Dear fellow investors / readers,

Today,

I would like to talk about Market Irrationality. I am sure many of you

are well verse with this term. For those who are not, it stems from a

phrase used by former FED Chariman, Alan Greenspan (Today, it is Janet

Yellen). As below

Once

again, these writings are just my humble sharing (not recommendation),

feel free to have some intellectual discourse on this. You can reach me

at :

Telegram channel : https://telegram.me/tradeview101

or Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Facebook : https://www.facebook.com/tradeview101/

Website / blog : www.tradeview.my

_________________________________________________________________________________

For

the past 3 months, the equities market has been considerably buoyant.

Some analyst said we have been enjoying a mini bull run. Some say it is a

technical rebound. Some say it is in anticipation of the corporate

earnings rebound. Whatever anyone says, the fact is the market has been

good for many.

1. Dividend Yielding stocks

2. Fundamentally sound and value stocks (Stocks that meet our FA metric / also known as FA stocks)

3. Growth stocks

Usually,

the stocks we call take a long time to move. Very simply, value

investing takes time. It is based on the fundamental growth of the

business, not short term punting / speculative play. Of course, there

are cases where the market misprice the true value of the stock, upon

realisation, the rerating is fast. However, across the board, our calls

for the past 3 months have moved at an extraordinary pace. Most calls

that usually takes more than 6 months moved in less than 2 months. I

would like to think I am good at what I do, but I must admit, the market

has been the bullish force behind the upwards movement. Hence, market irrationality comes in.

Based

on the market's movement the past 3 months, at which point do you think

KLCI was? Euphoria, Thrill, Excitement or Optimism? Thing is, few can

tell the future right? On hindsight everyone is 20/20, but if you ask

me, I would say for the past 3 months, KLCI was at Relief towards

Optimism. This is in line with the global markets especially the way US

markets rally following appointment of Trump as President + the promises

of pro-economic reforms that he brings with him. I think US market

potentially is at Euphoria as the market continued to create new highs

based on unfulfilled promises and reform plans to a large extent it has

already been factored into the share price.

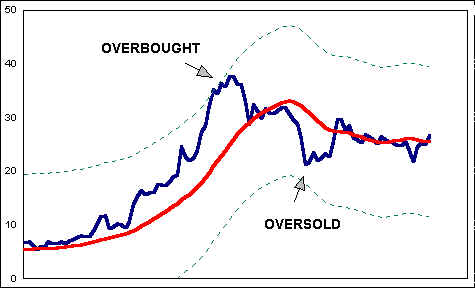

The

most basic concept of market irrationality is when people oversell and

overbuy. Ex: Buying something for a price beyond its true value VS

selling something for a price below its true value. When things are

negative, irrational people think it will be worst, hence they sell

things below its true worth. When things are good, irrational people

think it will be even better, hence they continue buying beyond its true

worth.

1. LiiHen (oversold) :

Liihen

is a very popular counter. Many would have invested in this counter

some time or another. It is a net cash, high growth furniture exporter.

The company has been doing well year after year especially so since the

MYR has depreciated against USD. Recently, the Quarterly Results

released was nothing short of spectacular. Record high dividend, Revenue

increased 10%, good profit and others. Any normal investor would have

read the report and say, kudos to the Management of LiiHen. The next

day, instead of gapping up, it was sold off (subjected to profit

taking). It continued till today and it close at RM3.36. In this case,

market was irrational.

My

view : Putting aside all the talks of the future direction of the MYR,

the potential slowdown of US housing market, the DY for just the

Quarterly Dividend at current price of RM3.36 stands at 2.97%. This is

not including the other quarterly dividend. The valuation wise, it is

trading at only 8x PER excluding all dividends. How can a high growth

counter net cash company with strong ROE, CAGR and DY be trading only at

8x PER just because it is in the low tech furniture sector? Clearly it

is undervalued and oversold.

It

has been a terrible 2 years plus for the oil and gas sector. I called a

rebound in oil and gas in March 2016, the rebound was from 35 USD per

barrel crude oil to 54 USD per barrel today. Following OPEC cut, many

counters have jump. PetronM clearly is beneficiary as well. Recent

results is outstanding. A simplistic valuation at a conservative

multiple of 10x would value PetronM close to RM8.80 despite the lumpy

earnings. Some are even calling it at 15x multiple attaching a premium

by comparing to PetDag valuing it at Rm11+. As a result, PetronM limit

up the day before from RM4.63 to RM 6.01. It continued on the next day

all the way to RM6.66 but faced profit taking and closed at RM6.09. In

this case, the market was mixed.

My

view : Reading the QR on PetronM, it was clear their refining margin

improve substantially following the rebound in oil price especially in

the last Q. Furthermore, due to the outstanding results, PetronM

declared 22 sens dividend to reward shareholders which is a positive

move. At current price of RM 6.09, the DY is 3.6%. The

valuation wise, it is trading at only around 7x PER excluding all

dividends. Based on such metrics, many jump on the bandwagon and pushed

up the price significantly. Some chase high at RM6+ as they believe

PetronM is still cheap. Of course, those who sold off / profit take

believe it has went up too fast. I neither consider PetronM overbought

or oversold but an in between where the market forces will determine its

value based on the majority expectation. Those who dislike lumpy

earnings and believe the coming Q might be subdued will not invest

further in this counter. Those bullish will aim for at least RM8+ going

into the next Q or at least to ex-dividend date.

3. GHLSYS (overbought) :

The

tech sector has been very hot for the past few years. Increasingly so

with new technology disrupting our way of life. As a result, the NASDAQ

is breaking record high and many unicorn starts up are achieving the

billion dollar status even if their earnings have yet to even breakeven.

In short, the best example would be UBER, valued close to USD 50

billion but yet to churn out profit. This is true market irrationality.

We can see it in the same light with GHLSYS. GHLSYS is currently in a

good space. It is a technology counter, it is specifically involved in

FINTECH, it is backed by banks / big funds and it is trading at 40x PER

valuation despite making less profit than many traditional businesses.

Granted, revenue and profit have been growing for the past few years at

extraordinary rate, hence many attached the bullish future prospect to

it. In this case, the market was irrational.

My

view : I think the tech space and fintech is always interesting and

exciting. I do like the fact GHLSYS is improving bottomline and topline.

It also declared dividend for the first time. However, I did not like

how the market was overly bullish going into the QR when its original

valuation was already beyond 40x PER. Even if the QR results was

extraordinary, it would have already been factored into the share price

long ago. A counter like GHLSYS should be collected on retracement, not

chased high especially when the valuation is over the top with limited

margin of safety. Hence, I consider GHLSYS to be overbought and to

accumulate on weakness.

Conclusion :-

The market is always irrational. It was like that in 1920s, 1980s, 2000s and it will continue to to be so. The irrational market stems from the different emotions, character, intelligence, greed, risk appetite of human in place. That is what makes the market interesting. The only way we can protect ourselves and our investment is to exercise prudence and diligence in studying a share. We have to look at the true value of the stock for what it is and not listen to the noises in the market. Long term view vs short term view, upside vs downside will help in our decision making. Never ever lose sight and conviction if you know the true value of the stock regardless how noisy the forum may be or what investment "gurus" are preaching. If Warren Buffet can be wrong, everyone is allowed to make mistakes too. As long as the % of wins exceed losses, you are alright.

_________________________________________________________________________________

Please note that I respect all investment styles and in no way saying one method of investing is better than another. I know that everyone has their own preferred method and that is what makes the market interesting. Diversity.

To join my telegram channel : https://telegram.me/tradeview101

Blog : www.tradeview.my

Facebook : https://www.facebook.com/tradeview101/

or Email me to sign up as private exclusive subscriber : tradeview101@gmail.com