CAB (7174) - CAB CAKARAN: Something Big Is Coming in Poultry Industry (Part 2) (WealthWizard)

This part will discuss on the factors that affecting the company & the industry

1. Broiler ex-farm price

2. Poultry feed price

3. US currency movement

4. Poultry industry & production growth

5. CAB Cakaran & other competitors

6. Capital management & Production Efficiency of CAB

1. Broiler ex-farm price & average selling price of CAB

Broilers are controlled items in Malaysia & broilers' selling prices are therefore pre-determined by the Government from time to time. As such, it is important to know the relationship between the selling price & the profit performance of respective companies.

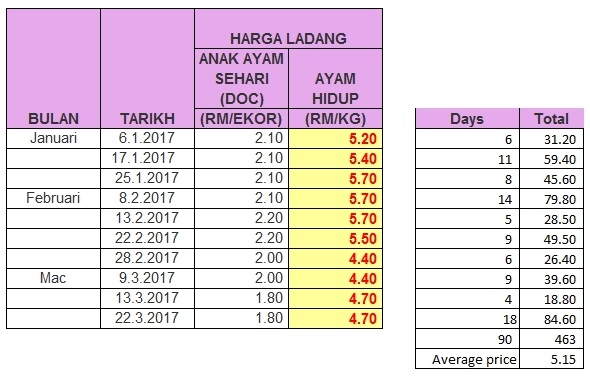

Based on the prices listed at table below, the broilers' selling price were higher in Jan to March 2017, my calculation of average selling price is RM5.15.

Source: http://www.dvs.gov.my/index.php/pages/view/440

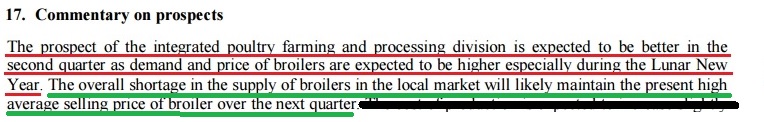

This is in line with the comment from the management in the latest quarterly report:

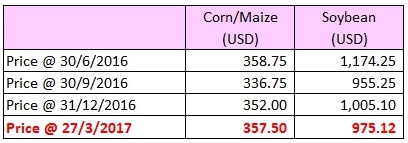

2. Poultry feed price

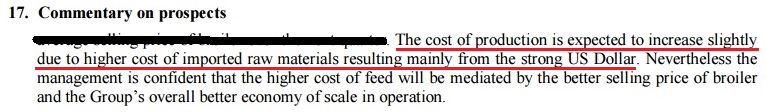

Prices of feed ingredients, especially maize and soya, accounted for 70% of the production cost. It is important to know what are going on on these 2 prices.The management has said so:

But it is interesting to know the following:

Click here for US Corn Price Chart & SoyBean Price Chart

3. US currency movement

Ringgit Malaysia has been staple against US Dollar:

4. Poultry industry & production growth

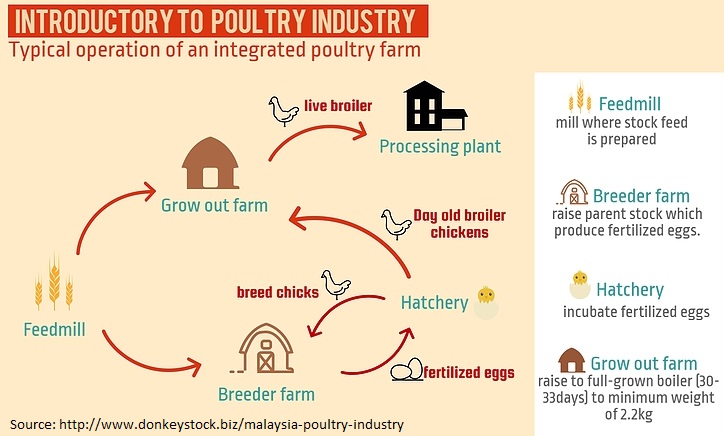

Thanks to donkeystock.biz, the infographic below helps to make easier understanding on how a poultry is run.

According to a report titled "Review of Domestic Broiler Market" (page 11), it is learnt that CAB Breeding Farm Sdn Bhd, a 100% owned subisidary of CAB, is one of the only 4 grandparent stock poultry farmers in Peninsular Malaysia.

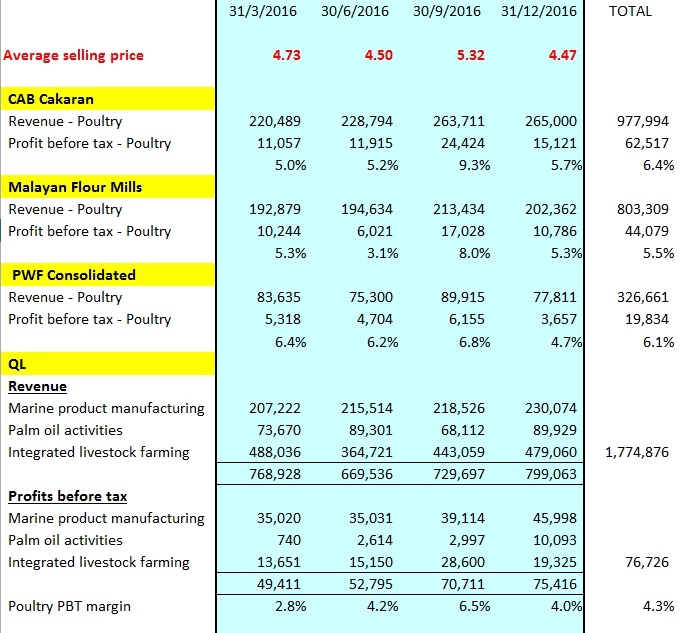

5. CAB & other competitors

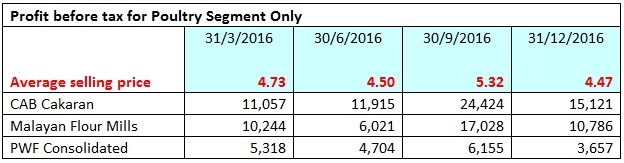

Except Leong Hup which was delisted in 2012 & lack of relevant financial information, the following are the comparison among 4 public listed companies in Bursa:

Sources: quarterly reports of respective companies at Bursa Website

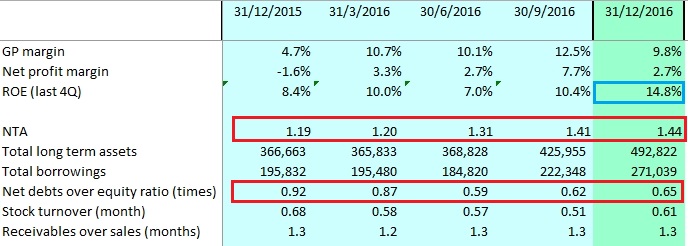

6. Capital management & Production Efficiency of CAB

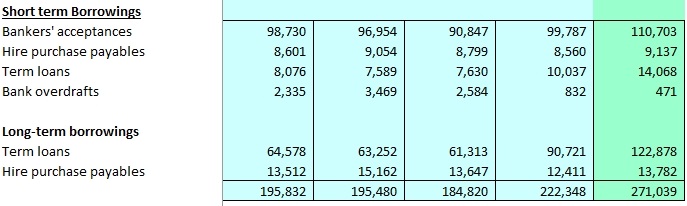

Net Debts Over Equity Ratio The Company has agressively expanding its farming assets via internally generated funds & borrowings. However, the net debts ratio has indeed been dropped from 92% (31/12/2015) to 65% (31/12/2016).

ROE

The agressive expansion has contributed positively to the shareholders' return and it proved that every ringgit reinvested brought greater return over time.

Stock Turnover (Months) CAB has maintained one of the best stock turnover ratio among all poultry farmers, its stock value was almost HALF of its monthly sales only.

Receivables over Sales (Months) CAB has maintained very tight credit control over its receivables and the average receivables turnover is only about 1.3 months.