CAB (7174) - CAB CAKARAN: Malaysia Broiler/Chicken Giant in Making (Part 1) (WealthWizard)

Since I came to i3 september last year, I have so far recommended 2 stocks, one was MYCRON & the other one was EKOVEST.

I had predicted MYCRON to reach RM1.12 when price was RM0.59, representing upside potential of 90%. Mycron had reached peak at RM1.20 later.

I had predicted EKOVEST to reach RM3.80 when price was RM2.08, representing upside potential of 84%. (After split, RM3.80=>1.52 & RM2.08=>RM0.83). Today, I have Ekovest valued at RM1.35 & pocketed special & final dividend of RM0.112 (after split). Please click here for reasons I am still holding Ekovest.

Today, I am going to recommend my 3rd stock in i3, that's CAB Cakaran.

My first target price will be RM3.04, representing upside potential of 81% based on yesterday's closing of RM1.68.

For more details & information about CAB Cakaran, please find out at CAB's Annual Reports & Headlines at i3.

On 9 Jan 2017, Managing Director Chris Chuah said the sales of quarterly period (31/12/2016) will increase by about 10% compared to the previous corresponding period & he expected improvement in margins. (Source: thestar)

We received the following results on 27/2/2017:

Market has not responded to the above quarterly results. In fact, the company's share price has been flat for almost 1 years as at today:

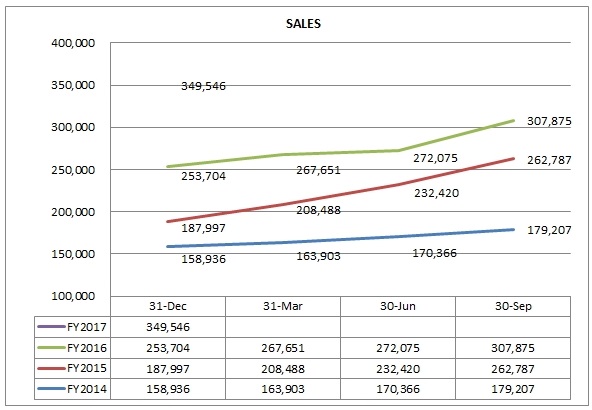

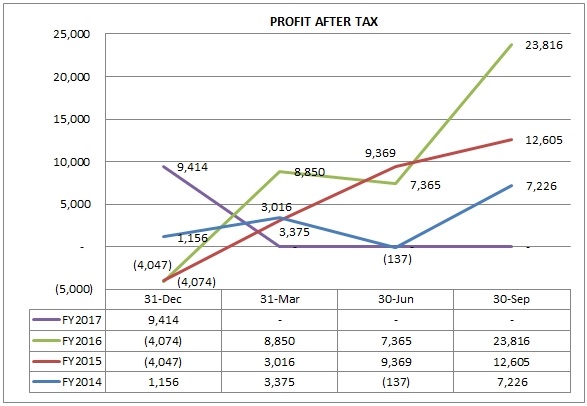

To get a clearer picture of how CAB has been doing in the past 3 years, you may refer to the following chart:

Historically, the 3 months period ending December was the weakest quarter in a year, but the Company has delivered fantastic results in the recently released quarterly report:

Expansion Plans in Malaysia

The acquisition of Farm’s Best Bhd will see an increase in the company’s broiler production capacity, from the current 5 million broilers per month to 7 million broilers.Concurrently, CAB Cakaran’s production of chicks will increase from about 4.5 million chicks per month to 6 million. “In the next two years, we will be producing 8 to 10 million chicks each month,” Chris Chuah tells StarBizWeek.

Note: The acquisition is expected to be completed by mid of 2017.

Expansion Plans in Indonesia (with Salim Group)

CAB Cakaran’s partnership with Indonesia’s Salim Group is awaiting approvals from the Indonesian authorities before construction of integrated poultry farm and plants in Jakarta can take place.Land locations for the integrated poultry farm have been identified and confirmed, which are spread across north and south Jakarta.

Earnings contribution from the Indonesian operations will only commence end-2018 or early 2019 & the Indonesian operations is envisaged to produce 4 million broilers per month and 3 million eggs per day

(Source: StarBizWeek)

Note: The Indonesia operations is expected to kick off in 1 1/2 years, it is not so far from now.

That's It? What Next?

Based on the above, the company is clearly undervalued & overlooked by the market:1. Sales & Profit are expected to grow at least 30% in 2017 & 2018 respectively

2. Salim Group (Indonesia's biggest conglomerates) is holding 20% in CAB by paying RM2.07 per share

3. The management is looking to do great with all the expansion plans in the progress

More to come on the following:

1. Good capital management by the Company

2. Lowest PE compared to peers (Lay Hong & QL)

3. The beginning of another growth

I will discuss more on all the above projections & valuation in my next few articles, Part 2.

Please stay tune.

CAB (7174) - CAB CAKARAN: Malaysia Broiler/Chicken Giant in Making (Part 1) (WealthWizard)

http://klse.i3investor.com/blogs/wealth123/118711.jsp