GMUTUAL (9962) - Gromutual Berhad: THE SOUTHERN LION

Let's see what's so interesting about GMUTUAL.

GMUTUAL

Gromutual Berhad, is engaged in property development. The development products include landed residential, commercial building and industrial parks with the development of service apartments is in the pipeline. Gromutual Group is also involved in investing in properties including students apartments and industrial building for manufacturers.

RESULT ANALYSIS

Compare FYE2016 vs FYE2015

- EPS of 6.18cents vs EPS of 4.26cents

- Revenue of RM91.2mil vs RM71.11mil

- Profit of RM23.2mil vs RM16.0mil

Revenue grows 28%, Profit grows 45%, with this growth rate is not in par with the economic condition as all of us know.

**Although in FYE2014 GMUTUAL achieved higher sales revenue compared with FYE2015 however as you can see, GMUTUAL is able to maintain the profit at same level, this indicates that higher sales margin and better cost control sustained by GMUTUAL in return.

How can the company achieved such a great result in FYE2016? Based on our analysis, we identified that the surge of revenue and profit are due to below reasons:

- Sales of Industrial Project and Good Progress of its high rise commercial project as well as residential projects.

1. Johor currently has 11 ongoing projects, the biggest is Austin18 Iskandar Malaysia with GDV of RM150mil poised to be completed by 2017. Attached link: http://www.gromutual.com/johor.php

2. Melaka currently has 7 ongoing projects. Attached link: http://www.gromutual.com/melaka.php

- Better occupancy rate from Emerald Apartments and Emerald Residence and Factory Leasing

1. Providing accomodation to university students in Melaka nearby universities namely Multimedia University, Melaka Campus (“MMU”) and Universiti Teknikal Malaysia Melaka (“UteM”). The total number of students residing in the service apartments is approximately two thousand two hundred (2,200) based on headcount. Who studied in both universities should know how famous this residence is and testified to be fully occupied.

2. Lease their built factories to industrial players.

Dividend

GMUTUAL has been very generous in dividend payout annually, in FYE2016 the dividend distributed is at 2cents, which constitute 4.5% of dividend yield.

NTA

GMUTUAL has extraordinary high NTA of RM0.91 (including the RM11.1mil new land acquired) which is 7 cents higher than FYE2015. The share price is 50% discounted of the NTA as at 14 March 2017 closing price.

Landbank

Stay with us on this! We wouldnt believe it until we sighted myself. The Group at present has 35 pieces of land, landbank size of approximately 238 hectares of land valued at sum of RM167mil (RM0.44 per share) for future investment development in Johor and Melaka (including the new acquired land worth RM11.1mil).

Management Capability

Management is capable in keep acquiring land in Melaka and Johor as they expected somehow development will expose to southern region like Iskandar and Malacca Gateway (recent China very hot about this!).

The Group will remain focus on its property development business and will offer a range of quality and affordable products located in good locations. The Group is optimistic on its launching of new housing and industrial properties as well as mixed developments that are in strategic locations in the states of Johor and Melaka. In addition, the Group will continue to expand its land banks, preferably in places where we have existing presence such as in Johor and Melaka so that we can expand our reach further. The Group is positive on its long term outlook despite the uncertainty and challenging business environment. The Group will continue its effort in enhancing operational efficiency by focusing on cost control and improving delivery of value and quality product on time.

Conclusion:

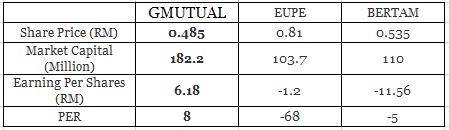

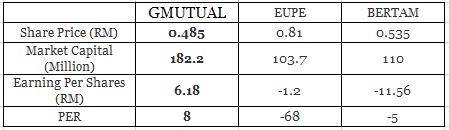

GMUTUAL is deemed undervalued in so many level as mention above. In short term (Q1 FYE2017) wise will the Group perform well? With the university reopen after December holiday and potential leasing rates readjust, with many projects ongoing, with the revenue recognition from project completion from Austin18, we believe you have your answers. Attached below as the peer PE comparison, with standard PE 15 the price should valued at between RM0.92 to RM1.00

GMUTUAL (9962) - Gromutual Berhad: THE SOUTHERN LION

GMUTUAL

Gromutual Berhad, is engaged in property development. The development products include landed residential, commercial building and industrial parks with the development of service apartments is in the pipeline. Gromutual Group is also involved in investing in properties including students apartments and industrial building for manufacturers.

RESULT ANALYSIS

Compare FYE2016 vs FYE2015

- EPS of 6.18cents vs EPS of 4.26cents

- Revenue of RM91.2mil vs RM71.11mil

- Profit of RM23.2mil vs RM16.0mil

Revenue grows 28%, Profit grows 45%, with this growth rate is not in par with the economic condition as all of us know.

**Although in FYE2014 GMUTUAL achieved higher sales revenue compared with FYE2015 however as you can see, GMUTUAL is able to maintain the profit at same level, this indicates that higher sales margin and better cost control sustained by GMUTUAL in return.

How can the company achieved such a great result in FYE2016? Based on our analysis, we identified that the surge of revenue and profit are due to below reasons:

- Sales of Industrial Project and Good Progress of its high rise commercial project as well as residential projects.

1. Johor currently has 11 ongoing projects, the biggest is Austin18 Iskandar Malaysia with GDV of RM150mil poised to be completed by 2017. Attached link: http://www.gromutual.com/johor.php

2. Melaka currently has 7 ongoing projects. Attached link: http://www.gromutual.com/melaka.php

- Better occupancy rate from Emerald Apartments and Emerald Residence and Factory Leasing

1. Providing accomodation to university students in Melaka nearby universities namely Multimedia University, Melaka Campus (“MMU”) and Universiti Teknikal Malaysia Melaka (“UteM”). The total number of students residing in the service apartments is approximately two thousand two hundred (2,200) based on headcount. Who studied in both universities should know how famous this residence is and testified to be fully occupied.

2. Lease their built factories to industrial players.

Dividend

GMUTUAL has been very generous in dividend payout annually, in FYE2016 the dividend distributed is at 2cents, which constitute 4.5% of dividend yield.

NTA

GMUTUAL has extraordinary high NTA of RM0.91 (including the RM11.1mil new land acquired) which is 7 cents higher than FYE2015. The share price is 50% discounted of the NTA as at 14 March 2017 closing price.

Landbank

Stay with us on this! We wouldnt believe it until we sighted myself. The Group at present has 35 pieces of land, landbank size of approximately 238 hectares of land valued at sum of RM167mil (RM0.44 per share) for future investment development in Johor and Melaka (including the new acquired land worth RM11.1mil).

Management Capability

Management is capable in keep acquiring land in Melaka and Johor as they expected somehow development will expose to southern region like Iskandar and Malacca Gateway (recent China very hot about this!).

The Group will remain focus on its property development business and will offer a range of quality and affordable products located in good locations. The Group is optimistic on its launching of new housing and industrial properties as well as mixed developments that are in strategic locations in the states of Johor and Melaka. In addition, the Group will continue to expand its land banks, preferably in places where we have existing presence such as in Johor and Melaka so that we can expand our reach further. The Group is positive on its long term outlook despite the uncertainty and challenging business environment. The Group will continue its effort in enhancing operational efficiency by focusing on cost control and improving delivery of value and quality product on time.

Conclusion:

GMUTUAL is deemed undervalued in so many level as mention above. In short term (Q1 FYE2017) wise will the Group perform well? With the university reopen after December holiday and potential leasing rates readjust, with many projects ongoing, with the revenue recognition from project completion from Austin18, we believe you have your answers. Attached below as the peer PE comparison, with standard PE 15 the price should valued at between RM0.92 to RM1.00

Stock Alliance

The information contained in this channel is for general information purposes only. Any reliance you place on such information is therefore strictly at your own risk.

We hope to bring profit to everyone as we did in today.

Do help us share out our channel link

Add our new fb:

https://www.facebook.com/stockalliance

Join our Channel and check out our performance.

https://telegram.me/stockalliance

We hope to bring profit to everyone as we did in today.

Do help us share out our channel link

Add our new fb:

https://www.facebook.com/stockalliance

Join our Channel and check out our performance.

https://telegram.me/stockalliance

GMUTUAL (9962) - Gromutual Berhad: THE SOUTHERN LION

https://klse.i3investor.com/blogs/stockalliance/118291.jsp