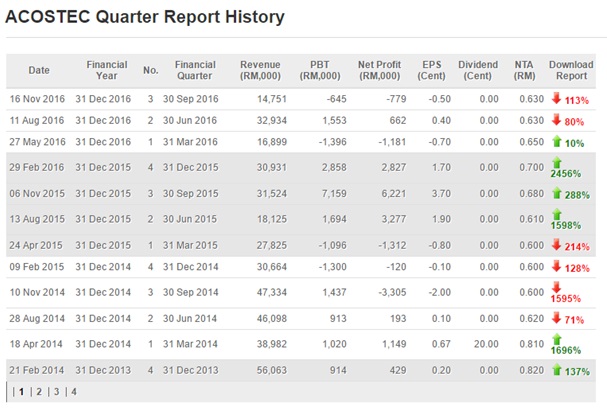

FPI is not stingy to share their profitability with the investors by rewarding them dividend annually. Based on the average dividend (cents) as shown above, we forecasted their dividend payout for this FY2016 will be ranged between 3-4 cents bear in mind with the economic condition.

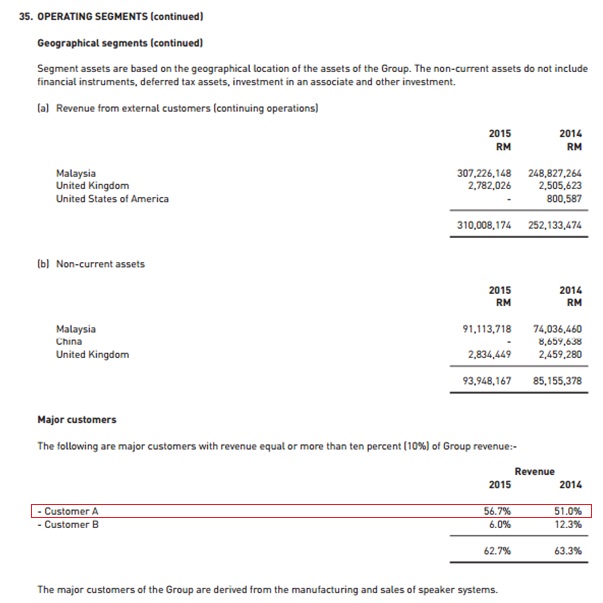

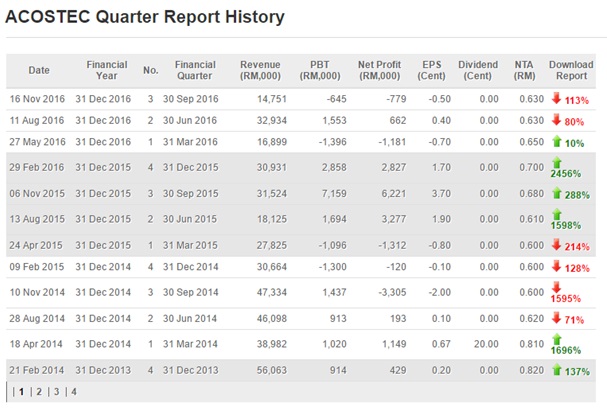

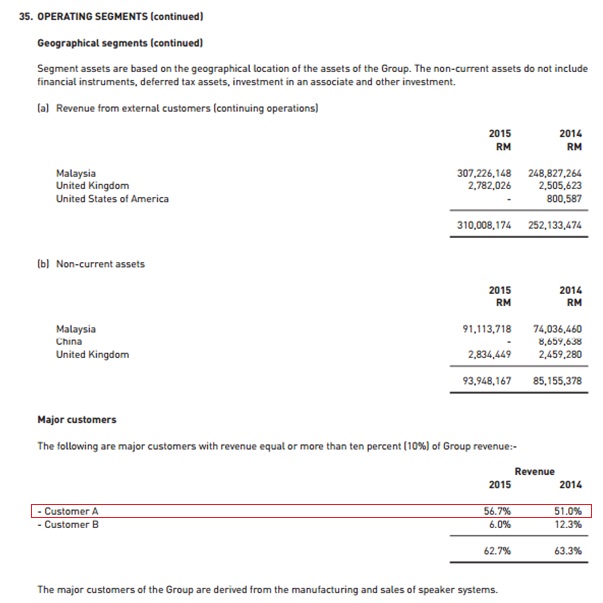

Revenue

The public might comment that the group is risky on rely on solely one customer generating halve of the company revenue. However, we see it differently, with 56.7% revenue generated (RM175mil) in 2015 and with 51% revenue generated (RM127mil) in 2014, it is an increase of RM48mil in ONE YEAR!!!!!

We are further confident with the fact that the forecasted market share in 2022 is beneficial to FPI as order books grow despite bad economic condition.

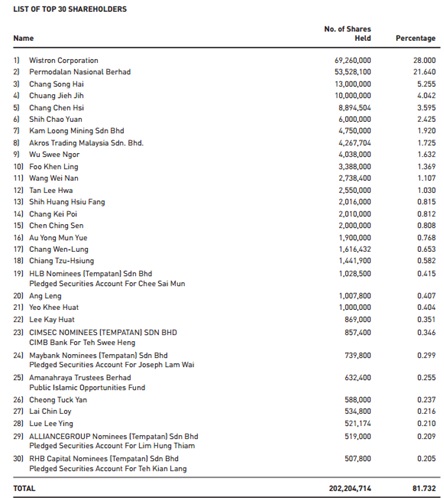

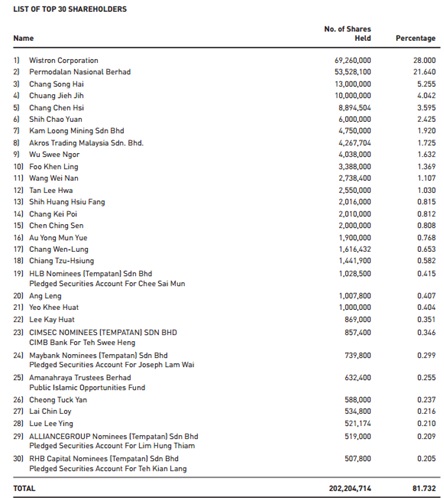

Top 30 shareholders

Lastly what we are going to highlight is the top 2 major shareholders in this company.

FPI’s largest shareholder Wistron Corp, a Taiwan-based company, bought its stake in 2014 and still holds 69.3 million shares, representing a 28% interest in FPI. For more information about Wistron, kindly refer: https://www.bloomberg.com/quote/3231:TT

Permodalan Nasional Bhd (PNB) owns a 21.64% stake with 53.5 million shares while Chang Song Hai, a Taiwanese, owns 13 million shares or 5.36%. Needless for me to mention PNB, you know who is the chairman of PNB… MY IDOL!!!

Conclusion

Come to conclusion... With a strong track record, low PER and strong fundamentals as well as consistency of its dividend payout, is FPI undervalued? RM1.50 is just the first target.

We are proud to say KGB has slowly moved up to our expected pricing RM0.48 to RM0.60 due to result turnaround and project awarded http://www.thestar.com.my/business/business-news/2017/01/27/kelington-unit-secures-rm40mil-pasir-gudang-project/. People will eventually notice this gem like the other FA we written though we are the first who highlighted this stock and cause a lot of contradicts.

Refer below for our KGB FA:

https://klse.i3investor.com/blogs/stockalliance/106370.jsp

FPI (9172) FORMOSA PROSONIC INDUSTRIES - High Five

http://klse.i3investor.com/blogs/stockalliance/115656.jsp

Company background

FPI, together with its subsidiaries is engaged in the manufacture, assembly, and sale of speaker systems primarily in Malaysia. It offers micro speaker systems, hi-fi speakers, home theater systems, multimedia speakers, car speakers, flat speakers, projection television cabinets, audio panels, and car and audio amplifiers. FPI offers consultancy services, system development, and integrated solutions for business application software, and also provides engineering design and marketing services.

For more product details, kindly refer to their website product range: http://www.fp-group.com/prosonic/about-fpi.html

Wireless/ HIFI forecasted market share by 2022

Based on our research on few articles highlighted that wireless audio market, home audio equipment market and many more, the growth rate of the sector is expected to grow at at least 20% CAGR between 2016 and 2022. This will inevitably benefit FPI in term of sales of its products.

Competency of Management

What amaze us is the management competency on decision making i.e. disposal of subsidiaries and disposal of associates. The intention is stated as below:

- The Board of Directors of Formosa Prosonic Industries Berhad (“FPI” or “the Company”) wishes to announce that Formosa Prosonic Manufacturing Sdn Bhd (“FPM”), a wholly-owned subsidiary of the Company, had on 29 January 2016 disposed of its entire 46,442,474 ordinary shares of RM0.50 each representing 27.787% of the issued and paid-up share capital of Acoustech Berhad (“AB Shares”) for a total cash consideration of RM34,831,855.50 or RM0.75 per share via direct business transaction. According to a source, the main reason for FPI’s disposal of a 27.8% stake in Acoustech was due to the latter’s intention to diversify into other business such as property development.

Acoustech Berhad share price as at 29 December 2016 priced at RM0.64. The recent decline is price is due to loss incurred in Q3 FY2016.

- On 30 July 2015, Winmax Holdings Group Limited entered into a Sale and Purchase agreement (“SPA”) with Tonly International Limited (“Tonly”) to dispose of its equity interest of 100% in a subsidiary, FP Group Limited and its wholly owned subsidiary, FP Group (Dongguan) Limited (collectively known as “FPG Group”), which was part of the operating segment in Asia, for a total cash consideration of USD14,302,166 (equivalent to approximately RM59,353,988), which is the disposal consideration subject to further adjustments. The decision to dispose of FPG Group was driven by the long term strategy of the Group in focusing on the audio speaker business in Malaysia.

We are further enlighten by the management intention to further invest in equipment and production enhancement. FPI appears to be committed to the manufacturing and selling of high quality speaker systems.

Both funds derived from disposal will be utilised according to the management shown in Bursa Announcement.

Cash Rich Company

As at 3Q FY2016 the company cash/ short term funds stand at approximately RM152mil equivalent to RM0.62 with no loan and borrowing whatsoever. FPI’s cash in hand alone represents a whopping 71% of its share price at the moment.

“It will be important to have a strong cash buffer during a slowdown in the economy. We have also invested quite a fair bit into machinery. When the need arises, the company will not hesitate to invest, whether in new products or to expand capacity” said by one of the company officials and further shared that the cash buffer is a strategic asset for the group.

Generous Dividend Payout

An investor who invested in FPI for the long term in the past would have been well rewarded. Its annualised return inclusive of the reinvestment of dividends paid over one-, five- and 10-year periods are 25.29%, 8.71% and 15.31% respectively.

(Source: TheEdge Market)

FPI is not stingy to share their profitability with the investors by rewarding them dividend annually. Based on the average dividend (cents) as shown above, we forecasted their dividend payout for this FY2016 will be ranged between 3-4 cents bear in mind with the economic condition.

Revenue

The public might comment that the group is risky on rely on solely one customer generating halve of the company revenue. However, we see it differently, with 56.7% revenue generated (RM175mil) in 2015 and with 51% revenue generated (RM127mil) in 2014, it is an increase of RM48mil in ONE YEAR!!!!!

We are further confident with the fact that the forecasted market share in 2022 is beneficial to FPI as order books grow despite bad economic condition.

Top 30 shareholders

Lastly what we are going to highlight is the top 2 major shareholders in this company.

FPI’s largest shareholder Wistron Corp, a Taiwan-based company, bought its stake in 2014 and still holds 69.3 million shares, representing a 28% interest in FPI. For more information about Wistron, kindly refer: https://www.bloomberg.com/quote/3231:TT

Permodalan Nasional Bhd (PNB) owns a 21.64% stake with 53.5 million shares while Chang Song Hai, a Taiwanese, owns 13 million shares or 5.36%. Needless for me to mention PNB, you know who is the chairman of PNB… MY IDOL!!!

Conclusion

Come to conclusion... With a strong track record, low PER and strong fundamentals as well as consistency of its dividend payout, is FPI undervalued? RM1.50 is just the first target.

We are proud to say KGB has slowly moved up to our expected pricing RM0.48 to RM0.60 due to result turnaround and project awarded http://www.thestar.com.my/business/business-news/2017/01/27/kelington-unit-secures-rm40mil-pasir-gudang-project/. People will eventually notice this gem like the other FA we written though we are the first who highlighted this stock and cause a lot of contradicts.

Refer below for our KGB FA:

https://klse.i3investor.com/blogs/stockalliance/106370.jsp

Stock Alliance

The information contained in this channel is for general information

purposes only. Any reliance you place on such information is therefore

strictly at your own risk.

We hope to bring profit to everyone as we did in today.

Do help us share out our channel link

Add our new fb:

https://www.facebook.com/stockalliance

Join our Channel and check out our performance.

https://telegram.me/stockalliance

Add our new fb:

https://www.facebook.com/stockalliance

Join our Channel and check out our performance.

https://telegram.me/stockalliance

FPI (9172) FORMOSA PROSONIC INDUSTRIES - High Five

http://klse.i3investor.com/blogs/stockalliance/115656.jsp